gorodenkoff/iStock via Getty Images

Performance Review

|

As of September 31, 2022

Inception of White Brook Capital Partners was August 16, 2019 Performance figures are provided by the administrator. Prior years are audited. 2022 is unaudited Performance is net of all realized and accrued fees

|

Market Review

The third quarter was in many ways a continuation of the second. On average, stocks traded down due to the higher cost of new debt issuance, the math of discounting future cash flows at higher rates, downward revisions in likely cash flow generation, and the volatility itself.

In equity markets, it’s the proverbial 60-degree day. Interest rates are high relative to the very recent past, but not on an absolute basis or relative to the pre financial crises era. For those that believed summer was never-ending, the Federal Reserve’s hawkishness, aggressively raising interest rates and convincingly setting expectations that they would remain there to curb stubbornly high inflation, was an awakening. For those accustomed to considered investment requiring weighing trade-offs, it’s a welcome change.

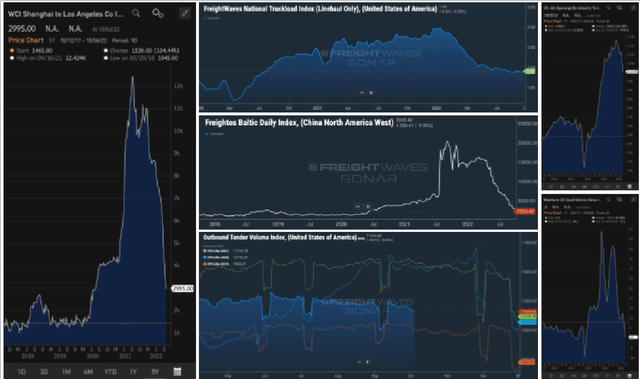

In the 1Q22 quarterly commentary, I noted that a return to normal would look a lot like a recession and that a key to the economy’s health was that transportation costs declined. As energy prices have receded from highs and demand shifted from goods to services, they have.

Housing prices have also receded somewhat, driven by a reduction in demand due to higher interest rates. While inventories have increased and traffic has declined, prices still remain elevated relative to a long-run historical average, reflecting, in my view, a national housing shortage. While higher interest rates will impact the affordability of larger homes, household formation continues, and a need for new homes is clear even if they are smaller than what might have been envisioned a year ago.

Given the underlying strength in employment and housing and housing’s importance to the nation’s economy, I believe anything more than a minor recession is improbable and the likelihood of something better than that, while non-consensus, is probable.

Today’s too high inflation has proven surprisingly sticky and suggests an institutional origin. Conversations with consumer facing general managers and their service providers suggest that price cuts outside of targeted promotions are not actively being considered by managers who also wish to be promoted. New entrants are less likely to emerge to force pricing as new plants are more expensive than in previous years due to higher interest rates. This is a break from the past 30 years, wherever decreasing rates meant the cost to build a new plant was generally lower than it was in years previous.

I continue to believe that investment in the stock market is the best opportunity for capital appreciation and am an advocate for higher allocations at these prices. However, more reasonable bond prices are also available across a range of risk profiles and are more likely to produce risk and cost-effective returns than they have been for the past decade and a half where those yields were not available and bond investment was foolhardy.

I have previously advised the risk averse to build cash rather than invest in poorly priced bonds, but given the better risk/reward, smart bond investments are now generally preferred to cash. Reach out if you would like more specific advice.

Portfolio Review

White Brook Capital Partners did not enter or exit any positions during the third quarter and trading was limited. Year to date, investments in industrials and financials have been the largest detractors from Fund performance while investments in materials and communications have been the biggest contributors to performance.

While US interest rates are somewhat higher than anticipated at the beginning of the year, they are not so in excess of the base case as to change White Brook’s outlook. Higher interest rates than the recent past have always been expected and I believe the portfolio is positioned to outperform as the hopes of other outcomes fade.

As outlined in the fourth quarter 2021 letter, White Brook Capital Partners is positioned to take advantage of the emerging opportunity in companies that benefited from an end to the supply chain shortage.

- Itron, Inc (ITRI). As outlined in our last letter, Itron suffered as their semiconductor suppliers prioritized higher value and higher priced semiconductors over Itron’s products. With a strong backlog, and high energy prices only enhancing their value proposition, the company will do well as their product can finally be assembled and is deployed to their customers. Their customers are in large part local municipalities and their budgets are fairly isolated from economic vagaries providing a margin of safety as the economy enters a period of lower growth.

- KAR Auction Services (KAR). KAR Auction Services suffered as car dealerships sold whatever used cars were available rather than optimizing their assortment during the supply chain crises. While higher interest rates are an impediment to auto transactions at ever higher prices, KAR can be expected to benefit due to two main factors:

- New cars becoming more available for lease and purchase leading to a higher volume of used car trade ins. Currently new cars are experiencing some decline in prices visible at the subsegment level even as they continue to command above MSRP in the premium segment. I believe we’re in inning 1 or 2 of additional supply leading to lower prices and more transactions – finally becoming a tailwind.

- Higher interest rates have a significant impact on the wide population of auto dealers who use fleet financing to finance their lots. Because of the payments that need to be made, these dealers are incentivized to sell cars as quickly as possible. Cars that don’t sell at a particular location, with the higher opportunity cost of keeping those cars, are more likely to be wholesaled to find another, more appropriate dealership using the wholesale providers like KAR.

- The Greenbrier Companies (GBX) is a railcar manufacturer, servicer, and more recently, leasor. Railcar manufacturing is a capital-intensive industry with low margins and an emphasis on reliable and scalable manufacturing. During Covid and the ensuing supply chain crises, the country’s railroads suffered as service levels dropped and the unanticipated demand for goods moved many loads to truck and air. With higher energy costs, railroad workers returning to work, manufacturing slowly returning to the US, and shippers seeking to reduce their cost burden by shipping on the cheapest mode of transportation, more loads are moving to rail. The railroad industry generally needs to replace ~35,000 railroad cars a year to maintain service level and has tracked materially below that for the last several years. With potential for further revenue growth, margin growth, and higher interest rates benefitting a growing leasing business while also limiting new competitors to their manufacturing business, GBX is priced to do well in this new environment.

The first two positions are down modestly from the Fund’s entry as of the end of the third quarter and the third materially so. The next couple quarters should prove their value proposition.

Focus: Box Inc (BOX)

Given the Fund’s three-year mark, I thought it appropriate to revisit our largest position over that period, Box, Inc.

Three years ago, Box was an enterprise software company focused on document collaboration. The company’s competitive advantage was born from its security and governance capabilities that allowed it to succeed in regulated industries and the superior number of integrations with other services that made it easy to use a single file across functions. As it looked forward, it hoped to build on those capabilities with a new workflow automation tool and expand its fledgling artificial intelligence capabilities.

There was significant opportunity in its sales and marketing expenditures which were relatively inefficient. The Company was overly dependent on partners to penetrate larger enterprises and generally struggled to sell to the mass enterprise market despite its superior product. From a financial perspective, the company had line of sight to operating profit breakeven and robust free cash flow generation when excluding the cost of stock-based compensation but had a history of missing Street expectations.

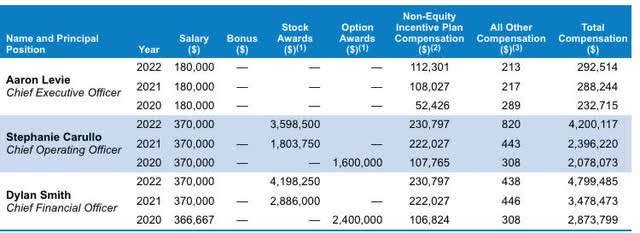

Its co-founder and CEO, Aaron Levie, was well thought of within the industry and was considered a visionary, but the company had a difficult time delineating to investors what differentiated the company from Microsoft’s (MSFT) OneDrive and Sharepoint, Google (GOOG, GOOGL) Drive, Dropbox (DBX), and a host of less sophisticated sync and share offerings.

On almost all fronts, the Company is stronger today than it was then. From a leadership standpoint, founding and running Box is likely to be a starting point for Levie. He continues to be a top mind and has proven an inspirational leader within Box. Even while reigning in stock-based compensation continues to be an opportunity, Levie does not, and has not for several years partaken. It’s both admirable and a source of some consternation, as the pay of the top executives appears to be in reverse to the value provided.

The Company’s growth has accelerated on the back of pricing changes by its competitors (now charging for storage for large enterprises) and the greater demands put on information workers and therefore the requirements of their document storage. Their competitors’ offerings, particularly the free ones, were always great for ~85% of use cases, but as the world’s workforces started working hybridly/remotely, the boundaries of those offerings were run into more often and Box’s extended capabilities in comparison have become more obvious.

Additionally, Box’s offerings have matured. 3 years ago, they were building the foundations of the house, and allowing others to make more money than they were building on top of their solution. Now, they are starting to expand, offering superior or fast follower versions of the applications they know their customers are willing to pay for, sometimes for free.

For instance, Box now offers e-signature capability for paying users of its basic offering, allowing a purchaser to make the argument that it can replace Docusign (DOCU) or Adobe (ADBE) Sign – tangible use cases – while also upgrading their additional file capabilities for free as a throw-in. They also offer, for additional expense, a best-in-class security solution to track employee file usage and prevent cybercriminal activity, at scale.

Moving forward, as investors, we can expect the Company to continue this motion, offering higher margin services on top of the infrastructure they’ve already built while increasing the compellingness of the platform.

At the behest of an active investor, they’ve become more mindful about their expenses, resulting in a more efficient go to market approach, and more efficient research and development spending. Their capital allocation has also improved, now buying back stock and using M&A to add features to their platform. They still struggle with their investor communications – many investors still don’t understand the boundaries of their competitors’ offerings and continue to regard Box, despite their growth, as a commodity offering. There is opportunity there.

Over the near term, despite their flawless execution over the past year or so, I believe they’re likely to miss headline earnings because of their outsized exposure to the Japanese Yen and the extent of that foreign exchange rate adjustment. I continue to like the stock over the medium term however and we continue to hold.

A Quick Note

During the third quarter White Brook Capital Partners completed its third year in operation. This is a major milestone – with over 36 months with a 3rd party administered investment track record, there is sufficient data to understand the strategy’s performance, its performance against the index, and the absolute and risk-adjusted alpha generation that has occurred over time.

Later this quarter, clients will notice an invitation to a client portal. For separately managed account clients, this portal aggregates custodian monthly statements and tax documents and provides a repository for the documents White Brook generates such as your accounts’ quarterly reports and these commentaries. It can track non-White Brook Capital assets as well. For clients of only White Brook Capital Partners, while the portal can and should be used – it is somewhat less useful as the administrator’s site already provides much of that information.

For clients, White Brook will now manage a portfolio of fixed income investments such as exchange traded bonds. Management fees for that service are substantially reduced to allow the client to earn a meaningful return. Following the bond market’s poor performance this year and a more supportive Fed Funds rate, bonds across a range of risk profiles can now produce risk effective returns. This is a stark change from the past decade where any allocation to bonds was poorly advised and represented a very poor risk/reward. Please reach out if you are interested.

The Midcap Opportunity

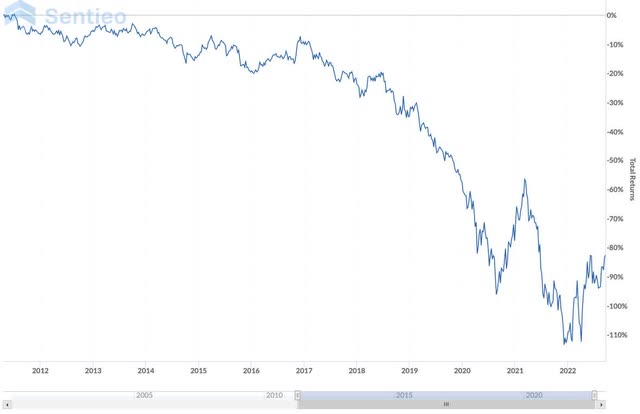

As an update to a longstanding and self-serving thesis that midcap stocks have underperformed and are set to outperform – the opportunity in middle capitalization stocks continues to be significant and I continue to be a proponent of increasing exposure.

Midcaps have now outperformed year to date, despite dramatically underperforming large caps since 2016. I believe that recent improvements in the relative performance of midcaps may be a harbinger of more.

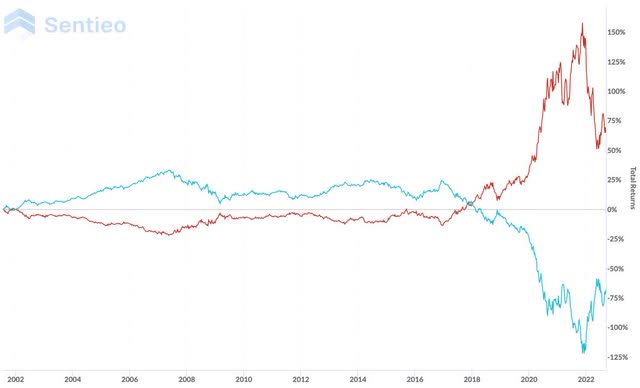

The second graph plots the performance of so-called “value” and “growth” factors vs the S&P 500. It illustrates the outperformance of growth over value since 2017 and the extremity of its current outperformance defying the long-term correlation. While value recovered somewhat during the 3rd quarter, it remains off the relative performance high for the year and very far from the historical relationship.

I continue to believe that midcap stocks present a compelling opportunity, especially relative to large cap stocks, and that exposure to the asset class provides an enduring tailwind for the Fund as it reverses.

As always, feel free to reach out to discuss this or any of your investments at White Brook

Capital. I thank you for your support and will strive to continue to earn your trust.

Sincerely,

Basil F. Alsikafi

Portfolio Manager, White Brook Capital, LLC

| All investments involve risk, including loss of principal. This document provides information not intended to meet objectives or suitability requirements of any specific individual. This information is provided for educational or discussion purposes only and should not be considered investment advice or a solicitation to buy or sell securities. The information contained herein has been drawn from sources which we believe to be reliable; however, its accuracy or completeness is not guaranteed. This report is not to be construed as an offer, solicitation or recommendation to buy or sell any of the securities herein named. We may or may not continue to hold any of the securities mentioned. White Brook Capital LLC and/or their respective officers, directors, partners or employees may from time to time acquire, hold or sell securities named in this report. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment