franckreporter

Canadian forestry company, West Fraser Timber Company, Ltd. (NYSE:NYSE:WFG)(TSX:TSX:WFG:CA), is one of Canada’s finest companies. Since listing on the New York Stock Exchange (NYSE) on Feb 1, 2021, after its acquisition of Norbord Inc., the stock price has compounded by 1.47% per month, from $62 per share, to $83.07 per share, at time of writing. Despite a history of profitability, the company remains vastly undervalued, with its free cash flow trading at a yield of some 33.42%.

Excellent Financial Performance

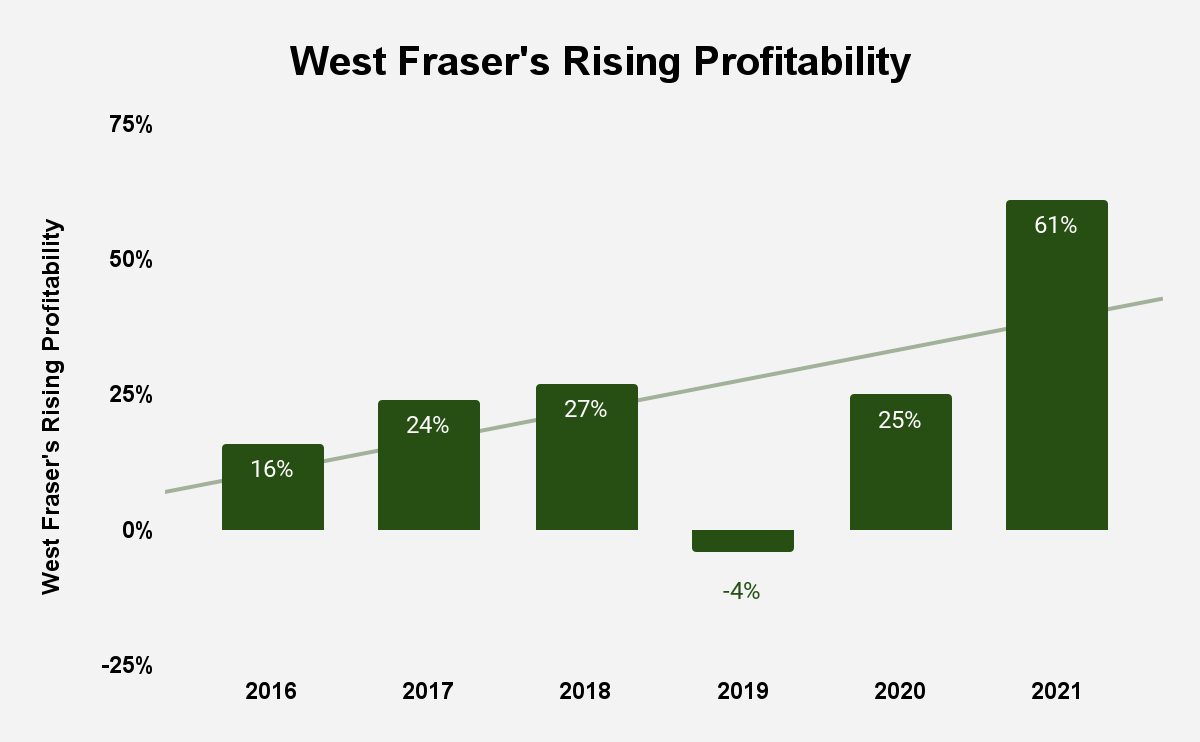

West Fraser has grown revenue from $4.877 billion in 2019, to $10.518 billion in 2021, compounding at 29.2% per year across that 3-year period. According to The Base Rate Book published by Credit Suisse, just 2.3% of businesses had a 3-year sales CAGR of between 25% and 30% between 1950 and 2015. The company’s gross profitability (gross profits scaled by total assets), grew from an anemic 0.098 in 2019 to 0.467, well above the 0.33 threshold that Robert Novy-Marx found was a signal of a firm’s attractiveness. In the trailing twelve months (TTM), gross profitability is 0.44. The operating margin has risen from -3.3% in 2019, to 37.5% in 2021, and is currently 33.6% in the TTM period. This shows an improving competitive positioning. This performance is, according to Credit Suisse’s research, very persistent across one-, three- and five-year periods. Net income has risen from -$150 million in 2019, to $2.947 in 2021, and is at $2.646 billion in the TTM period. Free cash flow (FCF) has grown from -$281 million in 2019, to $2.917 billion in 2021. The company reports a return on capital employed (ROCE), calculated as GAAP EBIT divided by total assets minus current liabilities, and, according to its 2021 annual report, ROCE has shot up from -4% in 2019, to 61% in 2021.

Data Source: 2021 Annual Report

Shareholder-Friendly Capital Allocation

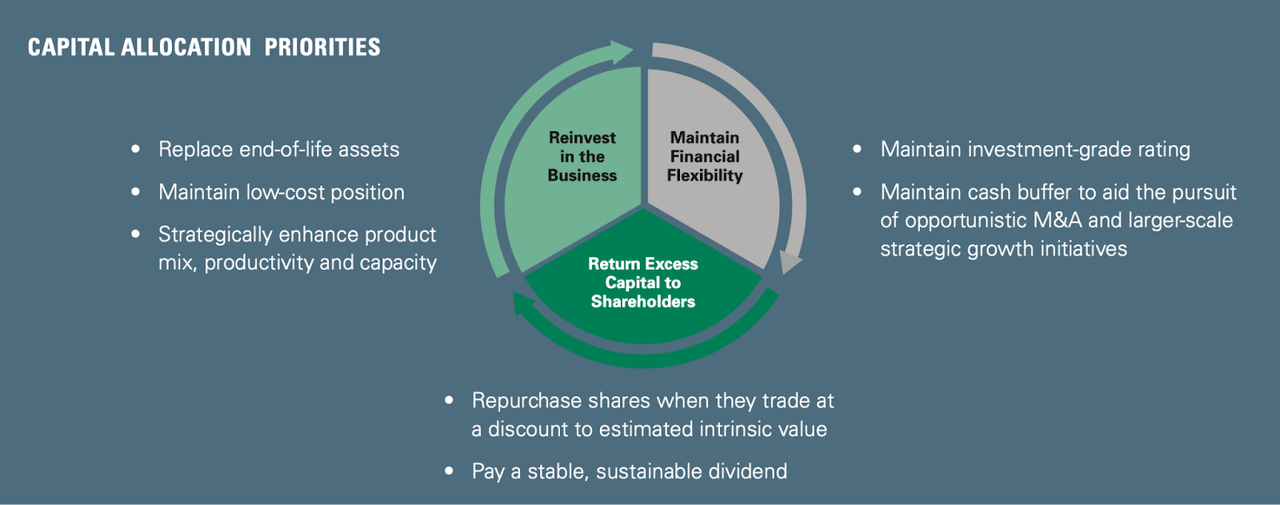

West Fraser’s ability to generate a high ROCE reflects its disciplined capital allocation strategy. The company’s $3.1 billion acquisition of Norbord is indicative of the quality of acquisitions that management has pursued: the acquisition was transformational, merging West Fraser, then a large North American diversified wood products company, with the world’s largest OSB producer. The company has also purchased the Angelina Forest Products lumber mill in Lufkin, Texas for $302 million, an idled Oriented Strand Board (OSB) mill near Allendale, South Carolina for $280 million including working capital, and invested in the production ramp-up of the new lumber manufacturing complex in Dudley, Georgia and in phase II expansion of the OSB mill in Inverness, Scotland. In 2021, capital expenditure totaled $635 million, and the company returned $1.3 billion in share repurchases and $75 million through dividends. The company expects to have spent between $500 million and $600 million by year-end.

Source: 2021 Annual Report

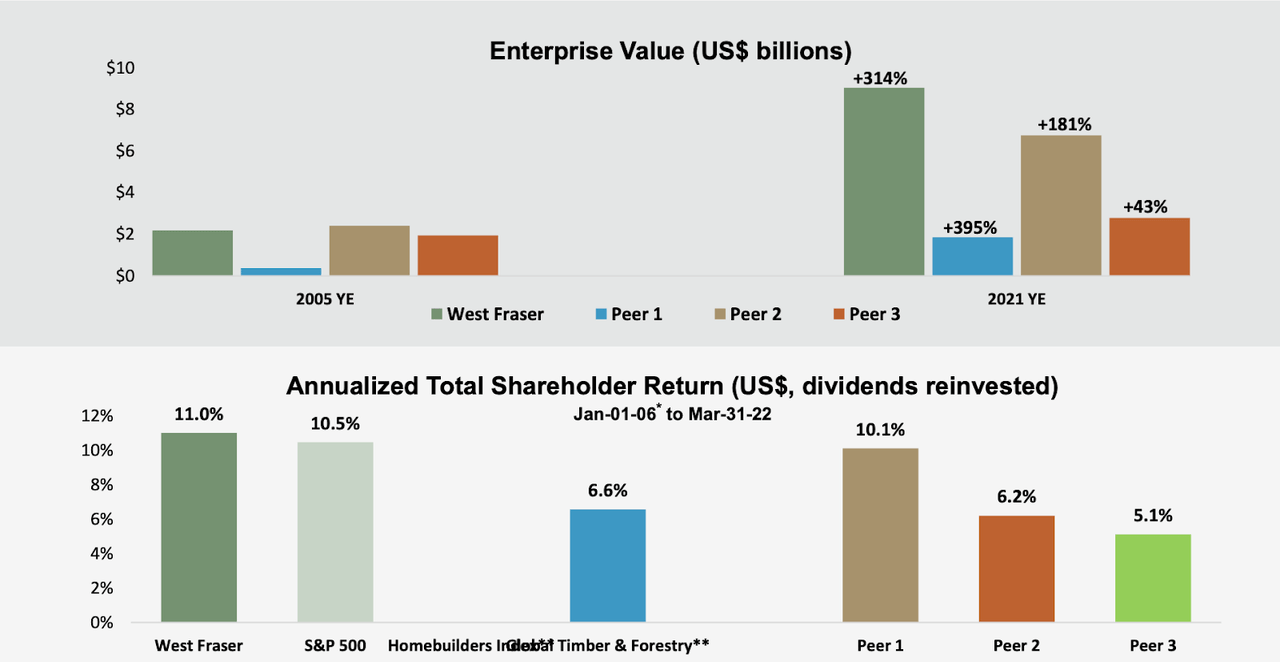

Thanks to the company’s capital allocation strategy, West Fraser has earned an annualized total shareholder return (TSR) of 12% since 2006.

Source: April 2022 Annual General Meeting

An Attractive Corporate Culture

According to McKinsey & Co.’s research, top quartile cultures give their shareholders a return that is 60% higher than that of median companies, and 200% greater than that of bottom quartile firms. In addition, culture is very difficult to copy, so it acts as a durable competitive advantage. Healthy cultures also drive greater organizational adaptability. In fact, McKinsey & Co. found that 70% of transformations fail, and 70% of the time, that is due to cultural issues. This is particularly important given the Norbord acquisition and investor estimates of West Fraser’s future.

West Fraser has twice been named as one of Canada’s Most Admired Corporate Cultures and eight times as Canada’s Top 100 Employers. The company’s reputation as a top employer stems from its policy of promoting from within its ranks, with 95% of managers and senior managers drawn from within, and providing platforms for training and experiential skills development. The company has five times been named one of Canada’s Top Employers for Young People.

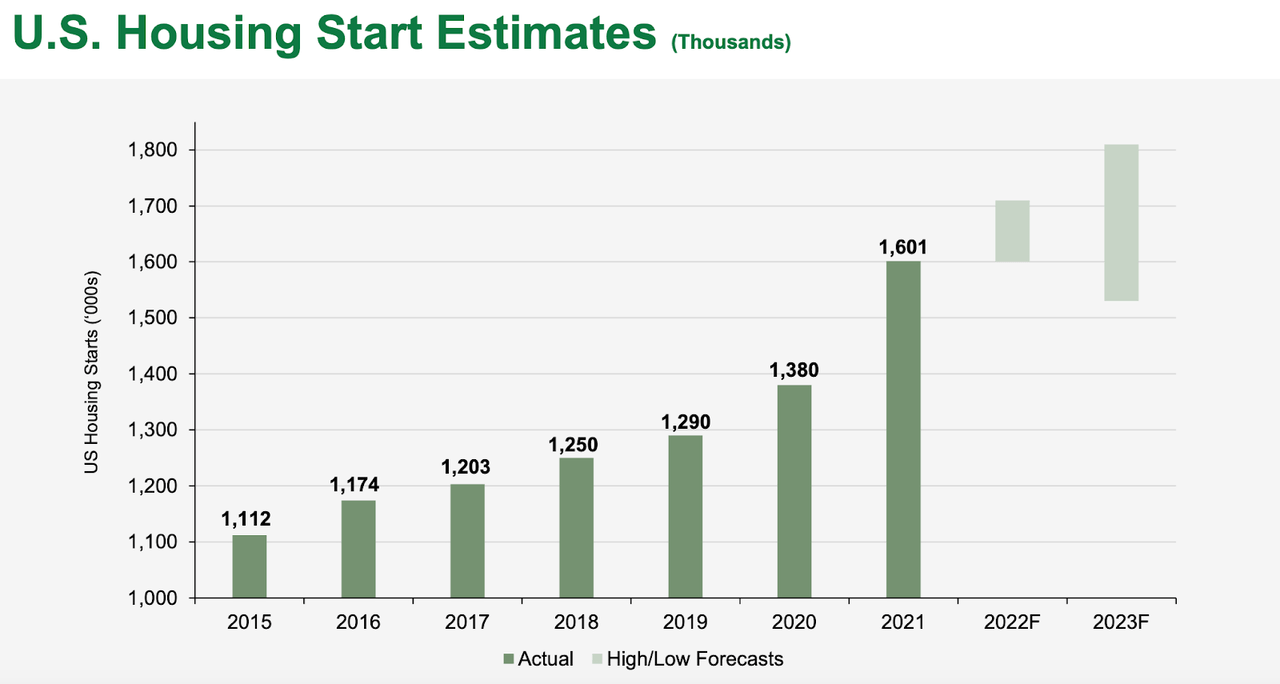

The Housing Market is Still Strong

Although the housing boom has softened in recent months, this does not speak to the long-term prospects of housing. As the chart below shows, estimates by the U.S. Census Bureau forecasts that housing starts will continue to grow in 2022 and 2023.

Source: April 2021 Annual General Meeting

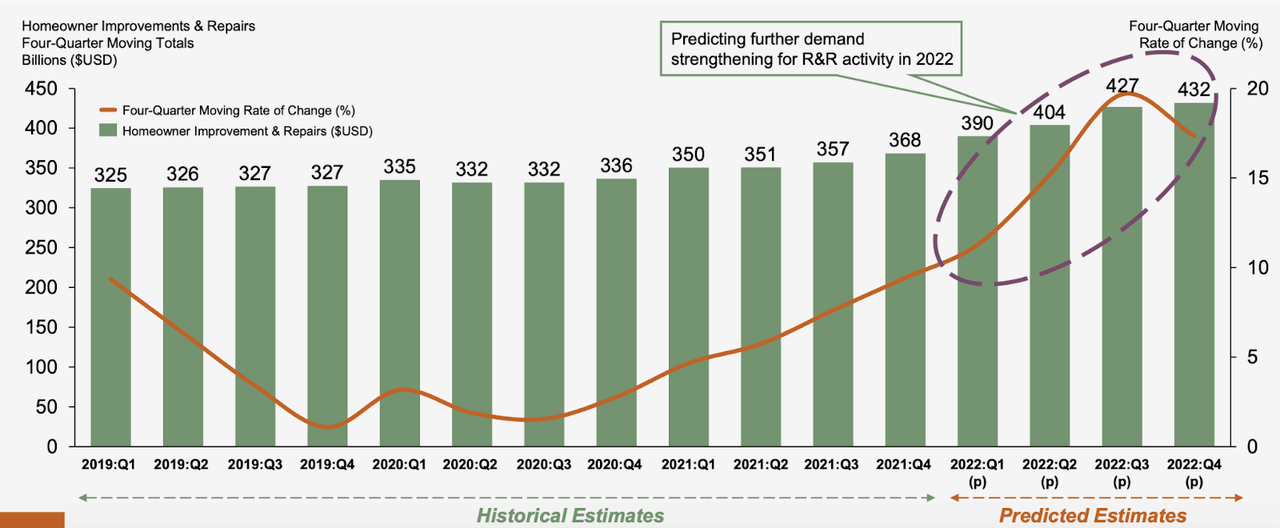

Not only are housing starts expected to rise, so too is remodeling activity.

Source: April 2021 Annual General Meeting

In the long run, the housing question should be seen from a broader perspective: while the Great Recession of 2008 burned into the investor consciousness the notion that housing is tied to mortgage rates, the housing boom of recent years has largely been debtless. In the decade following the recession, aggregate housing wealth rose by 150%, but home mortgages owed by households declined by 3%. This at a time when the United States was experiencing a secular decline in mortgages. In other words, house prices are not related to mortgage growth. Housing prices have, instead, been driven by construction costs.

As architect Apoorva Ganapathy has observed, what this suggests is that fears of a decline in housing starts due to rising mortgage rates, are unfounded. Given the balance sheet repairs that households have undertaken since the Great Recession, this also means that households are in a better position to continue with remodeling activity.

Furthermore, the United States is undergoing a vast shift as people migrate to the South and West. This shift has been accelerated with the advent of remote work, which has broken the link between where people live and where they work. The migration is driven by a search for lower costs of living, larger homes, and a better quality of life. It is also a migratory shift that will continue to fuel housing starts in the long run.

Risks

The company’s acquisition of Norbord seems to be working out, but we still do not know much about what drives the success of mergers and acquisitions. There is a lot of evidence, for instance, that bidder shareholders earn zero to negative returns in the immediate years (say 2 to 3 years) after a takeover. Furthermore, anticipated synergies are often overestimated as a result of a number of biases, cultural clashes, unexpected changes, and other issues. So, it has to be said that while the Norbord acquisition seems to be working out, the success of the deal can only be judged much later. The gains may prove smaller than anticipated, reducing the prospective size of the business.

Valuation

With $2.142 billion in FCF in the TTM period, and an enterprise value of $6.41 billion, the company has an FCF yield of ~33.42%. In other words, over a third of the company’s value is in the form of free cash flow. Compare this with the 1.5% FCF yield of the 2,000 largest companies in American markets, as calculated by New Constructs. This is a strong signal of future stock market performance.

Conclusion

West Fraser has demonstrated excellent pedigree over its history, growing shareholder value and achieving admirable financial results in recent years. The company’s corporate culture is a competitive advantage, while its capital allocation strategy ensures that it will continue to grow shareholder value. Growth is underpinned by secular trends that will be with us for some time. The company is trading at very attractive valuations, with an FCF yield of ~33.42%.

Be the first to comment