nensuria

Last week I enumerated a number of hurdles that we need to surmount in order for the rally to gather momentum to the upside. There are still a lot of naysayers, and fear of what comes after the first quarter or the second half of 2023. This is the time when I remind you that “stocks climb a wall of worry”. I like to give long-range projections about the market. In fact, I pride myself on being able to see what is coming over the next hill. For now, I just want to focus on the year-end action. Being able to acknowledge the limitations of our acuity is a good thing. I want to see what companies have earnings warnings for Q4. So far the earnings reports of prior quarters have been doing better than expected. The economy has not crashed, and we have the consumer to thank.

Improving inflation is supportive of a rally

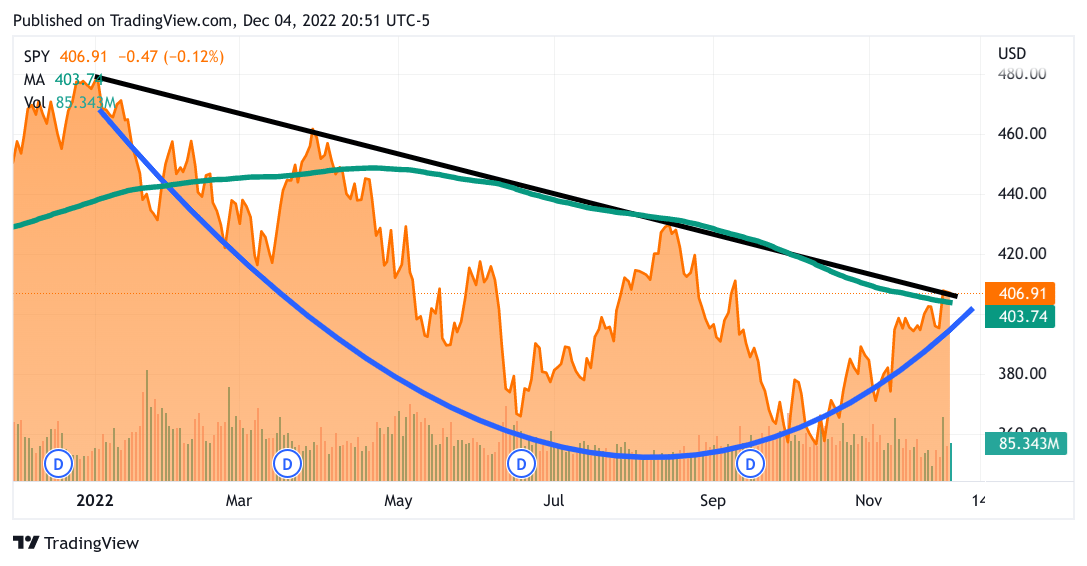

Right now, inflation seems to be loosening its grip on prices. What’s more, we are seeing interest rates falling in the treasuries significantly. The 10-Year has gone from a high of 4.22% to 3.54% – that’s 68 basis points! The 2-Year has gone from 4.545% to 4.259%, 29 bps. This change did not happen over 6 months – both were over the past week! The market has spoken, and it turns out inflation is transient after all. More importantly, have you seen where the dollar is? The dollar as measured in the DXY is now 104.15; the high was 114.78 in late September. If the dollar keeps falling, it will be back in the 90s in short order. So let’s think about this for a moment – if interest rates are lower and likely continue to fall with more data confirming receding inflation, then in turn earnings can be awarded a higher PE ratio. Even better news now that the dollar is practically crashing – the S&P 500 will be recognizing foreign revenue at a higher dollar translation. So all these predictions of S&P earnings have to be revalued upward. I know I said I am not looking into 2023 yet, but stocks anticipate. As there is more clarity regarding interest rates and the DXY, the narrative of smaller earnings will moderate. Do I expect record-breaking earnings? No. I believe the combination of earnings, lower inflation, and the weaker dollar will be enough to propel the S&P over 4300. Let’s worry about what happens in January in a few more weeks. When the conventional media figures this out, we’ll be another few steps ahead of them once again. Below is the one year of the SPY ETF for the S&P. The chart shows that the rally is already underway. The chart is very simple, the black line is marking out a very well-defined downtrend, the green line is the 200 DMA, and the blue arc is showing a rounding bottom. Look closely at the right side of the chart; you’ll see that the SPY has broken above that 200 DMA. The SPY is already in the process of breaking through the downtrend.

Tradingview

If you are going to wait for the breakout to be obvious, what you will be doing is buying more expensive shares from the early birds.

What about the hot November employment numbers from Friday?

How can inflation fall when the unemployment was 3.7% for November? We created 263,000 jobs and 200,000 was expected. Won’t inflation come roaring back when employees find jobs?

The Philips Curve is dead, that is the name of the graph showing that greater employment causes inflation. We have lived through a period that disproved this notion, we have seen both low unemployment and low inflation, before the pandemic. The most recent employment data shows more workers being taken up in the services sector, like healthcare. That means that the areas that needed workers, and the shortage of workers caused salaries to grow, now have those jobs being filled. More workers available in the service sector means lower starting wages. Workers are getting laid off but they are getting rehired where they will do the most good. Laying off workers from one company where there was bloat to a company that really needs the extra hands will only boost productivity, and again lower inflation.

China awakens

China is dismantling its benighted “Zero Covid” policy which has sparked the biggest civil unrest since the Tiananmen Square Uprising. Of course “Zero Covid” is still there in order to save Xi’s face, but the most draconian features are being moderated. If China finally reopens, their production will rise and that will lower prices as well. On the other hand, China is a huge consumer of crude oil and LNG. Once world consumption normalizes our E&P companies will accelerate production to meet whatever shortfall may arise from the new Russian price cap for their oil. As an aside, Russia will be shipping oil to China and India, I can’t imagine India halting the shipment of cheap Russian oil. In any case, our oil producers have been gushing cash, supporting the S&P earnings, and will continue to do so.

Finally, the big hurdles are behind us

In my last piece, I enumerated several hurdles: the PCE, the Employment numbers, and the Railroad strike. The market hardly paid any attention to the PCE, perhaps because it was an October number. It also paid no attention to the strike. Both worked out just fine. The employment number on Friday was the only one to perturb market participants. I will be honest, I was surprised that both houses of congress wasted no time in ordering the unions back to work. I can’t think of the last time congress didn’t wait for the very last second to make something happen. In any case, as it stands right now, any kind of Fedspeak is now embargoed, and the only data point that could upset the market is the PPI on Friday. I think that even the CPI on the 13th will likely show more benign inflation. The 14th is the FOMC meeting where the interest rate rise will most certainly be 0.50%. So frankly, aside from some residual volatility, I think we break through 4100 this week and perhaps we’ll see 4200 the week after. The last two weeks of December and the first week of January are the traditional Santa Claus rally, and we could very well see 4300+ before the year is out.

My Trades

I added several options trades this week. Some choices might be surprising. I have a few long Calls on The single stock ETF for Apple (AAPD) betting on the downside. I also have a few long calls on SPXS, looking for some selling on the S&P. These do not reflect my overall bullish stance. I am a bit hedged, in case we have a rocky start to the week. On the Apple play, I think their factories in China are a disaster and a brand nightmare for them. I am long the technology ETF (TECS) with several Puts, meaning I think technology will once again shine when the trends for interest rates and the dollar become clearer. I closed out my shares in BHVN and replaced them with several Calls. If they gain in value I may well spread them. I started a position in Zscaler (ZS) since I thought their earnings report was good, and so was their forward guidance. I will likely add to the position. I also started a position in The bull Cloud Tech ETF (CLDL) just to get general coverage as I look to diversify my portfolio. To that end, I added Caterpillar (CAT) to my industrial section, joining Boeing (BA), Raytheon (RTX), and Spirit AeroSystems (SPR). Finally, I started a position in Asana (ASAN). I just thought it was way too cheap, and the founder may just buy the whole thing.

Well, that is about it. Just let me say that you are hearing only part of what the Dual Mind Research community already acted upon. I asked them to buy on Friday morning when the losses were deepest. Most are anticipating a bullish finish to 2022. I hope 2023 treats us all a bit better.

Be the first to comment