hirun/iStock via Getty Images

Western Midstream (NYSE: NYSE:WES) is one of the largest midstream companies, owned partially by Occidental Petroleum (NYSE: OXY). The company has a $10 billion market capitalization, and a more than 5% 2021 dividend yield that’s expected to increase significantly in upcoming years. As we’ll see throughout this article, the company’s portfolio makes it a valuable investment.

Western Midstream 2021 Performance

Western Midstream had strong 2021 performance showing the strength of its asset portfolio.

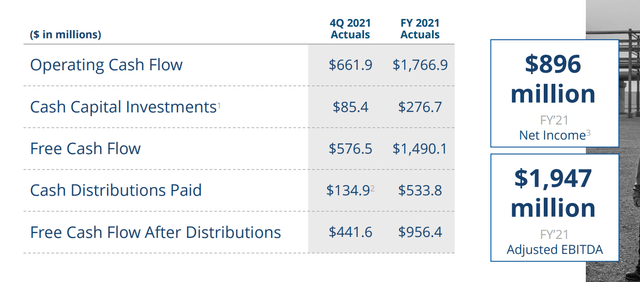

Western Midstream 2021 Performance – Western Midstream Investor Presentation

Western Midstream generated almost $1.8 billion in 2021 FY operating cash flow. The company spent almost $280 million on capital spending resulting in almost $1.5 billion in FCF and more than $500 million in cash distributions paid. That left the company with almost $1 billion in post-distribution FCF on top of significant investments.

The company significantly passed its leverage target with roughly 3.6x in leverage (~$7 billion in long-term debt). The company managed to use its excess cash flow to repurchase $250 million in units (~2-3% worth) and repay almost $1 billion in debt saving the company on interest. The company has been focused on continued interest reductions and improvements here.

Western Midstream Financial Improvements

Overall, Western Midstream has had a continued commitment to financial improvements.

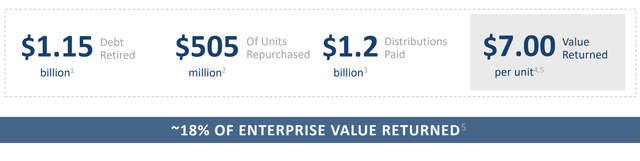

Western Midstream Financial Improvements – Western Midstream Investor Presentation

Western Midstream has significantly improved its financial position since COVID-19 in early-2020. The company has retired a massive $1.15 billion of debt, repurchased $500 million of units, and paid $1.2 billion in distributions. Overall, the company has managed to return a massive $7 per unit in shareholder returns through a difficult time period.

These financial improvements should continue with the company’s cash flow.

Western Midstream 2022 Guidance

The company’s 2022 guidance, and onwards, is for strong and continued shareholder returns.

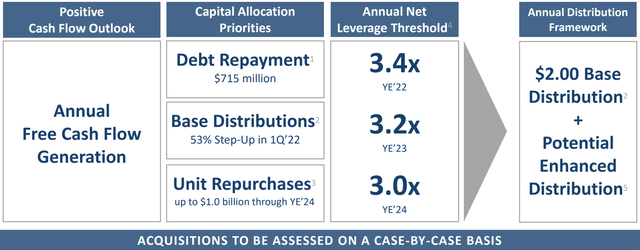

Western Midstream 2022 Guidance – Western Midstream Investor Presentation

To start, Western Midstream is stepping up its distributions significantly in 2022. The company is starting with a $2 base distribution (an 8% yield costing almost $850 million / year) with the potential for an enhanced distribution. The company expects $1 billion in repurchases through 2024, or 10% of its current outstanding.

The company is expecting to steadily decrease its annual net leverage threshold while increasing its overall shareholder rewards. The company is spending $425 million in capital expenditures, which will support some growth, and leave the company with $1.25 billion in FCF after those capital expenditures.

The company is spending roughly $850 million in dividends leaving the company with $400 million. We’d like to see the company frontload repurchases to save on dividends, however, regardless of how the company spends money, we expect it to benefit and generate valuable double-digit shareholder returns.

Western Midstream Shareholder Returns

Western Midstream has a unique ability to generate strong shareholder rewards.

The company is earning $1.25 billion in FCF after $425 million in capital expenditures. Roughly half of those capital expenditures are growth investments (more than $200 million) and the company can be expected to generate market-leading returns on these investments as it undertakes opportunistic small capital projects.

Outside of that the company has committed to a dividend of more than 8%. That will cost the company more than $800 million. Together with the growth capital, the company can generate double-digit shareholder rewards. After all this the company still has $400 million it can spend as it chooses. It can repurchase shares or reduce debt and save on interest.

This combination can enable the company to continue generating impressive double-digit shareholder rewards.

Western Midstream Risk

Western Midstream’s primary risk is the new risk that’s started to influence midstream companies. It became increasingly evident during COVID-19. That’s the company’s industries to the oil industry and its sponsors. Western Midstream saw its stock price suffer from its ties to Occidental Petroleum along with Occidental Petroleum’s need for liquidity.

While Occidental Petroleum has staved off the worst of the risk, there’s always a chance that the company faces the same pressures, again putting negative pressure on its share price.

Conclusion

Western Midstream has a unique portfolio of assets. The company has recently substantially increased its dividend pointing towards a yield of more than 8%. At the same time, the company is continuing to invest in growth capital, repurchasing shares, and paying off debt. Those debt payoffs save on interest and share repurchases save on dividends.

That investment is significant. The company’s substantial post capital spending FCF is enough to generate continued double-digit shareholder returns. The company has a variety of levers it can use to continue improving shareholder returns, levers that it’s continued to use effectively. Putting all of this together we think Western Midstream is a valuable investment.

Be the first to comment