JHVEPhoto

Article Thesis

Shopify Inc. (NYSE:SHOP) has split its shares 10-for-1, but that hasn’t offset the recent huge downward move. Shopify is a company with considerable growth opportunities, but it also has questionable profitability and its shares are very expensive still.

Declining interest rates could be positive for SHOP, and a potential resurgence of Covid could also be beneficial for e-commerce companies. Nevertheless, I do believe that staying on the sidelines could be the best choice here, as the current valuation still leaves plenty of downside potential even though the stock has already fallen 80% this year.

SHOP Stock Key Metrics

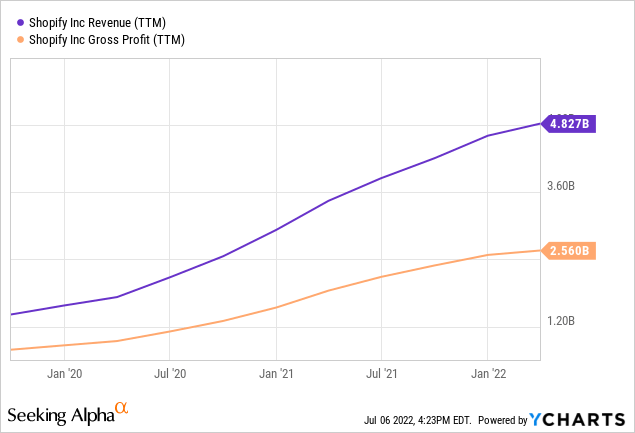

Shopify Inc. has benefitted from strong growth over the last two years. This can be explained by several macro trends. The pandemic and the lockdowns it caused resulted in consumers shifting their spending online, as malls and brick-and-mortar retailers were not available, or only under less-than-ideal circumstances. More online shopping naturally is beneficial for the emergence of new businesses that sell online, and when those use Shopify’s technology, that’s good for Shopify’s business growth. On top of that, massive fiscal and monetary stimulus resulted in consumers being flush with cash, which led to increased consumer spending. This is another positive driver for e-commerce businesses, and Shopify naturally got a boost from that as well. It is thus not surprising to see Shopify do very well in terms of revenue and gross profit growth:

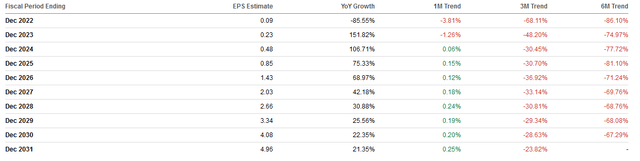

Revenue rose by 240% over the last three years, while gross profit rose 220% over the same time frame. Somewhat surprisingly, SHOP’s gross margin declined slightly, which is not typical for companies experiencing strong growth that should theoretically lead to scale advantages. Despite the small margin compression, gross profit still was up considerably over the last couple of years, climbing to more than $2.5 billion over the last four quarters. Unfortunately, Shopify has not managed to turn these huge gross profit increases into strong net profits so far, as the company was only able to generate a very small profit last year. For the current year, earnings per share of $0.09 are expected, which isn’t encouraging. Possibly even worse, earnings per share expectations for the current year and beyond have dropped massively in recent months. The environment for e-commerce players has gotten harsher, and Wall Street analysts are increasingly modeling for this when forecasting what the future may hold for Shopify:

Seeking Alpha

Earnings per share estimates have fallen off a cliff in recent months. EPS estimates for the current year, for example, are down more than 86% so far this year, and even EPS estimates for 2023 and 2024 are down more than 70%. The further into the future, the less reliable these estimates are, of course. But still, the trend is pretty clear — SHOP will, according to Wall Street, be way less profitable compared to what the same companies had believed half a year ago.

This is, at least partially, the result of inflation. When consumers have to spend more on essentials such as rent, gas, electricity, and food, they have less surplus spending power available for discretionary purchases. Since the first couple of items generally aren’t bought online, SHOP does not benefit when consumers shift their spending to these categories. But SHOP and its customers are negatively impacted when consumers spend less on apparel, jewelry, furniture, and so on. Inflation thus is a considerable headwind for Shopify, even before factoring in higher expenses for the company, e.g. when it comes to rising salaries for its employees.

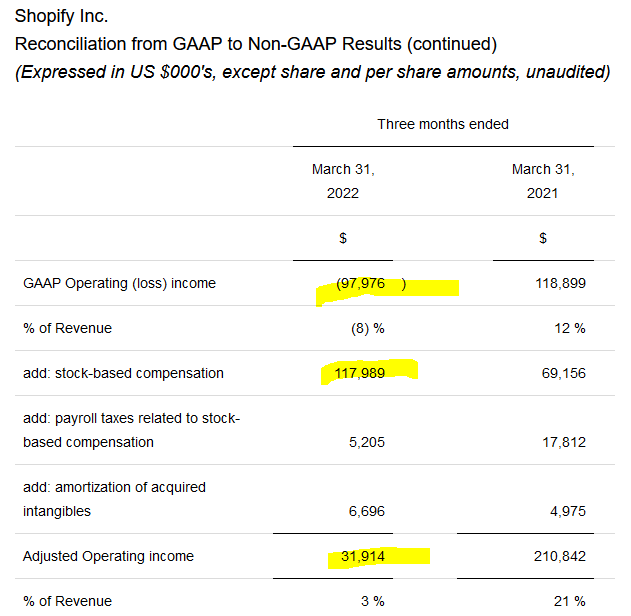

When it comes to Shopify’s profitability, another important factor to consider is the company’s non-GAAP accounting practice. Like many other tech companies, Shopify uses stock-based compensation. That makes sense, as it helps align employee goals with shareholder goals (both benefit when shares climb), and since it reduces SHOP’s cash flow need. But the difference between Shopify’s GAAP profits, or lack thereof, and its adjusted/non-GAAP profits is stunning:

SHOP Earnings Release

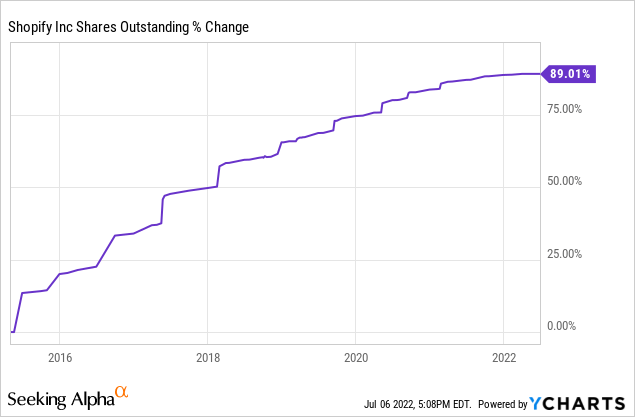

In the above table from Shopify’s earnings release, we see that the company generated a GAAP loss of around $100 million during the most recent quarter, or $400 million on an annualized basis. When the company adds back around $120 million in stock-based compensation (around $500 million annualized) and makes a couple of other adjustments, it gets to non-GAAP profits of a little over $30 million or around $130 million annualized. Pumping out $500 million worth of new shares a year in order to generate an adjusted profit of barely above $100 million annually isn’t a sign of great profitability, and it comes at a real cost for investors. Shopify’s hefty stock-based compensation spending has made its share count explode upwards in the past:

Over the last decade, Shopify’s share count has risen by 90%, which has roughly reduced each share’s portion of the company by half. SHOP has still been a strong investment for those that bought a decade ago, but investors should consider the dilutive impact of Shopify’s stock-based compensation practice when analyzing the company.

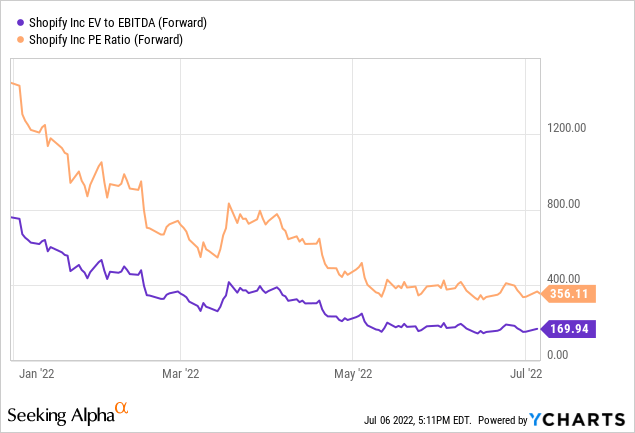

From a valuation perspective, Shopify is quite expensive:

Valuations have dropped significantly this year, thanks to the company’s 80% share price drop. And yet, Shopify still trades at 360x forward earnings, while the enterprise value to EBITDA multiple stands at a hefty 170. That is expensive relative to many other growth stocks, and that is despite the fact that non-GAAP numbers are used for this calculation. When we account for the cost (dilution) of Shopify’s SBC, the company is even more expensive. Shopify is forecasted to grow its revenue by 26% this year, according to Seeking Alpha’s data. That’s a little more than Microsoft’s (MSFT) expected revenue growth of 18% this year, but Microsoft only trades at 28x forward earnings — Shopify is growing a little faster, but is trading at a more than 1000% premium compared to ultra-high-quality growth stock Microsoft. This may work out for SHOP shareholders ultimately, but I do believe that this is a pretty risky investment proposition, especially when we account for SHOP’s questionable earnings quality due to the aforementioned SBC issue.

When Did Shopify’s Stock Split And What Does It Mean For Investors?

Shopify’s stock split on June 29, when one old share was turned into 10 new shares. That has made the stock more accessible, especially when it comes to using options, as one option contract always covers 100 shares. So now, following the stock split, options are usable for everyone that invests around $3,000 into SPOT, whereas a minimum investment of around $30,000 was required prior to the stock split. The underlying value of the company does not change when a company splits its stock, however.

The timing of the stock split is somewhat surprising — SHOP traded at as much as $1,700 over the last year, and yet the stock wasn’t split until it had dropped to $300 or so. Maybe management had a goal of shoring up shareholder enthusiasm, similar to what has happened with Tesla’s (TSLA) stock splits in the past. But if that was the goal, it hasn’t worked out so far, as SHOP still is trading close to its 52-week low and well below the pandemic highs.

Is SHOP A Buy, Sell, Or Hold?

E-commerce is a growth industry, and Shopify is a company that is exposed to this macro growth tailwind. But that alone does not make Shopify a buy. Other factors have to be considered, such as its earnings quality (or lack thereof), and its valuation. SHOP is clearly not profitable once we account for its hefty SBC spending, and at the same time, Shopify is trading at a very high valuation. Other companies with solid growth outlooks can be bought at way lower valuations, which is why I do not see Shopify as a compelling investment today. Obvious growth tailwinds for a business or an entire industry do not automatically make for compelling equity returns. SHOP’s stock split has the advantage of making option usage more accessible, but apart from that, not much has changed following the 10-for-1 split.

With inflation working against Shopify, and with rising interest rates presenting a headwind for all growth stocks/long-duration stocks, I do believe that staying on the sidelines could be the best idea here, although more aggressive investors may seek to buy in order to benefit from a potential bounce following the hefty sell-off during the first half of 2022.

Be the first to comment