zodebala/iStock Unreleased via Getty Images

Elevator Pitch

I assign a Buy investment rating to Exxon Mobil Corporation (NYSE:XOM). In five years’ time, I expect XOM to deliver much higher earnings and cash flow in line with management guidance. The key catalyst to re-rate Exxon Mobil’s shares is better-than-expected shareholder capital return going forward. With XOM’s debt-to-capital ratio already at a relatively low 21%, I am of the view that Exxon Mobil will prioritize capital return over deleveraging.

Is Exxon Mobil Growing?

Exxon Mobil is growing fast, as seen with the company’s full-year FY 2021 financial results released on February 1, 2022. Specifically, XOM has increased its bottom line, cash flow and shareholder capital return in a significant manner.

XOM has turned around from a net loss of -$22.4 billion in fiscal 2020 to generate a positive net profit of $23.0 billion in the most recent fiscal year. If impairments, and non-recurring, non-cash charges were excluded, XOM’s FY 2020 adjusted net loss would have been -$1.4 billion instead. In any case, Exxon Mobil has already reversed from (headline or adjusted) losses in the prior fiscal year.

Furthermore, Exxon Mobil’s FY 2021 net income was also +61% higher than its FY 2019 earnings of $14.3 billion. In its FY 2021 earnings presentation slides, XOM attributed most of the improvement in its bottom line to “price and margin improvement driven by demand recovery.” This is not surprising, considering the recovery in energy markets in 2021 as the pandemic eased.

Exxon Mobil’s operating cash flow also increased from $17.1 billion in FY 2020 to $48.1 billion in FY 2021, in tandem with earnings growth. Notably, XOM’s fiscal 2021 operating cash flow was the highest for the company in the past nine years. The company also achieved a free cash flow of $37.9 billion in the recent fiscal year.

XOM also raised the company’s full-year dividend per share from $3.48 for FY 2020 to $3.49 for FY 2021. It is noteworthy that this is the 39th year running that Exxon Mobil has increased its annual dividend in absolute terms.

In the subsequent two sections of the article, I assess Exxon Mobil’s five-year financial outlook and other key metrics as per the company’s management guidance revealed at Exxon Mobil’s 2022 Investor Day.

Where Will XOM Stock Be In 5 Years?

XOM hosted the company’s 2022 Investor Day on March 2, 2022, and if management’s expectations of Exxon Mobil’s future growth prospects are right, the company should witness meaningful bottom line expansion in five years’ time.

Exxon Mobil’s 2022 Investor Day Guidance For Future Earnings Growth

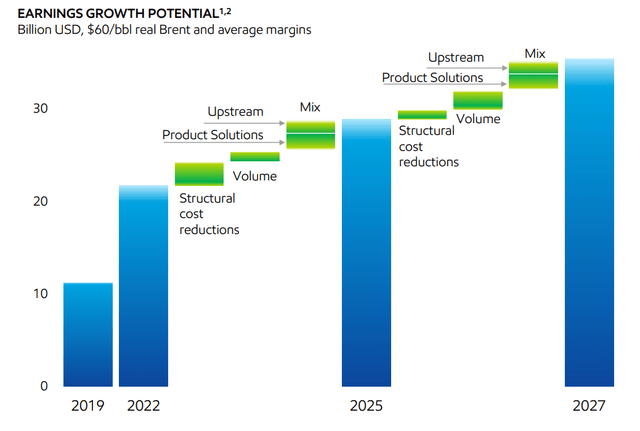

XOM’s 2022 Investor Day Presentation

As per the chart presented above, Exxon Mobil thinks that the company’s earnings should rise from $22.4 billion in FY 2021 to above $30 billion by FY 2027. Specifically, XOM’s net profit is guided to increase by +100% between fiscal 2019 and FY 2025, prior to expanding by an additional +20% between FY 2025 and FY 2027. There are three key drivers of XOM’s expected bottom line growth in the next five years.

Firstly, XOM has set a goal of achieving $9 billion in cost savings every year in 2023 as compared to 2019. At its 2022 Investor Day Call, Exxon Mobil noted that “the combination of the downstream and chemical businesses and the centralization of our technology, engineering and above-site operations” are the key factors that will help to drive the company’s expenses lower in the future. As disclosed in its Investor Day presentation, Exxon Mobil has already been able to deliver $4.9 billion (of the $9 billion target) in yearly expense reductions by 2021.

Secondly, a targeted increase in production volumes will also be another key earnings growth driver for XOM. Exxon Mobil guided at its 2022 Investor Day Call that its upstream production will expand from “3.8 million oil-equivalent barrels per day” in 2022 to “4.2 million oil-equivalent barrels” in 2027. Over half of the planned production volume growth will be contributed by its Guyana and Permian Basin assets, the Bacalhau field in Brazil and its LNG (Liquefied Natural Gas) asset portfolio.

Thirdly, Exxon Mobil should see overall profit margin improvement thanks to a more favorable production and product mix going forward. As highlighted earlier, XOM’s Guyana, Permian Basin and Bacalhau assets will account for an increasing proportion of the upstream business’ production volume in the future, and the company has referred to these as “low-cost-per-barrel assets” at its 2022 Investor Day Call. With respect to its product solutions business, XOM is also optimizing its mix with plans to reduce the proportion of distillate, fuel oil and gasoline, and increase the contribution of chemical feed, biofuels and lubricants which the company deems as “higher-value products.” Such changes in mix are supportive of XOM’s future profit margin expansion and earnings growth.

In my opinion, XOM’s expectations of earnings growth in the next five years are realistic and achievable.

I discuss about Exxon Mobil’s other key metrics relating to cash flow and shareholder capital return in the next section.

XOM Stock Key Metrics

In line with the expected earnings growth for XOM in the intermediate term, the company’s management is of the view that Exxon Mobil can double its operating cash flow from $29.7 billion in FY 2019 to close to $60 billion by FY 2027. This will potentially help to drive an increase in the capital returned to shareholders for XOM.

The key metrics to watch relate to excess cash flow and the potential for greater-than-expected shareholder capital return in the medium term.

Exxon Mobil noted at its 2022 Investor Day Call that “at a real Brent price of $60 per barrel, we generate about $100 billion of cash (between FY 2022 and FY 2027) in excess of CapEx (capital expenditures) and (current regular) dividend distributions.” The $100 billion in excess cash flow is equivalent to approximately 28% of XOM’s current market capitalization.

While a certain proportion of the $100 billion might be allocated to debt reduction, I think that most of the excess cash flow is very likely to be returned to shareholders in the form of increased dividends (above the current level of dividend payouts amounting to around $15 billion per year) and share repurchases. This is because XOM has already met its financial leverage target (20-25% debt-to-capital ratio) with its current debt-to-capital ratio of 21%.

Earlier, Exxon Mobil disclosed a new $10 billion share buyback program when it released its full-year FY 2021 financial results. Given the substantial amount of excess cash flow it is expected to generate, there is a high likelihood that XOM can complete the current $10 billion repurchase program in a shorter-than-expected period of time and even initiate another new share buyback program in the future.

Does Exxon Mobil Have A Sustainable Future?

In assessing whether Exxon Mobil is a good investment candidate, investors have to be assured that XOM has a sustainable future.

There are two key aspects relating to a sustainable future for the company from the perspective of investors. Firstly, investors should be able to derive a significant part of their expected investment returns from dividends and buybacks, and not be reliant on capital appreciation (which is less sustainable given share price volatility). Secondly, as ESG (Environmental, Social, and Governance) factors become more important considerations for investors, it is relevant to look at Exxon Mobil’s sustainability efforts,

With respect to shareholder capital return, Exxon Mobil currently offers a reasonably attractive consensus forward FY 2022 dividend yield of 4.3% as per S&P Capital IQ data. As mentioned in the preceding section, XOM is expected to generate approximately $100 billion in excess cash flow over the next couple of years, and this could potentially be allocated to more buybacks and higher dividends.

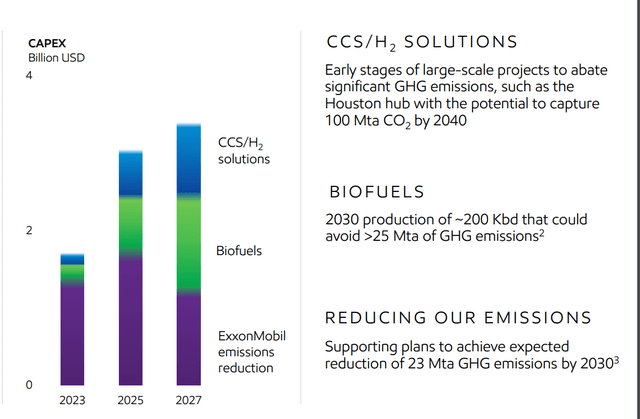

In terms of sustainability efforts, Exxon Mobil guided for investments in excess of $15 billion in the next few years with regards to lower emissions; the full breakdown of such investments in presented in the chart below. As highlighted in its 2022 Investor Day media release, XOM targets to “reduce company-wide absolute greenhouse gas emissions by an estimated 20%” in the medium to long term.

Breakdown Of Investments Relating To Sustainability In The Next Few Years

XOM’s 2022 Investor Day Presentation

In a nutshell, I think Exxon Mobil has a sustainable future in terms of both shareholder capital return and sustainability efforts.

Is XOM Stock A Buy, Sell, Or Hold?

XOM stock is a Buy. Exxon Mobil has various levers to drive future earnings growth, and the excess cash flow generated could support higher dividends and increased share buybacks.

Be the first to comment