BalkansCat/iStock Editorial via Getty Images

Why Did Revlon File For Bankruptcy?

On June 15th, Revlon, Inc. (NYSE:REV) filed for Chapter 11 in the US (note: among subsidiaries, only the UK and Canada subsidiaries are also included in the proceedings). Bankruptcy filing came as the company has been overleveraged ever since it acquired Elizabeth Arden in 2016 in a deal valued at $870m. The company’s long-term debt spiked from $1.8b in 2015 to $2.7b in 2016, compared to ~$1.6b market capitalization at the end of 2016. Meanwhile, Revlon has not had a profitable year since then. The company managed to maintain $87m-$104m in cash throughout the period but accumulated short- and long-term debt rapidly.

More recently, the company started losing US market share to cosmetics brands fronted by celebrities and online competitors. The final blow came with the pandemic – REV faced significant increases in key ingredient prices and labour shortages. Competitors seemingly had higher cash reserves which allowed them to secure components and raw materials in advance. Moreover, vendors started to demand upfront payments. Lockdowns in China only aggravated the company’s liquidity issues. Eventually, Revlon could not purchase all the necessary ingredients for its product portfolio. It is important to note that 80% of the company’s products are manufactured internally.

Why Did REV Stock Jump Up?

Since the announcement of Chapter 11 proceedings, REV stock has gone up by ~5 times, from the low of $1.64 to the current $8.14. Volume reached ~186m on June 21st, compared to the average 3-month daily volume of ~9m. Clearly, an important factor was and is a huge retail investor interest. REV quickly obtained the status of a so-called meme stock, with a huge following in such platforms as Reddit (WallStreetBets) and Stocktwits. Retail traders have been attracted by a high short interest, 37.55% of the float, on the stock as this presents an opportunity for a short-squeeze. This is evidenced by the company apparently being highly ranked on short-squeeze leaderboards.

The 2020 summer rally of Hertz offers an interesting analogy. In June 2020, Hertz soared nearly ten times on high retail investor activity after the company filed for Chapter 11. Eventually, Hertz exited bankruptcy in June 2021 as $5.9b in capital was provided by two investment firms – Knighthead Capital Management and Certares Management. In the end, shareholders received $8 per share compared to May 26, 2020 low of $0.40 per share.

Another important point is that after filing for bankruptcy Revlon has reportedly received takeover interest from Reliance Industries, an Indian conglomerate led by Mukesh Ambani. For Reliance, this is a strategic opportunity to push into the fashion and personal care market with a stable business that needs additional liquidity. Fundamentally, Revlon appears to produce quality internally manufactured products and has widely known brand names. For these reasons, Reliance may be interested.

What is Revlon’s Long-Term Outlook?

Upon court approval, Revlon will receive $575m in debtor-in-possession financing from its current lenders ($375m has already been approved). Moreover, the company possesses an estimated $205m in net working capital. These cash sources will provide Revlon with liquidity needed to run its business until reorganisation advances. In the last three fiscal years, the company burned $68.3m, $97.3m and $11m cash in operating activities. Based on these figures and depending on debt restructuring, current cash and net working capital position may allow the company to have sufficient liquidity for the foreseeable future.

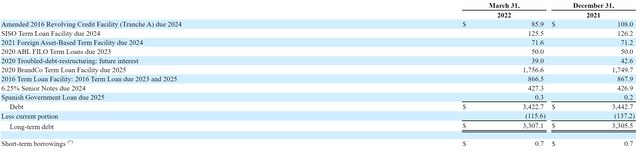

Debt restructuring is key here. Reportedly, debt restructuring discussions started before the Chapter 11 announcement on ~$1.7b in debt that matures due 2024. As of March 31st, total debt stood at ~$3.4b so these discussions will be crucial. The remaining part, ~$1.8b in BrandCo term loan facility, matures in 2025.

Revlon, Inc. Q1’22 10-Q Filing

Historically, Revlon has been able to refinance its debt. In 2020, REV reached an agreement with Jefferies to refinance $850m of its 2021 senior notes and 2019 term loan. In November of the same year, the company finished its 2021 senior note exchange offer for cash proceeds of $236m.

On a side note, in 2020 Citibank transferred $900m to Revlon lenders due to an operational error. To date, Citi has only recovered ~$400m as other creditors refused to return the payment, claiming that Revlon was in default on a loan at the time. The bank, in turn, has stated that it will assume the claim against Revlon if the funds are not returned. In any case, the liability remains on Revlon’s side and this may complicate the bankruptcy process.

In terms of financial performance, the company has run a strategic review with Goldman Sachs since 2019. In 2020, annual cost reductions between $200m and $230m were expected by the end of 2022. Actual operating expense difference between FY2020 and FY2021 was ~$154m, showing that REV was generally on track to achieve its goal. Recent quarterly earnings show that the company had benefited from strong consumer demand as the pandemic eased – revenues rose 8% and operating expenses fell 1% year-over-year in Q1’22.

Summing up, in the long-term the company’s prospects depend on its ability to execute debt restructuring. My analysis suggests that the lack of solvency, and not the underlying business, is the main issue.

Is REV Stock A Buy, Sell, or Hold?

With the current 37.55% short interest (out of 7.8m free float), this may very well come down to two scenarios – short-squeeze or short-covering. On the one hand, short-sellers reportedly have already marked-to-market $15.3m in losses in June. However, the stock has generally been declining for the last eight months so short-sellers likely had shorted at higher price levels which would allow them to short-cover even at the current price. Also, recent wider market sell-offs indicate that the investor sentiment is clearly not at the same level it was during HTZ/GME/AMC frenzies.

An obvious short-term risk for investors is high volatility. Given that the free float is only 14% of outstanding shares (85% are owned by a billionaire Ronald Perelman) and that Revlon is a widely known stock, volatility is likely to stay. Buying options is a choice. However, out-of-the-money REV $12.50 Jan’ 2023 call options have skyrocketed from ~$0.10 in late-May and June to the current $1.30.

Overall, bankruptcy could allow the company to set-up a more debt-light capital structure. As for now, current price action appears to be a short-term rally before the stock is likely delisted from NYSE. Given current price and trading volumes, I will keep monitoring REV and will not open a position.

Be the first to comment