Edwin Tan /E+ via Getty Images

(This piece was original published on November 10, 2022, well before the opening bell, for Second Wind Capital Members. Kopin shares opened for trading, that morning, at $1.06 per share. Subsequent to its publication, Kopin’s recently appointed CEO, Michael Murray, disclosed two open market purchases.)

This is an update on Kopin Corporation (NASDAQ:KOPN), as I haven’t written on it, since my June 19, 2022 piece, when I published (Kopin: Arguably One of The Most Torqued Micro-Caps). Kopin shares opened for trading, on June 21, 2022, at $1.14 and eventually traded as high as $1.90, on August 1, 2022. Since then, however, and after a somewhat disappointing Q2 FY 2022 as well as a ridiculously difficult backdrop for the vast majority of technology stocks, especially with near term negative Adj. EBITDA prospects, Kopin shares have pulled back.

The update piece since Q3 FY 2022

Unless you’re living in a cave or been sleeping, for five months, Rip Van Winkle style, everyone knows that it has been tough sledding for the vast majority of technology stocks with negative near-term Adj. EBITDA. Kopin has been no exception, and Mr. Market appears to have thrown the baby out with the bathwater, which tends to happen far more frequently in bear markets.

Despite the tough tape and inhospitable backdrop, as I personally didn’t sell the move to $1.90 per share (on August 1, 2022), I’ve spent a considerable amount of time thinking about why I own and continue to like the risk/reward, on Kopin. Also, please note, from a market capitalization perspective, the difference between $1 per share or $2 per share, in the case of Kopin, is only $95 million. Given Kopin’s extensive IP portfolio and the fact we are on the cusp of the AR/VR revolution, I don’t consider $95 million much in the way of market capitalization. Hard core short term traders seem to disagree, as they seem content trying to scalp this stock and happy to play for nickels and dimes. This has created unnecessary volatility, but perhaps par for the course in micro-cap land.

That said, and just to be crystal clear, Kopin has been losing money and only has $15 million of cash (although they have no debt). Therefore, it goes without saying that this is a higher risk bet and we are swimming in the higher risk end of the pool. No one is suggesting that this is Apple Inc. (AAPL) or Procter & Gamble (PG). Is it possible Kopin goes to $0.50 or even possibly zero? Sure!

Kopin generates negative Adj. EBITDA, so just like about every other technology stock or really many other stocks, with negative Adj. EBITDA, it has been taken to the woodshed.

New CEO and An Encouraging Q3 FY 2022 Conference Call

For perspective, Dr. Fan is an MIT Phd, that has led Kopin for 35 years. He is highly intelligent and a pioneer on the engineering side, notably in his swim lane, and has been imbedded in semiconductor world since the late 1970s and early 1980s. That said, he isn’t a very good businessman and hasn’t monetized or capitalized, on behalf of Kopin shareholders, on Kopin’s great inventiveness. He also sold one of its best businesses and inventions, HBT, in 2013, that later turned out to be a cash flow monster.

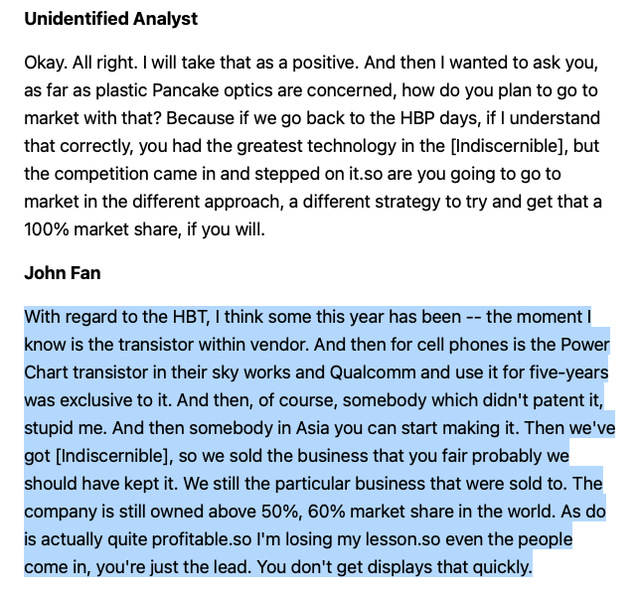

See these exceptions from Kopin’s Q1 FY 2022 conference (May 3, 2022):

Kopin’s Q1 FY 2022 conference (May 3, 2022)

Kopin needed the money to keep funding R&D (and / or this was just a misjudgment). Again, his periodic bouts of success led to higher stock prices, which were then often followed by secondary offerings, which in turn were reinvested back into the business and in R&D. Yet, when you run a public traded company, it isn’t a government or higher education funded R&D project, at MIT or Stanford or CalTech, where you are just playing for a moon shot, a technological breakthrough, that will result in windfall patent royalties stream that will fund future science and academic research in perpetuity.

To make a long story short, given Kopin’s burning platform, in the form of a declining cash balance, Dr. Fan finally saw the light and he appears to have hired a really smart and enterprising executive, Michael Murray. Michael has a track record of success, including roles with Analog Devices (ADI), located in Norwood, MA. Analog is one of most successful technology companies and created exceptional shareholder value, over the past forty years. In addition to his leadership experience at Analog, Michael, most recently, held leadership roles in the military defense world.

Now that we have established that although Kopin has zero debt, and only $15 million of cash, to be clear, this is a high risk bet, in light of the cash burn.

Enclosed below, let me share some encouraging commentary from Kopin Q3 FY 2022 conference call (all quoted material is from the Q3 FY 2022 conference call).

Green Shoots On the Q3 FY 2022 Conference Call

Exhibit A – A very healthy 2023 defense backlog.

Lastly, our military and defense business has significant order cover heading into 2023. And Furthermore, on recent customer visits, I clearly saw and heard how much they value Kopin’s vast display capabilities, our swap C value and the unique ability to offer complex integrated optical display assemblies.

Exhibit B – Kopin has very important defense relationships and Michael Murray has been informed, by its Tier 1 customers, they want Kopin to do more and move up the value stack.

And one of the things that I’ve learned and will bring to Kopin is how to move up the value stack line. And what I mean by that is our customers want us to provide them more capability. defense companies these days don’t want to necessarily do everything internally. And our biggest customers want us to do more. So that, I think, is the way I would answer the question is for our mutual fund business which is our defense business that pays the bills, we’re going to do more for our customers and monetize more of their system, move up the value stream and stack with them because they want us to and we’ll monetize that with us.

Exhibit C – Dr. Fan is laser focus on AR / VR and working with partners in Asia. He was in Asia on the last two conference calls. His reputation and legacy (Kopin) are on line, so he handed over the reins, to Michael, so he can focus exclusively on the meta verse.

Sure. Glenn, I think I got that. Yes, great question. So I think there’s multiple strategies at play, Glenn. When you think about consumer and volume and display markets, Dr. Fan has been working very hard in China on that strategy with partnerships and exciting opportunities that we have there. When we look at industrial and enterprise technologies, that’s more of a licensing model that we already have in place and really taking latent IP and IP that we can take to the market and monetizing it and we’ll do more of that in the future because it’s a great model for us and very profitable. And then when we think about defense business, I think there’s opportunities there to use more of our technologies in the defense market.

Also see here:

On the industrial front, we’ll continue to do our IP licensing and expand upon that business. And then, Dr. Fan is working on more of the strategy around how to move forward with higher volume OLED business with our partners, customers and strategies in China. So those are the 3 aspects of our strategy that we’re moving forward with and we will refine more in the next month or 2 as we have our strategic plan updates.

And see here:

We have a strong portfolio of products. Dr. Fans working on some really interesting things with our Chinese partners that I think is going to help fuel that growth.

Exhibit D – Michael Murray calls out his expectations for a ‘good Q4’.

Thanks very much, Rich. Ultimately, this quarter was a reflection of Kopin’s resilience, hard work and dedication to manage through global supply chain issues, the remnants hopefully of COVID and deliver a solid result. We remain cautiously optimistic that we’ve identified and have mitigation plans for us to play chain challenges and we expect to have a good fourth quarter. Now as we look forward, we are excited for the future and focused on pursuing an ambitious strategic growth plan while not losing sight of the current macro uncertainties.

Exhibit E – Management is foreshadowing innovation and new products.

As consumer grows, we’re going to have this wonderful base business that’s profitable and will move along at a decent compound annual growth rate. while the consumer business will ebb and flow as they do. But I do believe our consumer business will grow next year based on some of the LRIP that we’ve got there with some key customers. And you’re starting to hear some of the announcements that are coming out recently of Kopin being involved with Pancake Optics and some AR VR headsets. And I think you’re going to hear more of those in the future. And to that end, I highly recommend we’ll be at CES this year, Kevin. Hopefully, you’re able to come visit us and you’ll see some more of our new products in that suite and we’re hopeful to have a great CES this year.

Insider Buying

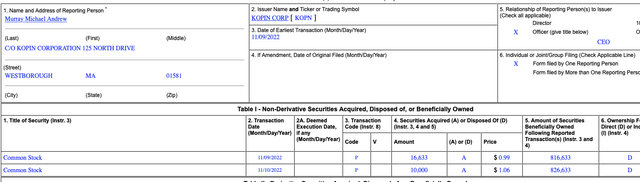

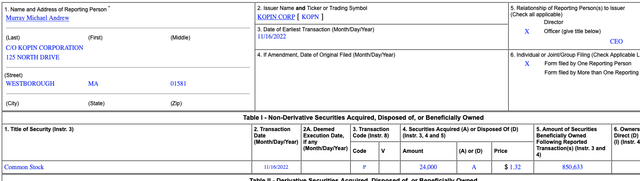

This week, there have been two insider buys filed, by Kopin’s new CEO, Michael Murray.

See here:

And see here:

Putting It All Together

On October 7, 2020, I wrote (Kopin Corp.: A Speculative Buy At $1.30), on Seeking Alpha’s free site. By February 2021, propelled by a bull market, Kopin shares, albeit briefly, crested over $13 per share. In other words, a 10 bagger!, in less than six months.

Since then, technology stocks have gotten taken to the woodshed, notably any companies with negative Adj. EBITDA and that lack pristine balance sheets. Kopin has been no exception, and the stock has given back the entire move from $1.30 to $13 and back to sub $1.30.

With only 95 million shares outstanding, $15 million in cash and no debt, the fact that we are on the cusp of the AR/ VR age, and the firm’s expansive IP portfolio, in the low $1s, I would argue that Kopin offers compelling upside and represents a good high risk/ high reward type of bet. Moreover, in a pinch, and I would argue, and just to be clear, management has never publicly commented on this, this is purely my imagination at work, that the firm has liquidity options. Given the firm’s expansive IP portfolio, I would argue (and could be wrong) a clever licensing deal could be stuck, if needed, to bridge the gap and fund them. Moreover, I would argue (and could be wrong) some of Kopin’s big defense contractors could offer them attractively priced debt, if needed, to extend the platform.

That said, it has been a nuclear winter for technology stocks. Anything with negative Adj. EBITDA has been taken to the woodshed. Kopin has been cast out and sent to the land of mis-fit stocks. Clearly, if you look at the stock price action, there are mostly a bunch of day traders involved here, moving in and out, trying to trades for nickels or a dimes. Perhaps, trading 10K to 20K share lots given the relatively low daily trading volumes. If people are trading a Kopin trying to make a nickel or a dime and that is what blows their hair back, who am I judge.

In closing, this is definitely a higher risk bet. However, I would argue there is a lot of upside potential here and probably many different cards that can come up on the ‘turn’ card (and I don’t this is a last card – what happens on the ‘river’ type of bet), where Kopin shareholders can win the pot. If they do, no one deserves it more than Dr. Fan. I would love to see his ingenuity and imagination monetized and recognized in 2023!

Be the first to comment