Nattakorn Maneerat/iStock via Getty Images

Introduction

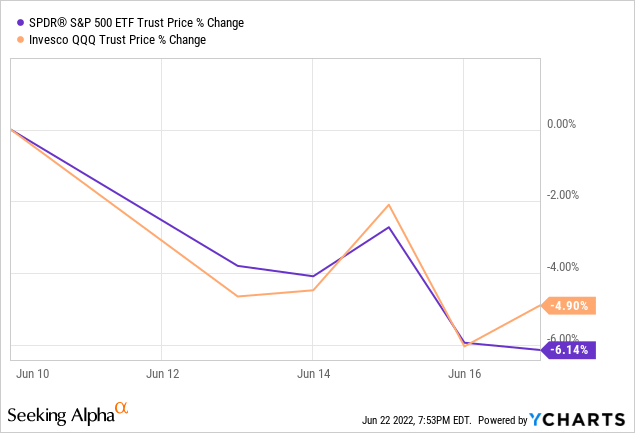

Last was the worst week for the indexes since the pandemic crash in early 2020. The S&P 500 (SPY) and the Nasdaq (QQQ) were down more than 5% last week.

It’s interesting to note that the S&P 500 fell slightly more than the Nasdaq. I wouldn’t read too much in this, but when the market turns, you should expect the Nasdaq to outperform the S&P 500. It also fell more, of course.

In A Bear Market And Extreme Fear

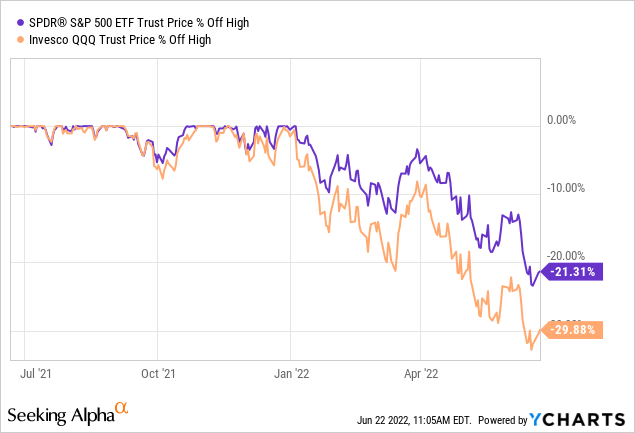

Both indexes are now still in a bear market, despite the better start this week. A bear market, for those who wouldn’t know, means down 20% from previous highs.

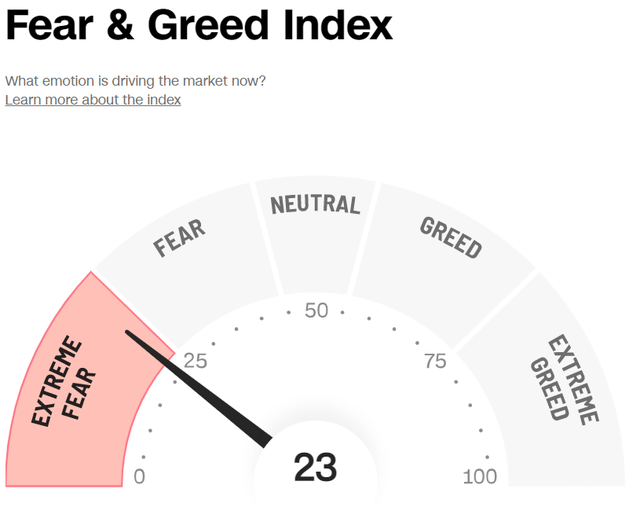

CNN

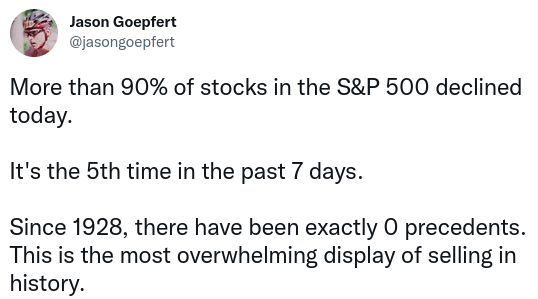

More and more people now use hindsight bias to say that this was obvious, and they knew this drop would happen. Don’t believe this too much. These people often try to convince themselves now that they knew all along. Just read this tweet from Thursday.

Twitter

If people still tell you that this selling is ‘normal’, don’t believe them. It’s absolutely not. We live through historical times for the stock market, and not in a good way. This selloff is the most brutal one in almost a century. Not in magnitude, but in the speed that it shows.

I know that this feels awful, especially when you look back to the all-time highs, which are not even that far away in the past and still unattainable at the same time. But that’s one of the reasons why I have always advocated scaling in slowly. Even if you haven’t done so, don’t worry too much, the tide will turn eventually, even though it seems like it’s impossible right now.

We don’t know when, but the market will turn at a certain moment. It could be next week, next month, near the end of the year, who knows, maybe just in a year or more, we really don’t know.

I invest money every two weeks, like clockwork, and if you have money to deploy, and you look at it from a rational point of view, not an emotional one, the longer the market stays down, the more you can buy the stocks of the best companies of our time at a much lower price than a while ago. That means that this bear market is an opportunity, not a disaster.

The Fed

The reason for the big drop last week was, again, the macroeconomic news. The Fed decided to hike the interest rate by 0.75%, not the expected 0.50%. It was the highest interest rate since 1994, 28 years ago. I think that the Fed does the right thing here. It sends a strong signal that fighting the sky-high inflation is its priority and that it will do everything within its power to do that.

Higher interest rates are seen as bad for stocks, but the worst part for most investors is the uncertainty. When will inflation end? Where will the interest rates end? Will there be an unavoidable recession now? If so, how long will it last? How severe will it be? There are so many questions and nobody knows the answers.

Recessions are awful for many people (losing their jobs or companies going belly-up), of course, and often the stock market is right in predicting them before they happen. The stock market usually goes down six months to a year before the crisis really hits the economy. But not every time the stock market goes down, there is a recession on the horizon. So, we don’t know for sure what we will see: a recession or a false sign. I think that there is no question here that the chances of a recession are quite high, but it’s not the absolute certainty that some make of it.

No matter what, I have always focused on the long term and will continue to do that. Some might comment again that it’s weak to focus on the long term now that stocks are down so much. I let them have their moment. I have always focused on the long term, you can see that in all of my articles going back to May 2016. My service is Potential Multibaggers and I aim to find stocks that have the potential to go up 10x over 10 years. I think that shows the long-term perspective already.

Stocks usually go up. But there are periods in which they don’t. In seven years out of ten, the stock market goes up. When it doesn’t, you should pay extra attention because that’s when you could be getting an excellent opportunity to buy more for the same amount of money.

Learning From History

(This was partly inspired by Bloomberg’s John Authers)

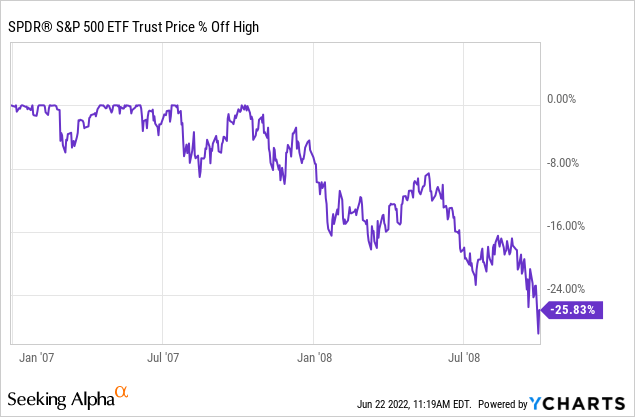

Let’s go back to 2008-2009, for example. On October 1, 2008, the stock market had dropped 25% from its previous high.

Now, just to make sure, we were in a much worse economic situation back then. The whole financial system was on the brink of collapsing. Lehman Brothers had filed for bankruptcy already two weeks earlier. Compared to the situation we were in at the time, this inflation and rate hike cycle is a walk in the park.

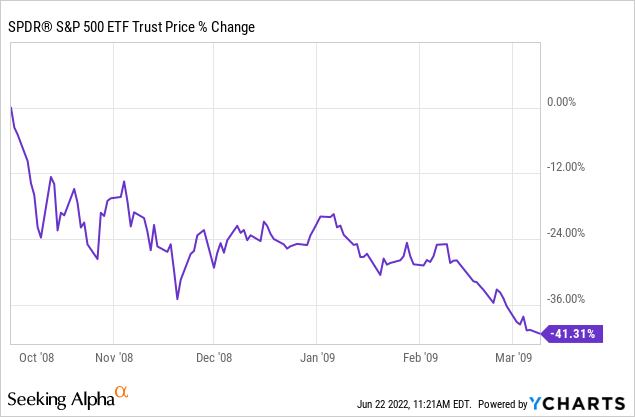

Suppose you bought then, October 1, 2008, you would have definitely been too early to catch the bottom. What would have happened? Over the next 5 months, your portfolio would have lost another 40% from that point.

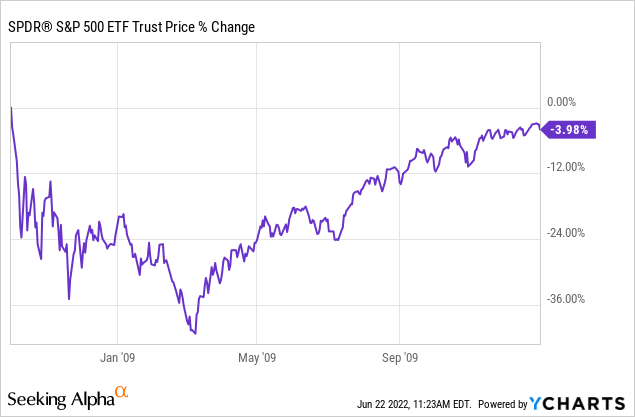

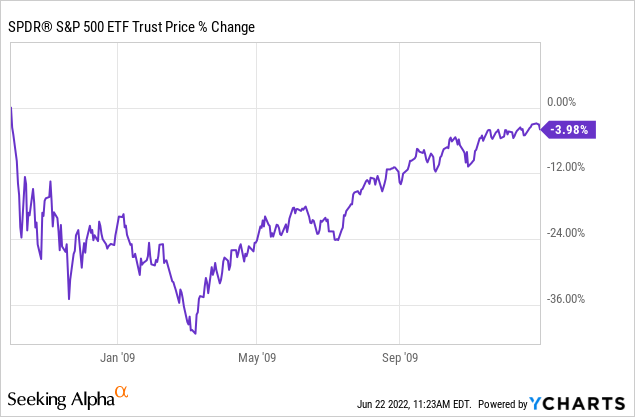

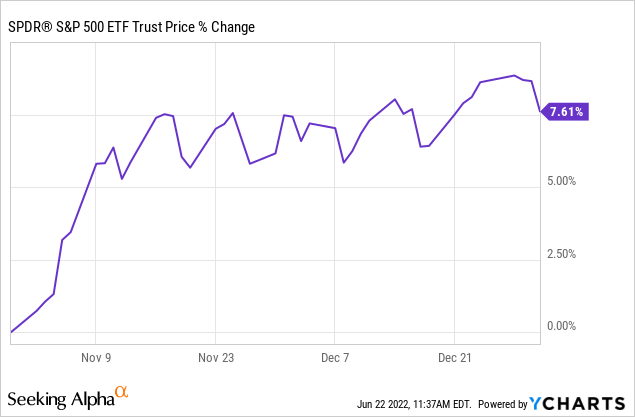

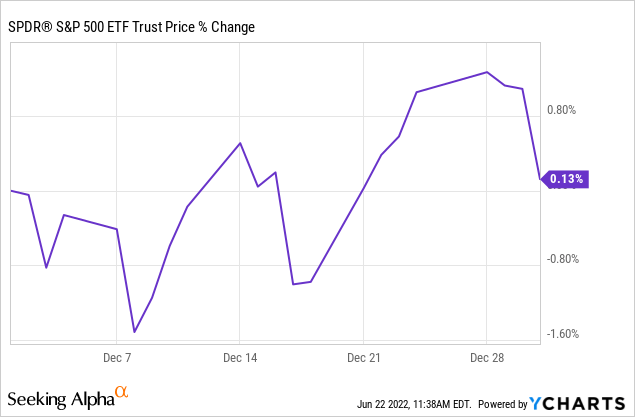

But at the end of 2009, you would have been almost flat, if you had not dollar-cost-averaged, that is, but just lump-summed your money on October 1, 2008.

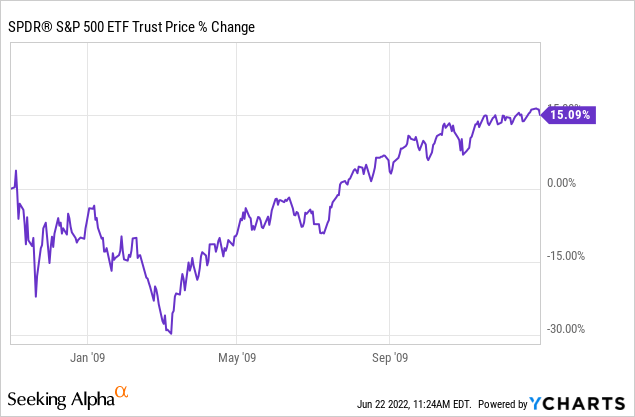

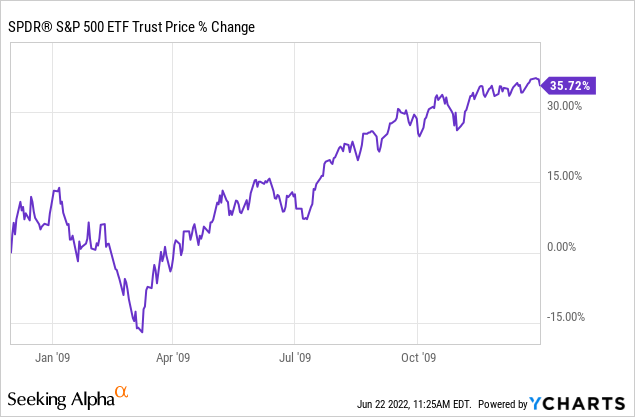

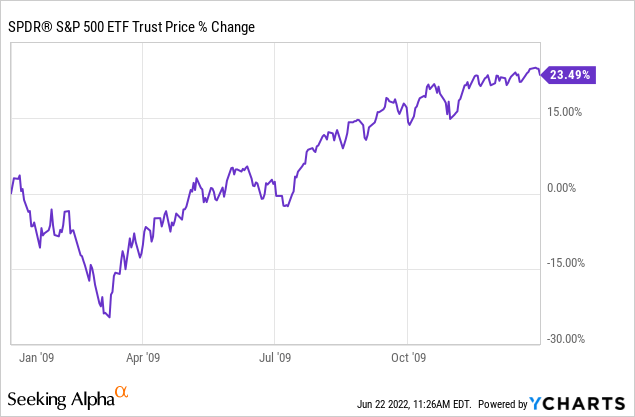

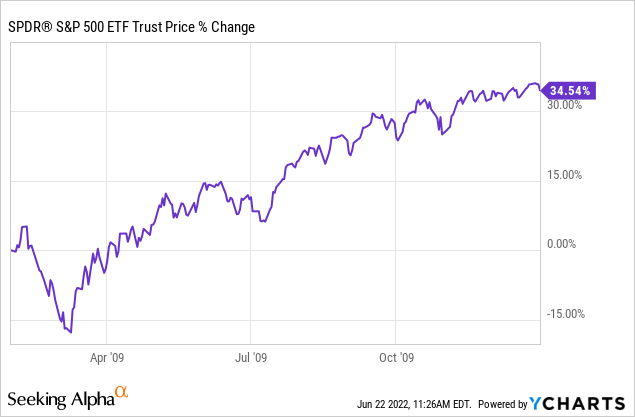

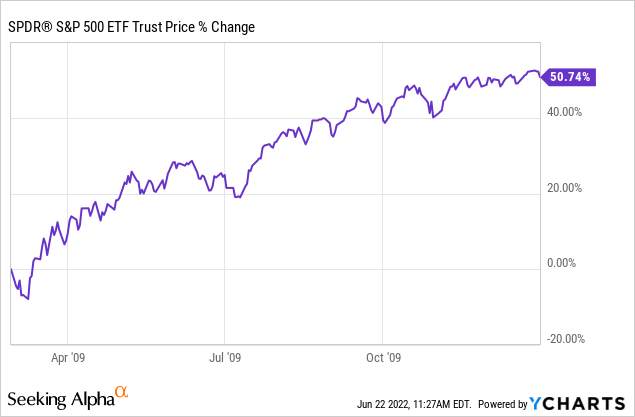

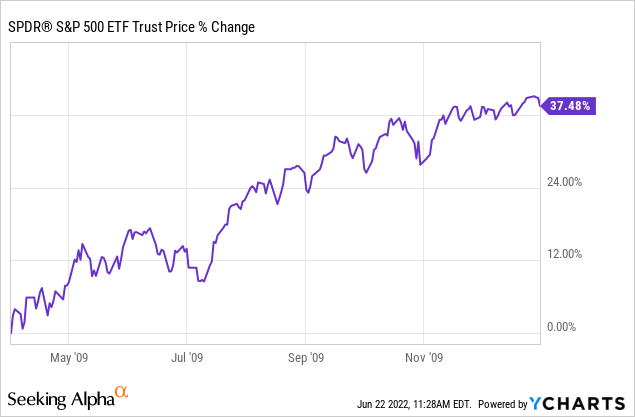

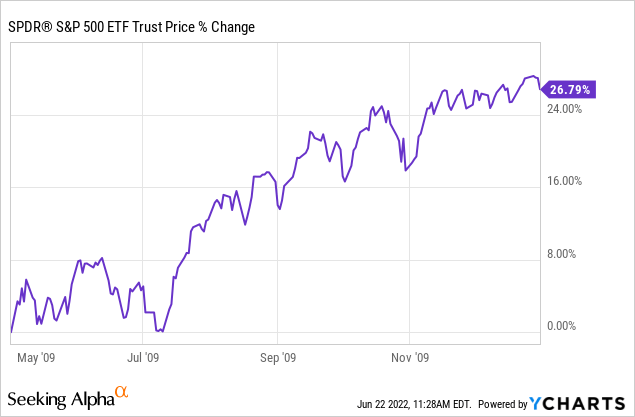

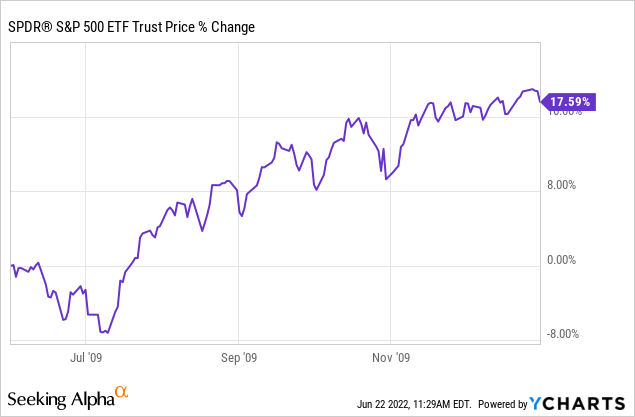

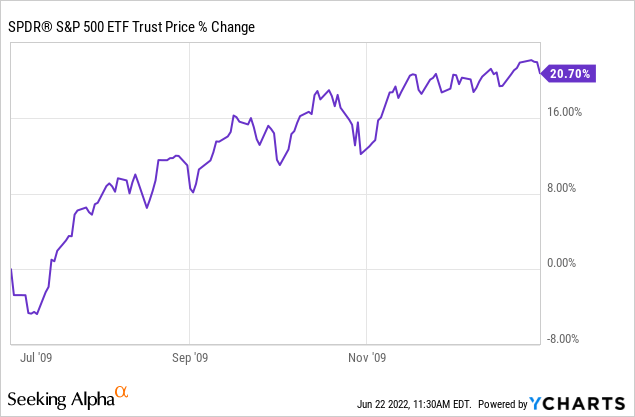

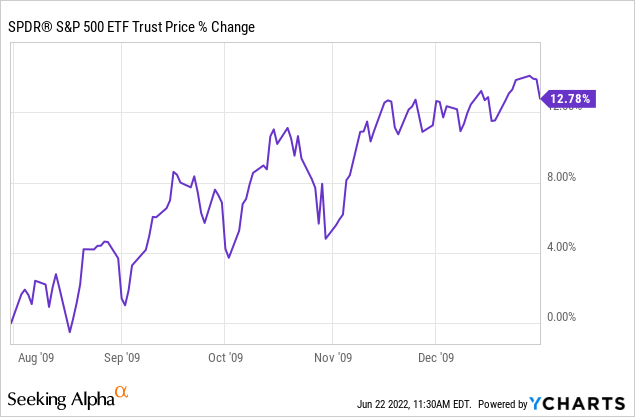

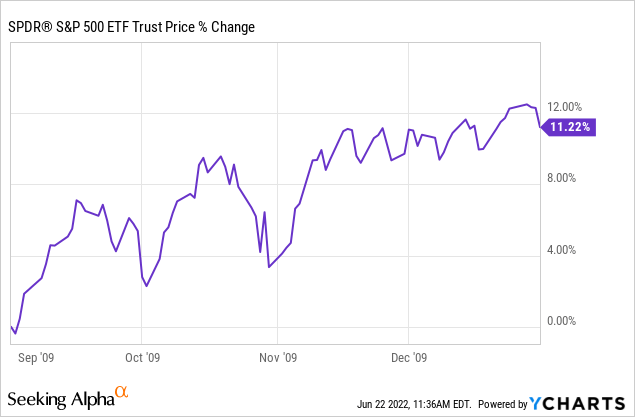

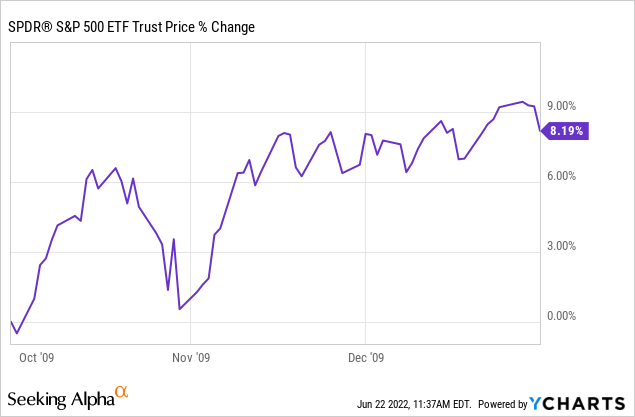

Had you bought $1,000 every month back then, these would have been the results (the ending period is December 31, 2009, each time)

October 2008:

November 2008

December 2008

January 2009:

February 2009:

March 2009:

April 2009:

May 2009:

June 2009

July 2009

August 2009

September 2009

October 2009:

November 2009:

December 2009:

So, this is what your results would have been if you started buying at the point we are now.

| Month | Start | End |

| October 2008 | $1,000 | $996 |

| November 2008 | $1,000 | $1,151 |

| December 2008 | $1,000 | $1,357 |

| January 2009 | $1,000 | $1,235 |

| February 2009 | $1,000 |

$1,354 |

| March 2009 | $1,000 | $1,501 |

| April 2009 | $1,000 | $1,375 |

| May 2009 | $1,000 | $1,268 |

| June 2009 | $1,000 | $1,176 |

| July 2009 | $1,000 | $1,208 |

| August 2009 | $1,000 |

$1,122 |

| September 2009 | $1,000 | $1,076 |

| October 2009 | $1,000 | $1,080 |

| November 2009 | $1,000 | $1,071 |

| December 2009 | $1,000 | $1,000 |

| TOTAL | $15,000 | $17,970 |

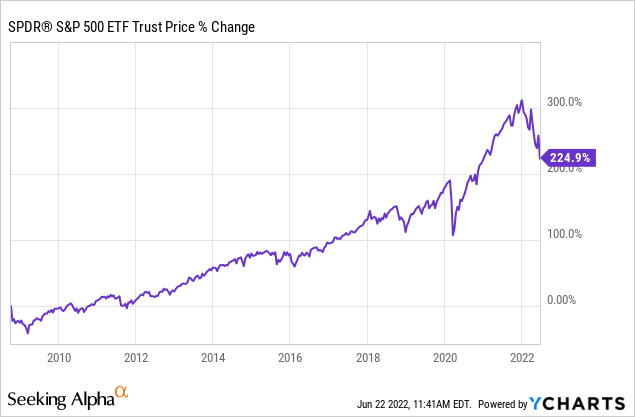

As you see, with a dollar-cost average strategy, you would outperform if you invested in a similar situation as right now. Similar in that sense that the market is down about 25%. But the most important chart for long-term investors is this one. Suppose you bought on October 1, 2008 and never touched that investment again. This is what your result would be:

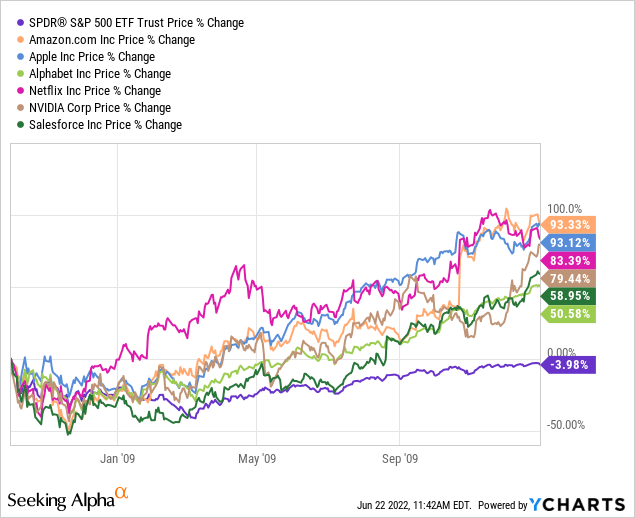

Of course, this is the S&P 500, but you shouldn’t forget that some individual stocks ripped up much more at the time. These are just a few examples from October 2008 to December 2009.

Of course, looking back, it is easy. But this is exactly the same. It may take 14 long months before we are back at this point, if the market keeps dropping. That feels long, especially with all of the negativity out there.

But don’t forget that in 2008-2009, the whole financial world was collapsing. That’s not the case right now, not even close. The S&P 500 dropped 56% then, which I think is unlikely to happen now, although one can never be sure.

People can prove everything with stats. But that’s why I wanted to take the same drop as in 2008-2009, not the bottom. Again, your invested money went down a lot initially, more than 40%. That’s possible right now, too. But you don’t have to catch the bottom to invest successfully, especially not with a dollar-cost average approach.

I hope this gives you some perspective on where I think we are. Yes, it has been tough, but the tide will turn. It can take weeks, months, even more than a year, but in the meantime, we can deploy our money and let it work for us over the long term. It might go down initially, but I’m convinced that it will do well over the longer term, just like in 2008-2009 at this point.

It’s important to zoom out. Stocks will go up again, and the stock market will surpass its all-time high again, as it always has. Some stocks won’t recover, that’s true, but others will and will make your portfolio outperform, no matter the losers. That’s because of the asymmetry of investing. If you invest $1,000, you can only lose $1,000, but you can go up tens of thousands of dollars. So one huge winner can wipe out all losers in your portfolio and still let you beat the market.

This is what J.P. Morgan’s strategist Marko Kolanovic wrote last Monday:

We maintain our positive view. May is a template for the year, record dispersion provides opportunities. We remain positive on risky assets due to near record-low positioning, bearish sentiment, and our view that there will be no recession given supports from US consumers, global post-COVID reopening, and China stimulus and recovery. The war in Eastern Europe is a significant risk for the cycle but will likely converge to a settled solution in H2. We believe that markets will recover year-to-date losses and result in a broadly unchanged year.

Now, I’m not saying that Kolanovic is right. But I want to let you hear another voice than the voices that only seem to compete to emphasize as many bearish points as possible. Like Kolanovic, they can’t know what the future will bring, even though they act as if a recession is already a given. It’s definitely a real possibility, but not as inevitable as some would want you to believe.

Conclusion

For long-term investors that have money to deploy, this might be a great time to add to their portfolio, especially using a dollar-cost average approach. Even in 2008-2009, when the situation was much worse than it is now, this was successful. While investors don’t seem to see the light at the end of the tunnel right now, it is there, and it will come someday. The money you have deployed in the meantime will reward your bad feeling right now.

In the meantime, keep growing!

Be the first to comment