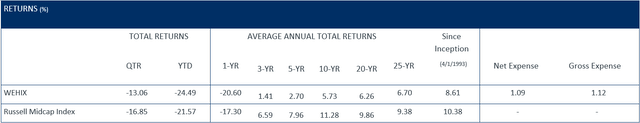

The Hickory Fund returned -13.06% in the second quarter compared to -16.85% for the Russell Midcap Index. Year-to-date, the Fund returned -24.49% compared to -21.57% for the Russell Midcap as of June 30, 2022.

Improved relative performance may be cold comfort given the depth of the Fund’s second quarter decline. With inflation approaching a 40-year high, Federal Reserve policymakers have lifted interest rates at a faster pace than previously expected. Their explicit aim is to break inflation’s back before it becomes fully entrenched in the economy and consumers’ expectations.

That said, measures designed to control prices and slow growth naturally risk tipping the economy into recession. As the quarter progressed and economic data suggested stronger policy measures were required to wrangle inflation, investors’ hopes for a so-called “soft landing” (i.e., implementing tighter monetary policy without triggering a recession) faded.

Compared to the start of the year, our portfolio companies’ stocks held up better relative to the index in the second quarter. Though on an absolute basis, there was nowhere to hide. To that point, each sector of the Russell Midcap Index produced a negative return (including energy, the prior quarter’s highflier). Our list of top detractors this quarter is likewise drawn from multiple sectors: building materials (Martin Marietta, MLM), enterprise software (Guidewire, GWRE)), financials (MarketAxess, MKTX), and communications services (Liberty SiriusXM [LSXMA] and Liberty Broadband [LBRDK]).

In our estimation, the table’s composition is less a function of company results and more a result of sizing within our portfolios. Despite potential near-term uncertainty, we remain confident in these businesses’ quality and potential for future gains. The quarter’s top contributor table is abbreviated, as LKQ (LKQ) and Black Knight (BKI) were the only positive contributors. LKQ’s operational execution continues to exceed expectations while Black Knight shares gained on news of a potential buyout

Axalta (AXTA) and CarMax (KMX) fared better than our portfolio this quarter, but the first quarter’s disappointing returns keep them mired on the year-to-date detractors list, joining Liberty Broadband, Liberty SiriusXM, and Guidewire. Markel’s (MKL) modest positive return was our only positive contributor for the first half of 2022.

Our performance discussion typically focuses on absolute returns driven by what worked, or what did not, within our holdings. That said, it is helpful context to note that a meaningful portion of our year-to-date underperformance results from a lack of exposure to energy and utilities, a significant positive contributor to the index in the first quarter.

Companies within these sectors are highly cyclical and commodity price dependent, and therefore do not meet our investment criteria. Nevertheless, global growth and rapid inflation in energy prices during the first part of the year drove solid gains for the index’s energy holdings. However, the energy outlook has been more challenging of late as investors weigh a potential recession.

As investors, we naturally feel some frustration when macro-economic factors overwhelm company fundamentals as the driving force behind stock prices. However, that frustration gives way to optimism, as we believe the volatility produced by these swings between fear and greed create mispricings that fuel future returns.

Given a nearly fully invested portfolio, we elected to trim or sell some holdings in favor of increasing our stakes in several more compelling opportunities. We continued trimming Markel on strength and sold our remaining AutoZone (AZO) shares during the quarter. Over our roughly 18 months of ownership, AutoZone was a strong contributor to results, and we would gladly own this business again. At current prices, however, we believe its defensive characteristics are well-appreciated.

We also closed our position in Liberty Braves (BATRA). Sports franchises possess unique value characteristics, but as a smaller position and with many cheaper alternatives, we elected to move on.

On the buy side, we continued to build our new position in research firm Gartner (IT, initiated last quarter). We added to several holdings, including most of the top detractors listed above: Liberty Broadband, CoStar Group (CSGP), Liberty SiriusXM, HEICO (HEI), MarketAxess and Guidewire. These actions resulted in a lowered overall estimated portfolio price-to-value in the high 60’s by our measure, while also improving the Fund’s weighted average quality score (our estimate of portfolio quality) — both of which we believe improve our prospects for forward returns.

Top Relative Contributors and Detractors

|

TOP CONTRIBUTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

LKQ Corp. |

8.63 |

4.03 |

0.25 |

4.3 |

|

Black Knight, Inc. |

12.76 |

2.56 |

0.20 |

2.7 |

|

TOP DETRACTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

Liberty Media Corp-Liberty SiriusXM |

-21.13 |

5.69 |

-1.26 |

5.7 |

|

Liberty Broadband Corp. |

-14.52 |

8.45 |

-1.07 |

9.1 |

|

MarketAxess Holdings, Inc. |

-24.93 |

3.53 |

-0.86 |

3.6 |

|

Guidewire Software, Inc. |

-25.21 |

3.10 |

-0.78 |

3.0 |

|

Martin Marietta Materials, Inc. |

-22.09 |

3.19 |

-0.77 |

3.0 |

Data is for the quarter ending 06/30/2022. Holdings are subject to change and may not be representative of the Fund’s current or future investments. Contributions to performance are based on actual daily holdings. Returns shown are the actual returns for the specified period of the security. Additional securities referenced herein as a percent of the Fund’s net assets as of 06/30/2022: AutoZone, Inc. 0.0%, Axalta Coating Systems Ltd. 3.4%, CarMax, Inc. 4.7%, CoStar Group, Inc. 5.9%, Gartner, Inc. 2.0%, HEICO Corp. 3.8%, Liberty Media Corp-Liberty Braves 0.0%, and Markel Corp. 3.5%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment