Naeblys

Today, many companies that once sold goods or services on a one-time basis are pivoting to a subscription-based business model for the benefits of recurring fees and enhanced customer retention and for the potential of cross-selling.

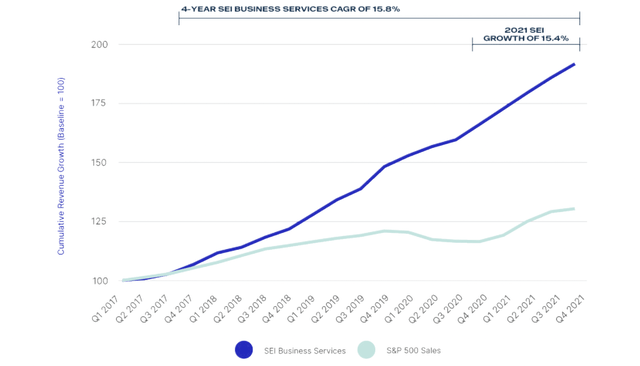

Businesses in the so-called subscription economy have registered a hefty CAGR of 18% in recent years, which is 5X faster than the pace of revenue growth of overall S&P 500 (Fig. 1).

Fig. 1. The subscription economy index, as compared with S%P 500 and U.S. retail sales (Zuora)

Against the backdrop of the aforementioned trend, there exists a unique group of business service companies that have actually adopted the subscription business model for decades. At The Natural Resources Hub, I lump these companies into the ‘digital resource’ space. Some firms in the digital resource space are found in VanEck Morningstar Wide Moat ETF (MOAT). Nearly all of them are among the holdings of Vanguard S&P 500 ETF (VOO).

For over 10 years, I have returned time and again to this distinct space to pick stocks that boast high margins, exceptional resiliency during recessions, secular growth and multi-year compounding.

Below, let’s have an under-the-hood look at this group of businesses.

What is the ‘digital resource’ space?

The digital resource space consists of a group of businesses that, in a nutshell, share the following distinct features:

- A unique value proposition. By accumulating big industry data for their proprietary databases and developing sophisticated tools for data analysis, these B2B companies enable their customers to make data-driven decisions and manage business risk intelligently.

- Recurring revenue. A high percentage of revenue is recurring as a result of multi-year subscription to their continuously updated databases and licensing of the associated analytical tools, which makes their business resilient during industry crises.

- Capital and operational efficiency. The solutions they provide are built once and installable or sellable countless times, which makes their operations scalable and capital-light. Consequently, they end up making high-margin profits and reaping high ROIC.

- Moat. These companies typically command a monopolistic or oligarchic position in their respective niche. Their competitive advantage is protected by high barriers to entry, forbidding switching costs, some network effects. Accordingly, they have a pricing power over their customers.

- Dominance in native industry. They are deeply entrenched in their respective native industries. Some of them were even bankrolled at their birth by the home industry advocacy groups, before they expand into adjacent industries.

- Aggressive acquisitions. As they expand into adjacent verticals, they often find a fragmented competitive landscape, an ideal environment for growth via M&A.

Digital resource firms are extremely rare; they are not just companies that deal with data. A digital resource company typically builds its core business around a proprietary database that is not only unique, often for historical reasons as in the case of Verisk, but also protected by a wide economic moat.

A digital resource company sells subscription to its database for recurring revenue and, on the periphery, offers a whole suite of application software to enable clients to extract and analyze data for intelligent decision making and risk management. While numerous SaaS companies also follow the subscription-based business model, they may not be called a digital resource company because they do not sell access to their proprietary databases for recurring revenue.

Digital resource businesses differ from generic IT companies too. Barring a handful of IT firms that provide monopolistic operating systems or operate dominant platforms, most IT firms actually generate little (or even negative) distributable free cash flow. That is because they need to invest heavily in R&D and compensate their executives and employees à la Palantir (PLTR), lest a competitor emerges from nowhere to make them obsolete. In contrast, digital resource businesses are capital-light relative to their recurring revenue.

Types of digital resource businesses

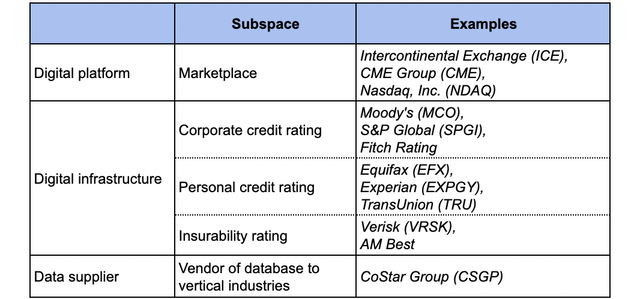

The digital resource space includes a number of distinct subspaces, such as exchanges, rating agencies, and data vendors, as shown in Table 1 with examples.

Table 1. The competitive landscape of the digital resource space (Laurentian Research)

Recent M&A activity has led to concentration of the digital resource space. S&P Global (SPGI) acquired IHS Markit in 2021 in a $44 billion deal that values the latter at 24.1X LTM EBITDA. That EV/EBITDA multiple is nearly twice what the London Stock Exchange Group (OTCPK:LDNXF) paid for Refinitiv. Back in 2018, a private equity consortium acquired Dun & Bradstreet at 13.4X EV/EBITDA multiple.

A possible blind spot in valuation

Proprietary databases are an intangible asset as a mineral deposit is a tangible asset. However, in contrast to mines that deplete and lose intrinsic value as mining goes on, the value of databases appreciates due to addition of new data and because old data already in the database retain value. In many cases, old data are impossible to gather by an aspirant entrant, which forms insurmountable barriers to entry.

- As the intrinsic value of the database increases, you would probably expect the book value to appreciate. But in reality, digital resource companies may end up with a negative book value after years of depreciation and amortization. So, digital resource stocks may come across as too expensive in terms of the P/B multiple.

- Consequently, a significant part of the GAAP operating income is to be offset by D&A, thus resulting an understatement of the actual earnings power. This is why digital resource stocks are perceived to be too expensive, when they are judged in light of a conventional multiple such as P/E.

The above can be a blind spot for analysts who set out to estimate the intrinsic value of a digital resource business.

7 digital resource stocks

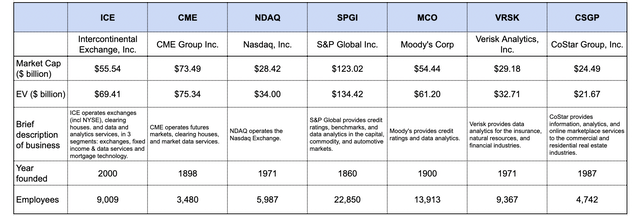

In Table 2, I highlight seven digital resource stocks, namely, Intercontinental Exchange, Inc. (ICE), CME Group Inc. (CME), Nasdaq, Inc. (NDAQ), S&P Global Inc., Moody’s Corp. (MCO), Verisk Analytics, Inc. (VRSK) and CoStar Group, Inc. (CSGP).

The three personal credit rating agencies, i.e., Equifax (EFX), Experian (OTCQX:EXPGY) and TransUnion (TRU) are not included here.

Table 2. Select digital resource companies (Laurentian Research based on data sourced from Seeking Alpha, as of July 24, 2022)

Of the digital stocks, I previously examined Intercontinental Exchange, discussed Verisk, and analyzed Equifax.

Economic characteristics

These digital resource companies manifest stable, recurring revenue; steady, profitable growth; and high margins.

Recurring revenue

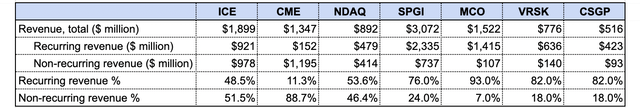

Barring CME, exchange houses Nasdaq and ICE have ~50% of the revenue sourced from subscriptions, which is impressive considering they generate so much sales from transactions (Table 3).

Table 3. Recurring and non-recurring revenues of seven digital resource companies, as of 1Q2022 (Laurentian Research based on data sourced from Seeking Alpha and the companies)

The rating agencies S&P Global and Moody’s derive the vast majority of their revenue from subscriptions these days. So do CoStar, a data vendor, and Verisk, a crossover between insurability rating and data supply.

Growth

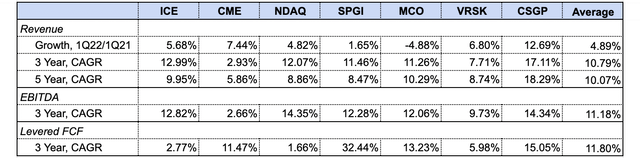

As compared with S&P 500’s 3.8% CAGR of top line growth, the seven select digital resource players have done nearly 3X better in revenue growth (Table 4).

Table 4. Growth of revenue, EBITDA and levered FCF of seven select digital resource companies (Laurentian Research based on data sourced from Seeking Alpha)

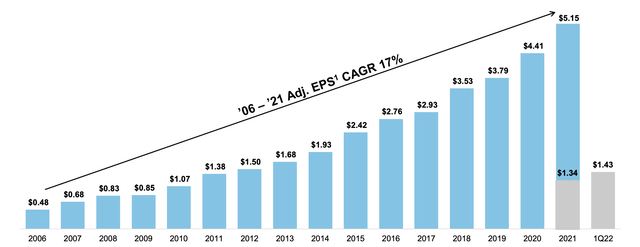

Such a rapid growth has three features:

- The growth is consistent across time, as exemplified by ICE (Fig. 2).

Fig. 2. Growth in revenue of Intercontinental Exchange, 2006 to 1Q2022 (ICE)

- A large part of the growth was accomplished through M&A, as I previously discussed in the case of Verisk.

- It was profitable growth. Top line expansion was accompanied by increasing EBITDA and FCF (Table 4).

Profitable growth is a point worth emphasizing because it is steady yet profitable growth that distinguishes the digital resource firms from so many money-losing growth-oriented IT companies. As Bruce Greenwald et al. pointed out,

“not all growth creates value… Growth only creates value when it takes place within the limits of a strong and sustainable company franchise, and these are rare.“

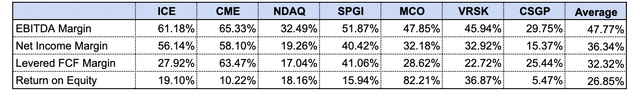

Profitability

This group of companies boast high EBITDA, net income and levered FCF margins as well as respectable ROE (Table 5).

Table 5. Profitability of seven select digital resource companies (Laurentian Research based on data sourced from Seeking Alpha)

High margins means resiliency when the going gets tough, while consistently high ROE is critical for compounding over a long period of time.

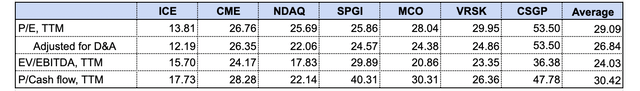

Valuation

These seven digital resource stocks, except for ICE, appear to be richly valued in terms of P/E, EV/EBITDA and P/Cash flow (Table 6). However, as I discussed above, digital resource businesses tend to understate the D&A, which may make these stocks look pricier than they actually are.

Table 6. Valuation metrics of seven select digital resource companies, shown with P/E adjusted for D&A assuming a portion – equal to the percentage of recurring revenue – of the D&A should be reversed (Laurentian Research based on data sourced from Seeking Alpha and the companies)

Dividends and share buybacks

With regard to share repurchases, these stocks fall into two camps: Nasdaq, S&P Global, Moody’s and Verisk believe in the share buyback, while ICE, CME and CoStar shrug off the concept (Table 7).

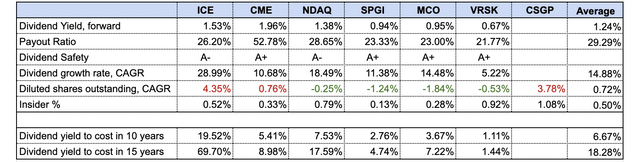

Fig. 7. Dividend and insider ownership metrics of seven select digital resource companies, with projected dividend yield on cost in 10 and 15 years as implied by the dividend growth rate (Laurentian Research based on data sourced from Seeking Alpha)

The low dividend yield of these stocks may disappoint an investor who wants high-yield dividends for immediate income. However, for a dividend growth investor, who is 10-15 years from retirement, some of these stocks – e.g., ICE and Nasdaq – are ideal, thanks to their strong profitability, low payout ratio, and excellent dividend safety ratings by Seeking Alpha. To put it simply, if an investor buys ICE today at a paltry dividend yield of 1.53%, the dividend yield to cost basis is projected to reach 20% in 10 years or 70% in 15 years, supposing the company maintains the pace of historical dividend growth.

Looking ahead…

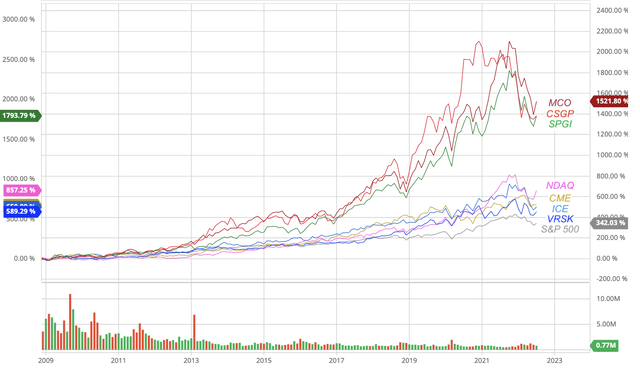

Wide-moated, multi-year compounders are rife in the digital resource space. Over the past 13 years, these seven stocks have risen exponentially, leaving the S&P 500 index in the dust. They formed two distinct packs, the leaders being Moody’s, CoStar and S&P Global, and the followers being Nasdaq, CME, ICE and Verisk (Fig. 3).

Fig. 3. Stock performance of seven select digital resource plays, dividend back-adjusted, as compared with the S&P 500 index (Laurentian Research modified from Seeking Alpha and Barchart)

The bane of these great businesses, however, is they rarely give investors an entry opportunity with an adequate margin of safety. Entry opportunities appear during recessions.

To that end, the recent pullback has made these stocks less overvalued, and further decline in the near future may finally create great entry opportunities.

Be the first to comment