Bill Oxford/iStock via Getty Images

American Tower (NYSE:AMT) is the world’s largest telecommunications-focused REIT.

Its primary business model is building and operating cell phone towers, or more specifically, buildings that carriers such as AT&T (T) and Verizon (VZ) lease in order to send phone signals to their customers. The company also leases out towers for other uses, such as radio and television broadcasting and government purposes. In addition, a small portion (3%) of the company’s revenues come from operational services, such as helping other entities with things like zoning, site selection and so on for the construction of towers.

American Tower also recently completed a large acquisition in the data center industry, expanding its reach into that category. That business is beyond the scope of today’s article, however I will note that the firm they acquired had posted 30% total returns compounded over the past decade. It will potentially be a major piece of AMT’s future growth story. For now, though, let’s stick to AMT’s primary tower business.

Why Buy American Tower Now?

The company (and industry) is highly attractive because it’s a necessary item that is recession-proof and has extremely stable cash flows. American Tower contracts tend to be for extended periods and have built-in rent escalators, making them a predictable cash flow stream.

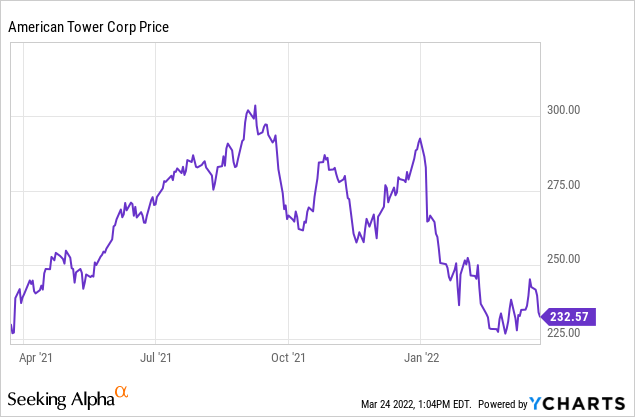

Of course, there are plenty of expensive high-quality companies out there. The market puts a big premium on predictable growth. So, instead of starting out covering the business, we’ll just hop straight into valuation. AMT stock has pulled back sharply in recent months and I argue that this is a steep enough decline to be worth buying here:

Indeed, if you back the chart up further, AMT stock is back at around 2019 levels.

Valuation: A Moderate Discount Now

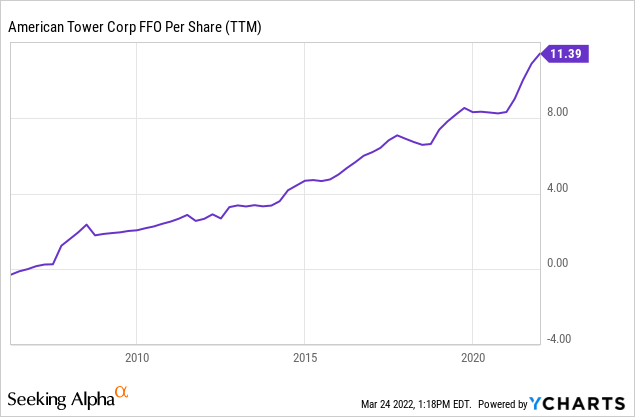

Historically, AMT stock tends to trade for around 25x FFO, give or take a couple of points. FFO is currently around $11.39 per share, leading to a normal fair value level of $285 per share. And, indeed, AMT stock was recently up at $300. However, with the latest sell-off, it has slid to around $240 which is a considerable discount to that normal valuation of $285.

In addition, American Tower is an incredibly consistent growth machine:

FFO virtually always goes up, and barely paused during either 2008 or Covid-19. Given the slope of the upward trendline, FFO at $14 or $15 in 2025 wouldn’t be surprising, which would get to a price in the mid-$350s versus today’s $236 quote. Throw in a solid dividend, which is increased every single quarter, and this has the makings of an attractive growth & income stock from this starting price.

Could Anything Disrupt The Growth Trajectory?

As long as AMT’s FFO continues growing at its usual rate and the stock stays around 25x FFO, we should get 12-14% annual returns from here. That’s quite good, especially given the solid income component to the story. So, what could go wrong?

In theory, it could run out of growth opportunities. However, from my understanding of the situation, there is still a ton of places to build more towers in emerging markets such as LatAm and Africa. There are also other more niche categories such as building mini-cells for venues such as sporting arenas. The rollout of 5G is requiring much denser coverage networks, which should create a lot more localized cell opportunities, though it remains to be seen how much capital American Tower will deploy there.

There’s also M&A, American Tower can roll up smaller tower companies when they need an exit strategy. There are a ton of sub-scale operators with towers in just one city or state who are likely to want to sell out to a national player in due time.

On top of all those options, there is also expansion into adjacent markets. American Tower just bought the data center REIT as described in the intro. However, time will tell if American Tower makes this a dominant piece of their business or only a small add-on to its core operations.

One potential risk to American Tower’s trajectory is the telecom carriers doing this themselves. T-Mobile, for example, has invested significant resources in building sites for itself at high-profile venues such as the T-Mobile Arena in Las Vegas and the Rams’ Stadium in Los Angeles.

However, it is likely that this will be one-off sorts of things to show off 5G for those venues, rather than a broader business strategy. For one, it’d take a ton of capital and the telecom operators are already drowning in debt (AT&T is the world’s most indebted company, for example). For another, you get huge scale efficiencies from having two or three carriers lease the same tower site, which I’ll detail below.

It’d be uneconomic for a firm like T-Mobile to build a bunch of its own proprietary sites and not share them with its rivals. As such, neutral third parties like AMT and Crown Castle (CCI) are more logical holders of these assets.

Why American Tower Over Industry Peers?

Speaking of Crown Castle, why buy American Tower and not the other players in the same space? I can’t remember who said it unfortunately, but there was a great anecdote about someone looking at a small tower play in Mexico and asking if it was “the next American Tower”. An industry expert said back something along the lines of: “More likely, American Tower is the next American Tower.”

That is to say that winners tend to keep winning. And, until proven otherwise, American Tower has given investors no reason to doubt its ability to executing on its consistent growth model.

Would buying a tower operator in LatAm or Africa or whatnot potentially offer higher returns if you time it just right? Sure. But you might also end up with dead money, or — even worse — a major loss of value if something goes wrong in those markets.

American Tower, by contrast, has low terminal value risk. Meanwhile, on the upside, I see double digit annual returns ahead from the newly-discounted price.

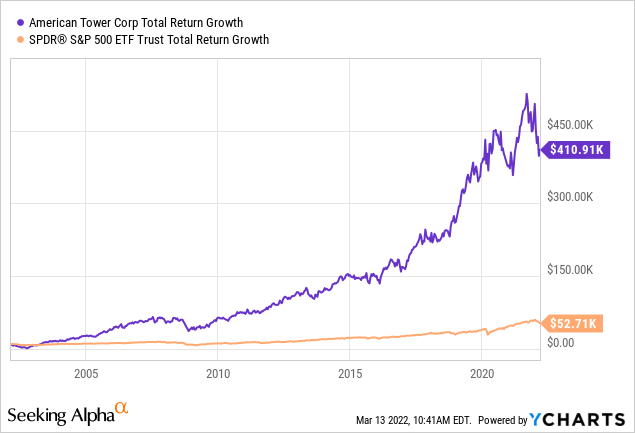

AMT Long-term Returns (YCharts)

$10,000 invested in American Tower 20 years ago would be $410,000 now, versus $53,000 in the S&P 500.

What about Crown Castle, though? Is that one worth owning too? Crown, for those unfamiliar, is the next largest player after American Tower. Crown differentiated itself by building smaller systems rather than the gigantic towers of old. In fact, Crown’s informal mantra could be said to be “More sites at lower heights.”

Crown gained a significant first-mover advantage with its differentiated strategy, but American Tower has adapted and not let Crown run away with the market. In fact, over the past 10 years, AMT has actually outgrown Crown by 2%/year compounded in both earnings and free cash flow. Yet, as of this writing, Crown trades at a significantly higher multiple to FCF and EBITDA as American Tower.

I have no complaints with Crown as a long-term holding. And some readers will probably prefer it given the higher starting dividend yield. However, American Tower has actually performed better operationally as of late, and my understanding of the situation is that their capital allocation and management decisions may be a bit better as well. I’m not highly partisan in the AMT versus Crown Castle debate, but my own capital is on the American Tower side of the fence for the time being.

Why Has American Tower Declined?

I believe there are two issues causing American Tower shares to fall lately.

The first is that so-called “hedge fund hotels” are checking out. Unpacking that analogy, there are a variety of stocks that a ton of leading hedge funds own. It’s no secret the fund managers attend the same conferences, idea dinners, and so on. Many are friends personally as well, and research gets passed around frequently.

A high-quality company that is an “obvious” long is easy for hedge funds to own. Mobile data demand is only going up, and 5G is a further catalyst. The industry will be bigger in the future than it is today. Plus it’s a toll-road style infrastructure asset, and fund managers absolutely love those. Throw in that AMT stock has gone up and to the right for decades, and it’s easy for fund managers to get comfortable with the story. So it is way “over-owned” by hedge funds compared to the index.

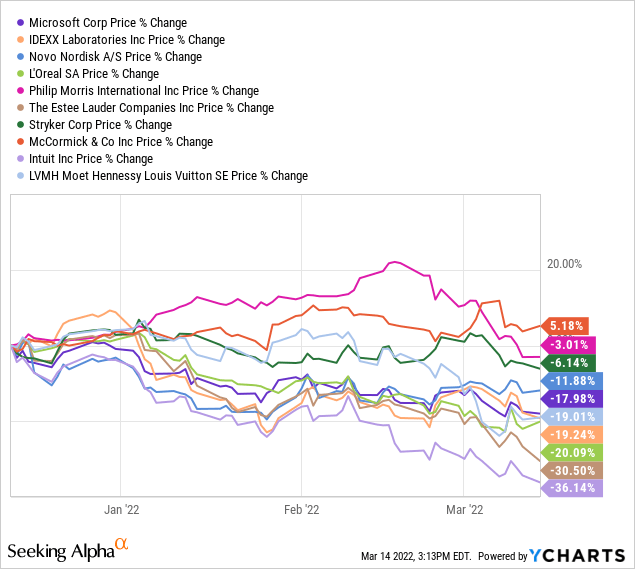

Now, however, we’ve seen a massive sell-off in quality compounder stocks. Here’s a chart of Fundsmith’s (a quality compounder mutual fund) top 10 holdings. They’ve largely gotten shredded over the past few months:

Fundsmith top holdings (YCharts)

Chart through March 14. Names have bounced a bit since then.

While Fundsmith is not a major AMT holder (at least not that I’m aware of), it is the sort of stock that their ilk owns in large quantity.

As holdings like this continue to tumble, some people are redeeming, forcing selling pressure across their holdings. Throw in that many hedge funds are on margin so when holdings are down 20-30% in a hurry, they have to delever, adding more selling pressure.

Additionally, all this selling has caused these stocks to fall into a negative technical pattern, which drives momentum-led algo strategies to switch from owning to selling names like AMT. All told, there is a lot of structural selling pressure right now that is not at all specific to names like American Tower, but is rather caused by fund flows and momentum.

American Tower & Inflation

The second factor is inflation. REITs (as measured by the IYR ETF) have not fared particularly well during the current market correction. IYR fell from 117 to below 100 before bouncing. REITs have a mixed bag in dealing with inflation. The value of their assets increases as the price of land and other holdings goes up in an inflationary environment.

However, REITs also tend to issue a mountain of debt. This is a double-edged sword. The principal value of the debt itself is inflated away to a significant degree. However, when interest rates reset, REITs tend to get stuck with much more expensive interest. REITs fared surprisingly poorly in the 1970s — particularly compared to the REITs prosper during inflation narrative we sometimes hear today — in part because spiking interest rates crushed their access to capital.

As for American Tower specifically, it has a stronger-than-average balance sheet in REITland so I’m not particularly worried about a credit crunch. That said, there is one thing that is worthy of consideration.

American Tower has fixed escalators for most of its towers, particularly in the U.S. It can charge approximately 3% higher rents each year for the largest share of its business. 3% higher per year has been wonderful in a low-inflation world. 3% rent escalators look significantly less impressive, however, when headline inflation rate is now closer to 7%.

At the end of the day, however, a tower is just a simple building on top of some dirt. It requires modest capital expenditure to maintain. The actual costs of operating a tower do not increase quickly, regardless of the inflation rate.

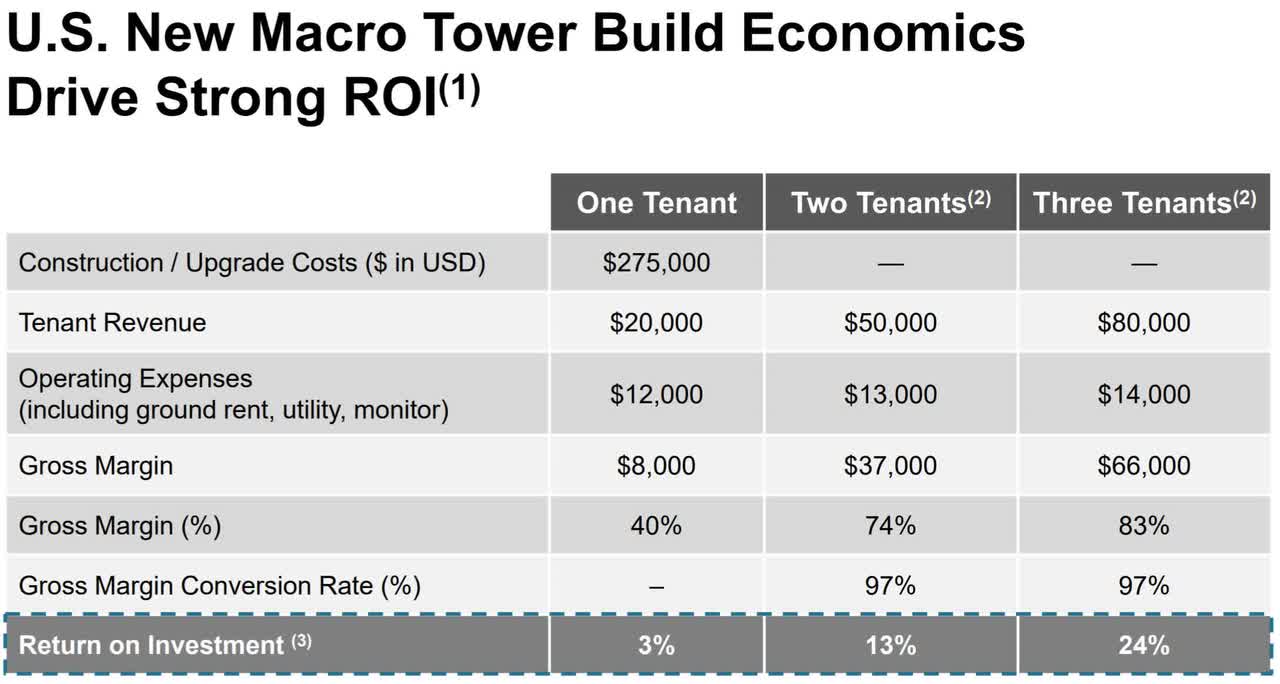

A look at American Tower’s cost economics per tower should highlight the underlying strength of the business model, regardless of the monetary environment:

New tower economics (AMT Corporate Presentation)

A tower with three tenants, for example, generates $80k of revenue against $14k of costs. Even if inflation ran at 7% for the next 10 years, causing costs to double by 2032, that would only cause AMT’s cost per tower to rise from $14k to $28k. That’s nothing given the revenues, which are $80k and contractually rising by $2,400 per year even at a mere 3% escalator.

In other words, when you have an 83% gross margin, you have a lot of wiggle room to deal with inflation.

From an economics perspective, it’s far more important that a tower be fully-leased up with three tenants, or at minimum two tenants. A one tenant tower generates an ROI well below American Tower’s cost of capital. A two tenant tower, by contrast, achieves strong economics and a three tenant tower delivers utterly breathtaking results.

The loss of Sprint and T-Mobile as separate entities certainly hurt the math here to a degree. However, remember that American Tower can also rent out space to other uses beyond the big three mobile companies. And it also has an extensive network of towers outside the U.S., which have different carriers as customers.

American Tower’s Dividend Policy

Finally, as American Tower is a REIT, it’s worth discussing its dividend policy. The company doesn’t offer a particularly high starting yield. That makes sense, as the company is still a strong growth firm. It isn’t in the mature stage where it simply exists to throw off a steady state rate of cash flow. Rather, American Tower is still spending a ton of new capital expenditures and M&A deals.

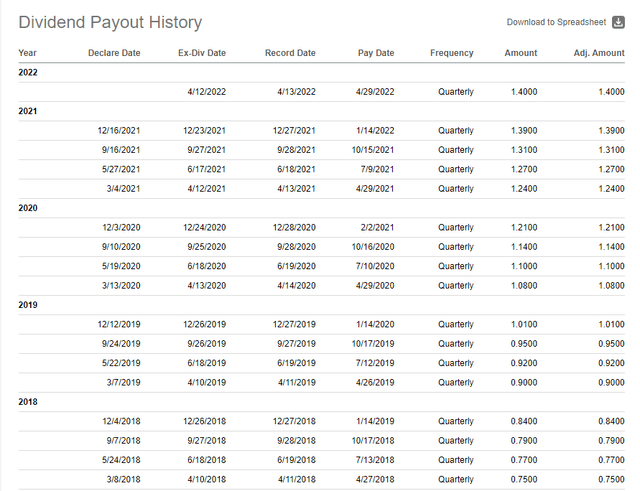

However, while AMT is not a strong starting dividend yield story, at least not by REIT standards, it’s rather a massive growth story. The company hikes its dividend every single quarter. That’s right, not every year, but rather with every single payout. It’s done so back to 2011. Here are the last five years, to give you a sense:

AMT Dividend History (Seeking Alpha)

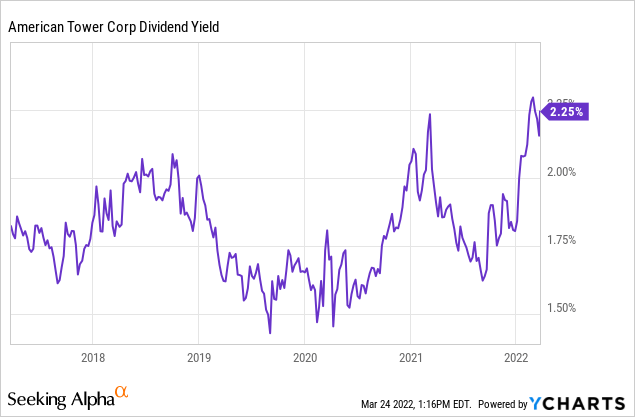

Add it all up, and it’s amounted to a 19% compounded annual growth rate over the past five years. That’s pretty incredible stuff, especially since the starting yield is 2.3% rather than some microscopic figure. Additionally, with the recent pullback, AMT stock is at its highest starting dividend yield ever:

Putting the pieces together, American Tower retains strong growth prospects in an industry with persistent tailwinds. It offers a compelling dividend growth story combined with its highest starting dividend yield on record. Meanwhile, shares are moderately discounted to their historical median multiple, offering a capital gain in addition to the dividend when valuation returns to normal levels.

Be the first to comment