RichVintage/E+ via Getty Images

Introduction

It’s been about a year since we covered Whitecap Resources, (OTCPK:SPGYF). As usual, we did a pretty complete first time work up on the company then, so this time around we will focus on what’s new. If you are new to my writing or the company, please give that older article a read for a more complete investing picture.

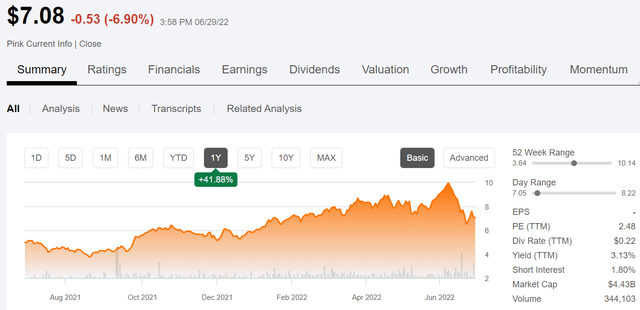

Whitecap Resources price chart (Seeking Alpha)

The company has been very busy consolidating smaller producers under its banner over the last year and a half. Recently, they scooped up a plum, gaining XTO Energy Canada’s Montney and Duvernay acreage. It changes the trajectory of the company and provides multiple avenues for growth and income. That deal will be a key focus of this article.

In anticipation of increased cash flows, the company has also put in an aggressive shareholder returns program that has already commenced, but will kick into high gear next year.

We gave WCP (its TSX listing) a BUY rating last year in the mid-$5s, and it has gained about 40% from there. Not bad, but that probably includes some underperformance compared to some companies we have covered in the same space. That being the case, is the sell-off in the market last week opening the buy window even wider, or should we look elsewhere for opportunity?

The Macro Picture For Western Canada Gas

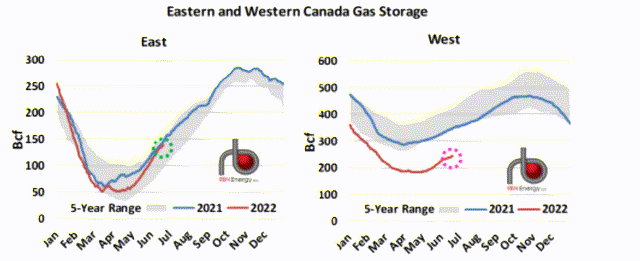

Gas is in short supply in Western Canada, as this RBN graphic indicates. This is compounded by lower than normal U.S. gas inventories, as documented in this week’s EIA Gas Storage Report. Currently, we are 11.6% below year ago inventory levels, an improvement from the prior week thanks to injections that added 82 BCF.

RBN Canadian Gas storage graph

As I noted in the Oil Trends tracker piece last week, everybody is looking for gas when they can afford it. It’s easily transportable in a pipeline or as LNG, and burns cleaner than alternatives, like coal.

RBM makes some additional commentary that feeds into a bullish thesis for Western Canadian gas. The low storage levels in Western Canada trump a potential fall off in export sales to the U.S-related to the Free Port LNG fire. RBN works out the math thusly-

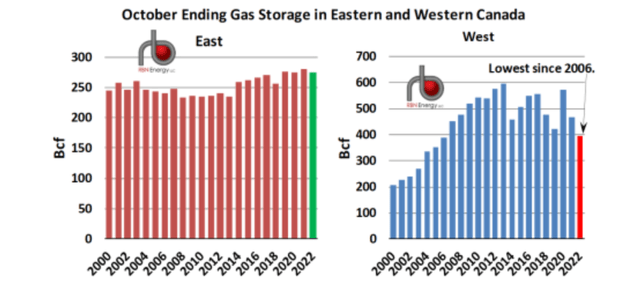

With this region having started the current injection season with 186 Bcf in storage (a 16-year low as we mentioned earlier), the remaining 210 Bcf of gas for injection would send Western Canada storage to 396 Bcf by the end of October, or at about 67% of capacity (red column in right-hand chart). This would be critically low in our view and would be the lowest end-October total for Western Canada storage since 2006. Given what we think will be a very low starting point for the upcoming winter, counting on mild weather in North America this winter to avoid even more critically low storage levels in the west might be asking for too much.

RBN gas storage forecast for Oct.

The risk here is the moratorium that RBN notes on new well permits-

Moreover, the dearth of new well licenses in BC could quickly come back to haunt the market. Depending on how much longer the embargo on new well licenses continues, and given the amount of time (and money) that producers need to do the preparation work for new drilling sites, production growth in Western Canada could be facing a serious deceleration sooner rather than later.

It appears that in Canada as well as the U.S. there is a sharp disconnect between supply signals from the market and governmental policy.

The Thesis For Whitecap And The Impact Of The XTO Deal

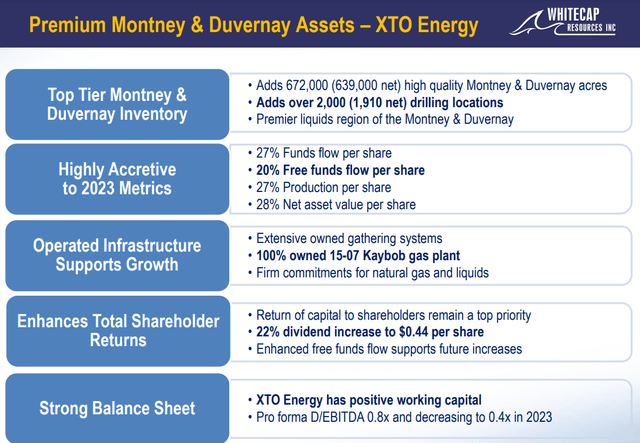

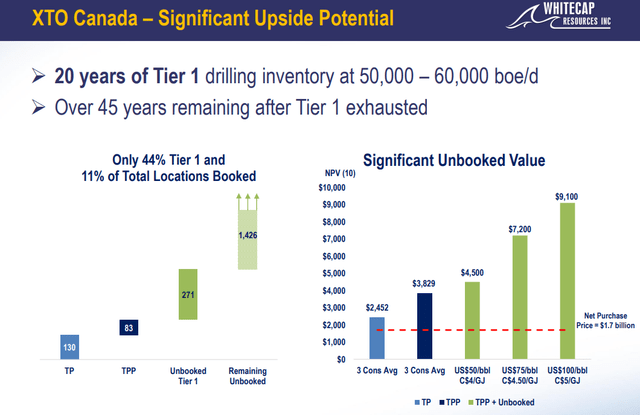

The company noted in the call that they expected the $1.9 bn spent on XTO to be immediately accretive, and had stress tested it down to $50 WTI and $4.00 AECO to ensure dividend coverage and debt covenant compliance. In terms of DCA-discounted cash flow analysis, the company estimates 1P values of $2.5 bn, and 2P values of $3.8 bn over 8 years using Tier I locations. This is a huge acreage pick up that is transformative for WCP.

Having established that come winter, Canada is going to be very interested in fresh supplies of gas, let’s look at what XTO Energy Canada brings to WCP.

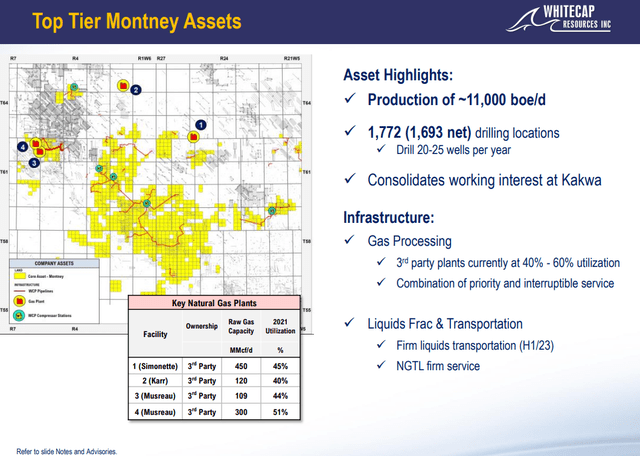

XTO increases WCP’s condensate and natural gas exposure, through the unconventional Montney-567K acres and Duvernay-72K acres plays. The company forecasts 2023 production of 36,000 boe/d on the acquired assets. This consists of 27% condensate, 9% natural gas liquids and 64% natural gas. They have a bullish outlook for North American natural gas, driven by increased natural gas exports and a focus on global energy security that underpins the XTO acquisition. It also balances WCP’s portfolio and diversifies its commodity revenue streams, gaining significant long-term exposure to North American natural gas prices and development optionality.

Whitecap discuss of XTO Canada deal (Whitecap Resources)

The slide above hits the highlights of the deal. The key things that stand out to me are the Tier I drilling locations that make up about a fourth of the deal. These are priceless and insulate the company from having to make further acquisitions – which is not to say they won’t, to maintain production. The gas processing plant acquired in the deal also has excess capacity beyond WCP’s growth plans and currently generates ~$15 mm in third party revenues.

XTO attributes (Whitecap Resources)

Regular readers know I am a fan of the blocky acreage shown here. It lends itself to longer laterals, which is the primary mechanism for increasing EURs from the reservoir.

XTO Montney footprint (Whitecap Resources)

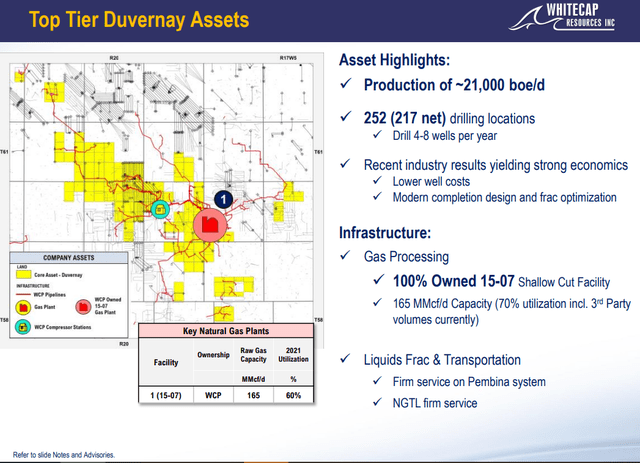

The Duvernay opens a new horizon for Whitecap, and brings the same blockiness. This advantages what they call, “modern completion” design in the slide below. Summarized, this means long laterals, and high sand concentrations per foot, primarily. There are also ways of selectively producing the reservoir that enable higher OW cuts before water inevitably takes over.

XTO Duvernay Footprint (Whitecap Resources)

In the linked call concerning the deal, the company noted in response to an analyst question that the focus areas would be Kakwa and Musreau. They went on to discuss how the acquisition only adds 24% to daily output, but extends reserves by 61%.

What To Expect From Q-2, 2022

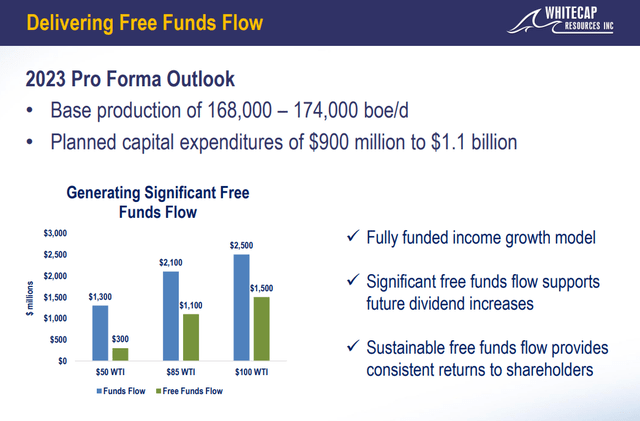

WCP expects to deliver Funds Flow of $2.5 bn in 2023 with $100 WTI. Given the relatively high prices in the NYMEX strip forward curve, I don’t think is unreasonable or overly optimistic. I’ve made my thoughts regarding the direction for oil prices pretty well known recently. At this point we just need to see how it plays out. A more modest $85 WTI estimate still delivers $2.1 bn in FF, so I think there is a reasonable cushion in their numbers.

Whitecap production and FFO after acquisition (Whitecap Resources)

Q-1, Financials

Obviously, the company is benefitting from the increase in WTI and gas prices. They are only moderately hedged at about 5% of production and therefore are receiving most of the current upside.

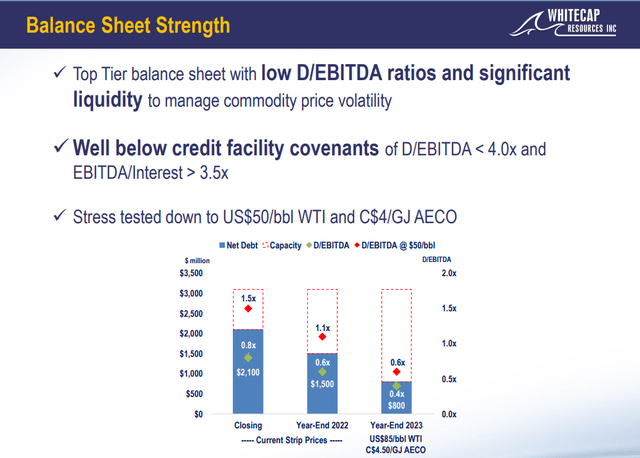

In Q-1, revenues hit $692 mm, a 30% increase from Q-4,2021. OCF was $1.2 bn on an annualized basis, with capex at ~$650 mm on the same basis. Capex will rise to adjust to the new acreage base to $750 mm. The company raised its dividend 22% to $0.44 annualized based on cash flow. By mid-year 2023, the company expects to have implemented two more raises, bringing the annual dividend to $0.74 per share. LT debt was ~$900 mm, but as noted below, it is above $2.1 bn now. At 1.5X the company’s ratio is still well below debt covenants of 4X.

Risks

WCP took on a lot of debt to do this deal. Fortunately, they weren’t carrying a lot up to this point. The acquisition will be funded through existing credit facilities and a new committed 4-year term loan. On closing, Whitecap is expected to have net debt of $2.1 billion on total credit capacity of $3.1 billion and a debt to EBITDA ratio of 0.8 times, decreasing to 0.6 times at year-end on current strip pricing.

Whitecap debt schedule (Whitecap Resources)

Given the company’s cash flow generating capacity and the likelihood of higher oil prices, the prospect is strong that they can pay down the debt incurred quickly. The slide above shows their schedule for doing so.

A Catalyst For WCP

Management has shown a knack for being a consolidator in Western Canada without running up a lot of debt. 2021 was a very busy year for them with incremental gains. Acquisitions in 2021 drove P10 reserves to 323 mm bbl, a 53% increase YoY.

The Kicking Horse, Torc Oil and Gas, and Nal Resources all contributed to EBITDA immediately, and helped to pay down the debt it took to buy them.

I view growth of the company organically or through acquisitions as management’s number 1 remit. In that regard, I think WCP’s team is a catalyst for growth at reasonable prices.

Your Takeaway

WCP has taken a 30% step back in share price recently along with everything else we discuss. The sentiment has just been horrible since the second week of June. I can’t predict when this will shift back, but my expectation is that it will.

Now, what should we pay for WCP? 12 of 14 analysts covering the company rate it a BUY with price targets ranging from $13-$22. In USD, that would be $10-$17 at current exchange rates, implying a 30-110% upside.

The company is trading at 2.5X projected cash flow at $100 WTI. That’s pretty cheap. A month ago it would have been 3X, still a deal. On a consolidated flowing barrel basis, it trades for $39,000 USD per barrel. Again, pretty cheap. There is a strong case to be made for WCP to regain the $10 level it achieved last month. From there, sustained high prices will deliver improved margins that will fund the shareholder returns program planned, further boosting the stock.

I think WCP is an attractive company with good long term prospects. They have an aggressive shareholder return program set to kick in once the company gets to the 1.5x debt target in 2023. At that point, 70% of free cash will go toward shareholders. The XTO acquisition fits right into their controlled growth theme, and gives them enhanced exposure to gas and the liquids rich Montney and Duvernay plays. Currently, they are on sale. Who knows how long that will last!

Be the first to comment