imaginima/iStock via Getty Images

Enterprise Products Partners (NYSE:EPD) has not seen its stock soar like many other energy stocks because it does not have the same torque to higher energy prices. Yet in exchange, the company provides greater stability due to its fee-based cash flows. With energy prices stabilizing at high levels, I expect EPD’s customers to improve in terms of credit quality, which bolsters the investment case for EPD stock. With EPD yielding around 7.2%, the stock could prove to be a great addition to income-seeking portfolios.

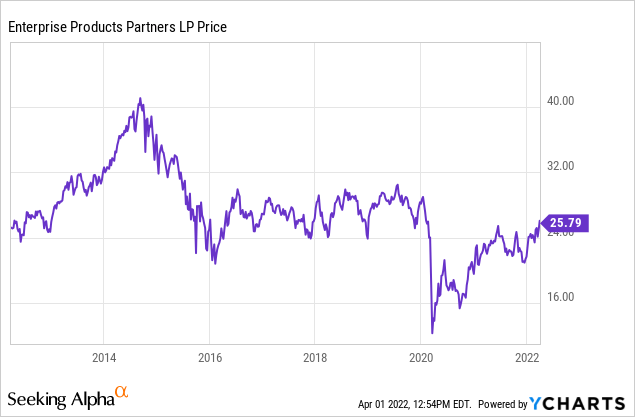

EPD Stock Price

Many investors considered EPD to be very cheap prior to the pandemic and the stock still trades lower than those levels. In fact, the stock trades at the same levels it did over 10 years ago.

Since I last wrote about the company in April of 2021, the stock has delivered 22% total returns, outpacing the 8.3% return of the broader market. In spite of the outperformance, I am switching gears and rating the stock a buy. At the time, I viewed the stock as offering a poor risk-reward proposition as the 8% yield did not look like enough to compensate for the credit quality risk of its customers. But with energy prices having rebounded to multi-year highs, there is high potential that the energy sector will emerge with far stronger credit metrics than before, as energy companies appear to be focused on balancing rewarding shareholders with deleveraging their balance sheets. Furthermore, EPD has rapidly scaled back its growth capital expenditure outlook, which has suddenly made its distribution fully covered even after accounting for capital expenditures. As a result, it makes sense to bump the stock to a buy rating even though I had sold at lower levels.

EPD Stock Key Metrics

I won’t rehash the general story for EPD – you can see my previous article for a more in-depth description of the business model. Instead, I’ll focus on the key metrics to look at for this stock.

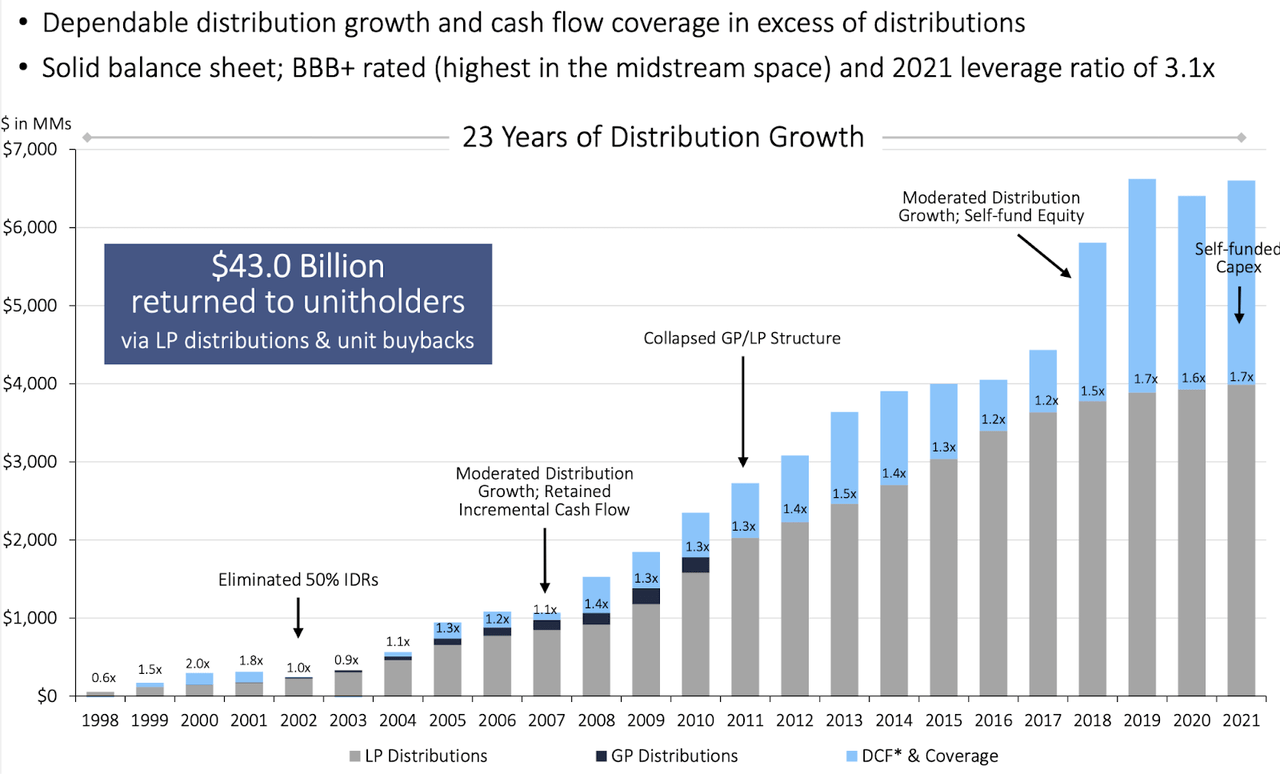

The most important metric is that of leverage. Debt to EBITDA stood at 3.1x as of the end of 2021, and the company had a BBB+ rated balance sheet. Compare this with the roughly 4x debt to EBITDA ratio at popular peer Energy Transfer (ET). Most investors likely understand that less leverage means lower risk. But in the midstream sector, leverage means much more than that. Leverage is the easiest metric to track management strength. Because midstream companies typically grow by building out new projects, the leverage ratio is a strong indicator of the company’s history of execution. A low leverage ratio typically means that the company has historically realized strong returns on investment. A high leverage ratio typically means that the company has historically underperformed expected returns on investment. EPD’s best-in-class leverage ratio is a testament to management’s ability to deliver on projected returns.

Besides the low leverage ratio, 2021 was a historic year in which the company was able to self-fund its capital expenditures.

EPD 2021 Q4 Presentation

What does this mean? Investors typically measure total distributions paid out versus free cash flow, which is defined as distributable cash flow subtracted by all capital expenditures. EPD spent $1.8 billion on growth capital expenditures in 2021, down significantly from $3 billion in the prior year. EPD had previously guided to $1.6 billion of growth capital expenditures in 2021. In 2021, EPD earned $6.6 billion in DCF and paid out $3.9 billion in distributions. The company was able to even reduce net leverage by over $2 billion in the year.

I note that the lack of self-funded capital expenditures was not necessarily a negative. I just mentioned that EPD historically realized strong returns on growth projects – that would suggest that using debt to fund growth projects should be encouraged by investors. Yet with new pipeline projects being largely restricted by Washington, the company suddenly is simply unable to fund new projects even if it wanted to. This may reduce the company’s ability to fund future growth, but my view is that the greater free cash flow coverage of the distribution will create greater unitholder value through multiple expansion. The benefits from the lower perceived risk should outpace the slower growth.

EPD spent $214 million on unit repurchases – a nominal amount but significant considering that the company has a limited history of unit buybacks. I am hopeful that the company will increase its love of unit repurchases as that in my opinion is the quickest avenue for multiple expansion. Looking forward, EPD has guided for $1.5 billion of growth capital expenditures and $1.85 billion of total capital expenditures in 2022.

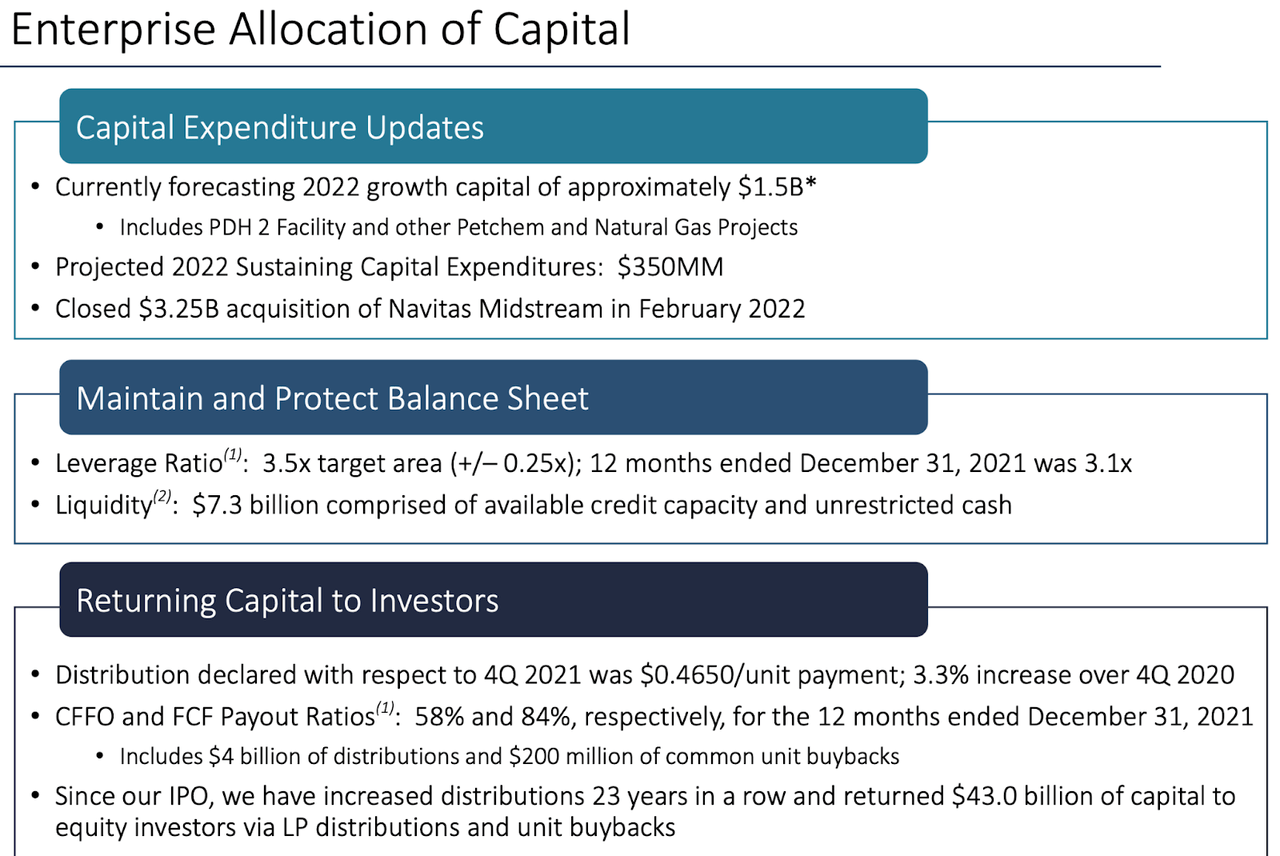

EPD 2021 Q4 Presentation

As stated on the conference call, the $1.5 billion in forecasted growth capital expenditures includes any capex related to its recently closed Navitas acquisition. This suggests that EPD should fully cover its distribution yet again in 2022.

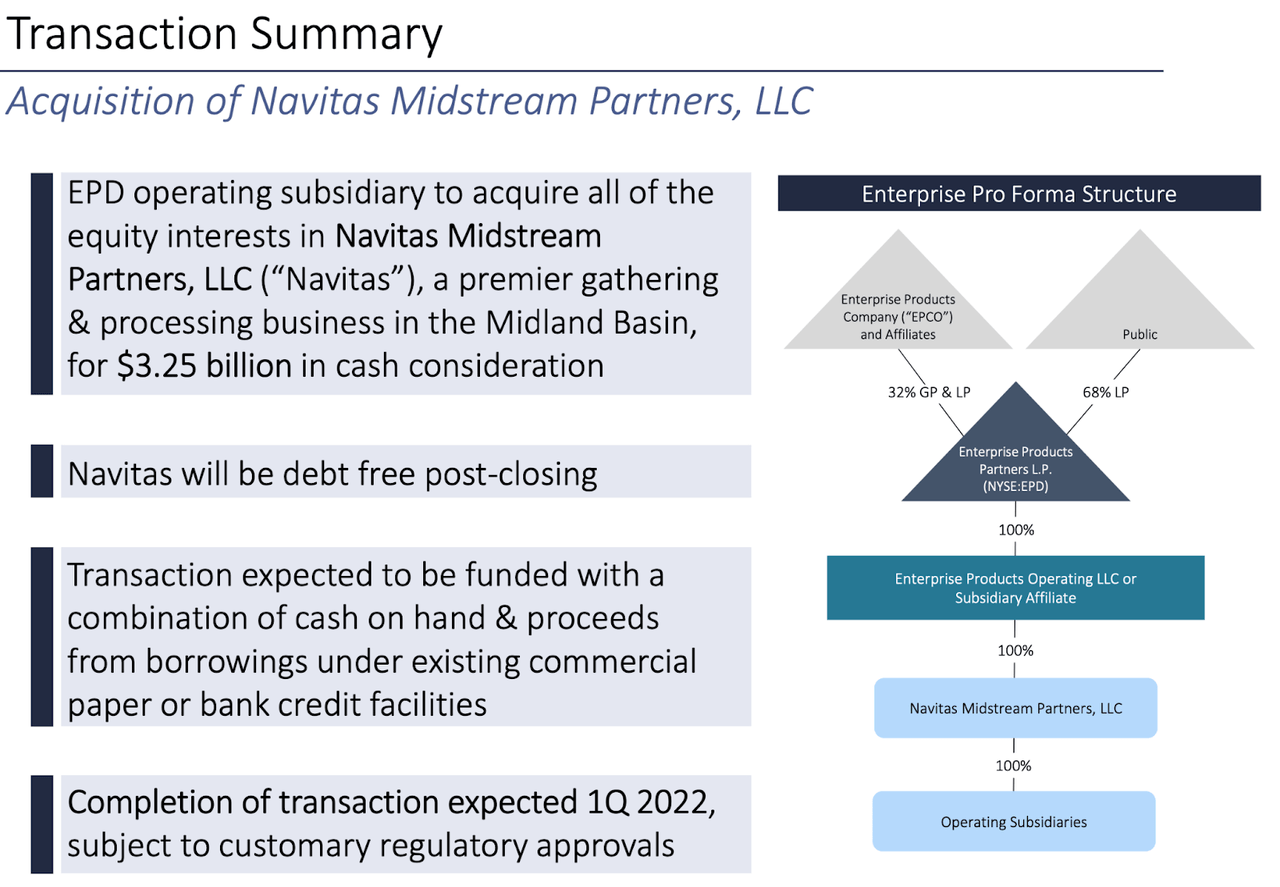

In regards to the 3.1x debt to EBITDA ratio, I expect leverage to tick up this year. This is because the company funded its recently closed acquisition of Navitas Midstream with $3.25 billion of cash and debt.

Navitas Acquisition Presentation

That increased EPD’s net debt by just under 10%, but leverage shouldn’t increase by that amount because Navitas was flowing cash already. The acquisition does show that the company will likely prioritize external acquisitions over share repurchases, which is understandable considering that it won’t be able to spend so much on growth capital expenditures. It is possible that investors may need to start including cash spent on acquisitions in their definitions of free cash flow moving forward, especially if EPD becomes a habitual acquirer of assets.

Is Enterprise Products Expected To Grow?

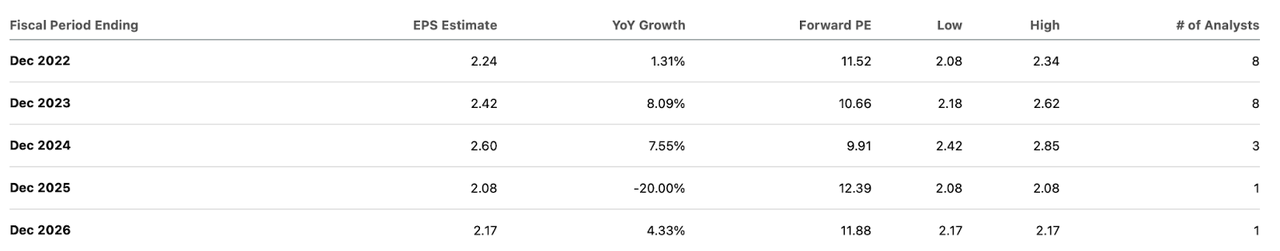

Over the coming years, EPD is expected to show modest growth. This makes sense because EPD primarily generates fee-based cash flows, which do not have direct torque to higher energy prices.

Seeking Alpha

EPD has guided for the Navitas acquisition to lead to incremental gains of $0.18 to $0.22 per unit in 2023.

Where Will EPD Stock Be In 5 Years?

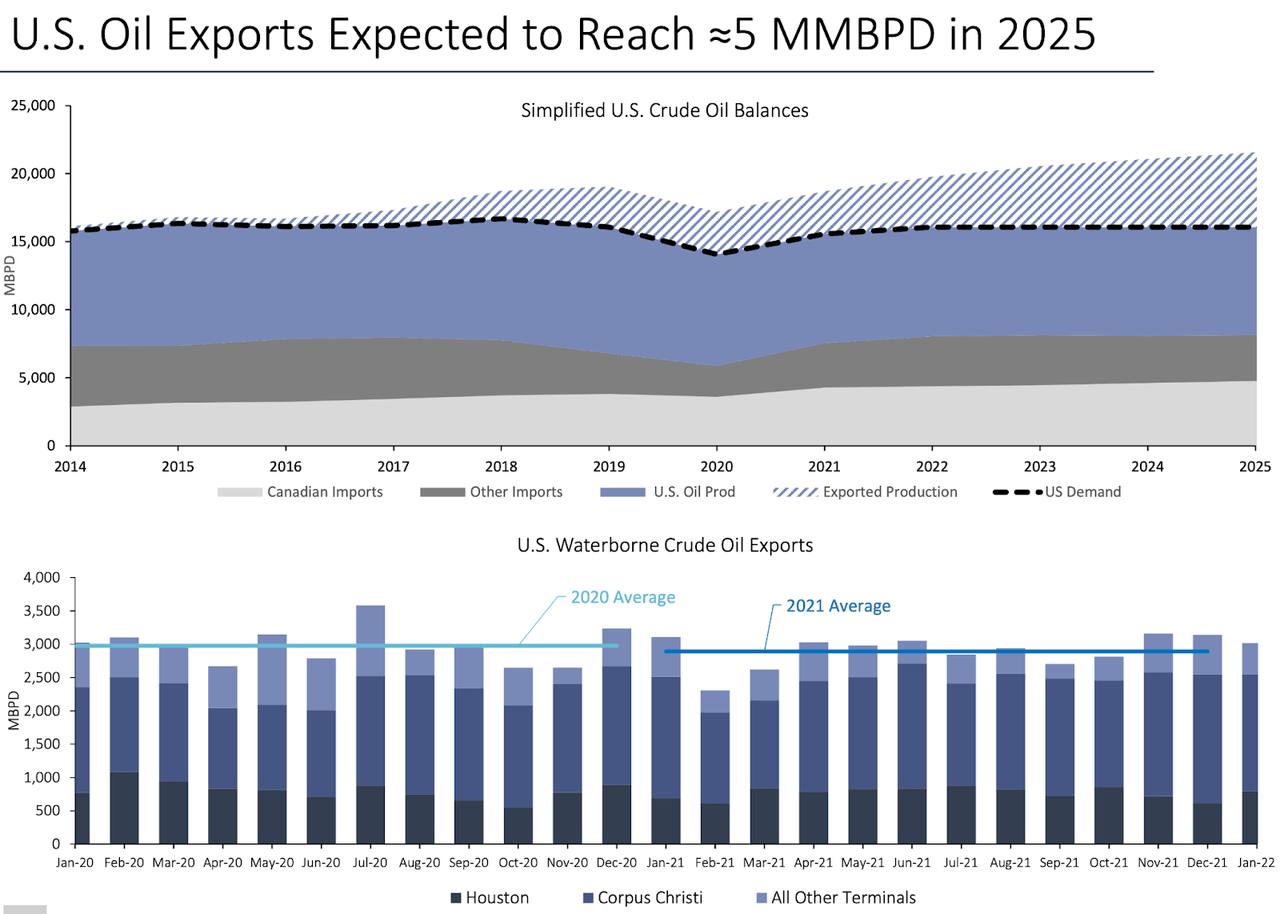

In 5 years, I expect EPD to trade modestly higher from here, though not necessarily by so much. Those gains would be driven by an improving macro picture for the energy sector. In particular, the Russian-Ukraine war may increase the likelihood of the United States becoming a more significant exporter of oil.

EPD 2021 Q4 Presentation

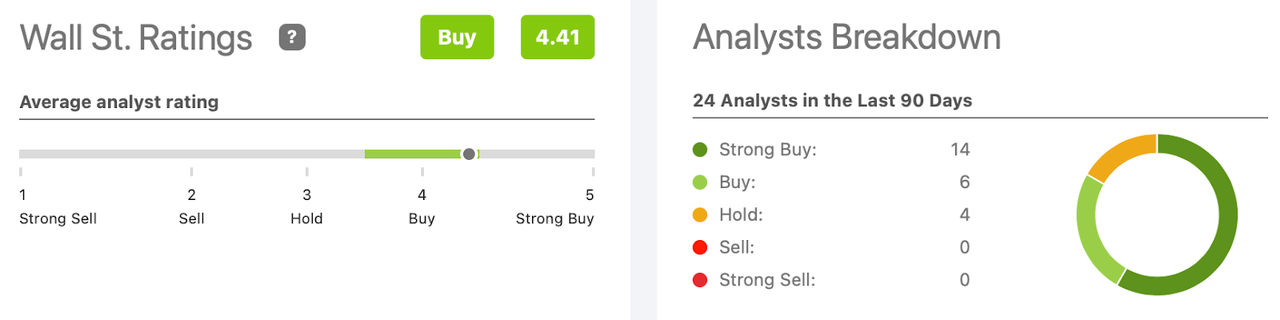

Wall Street analysts are quite bullish with a 4.41 rating out of 5.

Seeking Alpha

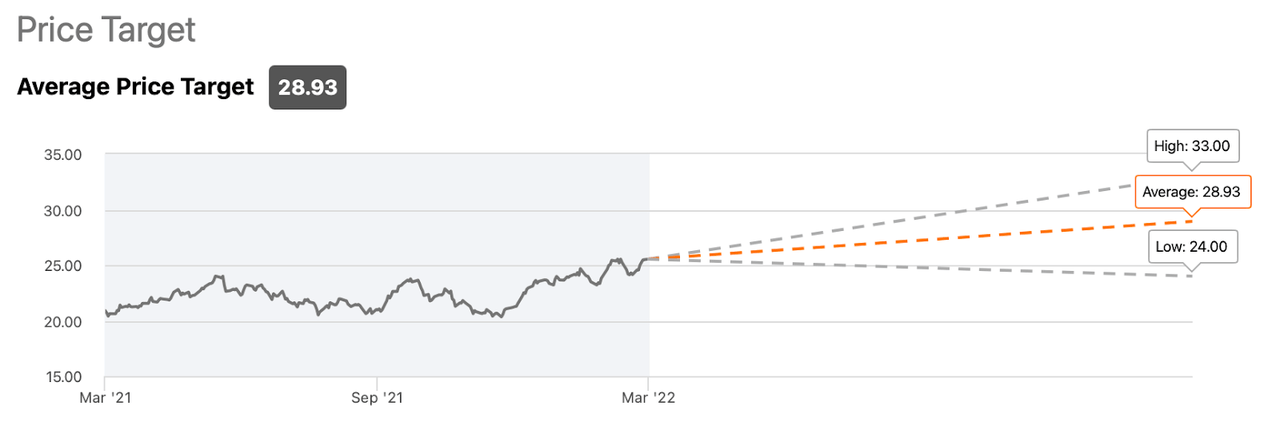

The average price target of $28.93 per unit reflects modest upside of 12% from current levels. Again, price targets should be held back due to the inherent ceiling on earnings growth.

Seeking Alpha

Another factor is that EPD’s current dividend yield is higher, but not significantly higher than historical levels.

Seeking Alpha

While I see high potential for multiple expansion, it is unlikely for that expansion to be that significant considering that it will take time for sentiment to shift so positively for the energy sector.

Is EPD Stock A Buy, Sell, or Hold?

At current levels, EPD is trading at a 7.2% yield which has suddenly become fully covered by free cash flow. Every month that energy prices remain high, EPD’s tenants are improving their balance sheets. If the United States can become a more significant exporter of commodities, then those credit profiles improve even further. I previously expressed doubt that the stock can hit a 5.5% yield. I still find that unlikely. That said, my view of the downside has improved significantly in light of the higher commodity prices and outlook for United States commodities. I can see the stock trading up to a 6.3% to 6.5% yield, suggesting around 10% capital appreciation upside. Alongside 2% to 3% of annual growth, the stock can deliver around 10% annual returns before accounting for projected multiple expansion. If the company decides to lean more into unit repurchases, then the likelihood of hitting that 6.3% yield (or even lower) increases substantially, though I reiterate that I expect the company to prioritize external acquisitions as a close substitute to growth capital expenditures. Because my bull thesis hinges on the improving credit profiles as powered by high energy prices, the key risk to this thesis is a crash in energy prices. If that were to occur, then I wouldn’t necessarily expect a huge hit to EPD’s cash flows. The fact that the distribution is fully covered by free cash flow has greatly reduced the risk to the distribution, which was already one of the least risky in the sector to begin with. Instead, a worsening outlook would reduce the likelihood of multiple expansion and increase the risk profile while reducing the return profile. Because I do not expect commodity prices to plunge so low nor so fast, I rate the stock a buy.

Be the first to comment