Going straight to the point, given the current market scenario, shouldn’t gold (NYSEARCA:GLD) be going through the roof? Common sense tells us yes. However, that is not what’s happening. Right now, gold has already lost close to 10% from its peak.

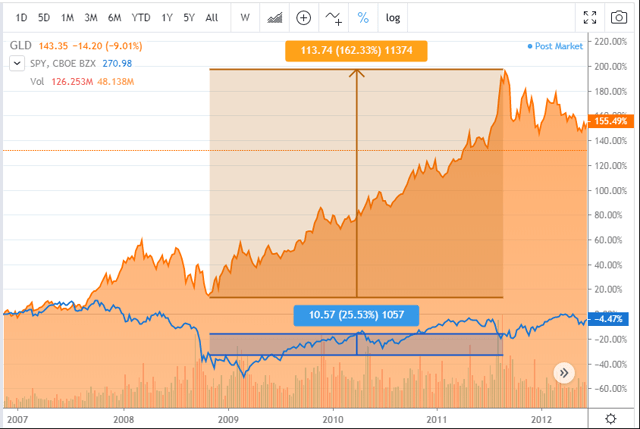

(Source: Seeking Alpha)

What’s happening? Market pundits will tell you that the selloff is a consequence of traders selling positions to meet margin calls. And, they are probably right. It is not new that Gold underperforms during panics. Investors tend to rely on historical correlations to hedge themselves, but, during market panics, correlations tend to break a lot. In part, because, in these situations, leveraged investors need to rebalance portfolios.

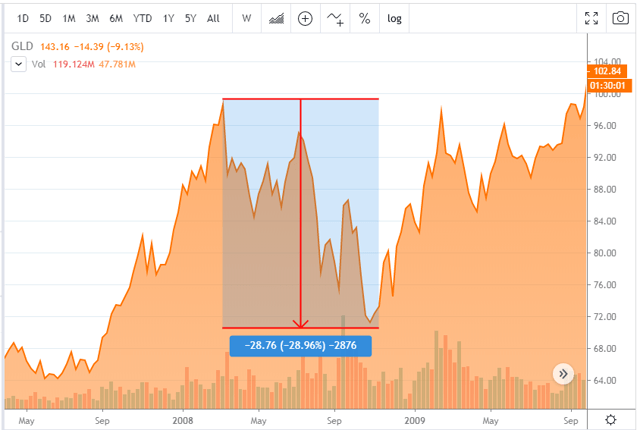

(Source: Seeking Alpha)

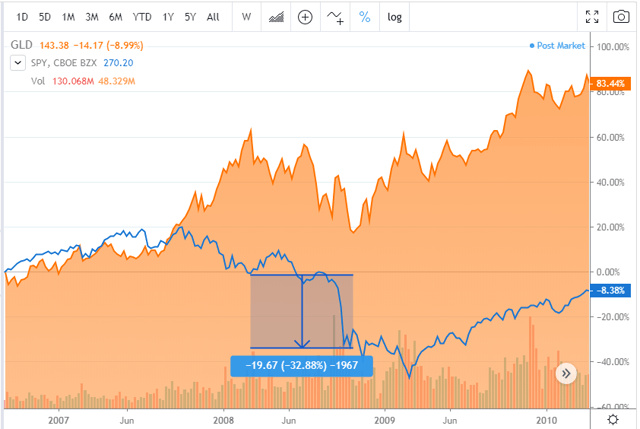

As you can see in the graph above, gold went on to lose roughly 29%. It was beaten by the S&P 500 (NYSEARCA:SPY) which managed to lose 33% roughly in the same period (below). Not a great hedge for all effects.

(Source: Seeking Alpha)

There are, however, good news for the gold bugs. After the Lehman debacle, gold went up to pocket 156% gains until the middle of 2011. During the same period, the S&P 500 booked 25%. What can we make of this? There isn’t any universal rule that tells us how gold will behave, but there are some interesting clues.

(Source: Seeking Alpha)

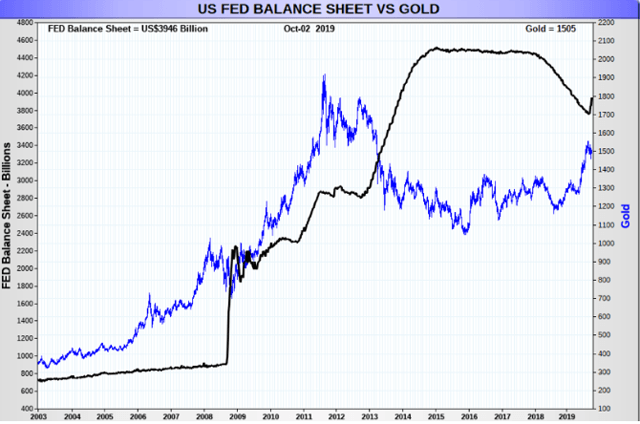

Quantitative Easing 1 (QE1) started in late November 2009. Gold was very sensitive to the stimulus since it started rallying around the same time. The capitulation in the equity market only happened later in March, meaning that it was probably the QE that was the main catalyst for the epic gold rally. For three years, gold kept hitting record highs. During this period, a new supply was developed, which ended up in a gold glut in 2011. But that’s another story.

Gold is very sensitive to the money press

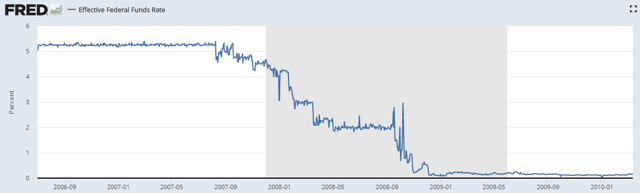

As you can see in the chart below, the Fed started reducing rates in late 2007, but that had little effect on gold. In my opinion, what really did the trick was the confluence of two main factors. Around November of 2007, the gold price was depressed, making it the perfect asset to own during a monetary expansion. It seems that it was the convergence of a low price level and the monetary expansion that made the rally so powerful.

(Source: FRED)

(Source: sdbullion.com)

One interesting note is the fact that, since 2005, the price of gold accelerated the appreciation. Those were years of monetary expansion of another type. I am referring to money creation provided by banks. It might seem obvious, but sometimes, the obvious is wrong. Not in this case; the data seems to support it. After 2007, the relation seems to have broken down. Again, that makes sense due to the panic making leveraged investors selling to cover positions. That just means that the price catalysts change over time. Sometimes, they are under the influence of the theme du jour. Other times, they tend to return to fundamental supply/demand fundamentals.

(Source: FRED)

(Source: Seeking Alpha)

If history is any guide, the current drop in price might still be far from over. Additionally, we might need a new round of money printing to get gold going. However, it seems to me that, this time, governments will join the party using (and likely abusing) fiscal stimulus. If that is the case, we might be on the verge of an inflation outbreak (again, a good topic for another day).

Is the Fed coming to the rescue?

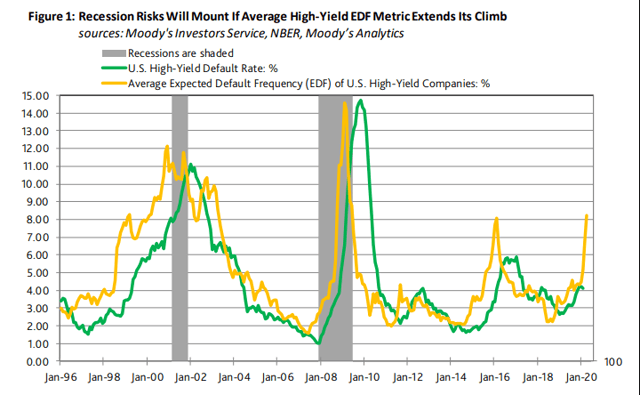

Is it likely that the Fed goes to QE5? I think so. Chairman Powell comes from the private equity world, and he must be terrified with the prospect of having huge cracks opening in the corporate debt market. The BBB segment of the market has been a worry for a long time, and I believe that the Fed will go far in its efforts to keep the market together. Slashing the Fed Funds rate by 100 bps to 0.0-0.25% and launching a $700B liquidity program are steps in that direction.

The expected default frequency probability for US/Canadian high-yield companies, as measured by Moody’s Analytics, has just doubled since January 17. To put it simply, the probability of default during the next twelve months will be higher as the market value drops.

(Source: Moody’s Analytics)

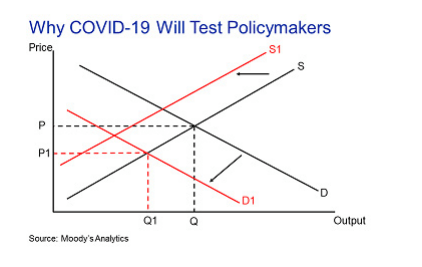

Additionally, the COVID-19 impact on inflation is likely disinflationary.

(Source: Moody’s Analytics)

How to address the gold market, then?

The current drop in price seems to have some correspondence in the 2008 crisis. Then, general panic led to a drop of around 30% in the gold price. If we use that as a reference, we might still have some way to go until we get to the bottom. However, as we’ve seen, after the gold price capitulated and the Fed brought fresh money to the table, gold rallied furiously. I believe that we might have a similar scenario in the making.

A word of caution is necessary. The fact that an apparent fall, from the safe-haven status, was followed by a superb rally, later on, does not mean that the same will happen again. We might be in a regime change moment, and the price of gold is just reflecting that. We will only know in hindsight.

In my opinion, we are not in one of those moments, yet. I believe we will see a regime change to inflation, later, after governments push for fiscal stimulus coupled with monetary largesse. And, this might be the beginning of that. However, for now, I am just seeing another QE cycle, coupled with fiscal spending, and gold prices tend to like it. But, again, I might just be plain wrong.

Be as it may, in the previous paragraphs, I’ve made a case that seems to offer an asymmetric risk/return proposition in GLD’s favor. The SPDR Gold Trust ETF (GLD) is an exchange-traded fund that invests in physical gold, and it tracks the performance of the price of gold bullion by holding gold bars.

(Source: SPDR Gold Shares)

That means investors do not have any embedded leverage in the process, unlike the futures market. However, that’s exactly what we want for the strategy outlined in the previous paragraphs. We are betting in further monetary and fiscal stimulus, and we want to take our time waiting for it to change the market’s GLD perception.

Bear in mind that this investment idea should be seen, in conjunction, with a diversified portfolio. And, at a time of deep market turmoil (and losses), the GLD might work very well as a diversifier for an equity portfolio.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Be the first to comment