benedek/iStock via Getty Images

Investors with cash on hand have a lot of investment choices, especially in the current market. One popular asset class is rental properties, as investors like the idea of having a tangible asset that they can touch and control.

However, rental properties are a big responsibility, given that having to find a new quality tenant every now and then takes time and costs money, not to mention unexpected maintenance costs, insurance, and property taxes, all of which are paid by the owner. Also, with housing prices expected to stay depressed with higher mortgage rates, capital appreciation may be non-existent at least in the near-term.

This brings me to Essex Property Trust (NYSE:ESS), which is a high quality REIT with which one can lock in a historically high yield, without any legwork that comes with a rental property. As shown below, ESS has fallen materially over the past year. In this article, I highlight why the recent downturn presents a great opportunity to layer into this dividend stock.

Why ESS?

Essex Property Trust is an S&P 500 company and a well-established apartment REIT that’s focused on acquiring, developing, and managing high-quality properties. At present, it has ownership interests in 253 apartment communities comprising 62,000 apartment homes.

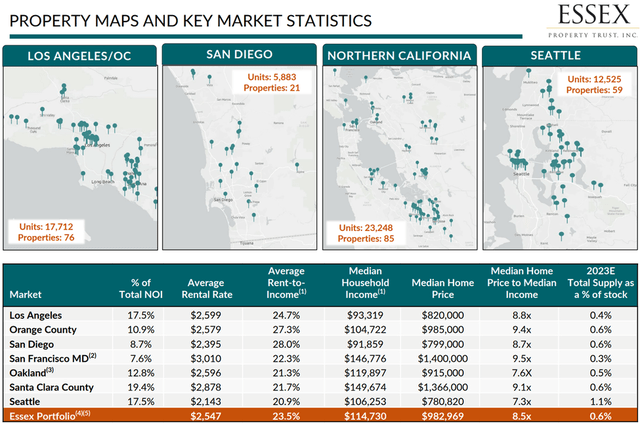

Unlike geographically diversified peers like AvalonBay Communities (AVB), Essex’s properties are concentrated on the West Coast, in high barrier to entry markets like San Francisco, Los Angeles, and Seattle. ESS benefits from its exposure to these prime markets as the high cost of land makes it difficult for new entrants to build competing assets.

As shown below, its markets have average household incomes well above the national median, with rent to income ratios well below the generally accepted 33% mark. Moreover, these markets have a high home price to median income multiple and low supply, making it more likely for tenants to continue renting Essex’s apartments.

ESS Locations (Investor Presentation)

Meanwhile, ESS is demonstrating some very strong results with Core FFO per share growing by 18% YoY, to $3.69 in the third quarter. Same property NOI grew by 15.4% YoY, driven in part by 10% rent growth on newly executed leases. Given the backdrop of a strong fundamentals, management raised its full year Core FFO per share guidance by 2 cents, equating to 16% YoY growth compared to last year.

Moreover, ESS maintains a strong BBB+ rated balance sheet with a safe net debt to EBITDA ratio of 5.8x, and carries $1.1 billion in liquidity. It only has 4% exposure to variable debt and recently refinanced $300 million worth of bonds at a 4.2% interest rate, and has no other debt maturities until May of 2024.

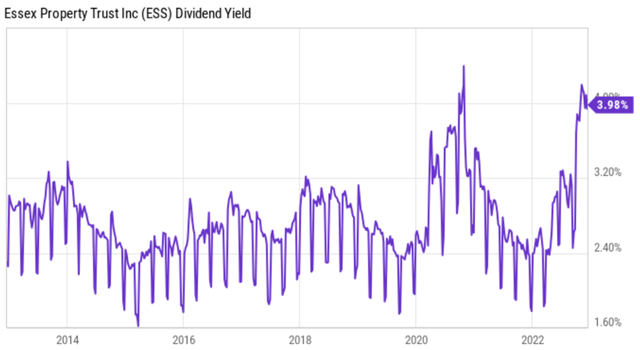

This, combined with the aforementioned operating fundamentals gives line of sight to its 4% dividend yield, which is well-protected by a 60% payout ratio, based on the aforementioned Q3 FFO per share of $3.69. Notably, ESS is also a dividend aristocrat, having raised its dividend annually for 27 consecutive years, and the dividend rate has doubled since 2012. As shown below, the dividend currently sits near its highest level over the past 10 years.

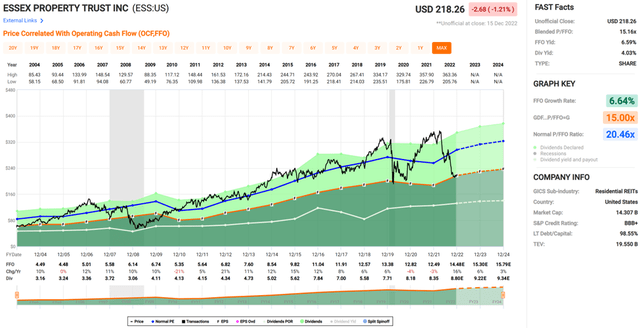

Turning to valuation, it appears that management even thinks the stock is undervalued as ESS repurchased $97 million worth of common stock during the third quarter, at a significant discount to internally estimated NAV.

I find ESS to be attractive at the current price of $218 with a forward P/FFO of just 15.1, sitting well below its normal P/FFO of 20.5. Analysts have a consensus Buy rating on the stock with an average price target of $248, translating to potentially very strong total returns.

Investor Takeaway

Essex Property Trust is a premium quality REIT that enjoys favorable demand characteristics in prime markets. Moreover, it comes with a strong balance sheet with no debt maturities until May of 2024 and pays a well-covered dividend. At present, ESS appears to be materially undervalued while sporting a historically high dividend yield. Given these attributes, ESS is primed for potentially market beating returns at the current price.

Be the first to comment