Bastiaan Slabbers

Despite being a beneficiary of the reopening trade, The Walt Disney Company (NYSE:DIS) has not been spared from the broad stock market swoon this year. Yet, we cannot say the valuation cut was entirely unjustified.

First, shareholders of Disney cannot have their cake and eat it too. When the COVID-19 pandemic was raging and lockdowns were rampant, DIS bulls pointed to the Disney+ video streaming service as a catalyst to push up the share price of DIS stock. They argued that DIS stock should be valued like Netflix Inc. (NFLX), the leader in the streaming subscription space. However, strict lockdowns in most parts of the world are a thing of the past and the valuation multiples of Netflix have dramatically fallen to previously unbelievable levels.

Second, Disney’s traditional businesses are still seeing some hiccups on their path to full recovery. Disneyland properties in Hong Kong and Shanghai continue to experience disruptions. Its merchandise sales are facing ongoing supply chain constraints. The inflation-induced economic slowdown has crimped the spending of park-goers.

Third, advertising is a substantial source of revenue for Disney and the economic headwinds are leading to concerns that advertising spending would reduce over the coming quarters. Companies that rely heavily on ad spending like Alphabet Inc’s Google (GOOG)(GOOGL) and Meta Platforms (META), the parent of Facebook, have seen their share prices plunge in the past months as investors pre-empt the revenue declines.

Nevertheless, I discuss in this article why I think the market may be too bearish on DIS stock and the positive catalysts on the horizon leading to my Buy call on Disney shares.

DIS Stock Key Metrics

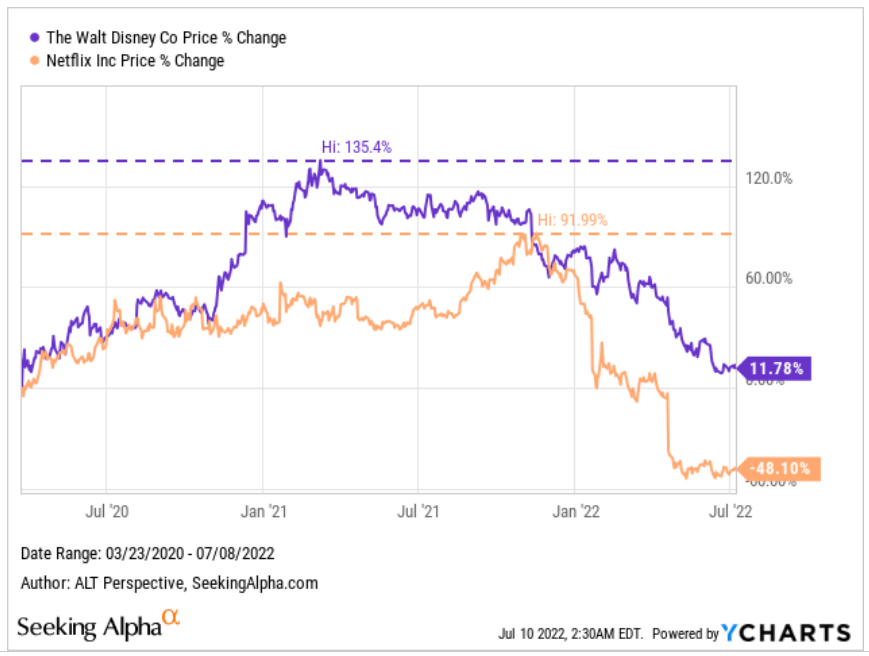

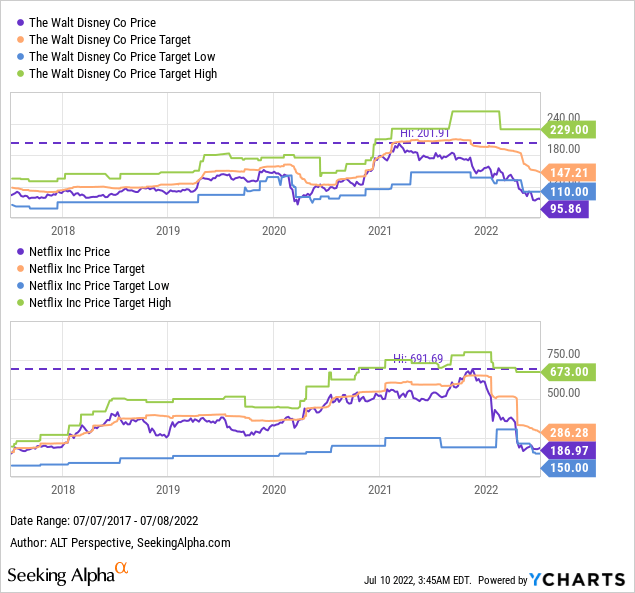

From the market bottom on 23 March 2020, the share price of The Walt Disney Company soared 135% around a year later. The surge of DIS stock surpassed that of the more obvious pandemic play, Netflix, for much of 2021. The optimism for Disney came despite its traditional core businesses of movies and entertainment parks being hampered by the series of lockdowns around the world. A second-half 2021 catch-up attempt by NFLX stock, driven by renewed interest in the company thanks to drivers like the unexpectedly popular Squid Game show, helped with a short-lived outperformance over DIS stock.

Unfortunately for the shareholders of Netflix, NFLX has lost all of its pandemic gains and more. It is down 48% since the market bottom on 23 March 2020 and is at a multi-year low. Those who only became shareholders of Disney in the past two years aren’t too happy either, with their DIS holdings underwater. I don’t think there is any schadenfreude by DIS shareholders over those holding NFLX but I suppose they should be comforted that DIS stock is up 12% since the March 2020 S&P 500 (SPY) trough.

YCharts

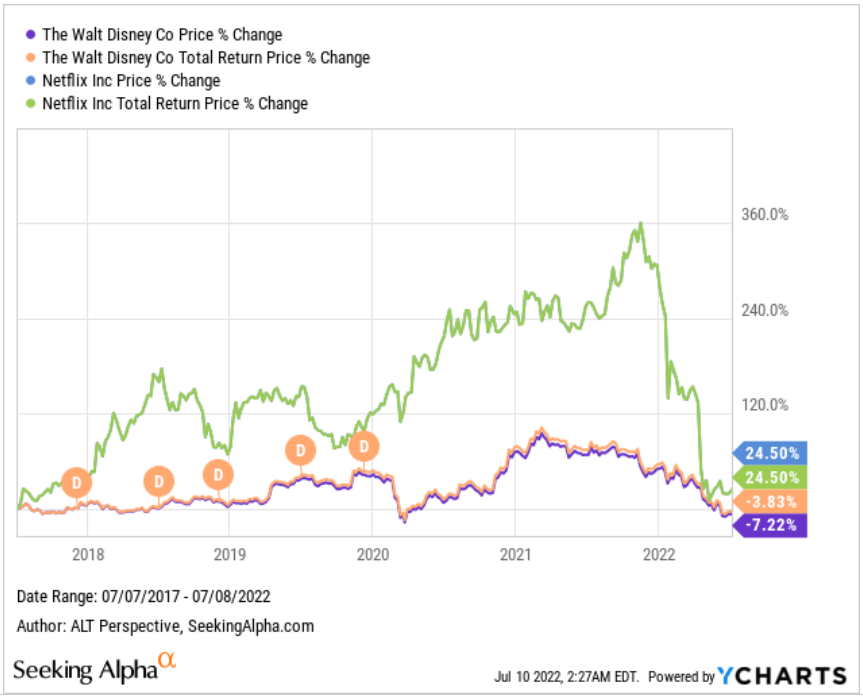

Netflix shareholders who have held the stock for much longer may be regretting they did not sell last year at the peak or even at any point since late 2017 when they could do so with a profit. Yet, those who bought exactly five years ago are still seeing a positive appreciation of 24.5% on paper. Disney shareholders from five years ago are underwater (-3.8%) even after factoring in the five dividend payouts before the media giant suspended its dividend policy from 2020 to conserve cash.

YCharts

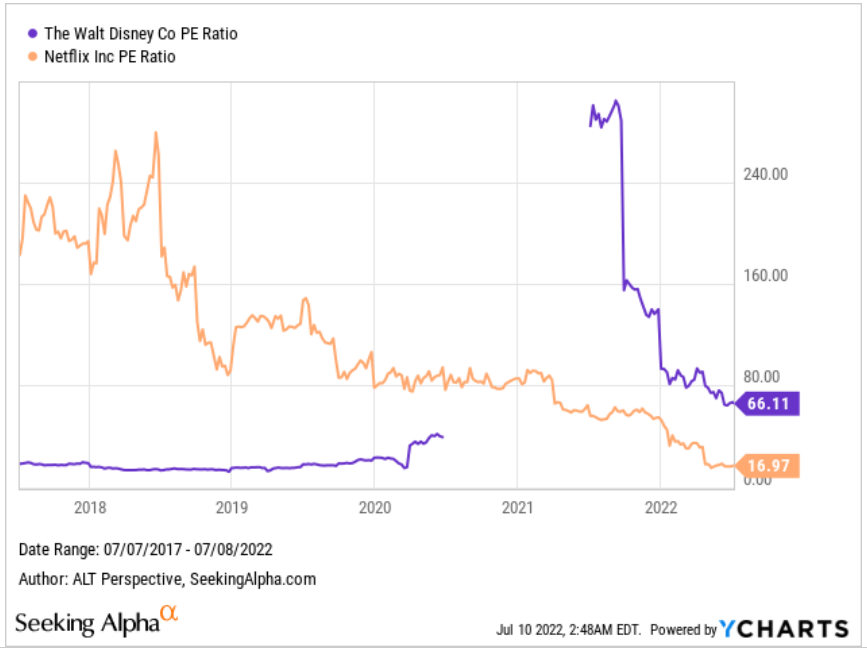

On a price-to-earnings ratio basis, Disney stock traded before mid-2020 at a multiple much lower than Netflix. Thereafter, as it was loss-making, it didn’t make sense to look at its P/E ratio. From mid-2021 when Disney resumed reporting profits, its P/E ratio was unusually high as its operations were still in recovery. In 2022, with its traditional businesses returning to some semblance of normalization, its P/E ratio remained higher than Netflix (66 times versus 17 times presently), though it was more of the latter being treated by the market as a broken growth stock.

YCharts

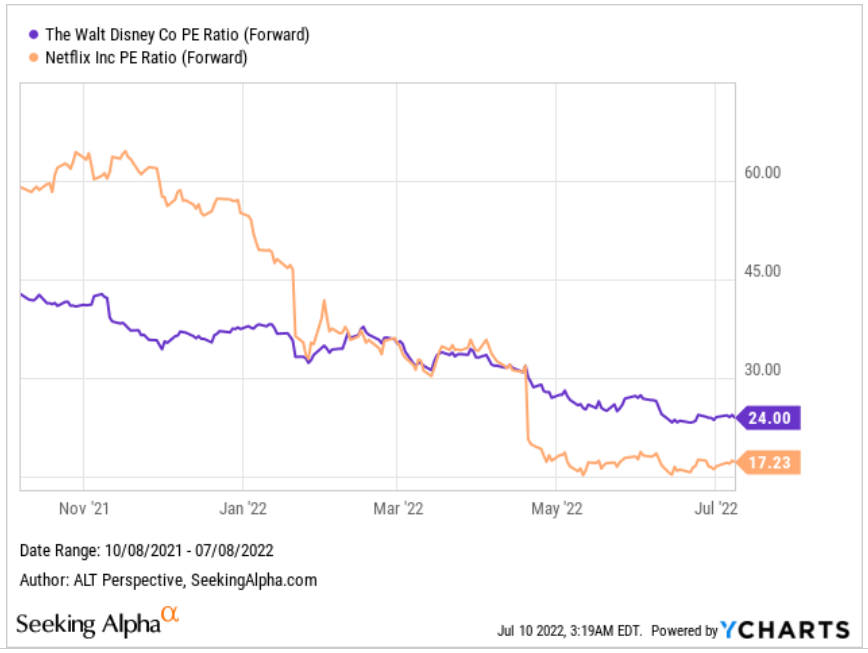

On a forward basis, Wall Street analysts expect DIS stock to continue trading at a multiple higher than NFLX stock (24 times versus 17 times), signaling their optimism for the former and pessimism for the latter. Note that this is a reversal from April when analysts were expecting DIS to trade at a similar P/E ratio on a forward basis as NFLX or higher, a reflection of how sudden sentiment has soured on Netflix.

YChart

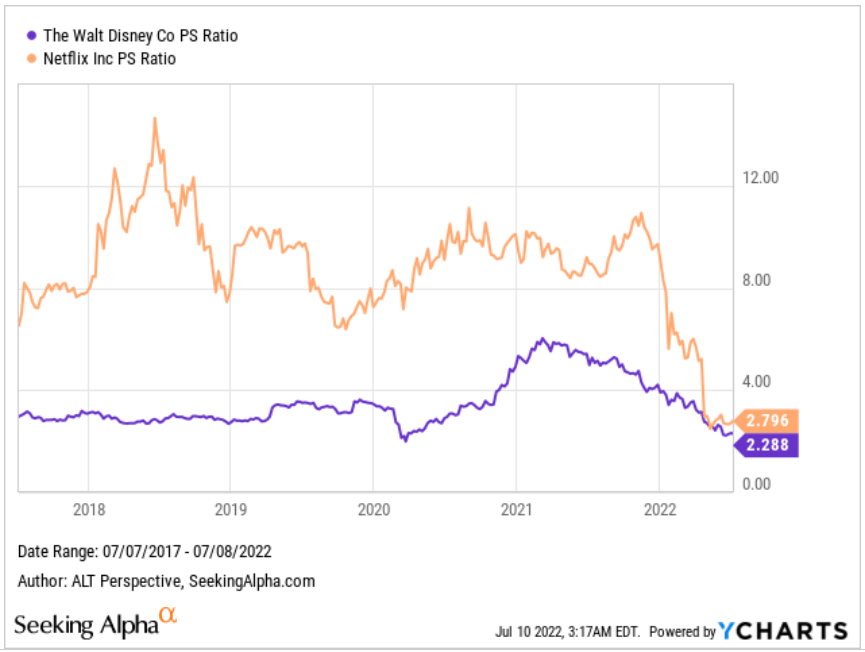

The sharp drop in the valuation of Netflix has also narrowed its P/S ratio gap with Disney significantly compared to historical levels. The P/S ratio of Disney was even higher than Netflix at some point in May this year before the latter regained some ground and is trading at a P/S ratio of 2.8 times, just slightly higher than the 2.3 times for Disney. When market pundits envisaged a catching up of the valuation multiple by Disney with Netflix following the official launch of its streaming service, Disney+, in November 2019, I don’t suppose they anticipated the eventuality to be due to the downfall of Netflix. Ironically, the current P/S ratio of Disney is even lower than that before the launch of Disney+.

YCharts

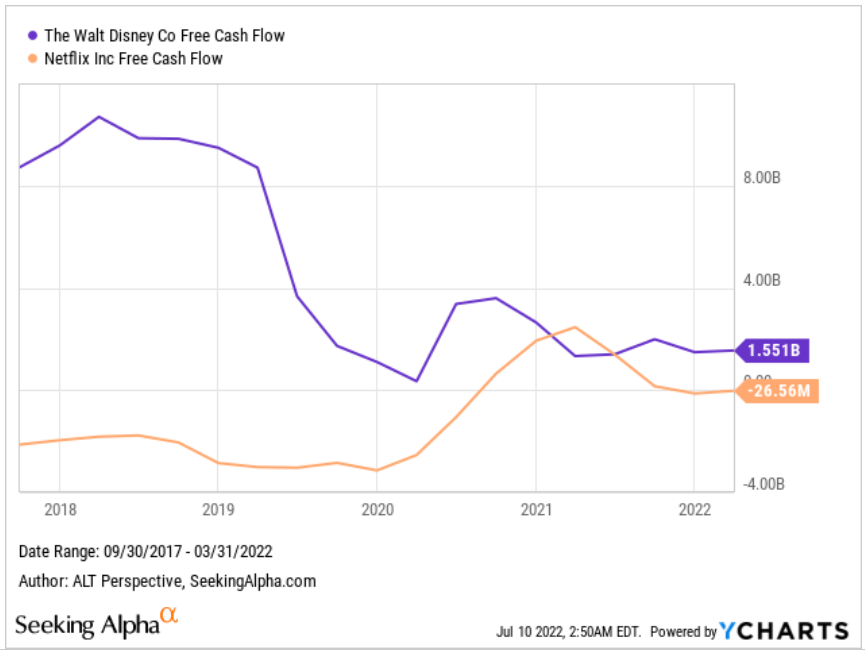

Comparing the two media titans, Disney’s free cash flow has historically stood out against Netflix with the latter investing heavily in content. During the pandemic constraints when Netflix had to throttle down the content spending with studios shut, its free cash flow momentarily improved and turned positive for several quarters. Despite the challenges with its brick-and-mortar businesses through the bouts of movement restrictions, Disney managed to keep its FCF positive, reflecting its financial discipline, while Netflix has slipped back into negative FCF as of the March quarter.

YCharts

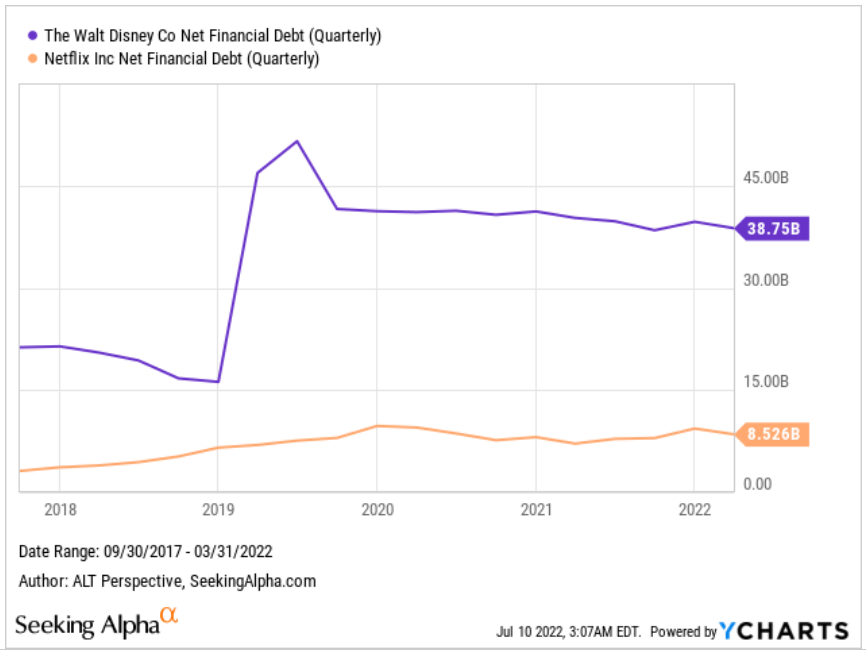

In an environment of rising rates, companies with high debt are frowned upon. The Walt Disney Co. has a much higher debt position than Netflix despite having just over two times larger market capitalization. Nevertheless, when Disney was led by its previous CEO Bob Iger, the company acquired four major movie studios (Pixar, Marvel, Lucasfilm, and 20th Century Fox) which continued to thrive to date, justifying the large monetary outlay.

In May, Marvel’s Doctor Strange in the Multiverse of Madness became the year’s biggest movie opener, grossing $185 million in its domestic theater debut over the launch weekend. Two months later, Thor: Love and Thunder, another Marvel production, looks set to perform spectacularly at the box office too, with an estimated $150 million in receipts for the opening weekend.

In 2019, Disney’s net financial debt doubled due to the completion of the purchase of 20th Century Fox which was announced on 14 December 2017. The $71.3 billion acquisition brings into Disney’s fold 21st Century Fox’s renowned film production businesses, including Twentieth Century Fox, Fox Searchlight Pictures, Fox 2000 Pictures, Fox Family and Fox Animation; Fox’s television creative units, Twentieth Century Fox Television, FX Productions and Fox21; FX Networks; National Geographic Partners; Fox Networks Group International; Star India; as well as Fox’s 33% interest in streaming service Hulu, thereby catapulting Disney to be the majority owner of Hulu.

The enriched library of content from Iger’s past acquisitions boosted the appeal of Disney+ and must have played a key role in the rapid subscriber additions since its launch. Not all debts are bad and Disney’s purchases have proven to be well spent, unlike at General Electric Company (GE) where the executives have been dismantling the industrial behemoth to lower its debt position built during the controversial leadership of Jeff Immelt. The benefits extend beyond Disney+ and box office receipts – Disneylands worldwide have added sections from the movie franchises like Marvel Avengers, expanding the target audience of the parks from young children to adults.

YCharts

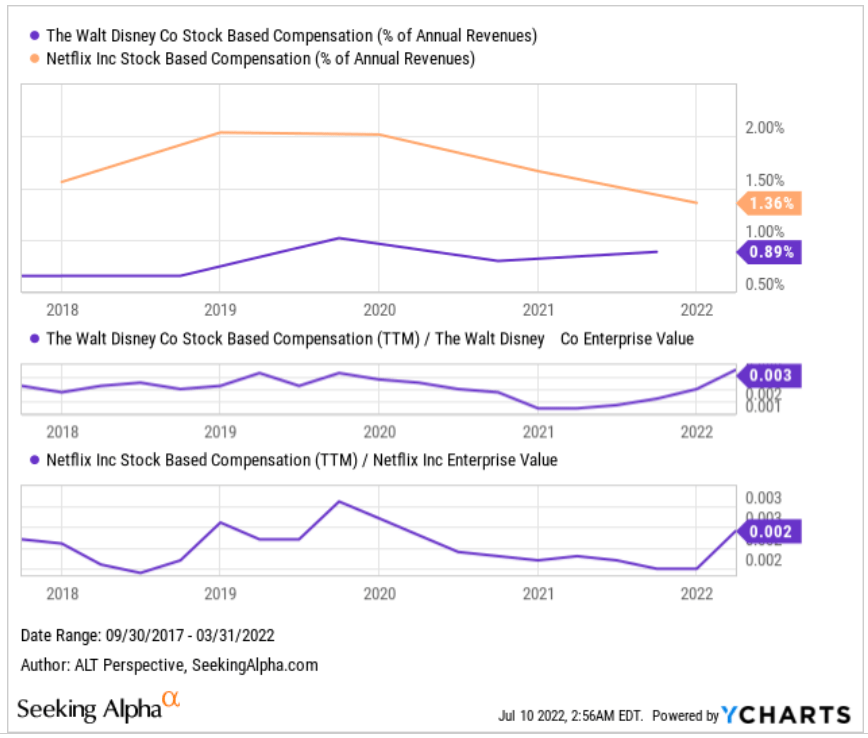

In the past months, market players have not only become averse to loss-making companies, but they have also heightened their scrutiny on those which they deemed to be providing “excessive” stock-based compensation [SBC]. As a percentage of their annual revenues, both Disney and Netflix cannot be said to be overly generous in their SBC at just 0.9% and 1.4% respectively. Relative to their enterprise value, the SBCs at Disney and Netflix are also small at 0.3% and 0.2% respectively. Hence, the two media giants are unlikely to be punished by shareholders for their SBC programs.

YCharts

DIS Stock Ratings

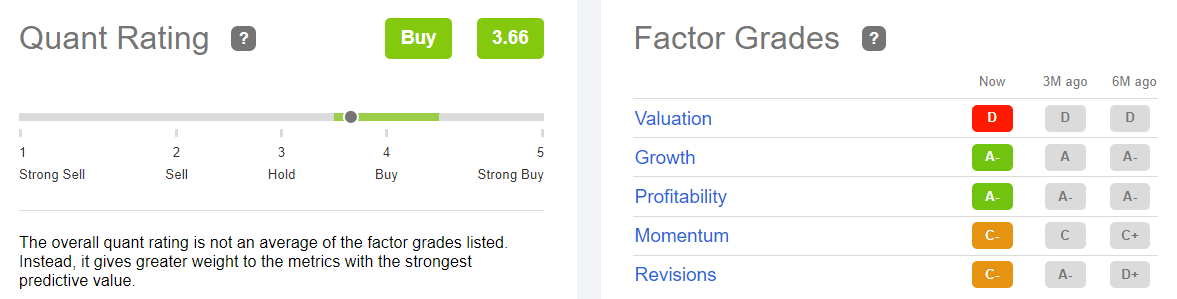

DIS stock has a consensus ‘Buy’ rating whether by Seeking Alpha’s quant system, SA authors, or Wall Street analysts. In contrast, NFLX stock is a consensus ‘Buy’ only by Wall Street analysts. It is a ‘Sell’ according to Seeking Alpha’s quant system and a consensus ‘Hold’ by SA authors. Looking into the factors contributing to the ‘Buy’ quant rating for Disney stock, only Growth and Profitability achieved a decent A- grade. Despite the share price correction, Valuation remains a D, the same as three months and six months ago. Meanwhile, Momentum has dropped slightly from C three months ago to C-, and Revisions deteriorated from A- three months ago to C-. More on the revisions later.

Seeking Alpha Premium

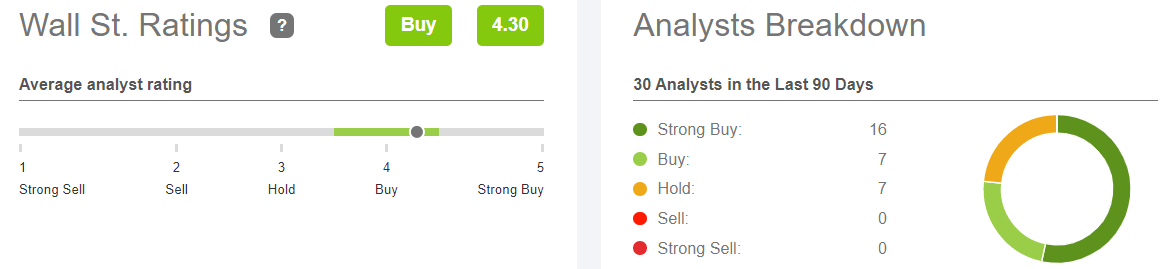

Wall Street analysts are generally bullish on Disney, with 16 out of 30 analysts covering the company rating the stock ‘Strong Buy’ and 7 analysts rating it ‘Buy’. Unlike Netflix which has lost favor with analysts, DIS stock has no ‘Sell’ or ‘Strong Sell’ call on it.

Seeking Alpha Premium

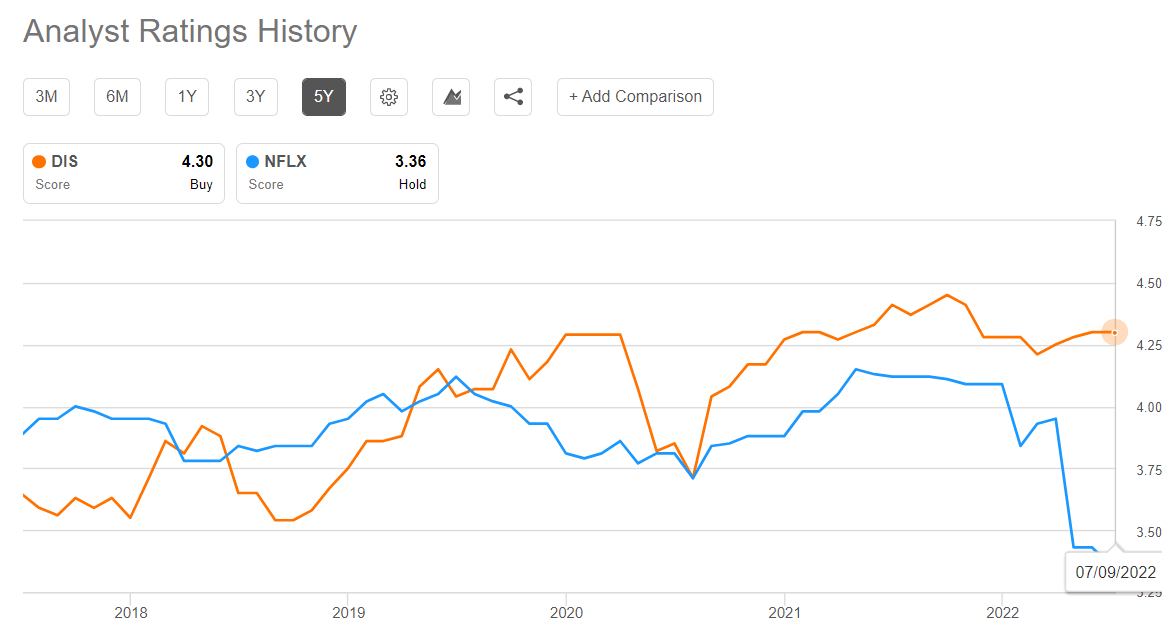

Wall Street analysts’ preference for DIS stock is not a recent phenomenon. DIS stock has received a higher rating score than NFLX since mid-2019 as the company made famous by its leading character Mickey Mouse attracted investor attention for its continued successes at the box office, its 20th Century Fox acquisition, and the pending launch of Disney+. Even as its sprawling parks were shut and theaters shuttered in 2020, the consensus analyst score on DIS remained higher than NFLX.

Seeking Alpha Premium

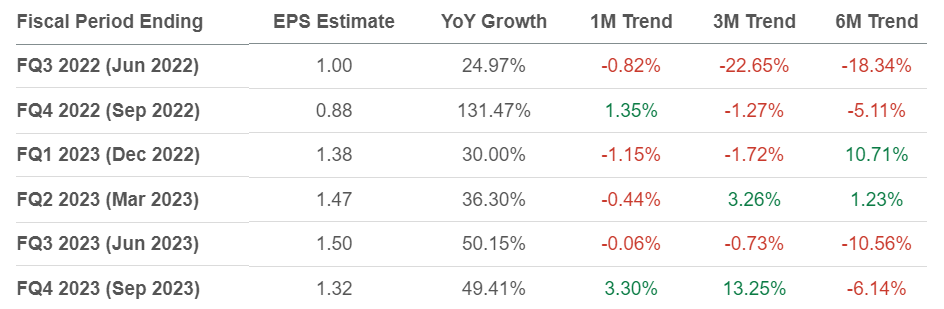

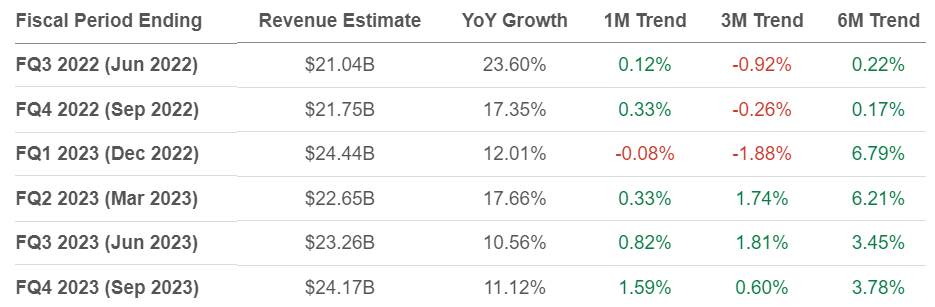

The bullishness of analysts may not be apparent with the downward revisions in the earnings estimate of Disney. The prevailing EPS estimate for the fiscal third quarter of 2022 (June 2022 quarter) is 23% lower than three months ago. However, things look rosier in FY2023 with minor reductions from three months ago and even positive revisions in some quarters.

Seeking Alpha Premium

In contrast, the EPS estimates for Netflix have been reduced by double-digit percentages through 2024. Analysts are expecting Netflix to post a negative 3.5% growth in EPS for the fiscal year ending December 2022, followed by a tepid 11.7% growth next year. Although the estimates are also shaved for Disney, analysts are still expecting the company to grow its EPS by a whopping 71.6% for the fiscal year ending September 2022. While this feat is achieved over a low base in 2021, note that analysts are forecasting Disney to also grow a hefty 38.6% year-on-year in the fiscal year ending September 2023.

Seeking Alpha Premium

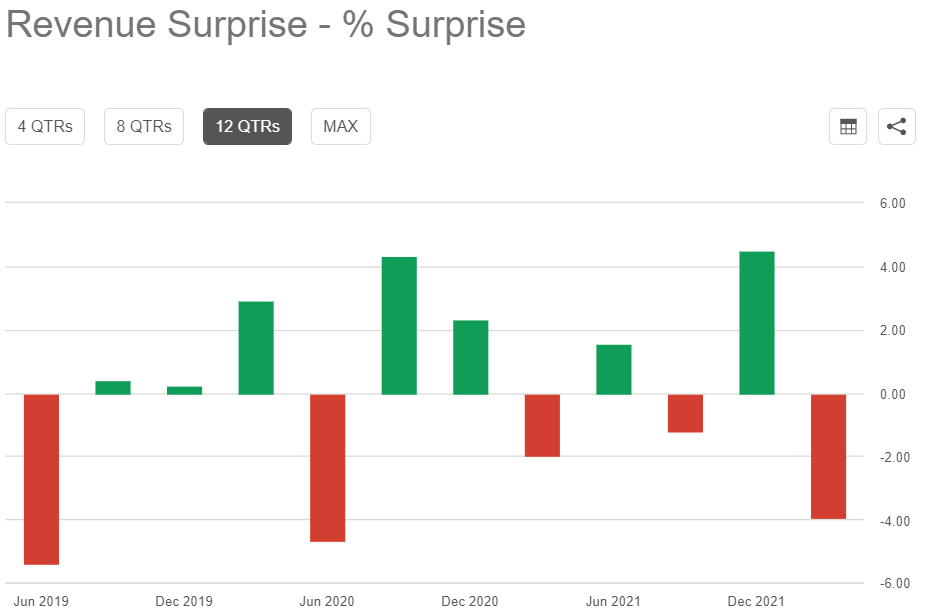

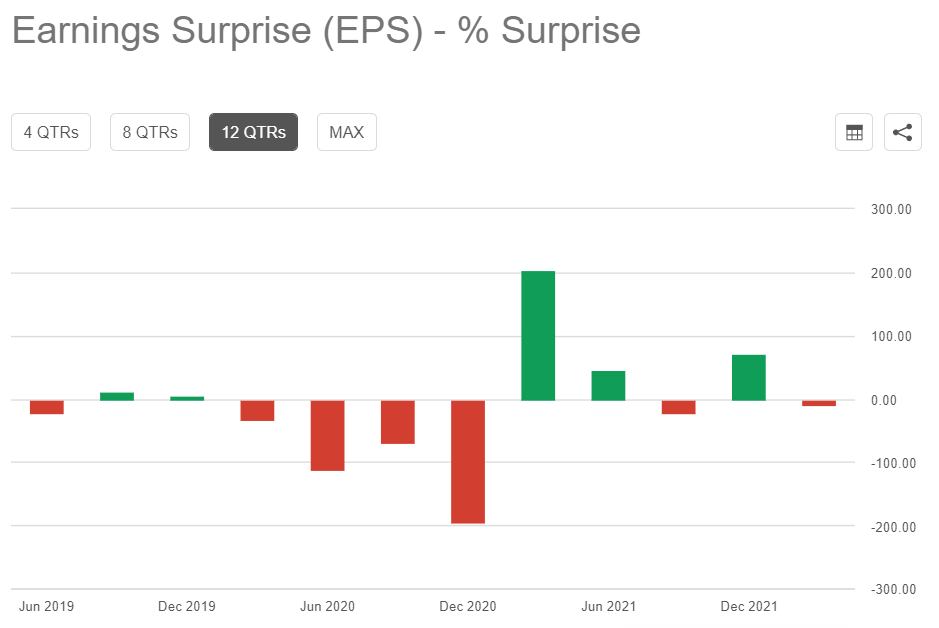

Investors have to be careful not to simply depend on the consensus analyst estimates as a reliable gauge of Disney’s upcoming earnings potential. Looking at the past 12 quarters, Disney analysts have a mixed track record on both the revenue and EPS estimates. The revenue surprises were as much as 4% to nearly -6% while the EPS surprises were wilder, ranging from -200% to 200%.

Seeking Alpha Premium Seeking Alpha Premium

Pending Full Recovery In Parks And Ad-supported Tier For Disney+ Are Strong Catalysts

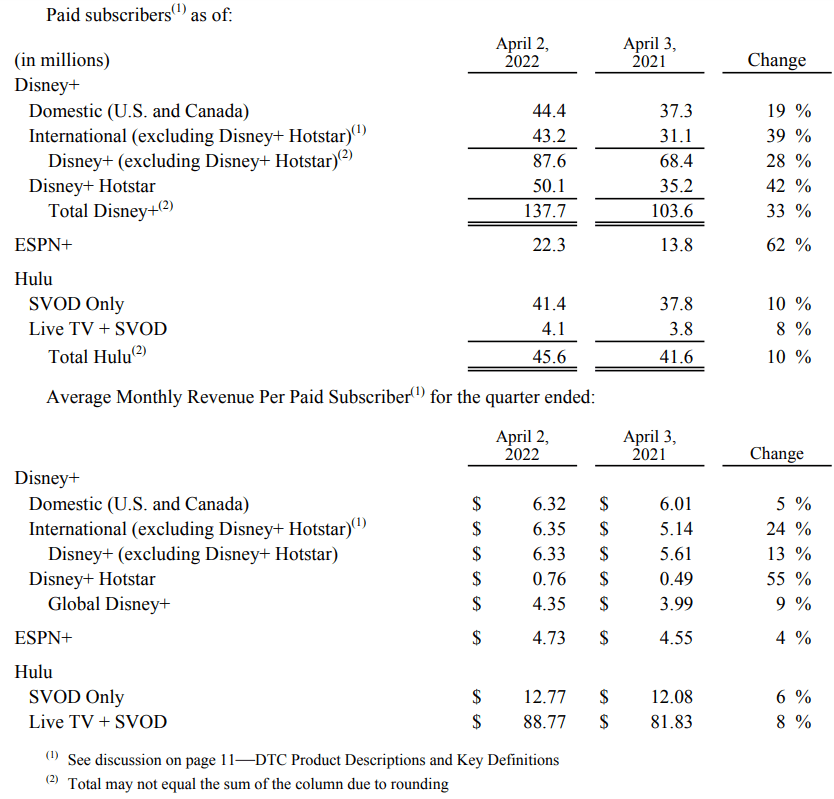

DIS stock peaked in March 2021 and the share price went downhill thereafter. However, Disney’s streaming business continued to grow gangbusters. Paid subscribers to the entire Disney+ category rose 33% between 3 April 2021 to 2 April 2022. At the same time, the average monthly revenue per paid subscriber for Global Disney+ rose 9%. Of note is the 55% jump in Disney+ Hotstar. Although it is priced at a much lower point than the domestic Disney+, the sharp increase in subscriber value from just a year ago suggests the pricing power and growth potential in the developing markets like India and Southeast Asia for Disney.

The Walt Disney Company

In the April 2022 quarter, Disney posted $6.652 billion in revenue for the Disney Parks, Experiences and Products business segment. This is higher than the $6.169 billion in revenue for the same segment in the quarter ending 30 March 2019, i.e. the comparable period pre-COVID, despite its cruise ships operating at reduced capacities and Hong Kong Disneyland Resort and Shanghai Disney Resort far from operating at full capacities. The introduction of Genie+ and Lightning Lane, the successor of the previous FastPass and MaxPass options, in the first quarter of the current fiscal year could continue to bring an increase in the average per capita ticket revenue in the coming quarters as park-goers become familiar with using them to improve their park experiences.

The Chinese government has been worried about COVID-19 overwhelming its health-care system and stands ready to impose lockdowns at the expense of the economy. Nevertheless, the situation may be about to dramatically improve. Bloomberg reported in April that two Chinese mRNA COVID-19 vaccines were moving into clinical trials. Recent reports signaled China is getting closer to approving its first mRNA vaccine for COVID-19.

Market pundits have long anticipated that Beijing is awaiting the rollout of more effective vaccines, coupled with greater access to COVID-19 pills, before loosening the strict zero-COVID policy. It’s a matter of time before this becomes an eventuality and both Hong Kong Disneyland Resort and Shanghai Disney Resort would stand to benefit. Furthermore, when the Chinese population is able to travel freely again, Disney properties around the world would also see higher attendance.

With Netflix and other streaming wannabes now prioritizing profitability, Disney+ would have breathing space to grow. Meanwhile, being a newer service as compared to Netflix, Disney+ can show improved metrics just by expanding to more markets. Christine McCarthy, Senior Executive Vice President and Chief Financial Officer at Disney, said in May that by the end of the year, Disney+ will be in about 150 markets.

Netflix has previously pointed to its enlarging subscriber count even as it raised the fees. However, having to resort to exploring an ad-based subscription tier suggests that its bargaining power over users has reached the proverbial ceiling, probably accelerated by the pressures from the inflationary environment and stiffening competition. Yet, an intention to earn from advertising does not guarantee success.

On the other hand, Disney has decades of experience and a proven track record in advertising sales, giving investors the confidence that it can execute its plans for adding an advertising-supported tier. Bob Chapek, who has recently received a three-year contract extension on his tenure as the Chief Executive Officer of The Walt Disney Company, detailed Disney’s experience in advertising sales during the fiscal second quarter 2022 earnings conference call on 11 May 2022 in illustrating their ability to successfully turn Disney+ into an Advertising-Based Video on Demand [AVOD] platform :

“We’re in really good shape in terms of being able to meet our timing with our Disney+ ad tier. And that’s largely because we’re already doing it. The combination of our ESPN+, streaming tech stack and our experience in Hulu and the software, we think that our current advertising capabilities really substantially prepare us to already bring this tier into operations. So there’s nothing that we need to go acquire or, frankly, even in any significant way developing anything new. And that’s due to the ongoing investments in technology that we’ve made over time to increasingly automate much of this process. And we’ve been looking forward to this for a while. So this is something that’s well-greased, if you will.”

Rita Ferro, President of Advertising Sales, The Walt Disney Company, reminded the audience of the same repeatedly during the MoffettNathanson Annual Media & Communications Summit held a week later on 18 May 2020 (emphasis mine):

“So, I mean, the integration of Hulu for us has been outstanding for multiple reasons, obviously — the obvious one is scale, but it’s also a great intel and learnings to our team, because Hulu was the first platform to launch advertising, right? The first AVOD platform. So they had 14 years’ experience in this space. But since we took operational control of Hulu, we’ve doubled the revenue, we’ve doubled the number of advertisers, programmatic revenue was up five times. So it was a really important piece of our portfolio. But it also benefited tremendously from being with a company who has been in the advertising business for decades.”

“We have 14 years of Hulu experience, decades of Disney experience on how to go to market and sell advertising. We have the relationships in the market, people trust us and we understand, I run the kids business, so I also understand what it is to sell advertising in a kid’s first platform and understand the control that we need to have round that, while being able to really fully monetize our adult business, which is a big piece of what we will have on the Disney+ platform. … And we’re seeing that right now as the rollout of many, many platforms that are coming out, but they don’t have the scale and the expertise that we have.”

Since Disney is already earning from advertisements on some of its platforms like Hulu and ESPN, Chapek reassured investors concerned about cannibalization that the upcoming rollout of the AVOD platform for Disney+ would be executed on a growing-the-pie strategy:

“In terms of sort of the growing-the-pie idea, we believe that the value proposition of advertising with Disney+ is only enhanced with our addition of an ad-supported tier on Disney+. So we believe it’s good for the consumer because it’s going to give us another entry price point, but it’s also going to be great for the advertisers. Our advertisers increasingly are looking for multiple platforms to reach a broader reach. And we think that as a company, we’re going to provide that given our portfolio of streaming and our linear networks. So I think we’re creating more avenues, both for consumer choice and for comprehensive advertising solutions, for our advertising customers at the same time.”

Is Disney Stock A Buy, Sell, or Hold?

The macro-economic environment is challenging. We know it with the broad stock market swoon in the past months and our portfolios shrinking in value from last year. However, we are also aware that The Walt Disney Company has several durable businesses. Parents around the world save up to fulfill the wishes of their children to visit Disney parks. No one wants to deny their kids a memorable childhood, on their birthdays or the summer holidays. Adults, teenagers, and children are thronging the theaters to watch movies from Disney’s suite of studios. Disney’s streaming platforms are registering strong subscriber and revenue growth and Disney+ launched in more than 40 countries in the calendar quarter ending June. The world is moving past COVID-19 and cruises are returning.

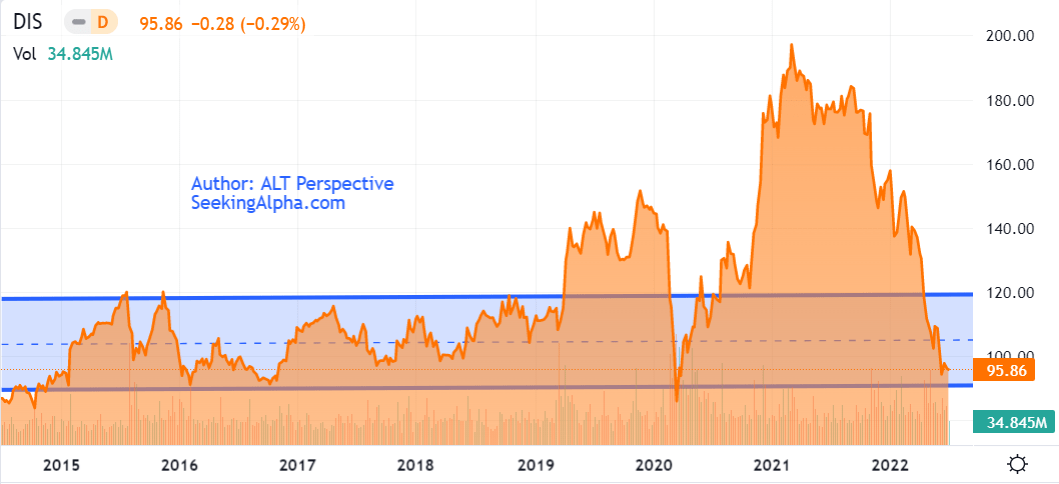

Meanwhile, Netflix, previously touted as the Disney-killer, is stumbling and analysts are expecting the streaming pioneer to post greater net subscriber losses than the guidance by the management when it reports second-quarter results on July 19. Yet, NFLX (at $186.97) is still trading above the least optimistic price target ($150) on the stock. The opposite is true for Disney, where DIS (at $95.86) is trading below even the least optimistic price target ($110) on the stock.

Down more than half from its peak last year, DIS stock is trading near the low point of its eight-year price channel. Coupled with several positive drivers on the horizon, DIS stock in the sub-$100 level is a seemingly good entry point for a quick rebound trade or a long-term investment. Hence, I conclude that Disney stock is a Buy.

Seeking Alpha Premium

Be the first to comment