franckreporter/iStock via Getty Images

Chatham Lodging Trust (NYSE:CLDT) has performed rather well since I last covered it back in September of last year, returning 11% since then, far surpassing the -2% return of the S&P 500 (SPY) over the same timeframe. It, however, still remains well below its pre-pandemic range, as this is a reflection of how far it’s fallen since early 2020. In this article, I highlight what makes CLDT a worthy consideration at present, so let’s get started.

Why Chatham Lodging Trust?

CLDT is a REIT that invests in upscale extended stay, premium-branded hotels. It has 42 properties across 16 states and Washington D.C., totaling approximately 6,300 rooms.

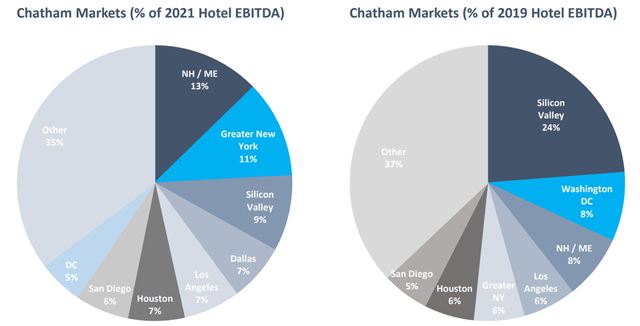

What sets CLDT apart from traditional hotel owners is its focus on extended stay properties which cater to business customers. This is an advantage for the REIT, as this model comes with lower operating costs than full-service hotels. As shown below, CLDT has a high presence in leading Tier 1 markets such as Greater NYC, Silicon Valley, Dallas, Los Angeles, and Houston.

CLDT Geo Mix (Investor Presentation)

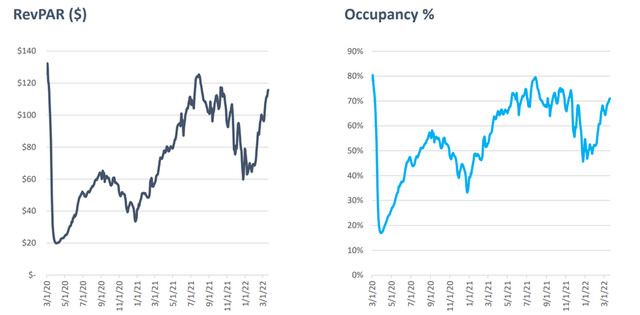

Chatham’s operating performance is also improving. After seeing a drop in performance in January and early February due to the Omicron variant, performance has resumed a strong recovery, with RevPAR (revenue per available room) rising to $115 as of early March, as shown below.

CLDT Operating Metrics (Investor Presentation)

Furthermore, CLDT made solid progress towards profitability, as it generated $19 million of free cash flow from April to December of last year. Looking forward, CLDT is set to benefit from a resumption of business travel, as the hotel industry saw an explosion of leisure travel last year.

This is driven by signals from Silicon Valley and Bellevue, Washington, as many technology companies, such as Apple (AAPL), have finally announced a formal return of workers to their offices. This bodes well for CLDT, as a return to in-person work is expected to bring incremental business travel along with it. Also encouraging, management has hinted at a return of the dividend, as noted during the recent conference call:

We’ve minimized equity dilution, as I said, more than most of our peers over the past two years. And we’re confident in the ultimate recovery and the trajectory of that recovery in our portfolio. Before reinstating a dividend, though, I think I’d like to see continued improvement specifically in our business travel in Silicon Valley and Bellevue. Because as you know, that is a very significant piece of our overall EBITDA. And we will look forward to that recovery as the year progresses.

We’ve historically targeted paying out 100% of taxable income. So when we look at any potential dividend, we’ll carefully analyze our taxable income for the upcoming years while also, of course, considering use of tax deductible net operating loss carry-forwards that came as a result of the pandemic. And we’ll look and review at our dividends on a quarterly basis with our board.

Meanwhile, CLDT maintains balance sheet flexibility, with liquidity rising by $185 million since the start of the pandemic. This was achieved through the issuance of $120 million of preferred equity in June of 2021, $25 million of common equity, and the issuance of a $40M loan on its Warner Center Development.

I still see value in CLDT at the current price of $13.74 considering the recent positive trends. Analysts expect a strong return to meaningful FFO/share ranging from $0.23 to $0.46 per quarter starting in Q2. Sell side analysts have a consensus Buy rating with an average price target of $15.63, implying a potential 14% one-year return.

Investor Takeaway

CLDT owns upscale extended stay, premium-branded hotels in leading Tier 1 markets. Its focus on extended stay properties gives it an advantage over traditional hotel owners, as this model comes with lower operating costs. It’s seen a strong recovery in its operating fundamentals and could resume meaningful FFO/share in the second half of this year. As such, I view CLDT as being a speculative Buy at present for those focused on the long-run.

Be the first to comment