FabrikaCr/iStock via Getty Images

Dear readers,

I’ve been expanding my position in Covestro (OTCPK:COVTY) for some time now, going step-by-step deeper into this investment. With my target being companies that offer over 25-30% annual upsides, Covestro fits perfectly into this sort of thesis or framework, being significantly undervalued to what I believe it’s capable of in the long term.

With the company now trading at below €34/share for the native, even after a slight recovery in the last week, I believe it is time to update my thesis on the business.

Covestro – Updating & Upside

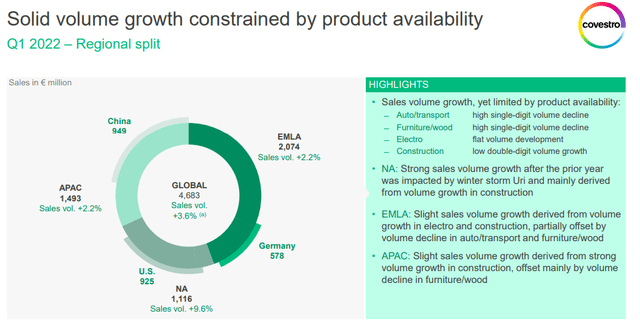

1Q22 is the latest update we have from the company. Covestro is, at its heart, a solid company with significant long-term upside. The strong focus on appealing MDI/TDI-based polymers, as well as polycarbonates, means that Covestro has a solid position on the market. Due to an ever-increasing share of the specialties business as part of its profits, we can continue to expect a forward earnings stability to materialize, which will do much to cushion some of the historical volatility that has otherwise been enough to scare many investors.

The current downturn doesn’t necessarily make a whole lot of sense. Company sales are very strong, cash flows are stellar, and while the company is experiencing an expected amount of input cost increases and risks related to macro – including the energy situation in Germany, the simple fact is that at below €34/share, the company trades at a P/E multiple of below 4x.

Perhaps most importantly, the way the world is going today, the company continues to benefit from solid global business trends, including electronic mobility, electronics overall, EV, and other modern trends that drive the demands for the products that Covestro offers.

I mentioned in my last article that the reason the company is experiencing such trends can be, at least in part, related to the belief that the positive pricing situation is at an end. The fear is that this is going to happen due to the raw material, energy and labor cost inflation we’re seeing on a market-wide sort of basis. On a historical basis, Covestro has enjoyed a strong pricing power position by being able to stay ahead of the cost curve. The fears are that this may be coming to an end, and the future may look somewhere muted.

This perspective, which can be viewed as somewhat bearish, is based on seeing COVTY’s growth and earnings as a product of GDP expansion – and with GDP now looming negative in Germany and other areas, the expectation is that this could seriously hamper earnings and growth for Covestro as a whole. That is part of the reason this company is trading down.

As I mentioned, and this is where we still are by the way, what analysts have done because of this is essentially cut the company’s EBITDA for 2022 by 15-25% depending on what analyst you’re looking at. The justification for this EBITDA cut is a mix of cost increases, pricing power reductions, and a general reduction in profitability.

I agree with this cut. Management itself seems to agree with this cut as well – but this doesn’t change the fact that the company posted an absolute blockbuster first quarter when seen in the context of macro.

The only reason sales weren’t higher is because there frankly wasn’t enough of the company’s product to go around. The company saw its highest quarterly sales ever, with a double-digit YoY 40%+ sales increase, which is worth noting by itself. The company also managed to increase its earnings, despite what analysts described as fears about the input cost situation. With solid top-line and bottom-line growth across Covestro’s entire line of businesses, the fear that the situation should somehow worsen materially to where 4X P/E or below is justified seems very far away.

Not a single segment in the company experienced negative 1Q22 trends. The only thing that can be said is that the company is working at a currently high working capital to sales ratio. Even debt is down due to the higher discount rates, and the company’s equity ratio is climbing above 50%.

On the horizon looms impacts from a potential doubling on the energy prices on a 2-year basis. Whether this will normalize in the near term is still up for debate – I personally do not believe a normalization to be a likely scenario.

Input cost factors are one reason why the company’s management is guiding down for the future. The other factor is demand forecasts – as of right now, the company is expecting global demand for its products to drop as a result of a global GDP slowdown.

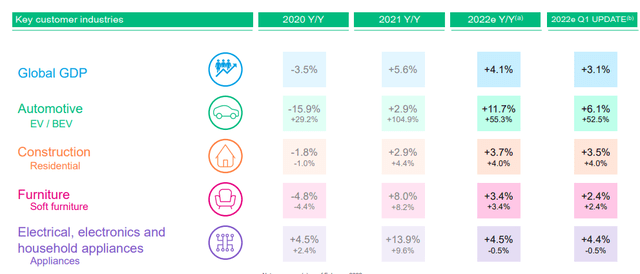

Covestro Forecasts (Covestro IR)

With the troubles from Russia, continued COVID, logistics crises, and the potential of stagflation, the notion that Covestro is facing difficult times is one that is understandable, and even something that I would say is likely.

Where I tend to disagree with the market is where this puts the fair value for Covestro. The company has reduced its guidance at the upper end at mid-cycle levels, and currently guides for between €2-€2.5B in EBITDA for the full 2022, with sensitivities being fx, input costs, and overall macro. The company further believes that 2023 and 2024 will bring increases to around €2.8B toward the end, as synergies from the company’s LEAP transformation program start to go into effect and following the realization of other, business-related synergies.

This does not change the fact one bit that Covestro is a primary beneficiary of the current trends in every sustainable sector out there. With EVs pushing demand in core segments, thermal insulation from the company’s PU-based solutions, and Wind energy pushing demand for PU infusion resin due to part manufacturing cost reductions, the company’s market outlook for the mid-term is nothing but positive.

Remember, demand is not the problem.

I believe that it’s possible analysts are underestimating the company’s actual pricing power in the long term. Both segments in the company reported excellent results and pricing.

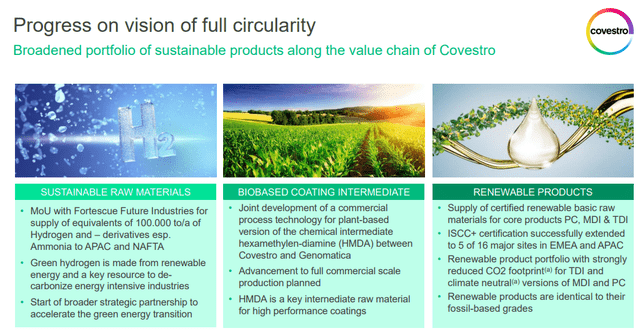

That’s not even mentioning the products that the company has in its pipeline.

Covestro Portfolio (Covestro IR)

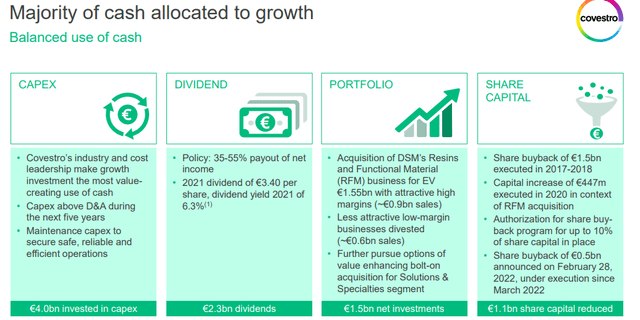

The core question to the Covestro thesis becomes if the current risk justifies the current pricing drop we’re seeing – and have been seeing in the company. Consider that Covestro has an investment-grade credit rating, consider the company’s yield which for payout in April at today’s price is an indicated yield of over 10%.

Is that yield safe? Hard to say. The company seeks to distribute 35-55% of net income as dividends to shareholders. But even if we go by trough-level dividends and earnings, the indicated yield at the lowest 5-year dividend level at today’s price indicates a yield of close to 4%, which for this sort of company is generally very good.

One of the main questions I’ve been getting from subscribers and readers about Covestro is; Should I be worried?

My response to that is still, “No”, you really don’t need to be worried long-term.

Will the company experience short-term volatility? Yes, I believe they will. There is plenty on the risk side that’s unclear at this time, and Covestro overall is a company that’s a bit “bouncy.”

Let’s update the valuation.

Covestro – The valuation & Forecast

When I say a 4% yield, that’s based on trough-level COVID-19 earnings. The company isn’t forecasted to earn as little as that going forward.

At this time, the company has dropped nearly 42% in around a year. There’s no way of sugarcoating that. The current price is low, and it’s hovering at low levels looking at the company’s listed pricing history.

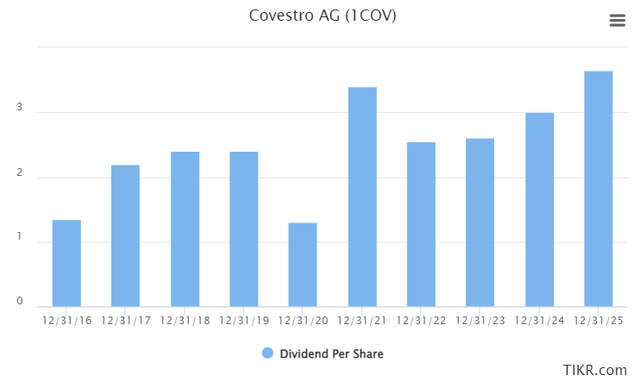

However, where others may see elevated risk and fear, i see opportunity at such levels, because it is at these levels that money is made. The current S&P global expectation is that earnings will be good enough for the company to keep the dividend at a level that, while lower, still implies a yield over 8% at this time, while with resulting LEAP and synergy contributions, being able to advance it to over €3.4/share until 2025E.

Covestro Dividend (TIKr:com/S&P Global)

If this turns out to be even remotely true, then you’ll be investing in a current 2025E YoC of over 11%, while investing in an investment-graded company with a solid set of fundamentals that’s a major beneficiary of current trends. Covestro is not going anywhere. Its dividends are not going anywhere.

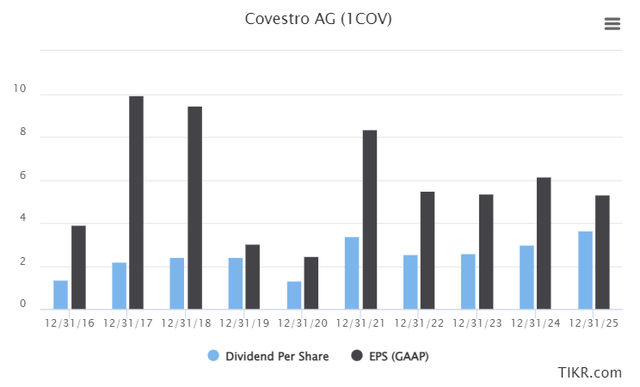

And the simple fact is, you’re now investing in a conservative S&P forecast P/E of below 6X, based on a forecasted GAAP EPS of €5.6/share for the next few years.

Covestro Earnings/Dividend forecasts (TIKR.com/S&P Global)

Remember, dear readers – it’s all about what you pay for something. And when you start paying single-digit P/E multiples for quality companies, that’s when the market or the company has my full, undivided attention.

The only issue I currently see is that there are plenty of great companies trading at not dissimilar multiples or low multiples – sometimes even A-rated businesses. This is the only reason why I have not yet made Covestro a 3-5% stake in my own portfolio – there are safer upsides still out there.

The question remains, how should the company be discounted for this new, and somewhat worse outlook for 2022-2023. Some analysts have lowered 2022E EPS forecasts by 25-30%, and 2023E by over 10%. Some are as low as 10-15%.

My choice remains a middle route, as I believe that analysts are underestimating company pricing power. Still, there are some uncertainties on the cost side that might really dial down earnings, and which are fair to account for. In the end, less than a 20% EPS impact for 2022E is unfair here, and a 5-10% EPS impact for 2023E seems to be the fair way to go, which includes most potential impacts.

I’ve lowered estimated sales growth below 2% in the long-term and bumped working capital to above sales growth as well as EBITDA growth. Company WACC of 8.2% and a 10-year forward period to discount brings the implied EV/Share to €66/share, which is significantly above today’s target price.

For NAV/Share, I’ve cut the multiple of EV/EBITDA for the company’s performance materials below 5X, and below 9X for Solutions & Specialties. I don’t change this estimate at this point. At 183M shares outstanding, the company’s NAV/share comes to around €70/share, which once again is well above the current share price.

As before though, I’m not setting a €70/share price- we’ve already established this may require some discounting.

S&P Global has further reduced its price targets on average from close to €58 about 3 months ago to around €54/share here. My impairing earnings call for a reduced PT of €61/share, which is above the general targets here, but accurately reflects my stance that Covestro will perform better than expected.

While I could lower it, I really don’t see any material reason for doing so. In my last article, I already expected the energy situation to get worse. This is not news to me. I expect a long normalization on part of Covestro – it will quite literally take years for the company, I believe, to reach its full potential.

Given the double-digit yield, that I on the basis of forecasted GAAP EPS view as relatively sound, I can accept this.

And so, it seems, can most analysts. 10 out of 19 have Covestro at a “BUY” or “Outperform” despite some of the overhanging headwinds here – and this to me is very impressive. Even the lowest price target from analysts here is very close to the current share price. I could not even tell you at this point how massively you would need to discount the company’s actual assets or NAV to reach where the company is currently trading. i will just say that “It wouldn’t be justified” – not in the least.

Thesis/Wrapping up

One of the primary fallacies or wrong assumptions that investors have for companies in this situation is the assumption that the businesses are too inflexible or bound to change up or adjust their processes for the better. Even if some of the issues affecting Covestro were fundamental – which they are not – Covestro is in a position to adjust where necessary, because it has a leading cost position across several markets and regions.

Covestro is one of the lowest-cost MDI producers in the world, and its recent plant investments will widen this gap further. Covestro has a cost advantage of 35% from its best plant, to the least competitive plants. It’s a similar and even better leader in TDI, with a cost advantage of 50% towards the average of the 5 least competitive production plants.

Yet that doesn’t even come close to its polycarbonate cost advantage of 60% based on the same metrics. In short, Covestro is, despite what the market would suggest, one of the most efficient and profitable producers of these commodities in the world.

While the overhang from energy issues should not be underestimated, German production sites for Covestro represent only 25% of the company’s global production capacity. Even with a 10-50% energy curtailment, the company’s production wouldn’t grind to a halt. The company’s Belgian, French and Spanish plants, including the new Tarragona assets, are expected to operate with minimal impacts from any Russian-related energy curtailments.

My stance, in short, is that the market is severely underestimating what Covestro can do. And I am happy that the market seems to be doing this.

The upside at this point is more than compelling. I would argue that the upside for Covestro is higher than 82% at full valuation. Will we be reaching that in the near term?

Still doubtful – I believe investing in Covestro requires at least a 2-3 year timeframe. My goal for the investment in Covestro remains, inclusive of dividends, 60-100% total RoR in a 3-5 year period.

This is generally how I establish my positions and my investments. I buy undervalued, quality businesses that people are underestimating, and wait with my cheap shares.

Recent excellent examples of this strategy are the following.

AbbVie (ABBV) which I believe saw a full rotation of this performance as it hit $160 and I sold 98% of my position. I bought most of my shares below $70 back in 2019, making this a 100%+ RoR in less than 3 years.

Unum (UNM) is another good example. I started buying seriously below $20/share, loaded up, and have now sold around 70% at a more than 90% RoR including dividends in less than 3 years.

If the company I’m buying doesn’t realize its upside In a short time, that is no issue. Why? Because it’s a quality business. Another great example is Simon Property Group (SPG). I’m not touching it yet. In fact, I’m buying more. With good yield, superb quality, and a top-tier balance sheet, I’m not miffed in the least if it takes yet another 3-to 5 years for that upside to be realized.

I was once much more “Buy-and-hold-forever” than I am today. Today, I’m more about active, qualitative portfolio management with a razor-sharp valuation focus. I do make mistakes and bad investments, but since adopting this approach, I’ve seen a significant decline in “thesis breakage”.

Be the first to comment