Author’s Note: All figures discussed will be in $CAD unless stated as otherwise. All graphs and charts are stated in thousands of $CAD.

A shred of hope has been hard to come by for Canadian oil and gas producers. Disputes over environmental regulation placed the industry front and center in political discussions. Tensions between legislators, judiciaries, and activists led to numerous projects being shelved by major industry players. Increased uncertainty saw investors flee the region leaving businesses to rely on an ever-smaller source of capital. This was just the beginning of the problems the industry is facing.

The coronavirus pandemic has halted many businesses and with it, energy consumption. With an expected decline in petroleum demand, OPEC met with its recent ally, Russia, to discuss an appropriate response to the dilemma. Unable to agree upon a solution, Saudi Arabia, OPEC’s largest producer, increased production to drive down oil prices to the lowest level in 20 years. This shock has leveled oil stocks globally and creates the possibility of widespread insolvencies.

With a flexible capital expenditure program, Whitecap Resources (OTCPK:SPGYF) may be able to maintain operations within the near term. Cash flow margins will be tight but should meet minimum capital requirements. Credit facilities with no near-term maturities provide liquidity to fund cash flow deficits. The expectation for large impairment charges creates a great deal of uncertainty surrounding valuation and leaves the business unworthy of new investments.

Flexible Capital Expenditure Program

The shock to oil prices could prove fatal depending on its duration and a producer’s liquidity. Already facing capital scarcity, management teams will need to ensure sufficient access to capital to fund potential shortcomings in cash flow. Whitecap saw its working capital position deteriorate in 2019, leaving the company in a less than ideal situation given recent events.

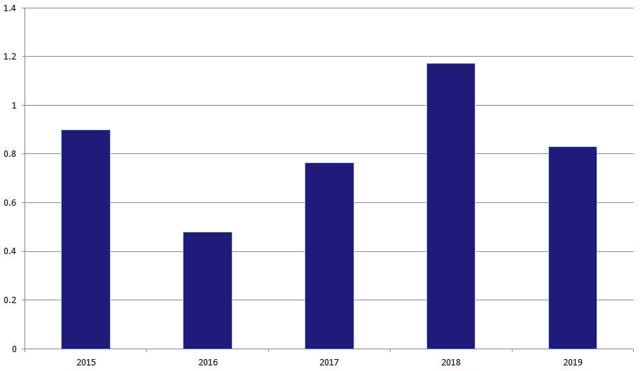

Working Capital Ratio

(Source: Whitecap Resources Annual Reports)

(Source: Whitecap Resources Annual Reports)

While investors would prefer to see improvements moving forward, this is not detrimental to the business even when considering the recent events. Management has typically elected to operate the business on a low cash basis, relying mainly on internally generated cash and credit facilities to fund operations. Whitecap currently has CAD$570 of its CAD$1.175 billion credit facility available, this amount should prove sufficient to make up any near-term shortfalls in cash flow. The facility is not set to mature until 2023 and has a possibility for an extension annually, but the severity of recent events calls into question the firm’s ability to maintain the facility’s covenants.

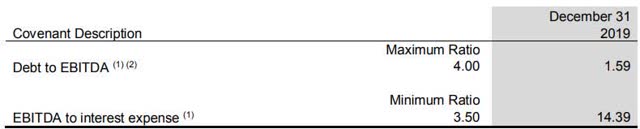

Debt Covenants

(Source: Whitecap Resources 2019 Financials)

(Source: Whitecap Resources 2019 Financials)

Both covenants could prove troublesome for the firm given the expectation for large drops in revenue. If cash flow proves insufficient to fund operations, the need to draw down its credit facility would negatively impact the business’ covenants from both directions. Assuming both debt and interest expenses remain flat, the firm’s EBITDA would need to drop by 60% before one of the covenants would be violated; the first being debt to EBITDA with a minimum acceptable EBITDA level of approximately CAD$249 million.

This assumption indicates the firm’s cash flow cushion but fails to address some key issues. If the firm cannot generate free cash flow, its need to increase debt will require a higher minimum EBITDA to maintain the covenants. It is important then to assess the company’s ability to remain cash-flow positive. While management has not given any guidance for revenue levels, the analyst can use expenditure guidance and work backward to determine the likelihood that the business can meet its minimum requirement.

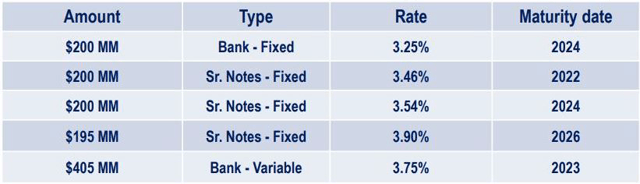

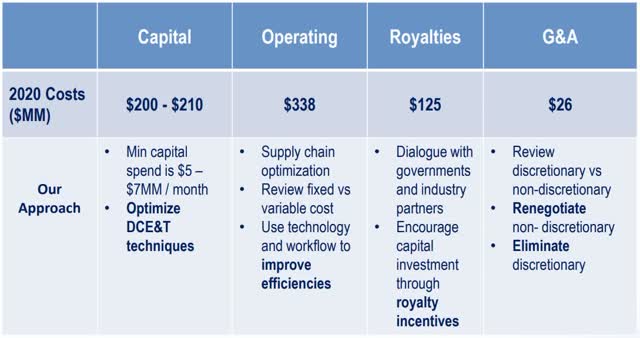

2020 Guidance Update

(Source: Whitecap March 2020 Presentation)

The significant reduction in both CAPEX and dividend payments comes as no surprise given the recent events. Management’s previous 2020 guidance would have proven far too ambitious given the falling oil prices. While production levels have only fallen slightly in comparison, it is expected they will fall by a greater amount in 2021. The delay comes mainly due to the difficulty to sharply reduce production within the short term.

The 43% and 50% reduction in CAPEX and dividends, respectively, will free up CAD$225 million to accommodate falling revenues. Further dividend cuts could additionally add anywhere up to CAD$70 million if they were to be suspended entirely. Subsequently, management has indicated a minimum CAPEX requirement of approximately CAD$60–84 million. This amount would likely require a steep drop in production volume and would not likely be achievable within the near term; we will thus rely on the $210 million figure to determine 2020 free cash flow prospects.

With the new guidance, the firm will require a minimum funds flow (CFO + changes in non-cash working capital) of approximately CAD$330 million to meet capital expenditures, dividends, and interest. This amount is significantly lower than 2019’s CAD$675 million figure, but given the extreme price drop, it should not be ruled out as a possibility.

Cost Structure

(Source: Whitecap March 2020 Presentation)

The above diagram fails to incorporate one key item that will work in the company’s favor, its hedge positions. As with any commodity producer, Whitecap relies on derivative contracts to smooth out short-term fluctuations in commodity prices given their volatile nature.

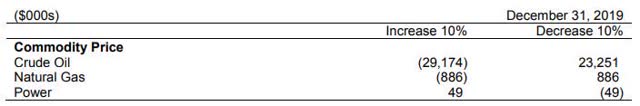

Derivative Contract Value Sensitivity

(Source: Whitecap Resources 2019 Financials)

If current prices around USD$30/bbl were to persist for the remainder of the year, Whitecap would likely realize a gain of CAD$50-100 million or more. This provides an extra and desperately needed layer of safety to the firm’s cash flow. While this allows Whitecap to potentially remain cash flow positive even within a USD$25/bbl price range, it would only prove sufficient within the short term as hedge positions will expire and leave the company exposed to lower prices.

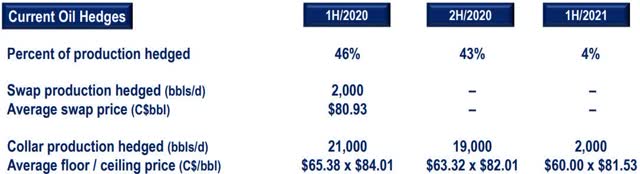

(Source: Whitecap March 2020 Presentation)

All told, Whitecap should be able to maintain a positive free cash flow position through the summer. Its EBITDA values will be severely depleted but should still meet the minimum levels outlined in the firm’s debt covenants. After this period if prices showed little recovery, management would be required to greatly reduce production in hopes of reducing cost.

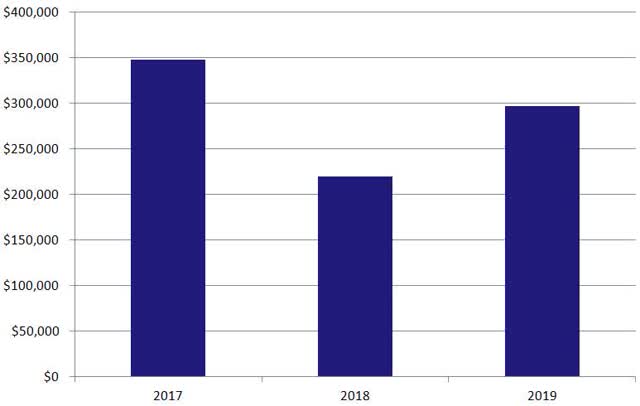

Impairment Charges Expected to Spike

As with any commodity producer, Whitecap uses a discounted cash flow analysis to calculate a hypothetical fair value for its reserve assets. With oil prices falling significantly, the company will need to update its cash flow analysis to reflect these new prices, likely leading to significantly lower asset values. This is then accounted for on the income statement as a non-cash impairment expense.

(Source: Whitecap Resources Annual Reports)

It is difficult to estimate what these impairment charges may be moving forward, but given the drop in prices, it is safe to assume these will eclipse the levels of previous years. The effect of increased impairment charges will see an increase in Whitecap’s accumulated deficit to account for the drop in assets – the net effect resulting in increased leverage for the business. For Whitecap, this does not prove detrimental in the short term as debt covenants are only concerned with cash flow metrics and not capital structure.

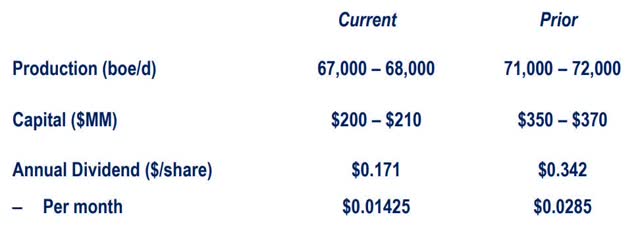

Financial Obligations

(Source: Whitecap March 2020 Presentation)

(Source: Whitecap March 2020 Presentation)

No near-term maturities give Whitecap a multiyear window to weather current conditions and improve its financial position before the need to raise capital. The size of the impairment charges will prove difficult to improve within this time as free funds flow is expected to be low, if positive at all. This will greatly limit management’s ability to improve upon its balance sheet and could lead to increased capital costs in the long term.

The first- and second-quarter results will give a clearer sense of both cash flow and impairment charges. Investors will then be able to determine, to a slightly greater extent, the firm’s ability to make any improvements to its balance sheet. While it seems likely the firm will survive, the negative impact on its financial position will greatly reduce the overall value of the business; only significant improvements in crude oil prices could change this outcome.

Conclusion and Valuation

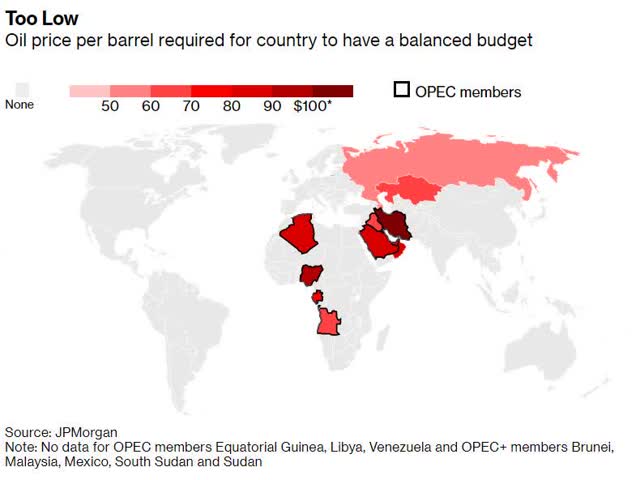

The coronavirus pandemic has widespread implications for all industries. Saudi’s decision to greatly reduce global oil prices added to problems producers were facing and has created a full-blown crisis. The attempt to force Russia’s hand may prove ineffective as some analysts predict Russian producers can maintain production at lower prices.

The longer oil prices remain depressed the higher the chance the industry on a global scale faces indefinitely low prices. Many OPEC producers cannot maintain production at current prices and have economies almost entirely dependent upon the industry.

(Oil Prices in $USD)

If the Saudis do not work to amend the situation, it seems likely smaller producers would exit the cartel. If OPEC were to disband the increased production through, greater competition would likely see low oil prices persist well into the future.

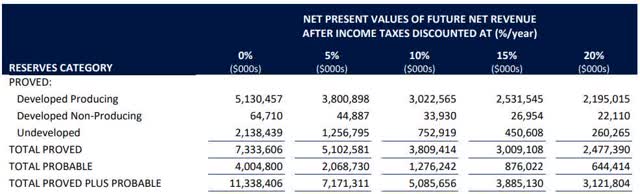

Net Present Value

(Source: Whitecap Resources 2019 AIF)

The Net Present Value calculation above was completed before the recent price shock and thus should not be used as an accurate indication of value. One could update the calculations but this comes with several problems. Firstly, predicting oil prices outside of a few months is highly uncertain as to the situation that caused the drop is still unfolding. Secondly, if low prices persist for an extended period, production levels will be greatly reduced to accommodate. While updating the calculation is possible, the wide variability in the input assumptions is unlikely to deliver a higher degree of accuracy.

New investments would not be recommended if one cannot assess intrinsic value. Those looking to find bargain securities within the oil industry would be wise to wait until a clearer picture emerges. The recent pandemic alone leaves a highly uncertain future, compound this with a political stalemate and the oil industry should be avoided. Investors who are currently holding positions would approach the matter from a different perspective.

The company’s ability to survive will depend on its cash flow. Management’s ability to greatly reduce capital expenditures could prove vital in Whitecap’s survival. Further dividend cuts provide room for greater cash savings and low margin for error should be expected moving forward. While the company should be able to maintain operations within 6 months, the expiration of hedge contracts will leave the business with greater exposure. This leaves a short window for management to plan for a significant adjustment to operations through greatly reduced production, if necessary.

This creates a very difficult situation for shareholders, one that rests largely upon faith in management. Initial cash flow estimates show the company can maintain operations within the near term, even if only by a slim margin. Looking at the NPV calculation, developed producing reserves with a 20% discount rate net of outstanding debt leaves approximately $943 million. This then approximately requires a 26% drop in value for the assets to meet current market capitalization. This is a very real possibility. This figure is likely lower than the actual number given only developing reserves are used and the high discount rate. Given the severity of current events, conservative adjustments such as these are appropriate.

The decision to sell in hopes of avoiding a complete collapse rests on the individual investor. Personal budgeting and portfolio characteristics matter to a far greater extent than market activity. There are far too many variables to predict movement with any degree of certainty. Economics for too long has been pursued by academia as a hard science, relying heavily on data analysis and econometrics. This has created a false sense of security and wildly underestimates the difficulty of predicting single individual’s decisions, let alone the simultaneous decision of millions.

Whitecap has a chance of surviving this crisis. Margins are slim and current market capitalization may prove to be a fair assessment of intrinsic value; only time will tell. One’s personal liquidity needs and risk tolerance should drive the decision to hold on or jump ship. The possibility for success may very well come down to coin flip probabilities. Those who are willing to roll the dice could add a small nominal amount to their position as this would make up for significant losses if the stock were to rebound at some point, but this should only be done with funds the investor is willing to potentially forfeit.

Author’s Note: Thank you for taking the time to read my work. If you found the article intriguing and/or useful, please like and leave a comment below. For more articles, be sure to follow my page and subscribe to email alerts.

Disclosure: I am/we are long SPGYF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment