Scott Olson

Investment Thesis

Whirlpool’s (NYSE:WHR) outlook has weakened significantly over the past several months. The company is seeing decreased demand from consumers. Cost inflation is still hurting margins. But after a 33% drawdown, I feel that the risks of this investment are now priced in.

The home appliance market is deteriorating

By now, it’s clear that Whirlpool’s situation has deteriorated. Just look back at the guidance management has issued over the past year.

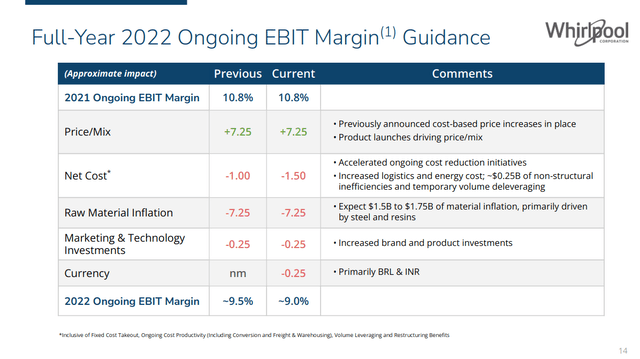

In January, the company guided for 5% to 6% top line growth. Projected EBIT margins were 10.5%, generating an estimated EPS of $27 to $29 per share.

Last week, management called for a 5% to 6% decline in revenue. The company slashed its EPS guidance to $22 to $24 per share. EBIT margin guidance was cut by 150 basis points.

In January, management was very optimistic about the demand environment. On their fourth quarter earnings call, the company reported that they “strongly believe that consumer demand trends will remain strong.” Now, the company is issuing a more cautious outlook. Management discussed a rapid decrease in demand on their last earnings call.

But we did see in pretty much around the late April, May time frame, a pretty strong drop in consumer demand, which is ultimately driven with consumer sentiment dropping off and we all know it, I mean, it’s consumers — it’s not that consumers have no cash available, I think, versus disposable income, it’s the consumer sentiment driven by inflation, all the bad news around war and the pandemic, which is still now behind us. That together dropped or led to a significant drop of consumer sentiment impacting demand.

Management’s macro assumptions are bleak compared to the start of the year. They’re now assuming a recessionary environment. To combat this, the company is undertaking cost cutting measures. These headwinds aren’t expected to clear up until November or December at the earliest.

Inflation and consumer weakness aren’t the only issues facing the company. Rising rates have caused widespread weakness in the housing market. New home builds are declining, and expectations for future builds are also lower. Homebuilders make up a significant portion of home appliance buyers. They’re also a key piece of Whirlpool’s growth story.

The long term thesis is still intact

Demand for Whirlpool’s products is cyclical. Sales are good when the economy is booming, and sales are poor when the economy is struggling. The company will undeniably have a tougher year ahead. But I believe there is opportunity in the long term.

The company sees a structural increase in home demand as one of their major growth drivers. The US is currently facing a severe housing shortage. At some point, there has to be an acceleration in property development. This will create secular growth in the home appliance market, which Whirlpool is well positioned to enjoy.

Management articulated a plan to double down on their North and South American business segments. They’ve spent the past few years divesting from their international businesses. This positions the company well for an acceleration in the American housing market. This upside also comes without high exposure to interest rates and the US labor market.

The company has created structural improvements in their margins. The company’s EBIT margins have increased significantly over the past 10 years. Even after the recent guidance cuts, management projects operating margins 25% above their long term average. This is especially true in their North American segment, which now reports consistent EBIT margins above 15%.

Whirlpool Q2 2022 Earnings Presentation

The company is struggling the most with raw material inflation and related costs. These costs are likely to drop during a recession. This creates a long term tailwind for the company’s profit even if revenue dips. I think the company is in a position to survive a pullback and come out stronger as the market recovers.

I think the risk is priced in

Whirlpool is considered a cyclical company. This means that it’s more difficult to value it with traditional comparables. But I think that the company has generated stable revenue in a variety of economic environments. The business has a consistent track record of reporting revenues in the range of $16 to $20 billion. Shares are currently trading at a forward EV/FCF of just under 11.

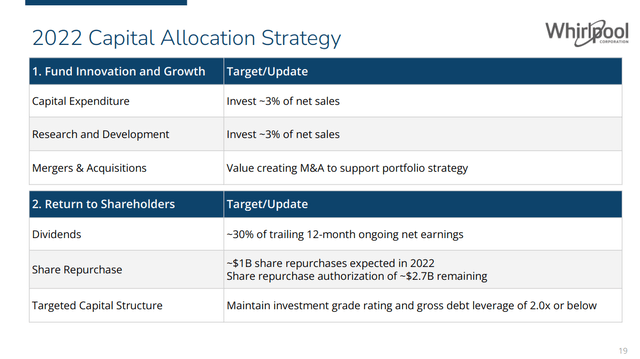

The business’s long term goal is 5% to 6% annual top line growth. Leadership plans to convert about 7% to 8% of this into free cash flow. For a business that consistently reports over $18 billion in sales, this seems very cheap to me. Whirlpool targets a 15% to 16% return on invested capital. The company has delivered a steady double digit ROIC.

Whirlpool Q2 2022 Earnings Presentation

Management is committed to returning cash to shareholders. Over the past ten years, the company has returned about $8 billion in buybacks and dividends. The company is on track to return over $500 million throughout the rest of the year.

Whirlpool is increasing its capacity to generate free cash flow and return it to shareholders. At the current valuation, I believe the risks to the core business are priced in.

Final Verdict

I think Whirlpool’s stock is a good way to gain exposure to the new housing market. This investment will likely be volatile. But I think it will probably carry less risk than homebuilders or commodities. I’d still recommend holding off for investors looking for steady income or low volatility.

I think this stock is a good buy for investors who think housing will enter a secular bull market. At the current price, I believe the risk to reward is favorable.

Be the first to comment