solvod/iStock via Getty Images

As Russia began to invade Ukraine early on Thursday morning, we saw WTI cross over $100. Shortly after, Whitecap Resources (OTCPK:SPGYF) reported record-breaking Q4 earnings. The big story here is the free funds growth. Whitecap is allocating 50% of discretionary free funds back to shareholders in the form of dividends and buybacks. It’s a great time to be a shareholder, and the best is yet to come.

How Were Earnings?

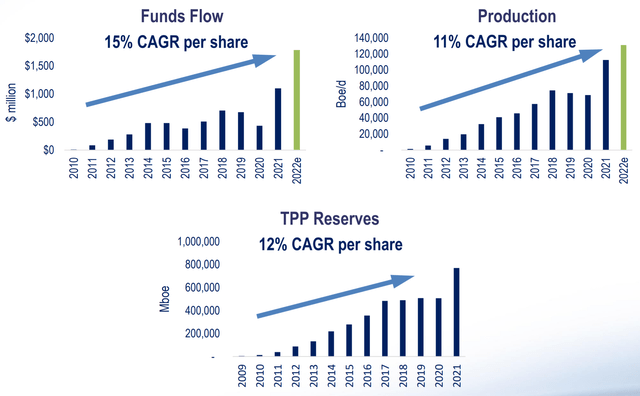

Whitecap set records in both production and funds flow. For Q4, we saw production climb to 120,020 barrels per day, an increase of 88% year-over-year. Even more impressively, we saw funds flow of $351 million, an increase of 234% year-over-year. Not bad!

2021 was a good year for Whitecap. They completed and integrated four corporate acquisitions and two asset acquisitions. This helped lead them to achieve the numbers you see mentioned above. The good news is there is going to be further growth from here.

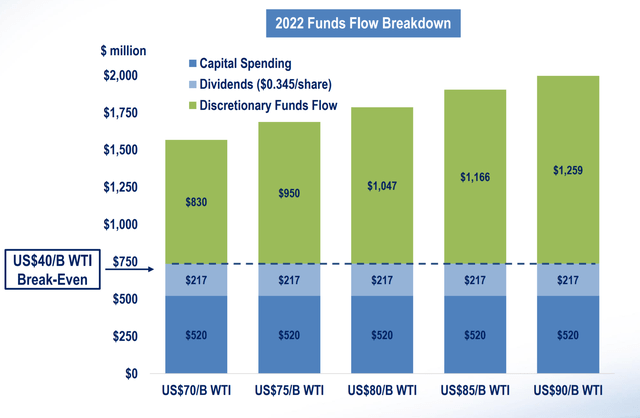

Looking at the guidance for 2022, we see Whitecap predicting production moving to 130,000 to 132,000 barrels per day with CapEx between $510 – $530 million. With respect to funds flow, they are looking at $1.3 billion after capital and the increased dividend. The price of oil obviously has impacts here. When Whitecap first put their 2022 budget together, they were using $70 WTI. Now, they are using $80 WTI. The incremental cash flow on $10 is approximately $300 million relative to any potential inflationary pressures they expect to see in the second half of the year. Whitecap is currently about 16% hedged for 2022, which is much lower than we have seen in previous years which helps drive funds flow higher as prices increase.

Free Funds Flow Say What?

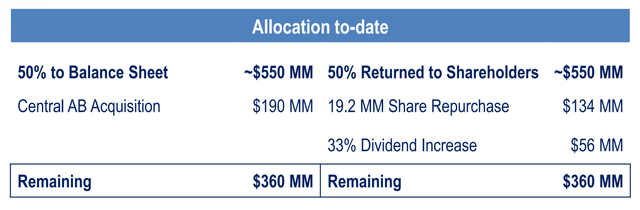

No for the fun part. What does all this excess cash mean for shareholders? It means a 33% dividend increase, with more coming. This drives the yield up to ~3.9%. Whitecap has committed to returning 50% of its discretionary funds flow. This is why we saw them buy back 19.3 million shares in Q4 of 2021. What does this mean for 2022? Well, that depends on the oil price! Looking below, we can see that if oil remains around $90 WTI, we could see as much as $2 billion in funds flow. What we know right now, is that the dividend in its current state at $0.345 per share this year, and the CapEx of ~$520 million, leaves room for a lot of cash to be returned to shareholders. On the chart below, shareholders would get 50% of the green bars based on what Whitecap has laid out thus far. That would be returned in the form of further buybacks, or dividend increases. If we continue to see $90+ for the next couple of months, we could even see special dividends.

Where does the rest of the funds go? Well, if you know Whitecap, you know they are ALWAYS looking at M&A. I do think that 2022 will be a much different year given the high commodity prices, and the geopolitical issues that continue to go on. The reason that Whitecap can continue to look for attractive assets, is thanks to the management of their balance sheet. Whitecap closed off 2021 with a 0.9x leverage ratio (Debt to EBITDA). The company is expecting to see that drop to 0.2x by the end of 2022. Below we can see the allocation to date of the funds flow. This level of transparency gives shareholders a really good idea of how the excess cash flow is being used, which is nice to see.

What is exciting here is that there is already $360 million in the kitty that is waiting to be deployed to shareholders, and that’s only based on the 2021 results. Never mind the cash that they are bringing in while WTI remains elevated over $90. The reason they aren’t deploying all that cash is “just in case”. Whitecap does have a history of cutting the dividend when oil crashes, and having the extra cash allows them to maintain the dividend long term. This makes it a much safer investment in the long run. It is an extremely exciting time to be a shareholder and a loyal one at that. The party is just getting started.

What Does The Price Say?

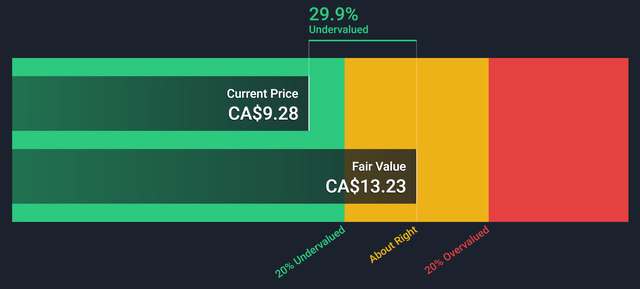

Well, another two months have gone by, so let me update some charts and price targets. We can start with the news that will shock no one, but the valuation has increased again. Of course, this is due to the jump in free cash flow that I mentioned earlier. When I wrote on Whitecap in mid-December, the fair value was sitting at $11.89. I also stated my price target was $10 at the time. Let’s dive into where I have moved it to at this point.

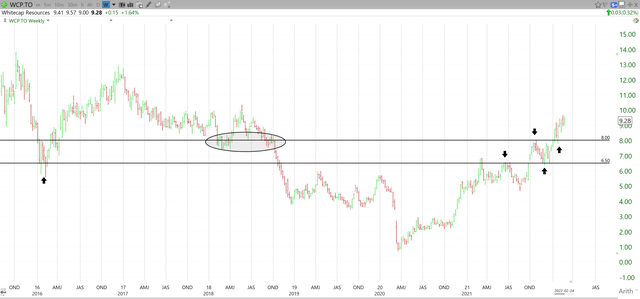

Let me start with where I see current support, and where my stops are. Unfortunately, we didn’t cross the $10.00 mark, so we cannot use that just yet, but I have a good feeling it’s coming soon! That said, we kind of find ourselves in a bit of no man’s land right now, which isn’t great. Looking below, we can see why. There appears to be some support around the $8.00 mark in the short term, but zooming out we can see that it proved to be useless in 2018. With Whitecap being my largest holding, I would likely sell half if we crossed the $8.00 level to lock in profits.

Next up would be $6.50. This is where I would look to re-add what I got stopped out of, or if it broke, liquidate the entire position. This would require a 30% drop from current levels which is a lot more than I would usually risk. If it’s just a normal holding, I would recommend the $8.00 or somewhere slightly below it to protect capital.

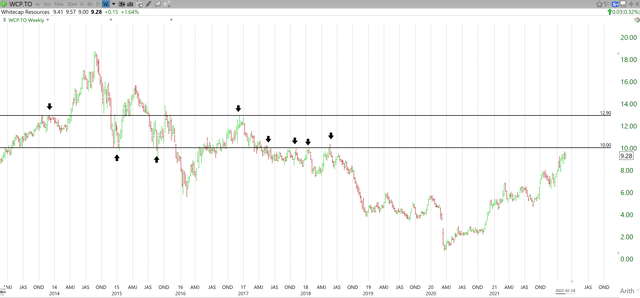

Enough downside talk, let’s look at where I think we are headed. Looking below we can see two targets. First is the $10.00 mark I mentioned in previous articles, clearly, there is a huge wall of support here. I think we’re going to see that level fall very shortly. I do think we could see a test with e negative reaction first, but I don’t expect $10.00 to act as resistance beyond that. Next up, I look to $12.90. We can see the path to $12.90 once we are over $10.00 is pretty clear. I think once we cross $10.00 we could consolidate in the short term allowing moving averages to catch up while building a good base for future resistance before making the run for $12.90 and beyond.

I have some heavy exposure to the Canadian mid-cap oil plays. Whitecap is the largest holding followed by Nuvista Energy (OTCPK:NUVSF), MEG Energy (OTCPK:MEGEF), and ARC Resources (OTCPK:AETUF). I think there is still a lot of potential in these names, given the current macro outlook. They have been and continue to be long-term holds in my portfolio.

Wrap-Up

As you can see, Whitecap continues to impress. The biggest potential risk here is oil price correction, but with breakevens at $40 WTI, there is incredible potential here. Whitecap is going to continue to produce waves of free funds flow, and those waves will flow right into shareholders’ pockets one way or another. I remain very bullish on both oil & gas, and Whitecap. This is the perfect storm, and there is still a lot of room to run here if we continue to see elevated oil prices in the long run. I’m already excited to see Q1 results. The best is yet to come.

Be the first to comment