DKosig

Dycom Industries (NYSE:DY) beat the S&P 500 (SPY) return since May 2022. Investors who relied on the index’s lift in the summer missed out. DY stock peaked at around $116 but fell with the markets. In the second quarter, the company beat analyst expectations. Does this mean that the engineering firm that supplies critical resources to telecom service providers has more upside from here?

Second Quarter Results and Outlook

In Q2, Dycom posted revenue growing by 23.5% Y/Y to $972.35 million. It earned $1.46 a share on a non-GAAP basis. In its reconciliation of net income to non-GAAP adjusted EBITDA, the company did not have any unusual line items. For example, Dycom recorded stock-based compensation of just $4.63 million in the quarter.

On its conference call, President & Chief Executive Officer Steven Nielsen highlighted labor cost issues that started at least a year ago. Dycom is experienced with managing such persistent costs. It is working with its customers to provide the valuable resources they need. Without it, customers will not work as effectively or reach their potential output.

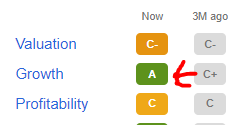

More importantly, CEO Nielsen said that the business sees no signs of a recession. Dycom’s revenue expanded in the last quarter. In addition, it has a healthy balance sheet. It bought back 104,030 shares in Q2 for $10.0 million. It ended the quarter with $120.28 million in cash and equivalents. It has $815.33 million in long-term debt. According to Seeking Alpha Premium grading, DY stock scores well on growth:

Seeking Alpha premium

Value and profitability scores could improve.

The company expects revenue for the quarter ending October 29, 2022, to increase in the low- to mid-teens as a percentage of contract revenue.

Opportunity

Dycom works with large-sized customers with established businesses. Regardless of the economic cycle we are in, customers require skilled staff to meet strategic targets. Input costs, such as energy, will moderate. That alleviates cost pressures.

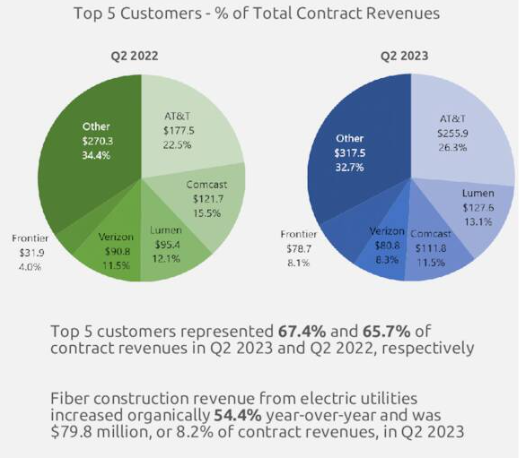

The company has infrastructure projects that will lift quarterly results. For example, Dycom performed fiber deployments for electric utilities worth around $80 million. This is 54% higher than last year. The company believes that government expenditures will result in over $15 billion worth of business. Currently, Dycom’s top five customers accounted for 67.4% of revenue in Q2/2022:

Dycom Q3/2022

Its key customers included AT&T (T), Lumen (LUMN), Comcast (CMCSA), and Verizon (VZ). Dividend income investors holding any of those telecom stocks are faring poorly. While they collect dividends that yield 7% from AT&T or 13.7% from Lumen, their share price is down this year.

Dycom has a backlog worth $6.03 billion. This could grow to 2021 levels if the company wins more awards and extensions for fiber construction, construction and maintenance, and rural fiber deployment projects.

Dycom Q3/2022

Risks

The engineering and construction sector is not immune to a prolonged recession. Investors who hold MasTec (MTZ), another E&C firm I wrote about when the stock traded at $86, trended lower. Markets anticipate a slowdown in many projects.

Just as investors dumped telecom stocks on worries of their high debt, Dycom is not debt-free. However, its $500 million senior note costs 4.5% and matures in April 2029. The Federal Reserve will very likely pivot (lower interest rates) within the next seven years.

Fair Value

In the last six months, Dycom’s quant rating remained a strong buy:

Seeking Alpha premium

According to Stock Rover, Dycom’s stock trades at a 3% discount to its fair value:

Stockrover

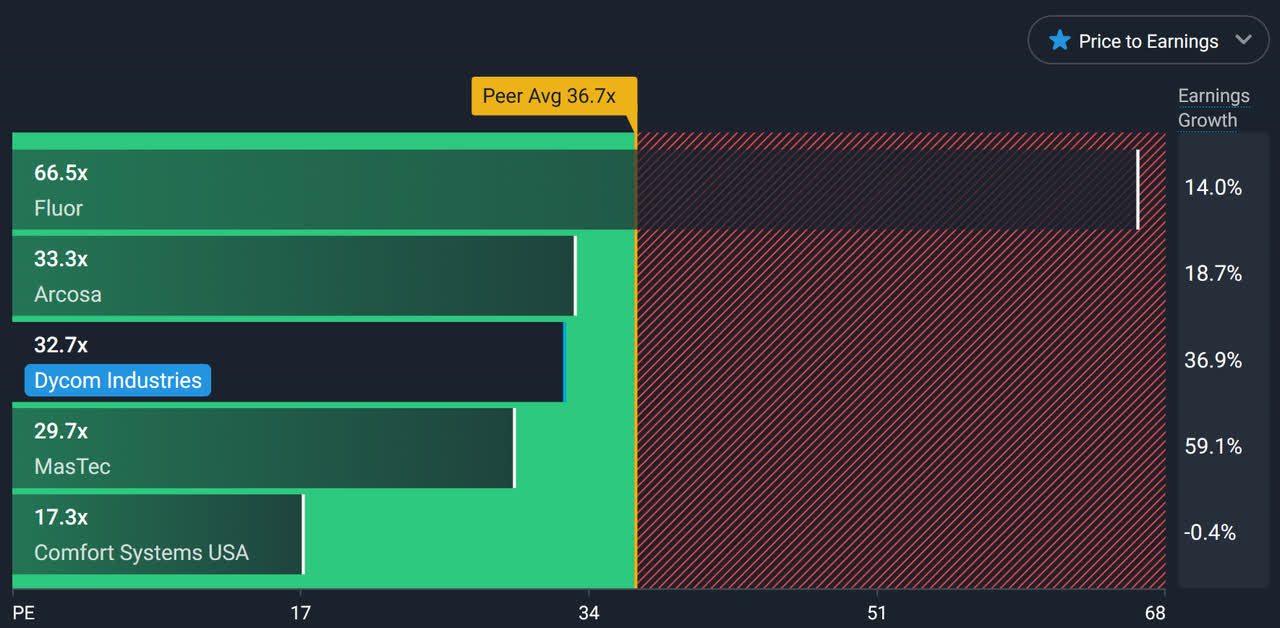

Similarly, simplywall.st’s peer analysis indicates the company trades at comparable valuations:

simplywall.st

MasTec’s relative discount is a small takeaway from the above chart. Investors get a slight discount on owning MTZ stock from here at a 29.7 times price-to-earnings ratio.

Your Takeaway

Dycom is a solid holding. When the company reports quarterly results, look for the company to provide positive updates on its projects with Verizon. It should also report strong sequential growth from its largest customer, AT&T. In addition, Dycom might have updates on its diversified opportunities with Dish Network (DISH) and T-Mobile (TMUS).

Infrastructure investments are multi-year projects. They do not react to fluctuations in the economy. Telecoms and governments will keep investing to build their networks. This will reward Dycom investors in the long term.

Be the first to comment