Leon Neal

Elevator Pitch

I have a Hold investment rating assigned to Coinbase Global, Inc.’s (NASDAQ:COIN) stock.

I touched on COIN’s poor year-to-date share price performance in my earlier May 27, 2022 update for the stock. In this article, my attention turns to Coinbase’s outlook following its Q2 2022 financial results.

Coinbase is rated as a Hold. In the short term, the financial outlook for Coinbase isn’t appealing in terms of the expectations for revenue growth and losses. However, revenue diversification and increased adoption of cryptocurrencies by institutions will help to re-rate COIN’s valuations in the long run. I think Coinbase warrants a Hold rating.

What Were Coinbase’s Expected Earnings?

According to Seeking Alpha’s financial data, Coinbase’s expected normalized earnings per share for the second quarter of 2022 was -$1.23.

This implies that Wall Street analysts were expecting that COIN will turn loss-making as compared to its positive adjusted EPS of +$6.78 in Q2 2021 in the recent quarter. It also suggests that the market expected Coinbase’s net losses to widen on a QoQ basis as compared to its net loss per share of -$0.12 for Q1 2022.

In my late-May article for Coinbase, I had noted that “the cryptocurrency market weakness” might “continue to be a drag on COIN’s near-term performance.” As such, it is understandable that the analysts were of the opinion that Coinbase will remain loss-making in Q2 2022.

Did Coinbase Beat Earnings?

The analysts were right to some extent. Coinbase’s actual Q2 2022 earnings were weak based on a QoQ and YoY comparison as expected, but the company’s net loss per share for the recent quarter did beat analysts’ expectations. COIN delivered a non-GAAP adjusted net loss per share of -$0.87, which was superior in comparison with the sell-side’s consensus net loss projection of -$1.23.

Despite the fact that COIN was still in losses for the second quarter, its narrower-than-expected loss could have contributed to its positive post-results share price performance. Coinbase’s stock price rose by +7% from $87.68 as of August 9, 2022 to $94.14 as of August 10, 2022, after the company reported its Q2 2022 earnings on August 9, after the market closed.

COIN Stock Key Metrics

In my opinion, it was a mixed quarter for Coinbase based on an assessment of COIN’s key operating and financial metrics.

On one hand, COIN has managed expenses well, and both the company’s net loss and operating loss for the recent quarter turned out to be better than what the market had feared.

In the preceding section, I mentioned that Coinbase’s Q2 2022 net loss per share was -$0.87, and not as bad as Wall Street’s net loss expectations of $1.23 per share. Similarly, COIN’s non-GAAP adjusted EBITDA loss of -$151 million, as indicated in its Q2 2022 shareholder letter, was smaller than the sell-side’s estimated EBITDA loss of -$175 million as per S&P Capital IQ.

Coinbase noted at the company’s Q2 2022 investor call on August 9, that it has “taken several steps to streamline our cost structure, including the 18% employee reduction that we announced in June.” COIN’s efforts are paying off, as evidenced by COIN’s narrower-than-expected operating loss and net loss for the recent quarter.

Also, COIN did well on the Monthly Transacting Users or MTUs operating metric. As highlighted in its Q2 2022 shareholder letter, MTUs for Coinbase rose by +2.2% YoY from 8.8 million for Q2 2021 to 9.0 million in Q2 2022, even though the cryptocurrency market conditions weren’t favorable.

On the other hand, Coinbase’s top line and trading volume metrics were disappointing.

COIN’s net revenue fell by -60% YoY from $2,033 million in Q2 2021 to $803 million for Q2 2022. The company’s actual top line for the recent quarter fell short of the Wall Street analysts’ consensus revenue forecast of $870 million (source: S&P Capital IQ) by roughly -8%.

In tandem with the revenue decline, Coinbase’s trading volume dropped by -53% from $462 billion in the second quarter of last year to $217 billion for the most recent quarter.

What To Expect After Earnings

The expectations for Coinbase’s future quarterly earnings as indicated by the company’s updated guidance are in line with COIN’s recent Q2 2022 performance.

Coinbase changed its full-year FY 2022 annual average MTUs guidance from 5.0-15.0 million previously to 7.0-9.0 million now. In other words, the mid-point of COIN’s MTUs yearly guidance for fiscal 2022 has been reduced from 10.0 million to 8.0 million. This points to a weak revenue growth outlook for COIN in the short term as validated by the market’s consensus numbers. Wall Street expects Coinbase’s top line to decrease by -48% YoY and -69% YoY for Q3 2022 and Q4 2022, respectively.

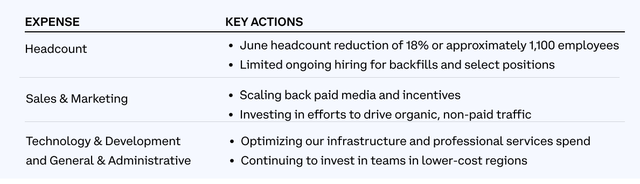

On the flip side, COIN emphasized at its second-quarter results call that it is “cautiously optimistic about our ability to operate within “the $500 million adjusted EBITDA loss guardrail we communicated for 2022.” The market consensus sees Coinbase generating EBITDA losses of -$202 million and -$114 million in Q3 2022 and Q4 2022, respectively as per S&P Capital IQ data. On a full-year basis, the analysts predict that COIN’s FY 2022 EBITDA loss will be -$477 million, or within the company’s management guidance. It is expected that Coinbase’s cost optimization initiatives (as detailed in the chart below) will enable the company to cap its losses at the EBITDA level to -$500 million or better.

COIN’s Cost Optimization Initiatives

Coinbase’s Q2 2022 Shareholder Letter

In a nutshell, Coinbase will witness further YoY revenue contraction in subsequent quarters, but the positive thing is that operating losses for COIN might not be as substantial as feared.

Is COIN A Good Investment Long-Term?

COIN needs more time to prove to investors that it is a good long-term investment yet, and there are two critical factors that investors need to watch closely.

The first factor is revenue diversification.

I mentioned in my May update for COIN that its new “NFT (Non-Fungible Token) marketplace marks a critical milestone in COIN’s revenue and product diversification efforts.” Coinbase’s recent Q2 2022 results also suggest that the company is making progress in other areas of revenue diversification.

COIN’s subscriptions & services revenue increased by +44% YoY to $147.6 million in Q2 2022, and the proportion of revenue contributed by subscriptions and services expanded from just 4% in Q2 2021 to 18% in the recent quarter.

Coinbase explained at its Q2 2022 results briefing that its “staking business” has “grown into a great source of subscription and services revenue and is growing nicely”, and it noted that “customers are hanging around (at COIN’s platform) and engaging with crypto in new passive ways, notably staking.” COIN defines staking as committing to “a lockup or ‘vesting’ period, where your crypto can’t be transferred for a certain period of time” as “a way of earning rewards.”

However, transaction revenues still represented 82% of Coinbase’s top line in Q2 2022, so revenue diversification is still a work-in-progress.

Separately, while cryptocurrencies are in general going through a rough patch, the long-term investment case has been that there is substantial room for the institutional adoption rate of cryptocurrencies to grow. This is the second factor.

On August 4, 2022, Seeking Alpha News reported that Coinbase has entered into a partnership “with asset management behemoth BlackRock (BLK) to enable its institutional clients to trade bitcoin (BTC-USD).” According to this news article, “institutional clients of Aladdin, BlackRock’s end-to-end investment management platform, will be given direct access to buy and sell crypto” using Coinbase Prime. This sends a very clear signal that an increasing number of institutional investors are becoming more interested in increasing their exposure to cryptocurrencies, and this is a major positive for COIN in the long run.

But the institutional adoption rate of cryptocurrencies won’t shoot up in weeks or months; one needs a multi-year investment horizon. Also, the impact on COIN’s financials in the short term might also be limited because the take rate for institutional investors (as opposed to retail clients) is lower.

Is COIN Stock A Buy, Sell, or Hold?

I rate COIN stock as a Hold. The near-term outlook for Coinbase isn’t particularly exciting, and it will take time for COIN’s long-term growth drivers to be realized.

Be the first to comment