luvemakphoto

WestRock (NYSE:WRK) seems well on track to deliver on its promises. The company just released its three-month accounts and once again we are back to comment on the company’s Q2 performance. WestRock is the last company to report in our universe coverage within the sector, and below you can find:

- A comps analysis between Kimberly-Clark and Essity;

- Clearwater Paper Q2 results;

- And more important to compare – International Paper’s Q2 analysis.

Last time, we concluded that:

- the company was able to pass through higher input costs, this was achieved in the quarter;

- we were positive about the Panama City mill closure; again this happened in the quarter (as expected). This just confirmed our internal assumptions on how WestoRock can reshape its portfolio towards more profitable locations;

- we also provided numbers ahead of Wall Street consensus expectation. And once again, if we are looking at the numbers, the fiscal Q3 adj. earnings per share stood at $1.54 up by 6 cents versus IBES consensus. Top-line sales and EBITDA performance were also superior again to estimates by 1% and 5% respectively.

Q3 Results

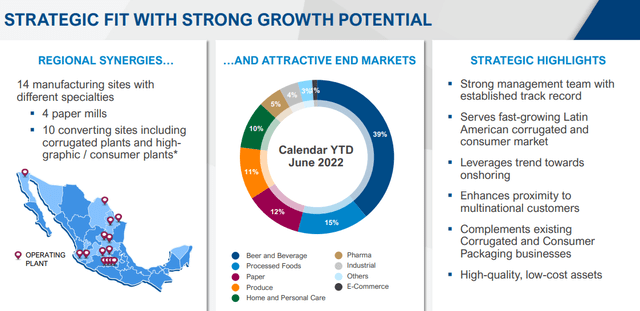

Starting with the CEO’s comment: “I’m pleased to report that WestRock generated more than $1 billion in Consolidated Adjusted EBITDA in the quarter, a record for our Company, and continued to deliver on our transformation initiatives”. During the quarter, WestRock has not only delivered its higher turnover and EBITDA in abs value but has also announced the acquisition of the remaining interest in Grupo Gondi. The Grupo Gondi is the leading paper and packaging company in Mexico thanks to 14 plants and a workforce of more than 7,000 employees. Thanks to its multi-plant approach, Gondi offers comprehensive packing solutions. This is a strategic fit for WestRock.

Source: WestRock Q3 results

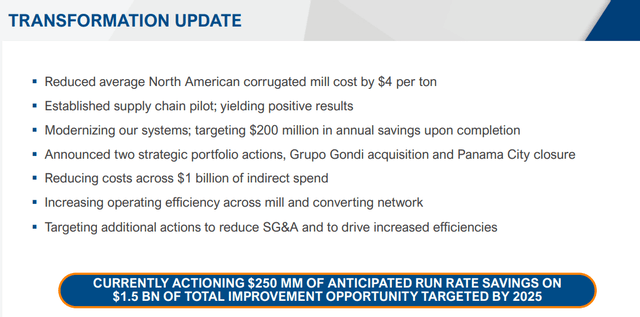

As we already mentioned, the company seems well on track with its transformation plan. Aside from the inorganic acquisition, here below we can see the major company’s development in the quarter.

Source: WestRock Q3 results

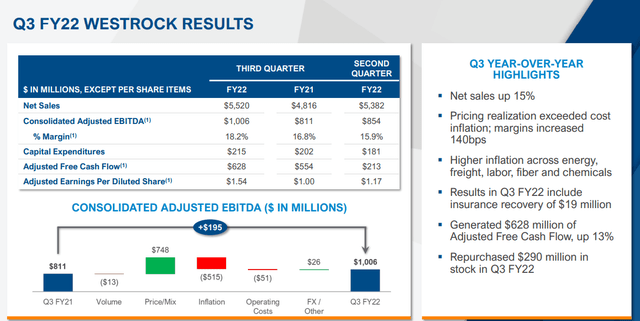

Looking at the results, the company delivered $5.52 billion in turnover up 14.6% compared to the previous year-end quarter. Adj. EBITDA stood at $1 billion signing a plus 42%. The positive trajectory was recorded at the group’s net income level which achieved $377.9 million, up by 51.1%. Well, we can clearly note that WestRock’s operating leverage is working pretty well. More in specifics, the positive performances were driven by higher selling prices and a better product mix. These outstanding results were partially mitigated by lower volume and inflationary pressure in input costs such as energy, chemicals and freight.

Source: WestRock Q3 results

Conclusion and Valuation

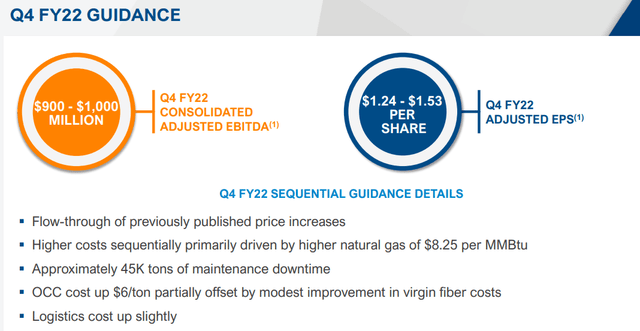

WestRock already raised its guidance during the Q2 presentation. Adjusted EBITDA was projected to be in a range between $3.5 and $3.7 billion. Looking at the latest numbers and the company’s future estimates, WestRock will most likely be in the low range of its own guidance. This might not sound great but in reality, this proves WestRock’s resiliency and supportive profitability.

Source: WestRock Q3 results

Concerning the company’s valuation, we derive a target price of $70 per share based on the average of the two following methodologies:

- A 7.0x EV/EBITDA on our 12-month forward estimates (a lower multiple than International Paper despite the fact that WestRock has no exposure in Russia);

- A DCF valuation with a 10% cost of equity and a terminal growth rate of 2%.

The company’s positive trends and risk paragraph are included in our initiation of coverage.

Be the first to comment