InspirationGP/iStock via Getty Images

Co-produced with Treading Softly

When you’re in the market for income, often you can find various opportunities and then are presented with a decision and thus a judgment call to make. Which choice is better at this moment?

Today, we want to walk through a quick evaluation of two different income opportunities in the fixed income space to show how we might consider these two ideas and evaluate them for a buy-and-hold type investment. We’re not interested in a quick flip here but a buy till the company calls them away style of investment.

So today, I want to look at a preferred from ACRES Commercial Realty Corp. (NYSE:ACR) and Arbor Realty Trust (NYSE:ABR).

Let’s get to it!

What Do They Do?

ABR and ACR are both mortgage REITs. However, unlike Annaly (NLY) or AGNC (AGNC), ABR and ACR are both involved in commercial real estate or multi-family style investments. Instead of buying MBS or servicing rights, they are involved in every step including origination. ACR and ABR take these loans from birth to death if possible. Thus, they enjoy the returns from start to finish without having to buy them from someone else.

While NLY and AGNC see large swings in book value, often ABR and ACR see less movement due to this. ACR for example holds its book value as “undepreciated book value” which is vastly different than NLY or AGNC’s book value which moves with the current MBS pricing. ABR holds its book value as “undepreciated book value” as well. So in this evaluation it keeps it as “apples to apples”, however when compared to other mREITs it will not be so.

ACR Earnings

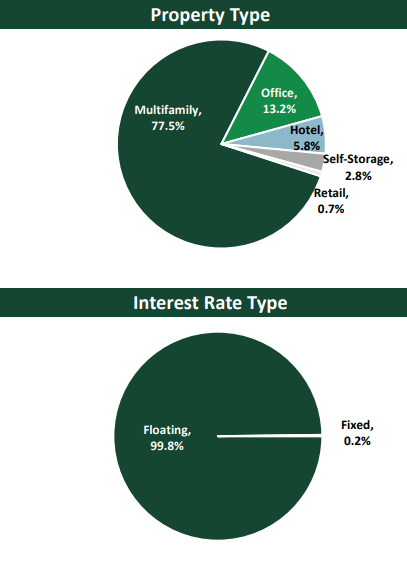

From ACR’s earning slides, we can easily see they are heavily invested in multifamily loans, which are overwhelmingly floating rates.

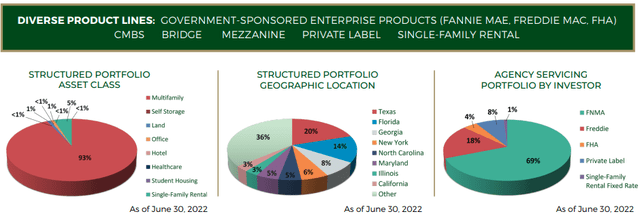

ABR has a wider-ranging portfolio of investments than ACR, this diversity can be a benefit if CRE loans face pressures; however, exposure to residential loans also means exposure to consumer struggles which ACR sidesteps.

Overall, we see no major issues with the type of investments that ABR and ACR make. Common shareholders have more readily rewarded ABR with a higher share-to-book value ratio and ABR trades at a premium to book value, while ACR trades at a discount.

We are less concerned about this when we are evaluating their preferreds.

Earnings Strength

When investing for income, we want to look closely at the earning power of our investments to ensure the income we’re paid is sustainable. Only ABR pays common dividends, as a bonus ABR is actively raising their dividend as well – yay for common shareholders! However, how sustainable is this? Let’s look at ABR first:

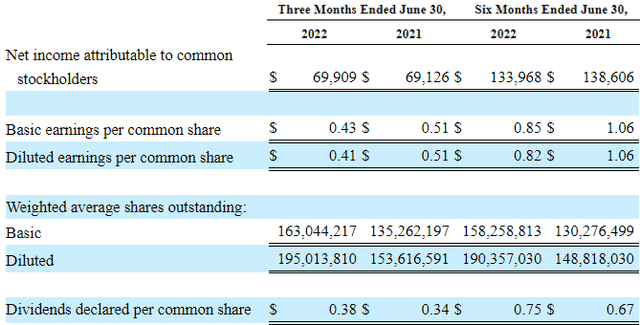

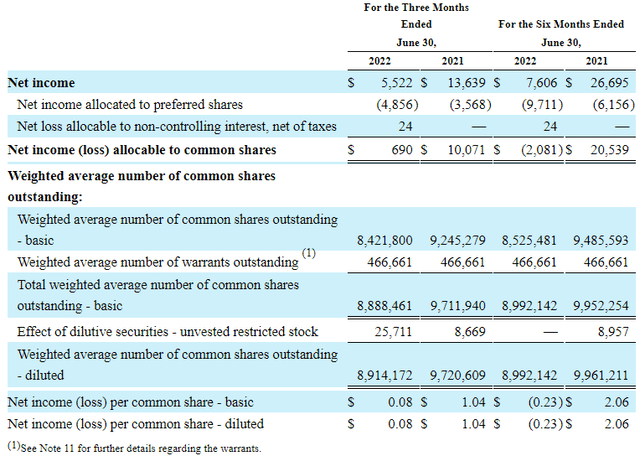

ABR has had solid GAAP earning coverage of their dividend, which helps explain their ability to continue to raise their dividend. It also bodes well for their ability to pay their preferred dividends.

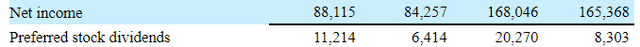

As we can see, ABR has continued strong coverage of their preferred dividends; last quarter was close to 8x alone using net investment income. We must note that ABR has a much higher preferred securities dividend expense in 2022 over 2021. However, their earnings haven’t significantly jumped to meet this rise.

ACR is a slightly different story.

ACR is paying the vast majority of its cash flow to its preferred holders, leaving less room for its common shareholders to enjoy any direct benefits. Recently, ACR’s management has been more focused on buybacks and reducing leverage than paying out a common dividend – as it doesn’t pay one.

ACR’s negative 6-month GAAP earnings are tied to its paying down of debt due in August of this year, so we expect their 3rd quarter earnings to reflect the impact of finishing that off. ACR is in the midst of a turnaround from when ACRES took over external management.

ACR’s large discount to its book value is essentially explained by the complete lack of a common dividend. ABR trades at a premium due to having a healthy and growing dividend. The idea that ACR will suddenly snap back towards its book value is a pipedream so long as shareholders are getting no direct reward for holding the mREIT. Management won’t be rewarded a higher share price so long as the shareholders aren’t rewarded with a reliable dividend.

For preferred holders, ACR covers the preferred dividends, albeit barely on a quarter-to-quarter basis. We expect this to meaningfully increase with the 2022 convertible notes paid off.

So why is ACR buying back its shares? It is an effort to boost book value per share and boost the per-share earnings.

Knowing that ACR has no common dividend while ABR is raising theirs, let’s look at the preferred securities that we want to evaluate.

Preferred Showdown

Arbor Realty Trust, 6.25% Fixed-to-Float Series F Cumulative Redeemable Preferred Stock (NYSE:ABR.PF) currently trades below PAR and yields 7.4%. If it is not called in October of 2026, it begins to float at the 3-month SOFR rate plus 5.442% per annum; however, in no event shall the floating rate be lower than 6.125% per annum. The floor rate of 6.125% gives a current yield on cost of 7.7% for the floor.

ACRES Commercial Realty Corp 8.625% Fixed-to-Float Series C Cumulative Redeemable Preferred Stock (NYSE:ACR.PC) currently trades below PAR and yields 10.0%. If ACR-C is not called in July of 2024, it begins to float at a floating rate equal to three-month LIBOR plus a spread of 5.927% per annum, provided that such a floating rate shall not be less than the initial rate of 8.625%. In essence, ACR-C is a fixed-to-float preferred with a capped downside and unlimited upside for its rate.

With both preferred trading at a discount to PAR, they are highly attractive. However, ABR-F carries a much lower perceived risk to its dividends and thus is rewarded a lower yield for current investors. We do not see interest rates remaining elevated through 2026 due to high levels of recession risk between now and then. So if one is buying ABR-F, they should expect the dividend to be reduced closer to the floor rate in 2026. The good news is that the 6.125% floor is a coupon that will look very attractive if interest rates return to 0%. Especially, considering that such an environment would be positive for ABR’s core business.

ACR-C has a higher perceived rate of risk, so it trades at a double-digit yield. ACR’s common dividend is nonexistent. Management is effectively handling the debt required to be tackled and will likely look to add a common dividend after that. ACR-C has a better floor than ABR-F and an earlier floating period. However, rates are likely to have subsided some prior to ACR-C floating. If not, management will likely do everything possible to call it and replace it ASAP.

In this instance, ACR’s external management actually makes ACR-C more attractive. They are working hard to improve ACR’s position while not rewarding common shareholders during that time. ABR is internally managed and, in many regards, more focused on common shareholder rewards in the present. Their mortgage origination platform to retail customers is concerning vs. commercial origination, which is less cyclical.

Still, if you’re looking for safer income, ABR-F is a clear winner in our opinion. While you must be aware of the headwinds for common shareholders, as a preferred security owner, you can sidestep what may lead to common dividend cuts down the road. ABR has proven management and experience through multiple cycles and a diversified business model. ACR’s management is new, and during COVID, ACR was forced to suspend the dividend. The ABR preferred yields less than ACR’s preferred, but it is also lower risk.

Dreamstime

Conclusion

As income investors, it is important to evaluate the ability of your investments to pay your dividends not only now but looking forward. ABR has a strong earning potential, even considering potential losses from its retail mortgage origination platform when compared to ACR still getting its footing from its transition.

Furthermore, ACR-C has a higher likelihood of facing deferred dividends or being called away rapidly than ABR-F. When buying a preferred, we want to lock in a long-term stable income with a nice potential capital gain in the end. On both fronts, ABR-F is superior to ACR-C.

Retirees looking for income to fund their retirement want low-stress no-fuss income, which allows them to enjoy the benefit of their years of hard work rewarding them. Preferred securities and other fixed-income investments can readily do so for those retirees who invest in them.

While aggressive investors will receive a higher yield from ACR-C, we have to keep in mind our goals. When we are buying preferred, we are looking for security with a great yield. ABR-F offers that. ACR-C offers a great yield but not the security we want. Today, we choose ABR-F because it achieves both of our goals.

I recommend holding a minimum of 40% of a retiree’s income portfolio in such investments, and the High Dividend Opportunities team routinely evaluates countless preferred securities to determine the best ones for our Model Portfolio. Today, we pulled back the curtain slightly to highlight how we do this so you can have a better understanding of how to do it yourself.

What preferreds have you been buying lately? We’d love to hear about them below.

Be the first to comment