patty_c

Home Depot (NYSE:HD) stock has fallen due to rising interest rates, as investors fear that high mortgage prices will negatively impact housing prices and in turn homeowners’ appetite to remodel their homes. Yet HD’s recent earnings report showed continued strength with management even reaffirming full-year guidance. The stock is trading at reasonable valuations for what remains a secular compounder with a solid balance sheet. I rate HD a buy for long term investors.

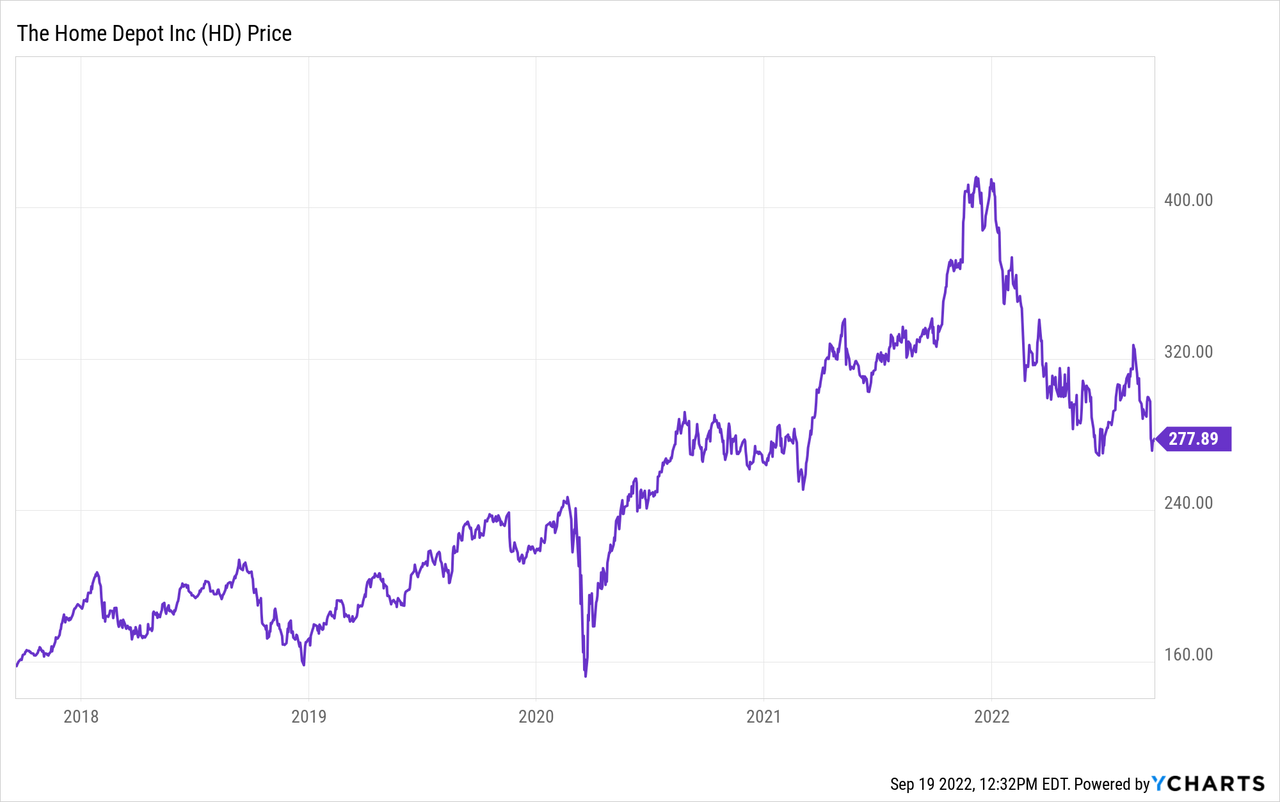

Home Depot Stock Price

After peaking at $420 per share near the end of 2021, HD has since slid over 30%.

HD remains a strong performer over the last several years even after the pullback, though with the stock effectively trading not too far from where it did prior to the pandemic, this represents an attractive buying opportunity.

Home Depot Stock Key Metrics

In HD’s latest quarter, the company achieved 5.8% comp sales and 11.5% growth in earnings to $5.05 per share. Management noted that the comp average ticket increased by 9% and comp transactions decreased by 3.1%. Inflation was a significant driver of the growth in comp average ticket.

During the quarter, HD paid $2 billion in dividends and repurchased $1.5 billion of stock. Year to date, HD has returned $7.8 billion to shareholders, surpassing the $5.8 billion in free cash flow.

HD reiterated guidance of 3% comp sales growth and mid-single digit earnings per share growth.

HD ended the quarter with a solid balance sheet, with a 1.8x debt to EBITDAR ratio. HD has historically optimized its balance sheet to accelerate shareholder returns and I would not be surprised if the company decided to be more aggressive with its share repurchase program if the stock price weakness persisted.

What Are Home Depot Catalysts To Watch For?

With interest rates rising, one might think that this would be a negative catalyst for home improvement stores. In reality, the company continues to see strong results. On the conference call, management noted that it has not seen “anything in their business yet from macro housing.” In fact it is to the contrary – they continue to generate solid comp sales growth. Management stated that it is possible that would-be home movers are seeing the high mortgage rates and deciding to instead remodel their existing homes and stay put.

At a recent investor conference, management even hinted that remote work may be proving to be a catalyst. Even if workers on average work remotely just one day of the week, that represents 20% more time of a work week that is spent in the house leading to wear and tear.

Will Home Depot Stock Rise Again?

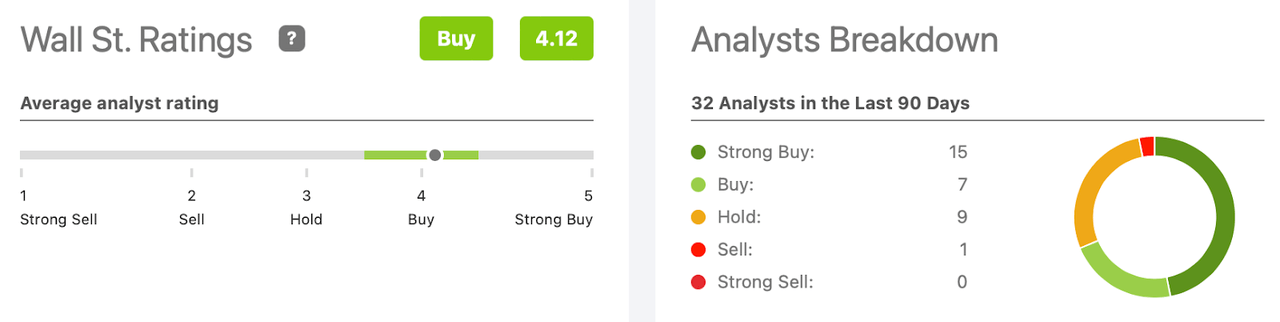

Wall Street analysts remain bullish on the stock with an average 4.12 out of 5 buy rating.

Seeking Alpha

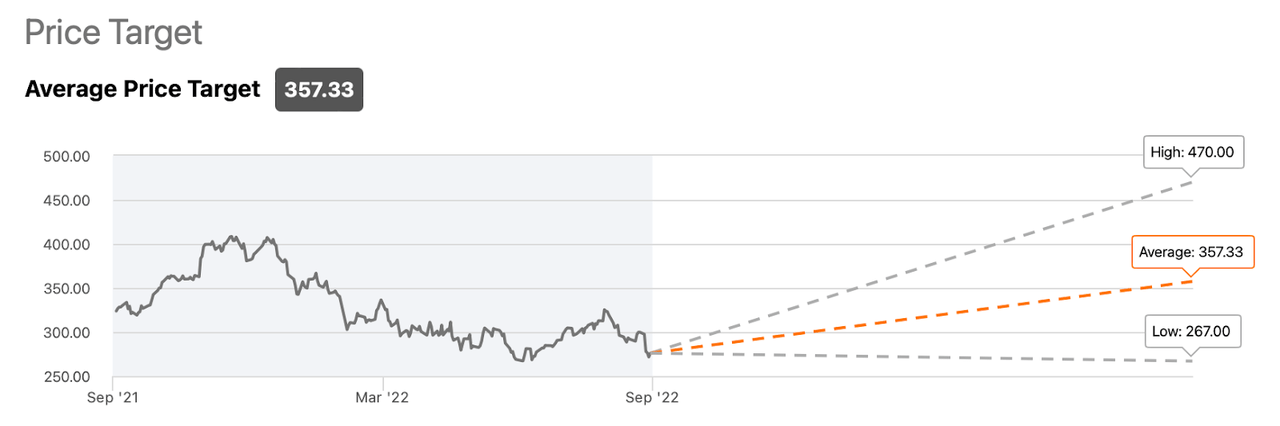

The average price target of $357.33 per share represents 29% potential upside.

Seeking Alpha

Where Will Home Depot Stock Be In 5 Years?

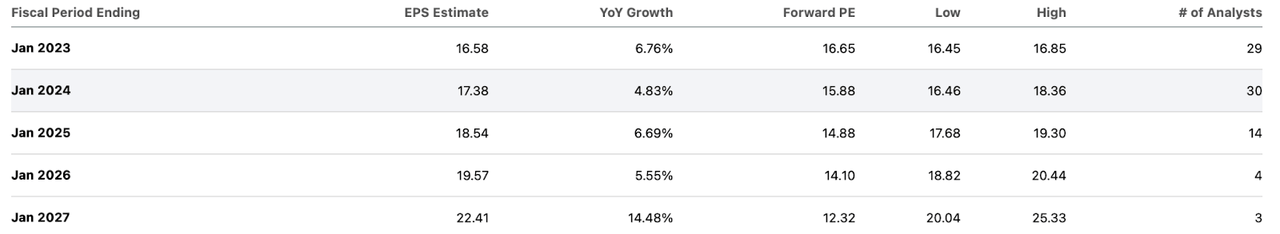

HD is expected to generate low single-digit revenue growth moving forward, which should in turn lead to mid-single digit earnings growth.

Seeking Alpha

Given that the stock is trading at just under 17x this year’s earnings, it is a reasonable assumption that HD stock should be trading higher in 5 years.

Is HD Stock A Buy, Sell, or Hold?

But how much higher? Given that HD is a shareholder return story with a generous dividend and share repurchase program, I expect the stock to trade at premium multiples. What’s more, while management has not given any indication that they wish to drive gross margin expansion, it is worth noting that a 1% increase in gross margins could theoretically lead to around a 9% increase in net income. That would be in addition to any scale-driven operating leverage. I could see HD trading at 20x earnings, representing a stock price of $448 per share by 2027. That represents around 13% annual return potential over the next 5 years inclusive of dividends. That is an attractive return proposition especially considering that the stock’s 5-year average P/E ratio is 23x.

What are the key risks here? It is possible that the recent resilience in consumer spending will prove short-lived. Perhaps a prolonged downturn in the housing market may eventually take its toll on home improvement spending. There is also the risk of competition – it is not entirely clear how this does not become a commoditized business. HD has an A credit rating or equivalent from the credit rating issuers, but its leverage load may prevent the company from utilizing share repurchases in a vicious downturn.

I rate the stock a buy for long term investors as yet another attractive buying opportunity offered from this recent bout of volatility.

Be the first to comment