Vladislav Zolotov/iStock Editorial via Getty Images

The Queen was born not far from where I’m writing this in Central London and this week was laid to rest in Windsor (whose namesake castle is pictured above). With the Queen’s passing, Charles has taken her place as King, the latest in a long line of succession. My trip has been more solemn than it usually would be, but it’s cool to experience history firsthand and in real time. The royals have always captured the public imagination–their wealth and fame have few parallels in the world. Everyone knows about the immediate royal family, but what is less commonly known is that there are hundreds of aristocratic families in the UK that have preserved wealth for centuries. And in Continental Europe, there are thousands more.

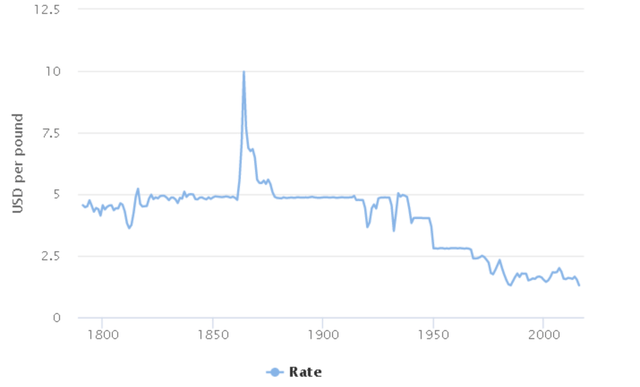

The typical wealth of the 600-700 aristocratic families in Britain is estimated at about £16-20 million, although the data is based on wills, so you likely can double it to account for estate planning. What’s interesting about this is that researchers can track their wealth against their ancestors to see the relative rise and fall of the aristocrats. The record shows that the nobles reached their first peak around WWI, but then saw a steep decline to around £4 million. Now they’re recovering. Another interesting wrinkle is the exchange rate between the pound and the dollar. 100 years ago, the pound was the world reserve currency, and it traded for around $5.00. Now it’s $1.14. That implies pre-war purchasing power for the aristocrats at over $100 million per family.

There’s a book that my friend Pietros Maneos likes called The Decline and Fall of the British Aristocracy. The book’s premise is somewhat debated in light of the fact that the aristocrats are still very rich, but it details some of the misfortunes and declines of the aristocracy and shows which families were able to maintain and grow their wealth and which ones weren’t. The main keys to lasting success seemed to be a healthy level of ownership in stocks and diversifying into different asset classes and countries, rather than simply owning land as previous generations had done.

1. Diversification and Patience Are Virtues.

Diversification is a free lunch (yes, really!). Being King will obviously make one very rich, and it gives access to some state funds for items like security and upkeep. But thousands of other aristocrats aren’t so different than American millionaires in how they get their money– from owning stocks, bonds, and property.

One of the unique things about the British empire was how sound its monetary policy was. Britain was on the gold standard for hundreds of years, meaning that inflation was effectively zero. My feeling is that the low rate of inflation served to promote and reinforce patience, savings, and long-term thinking. These are all factors that pushed the wealth of the aristocracy to over $100 million per family in today’s dollars. This is also another reason running lots of inflation is bad.

US Dollar Vs. British Pound (Exchangerates.org.uk)

A few other interesting things about the long-term history of the pound vs. the dollar.

- The US dollar tanked during the Civil War but recovered after. Americans who were smart or connected enough to have investments in England at the time would have had protection from war disrupting their business and livelihoods and would have had the capital to buy low once peace was imminent.

- The pound lost its status as the world reserve currency starting in the Great Depression and especially after WW2. Over the last 100 years, the pound is down a bit less than 80% against the dollar. Brits who were invested in America held their purchasing power very well as a result.

- Could this happen to America in the future if we lose our status as the world reserve currency? It’s not clear, but it’s a good argument for diversifying your investments.

Not only did aristocrats who invested outside their country do better than those who didn’t – the changing world also rewarded those who diversified outside of traditional investments. Traditionally, the aristocrats simply owned land and collected rent. However, over time, their wealth ended up being surpassed by merchants and other aristocrats who trusted the financial system enough to buy stocks. This is still true today, and the implication is that your best bet is to own investments in various asset classes and parts of the world. Those who were rich and only invested in Britain did fine, but those who were able to see the potential for other markets like the United States ended up far richer. Right now, the dollar is insanely strong, and that’s a big part of why I’m able to come over here. US investors can similarly use the strong dollar to buy assets cheaply abroad, especially stocks and property.

The big question mark here is whether China will overtake the US. My feeling is that they won’t because of the so-called middle-income trap, but there are dozens of other politically stable countries included in international stock indices that you can allocate to! My favorites are Vanguard’s International High Dividend Yield Fund (VYMI), Vanguard FTSE Developed Markets (VEA), and iShares MSCI EAFE Small-Cap ETF (SCZ).

Bottom line: diversify between asset classes and countries.

2. Trust, But Verify

One thing that wealthy people in America and Britain have in common is that when you have wealth, there are people who will try to take advantage. Of course, there are the stereotypical gold diggers and scammers, but by and large, the financial industry preys on those who have money. Being able to trust the system while protecting your money from those who want to put their muddy paws on it is a great skill to have.

Finance is one of the only places where you can objectively subtract value and still get paid a lot of money. Over time research has shown that in excess of 90% of mutual fund managers end up underperforming the market. Many financial advisors also are happy to charge 1% of AUM or more in non-tax deductible fees for the privilege of underperforming the market. And if you want an even “higher” level of service, there are hedge funds and slick private bankers who will help out. It’s Warren Buffett’s parable of the Gotrocks Family in action, time and time again. Buffett called these “hyper helpers.” But in the end, never trust a skinny chef or a fat banker!

Bottom line: Unless your financial advisor or mutual fund managers are objectively in the top 10% of their peer group, chances are that you’re better off managing your money yourself, and/or going with a thoughtful portfolio of diversified low-fee index funds.

3. The Importance of Marriage & Family

The coming decades will see the greatest transfer of wealth in human history. The estates of the rich and famous will grab the headlines, but millions of people who worked hard and trusted the system have accumulated multimillion-dollar portfolios. Many people won’t leave much in the way of inheritance, but a solid number will. Is the next generation ready? One can hope so. The current generation of millennials is poorer than their parents were at the same age, but they’re better educated. For my part, I think they’ll be up to the challenges that the 21st century will throw at them, although of course, a lot of the people I went to school with are more Marie Antoinette than Queen Elizabeth II.

We can again draw lessons from the aristocracy on the importance of marriage, family, and tradition. Marriage is obviously of paramount importance to life, and the aristocrats are obsessed with it. Marry the wrong person, and your life is hell. Marry the wrong person and make a bunch of money in America, and oftentimes you have to give half of it to them.

Family too is critically important. Besides the cynical and obvious benefits of cohabitating with someone (i.e. splitting rent!), having and/or creating a family offers support in ways that you simply can’t get by being alone in life. Whoever you are, having spouses, parents, and children who love and support each other allows each one to take the right kind of medium-term risks that lead to long-term rewards. If you have this, the path to success is far easier, although it can be definitely done without it. Finally, values and tradition are overlooked aspects that I think we can take away from studying the aristocrats. Having good values and passing them on is not a trivial thing, and will separate those who maintain and grow their wealth from those who lose it.

Bottom line: Many takeaways, but the main one: choose who you marry carefully.

Be the first to comment