Introduction

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 5 years. This subset of the different portfolios I regularly analyze has now reached 150 weeks of public selections as part of this ongoing live forward-testing.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request into 2020, I now generate 4 selections each week, 2 Dow 30 picks, and a separate article for Growth & Dividend MDA breakout stocks. I now provide 6 different ways to beat the S&P 500 since my trading studies were made public.

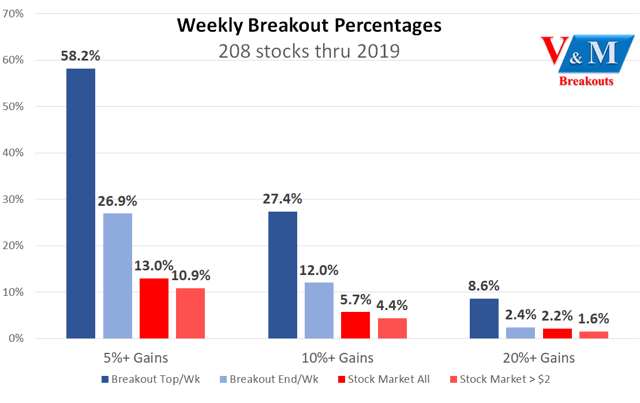

Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week remains at highly statistically significant levels above 80% not counting frequent multiple 10% gainers in a single week. More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017.

2020 YTD Breakout Portfolio Returns

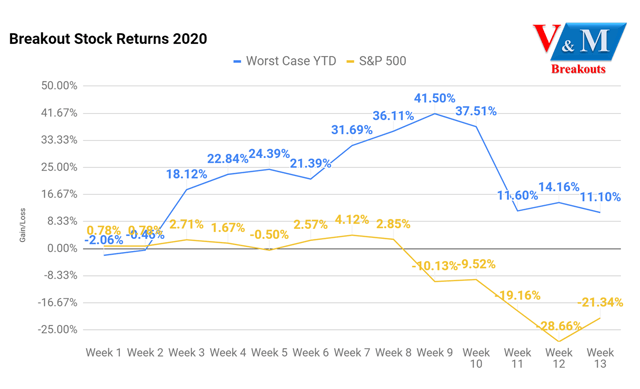

The Breakout Picks are up +11.10% worst case, buy/hold, do nothing, equal weighted returns through Week 13 compared to the S&P 500 -21.34% over the same period. Exiting the portfolio with the negative Momentum Gauge signal of Feb. 24th, the returns were at +41.50% in the first 9 weeks of 2020.

These breakout picks skew highly positive for high frequency short-term gains in less than 5 days as documented over the past 3 years. I have removed the best case (High YTD +139.34%) gains from the chart below as it begins to distort the chart between the worst case gains and the S&P 500 returns.

(Source: Value & Momentum Breakouts)

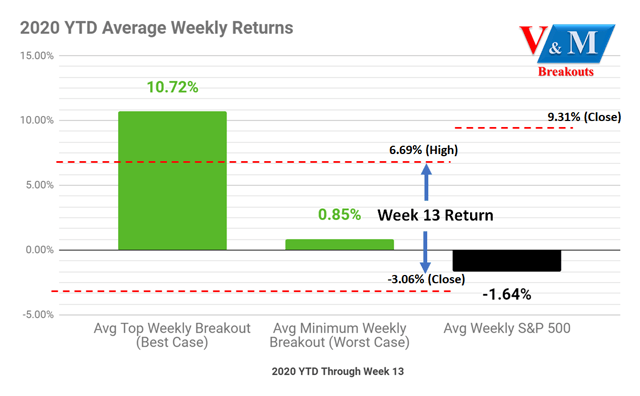

The best case average weekly returns are +10.72% and worst case +0.85% YTD as shown below. These returns include trading against all the Negative Momentum Gauge signal warnings which increases your risk of declines. Week 13 closed with an average gain of -3.06% compared to a gain of 9.31% for the S&P 500.

(Source: Value & Momentum Breakouts)

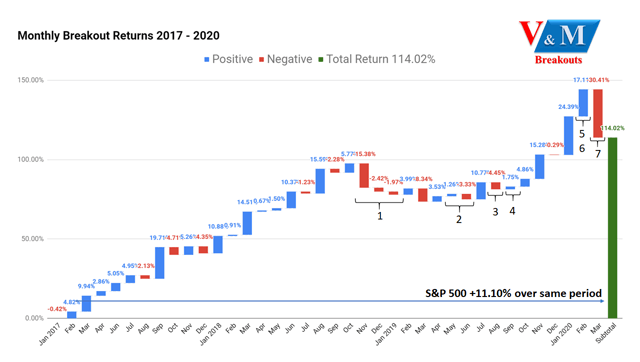

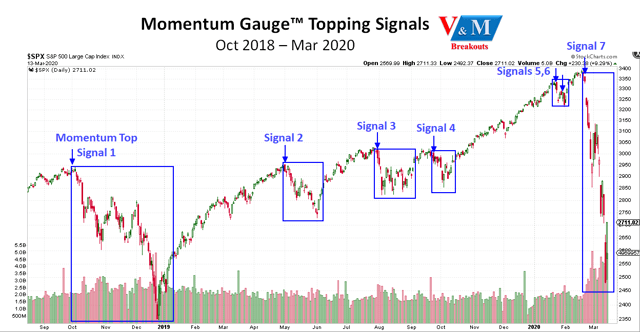

The Breakout Returns are up +114.02% since inception including the negative Momentum Gauge warning event periods. The buy/hold S&P 500 return is +11.10% over the same period from 2017. Avoiding trades during the weeks when the Momentum Gauge signals turned negative as shown across the 7 topping signals warned in advance to members would increase total returns to over 170% since inception.

(Source: Value & Momentum Breakouts)

(Source: Value & Momentum Breakouts)

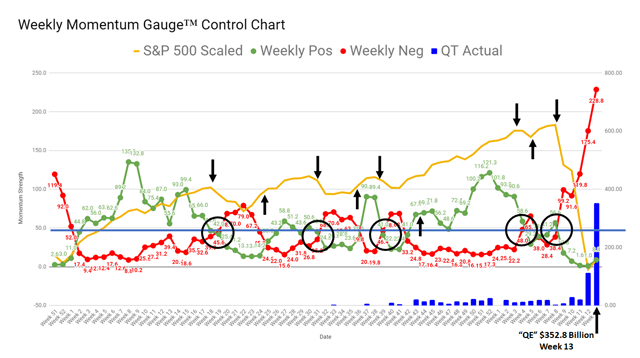

You can see how each of the 7 prior events numbered above relate to the Momentum Gauge topping signals shown below. These forecasted market tops are detailed in my recent article:

Revisiting The Signals That Forecasted Every Recent Decline, In Search Of Early Recovery Indicators

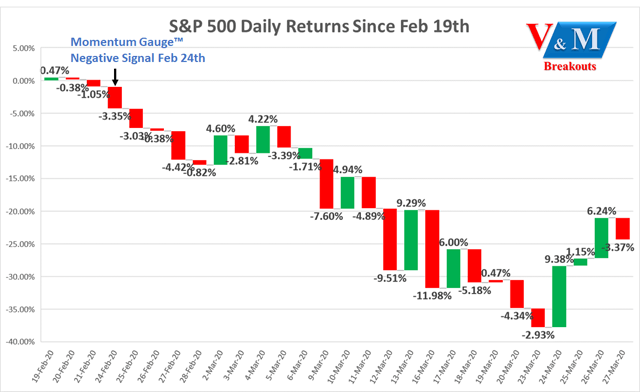

Over the years, the evidence is clear that timing your investments during the most positive momentum periods greatly enhances your weekly returns. We are currently still in negative event 7 since the Feb. 24th signal with the highest levels of negative momentum scores ever recorded by this model.

(Value & Momentum Breakouts)

Momentum Gauge Signal 7 – February 24th

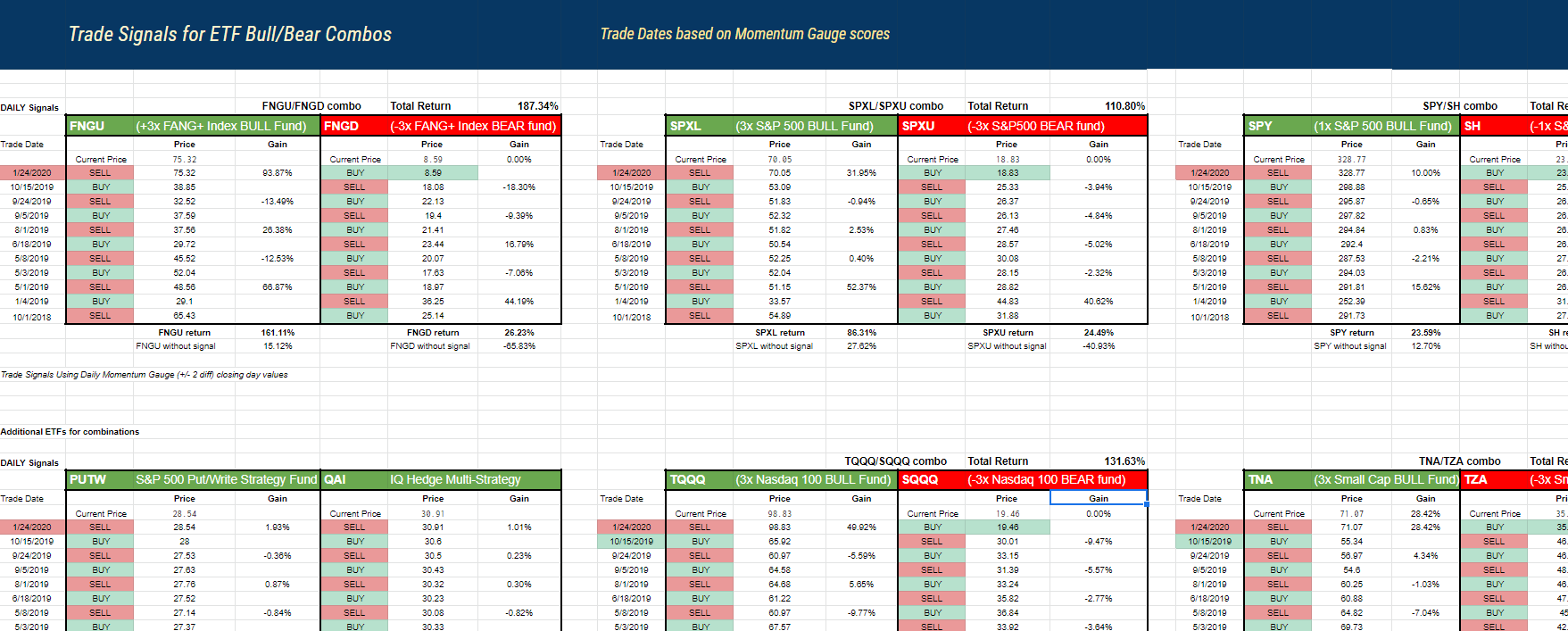

The Momentum Gauge signals are also the basis for the bull/bear ETF combinations used to hedge or leverage market conditions for maximum returns.

Strongest Market Timing Signals To Enhance Bull/Bear ETF Returns (Value & Momentum Breakouts)

(Value & Momentum Breakouts)

The bull/bear ETF trading signal turned negative on Feb. 24th for the 7th major event in the past 18 months as illustrated above. Trading on this signal has produced the following returns for members, while we still remain in a very negative momentum signal through the close Friday.

- MicroSectors FANG+ 3x Index bull/bear (FNGU)/(FNGD) +25.57%

- Direxion Daily S&P 500 3x bull/bear (SPXL)/(SPXU) +29.27%

- SPDR S&P 500 (SPY)/ ProShares Short S&P 500 (SH) +17.63%

- Alpha Architect Intl Momentum (IMOM)/Dorsey Wright Short (DWSH) +40.56%

- ProShares UltraPro Nasdaq 3x bull/bear (TQQQ)/(SQQQ) +9.99%

- Direxion Daily 3x Small Cap bull/bear (TNA)/(TZA) +68.40%

- Direxion Daily 3x Biotech bull/bear (LABU)/(LABD) +20.92%

- Direxion Daily 3x Energy bull/bear (ERX)/(ERY) +111.96%

- MSCI 3x Emerging Market Index bull/bear (EDC)/(EDZ) +31.37%

- VIX Index 1.5x bull/bear (SVXY)/(UVXY) +324.75%

- Direxion Daily 3x Financial bull/bear (FAS)/(FAZ) +24.47%

- Direxion Daily 3x Oil & Gas bull/bear (GUSH)/(DRIP) -83.24%

Market Conditions into Week 14

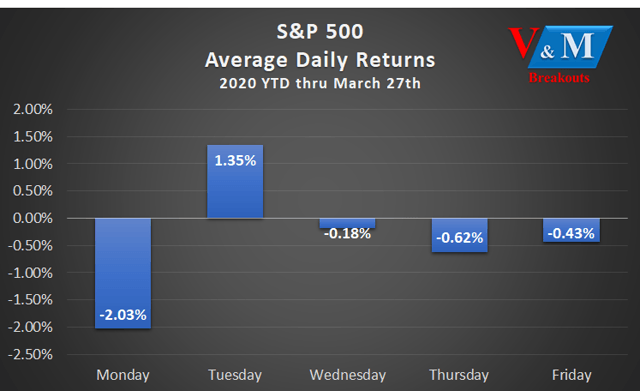

The biggest one day drop since 1987 occurred last Monday. Now Tuesday is returning to the historical patterns well documented in research as the best day of the week, especially ahead of FOMC meetings. We can expect these unusually large volatility swings to continue.

Strong 2020 MDA breakout stocks

There are very few stocks with any confirmed positive accelerating momentum this week. I would suggest that readers remain cautious in cash or inverse funds until the Momentum Gauges show much more indication of positive conditions. These stocks may be good for additional short term gains.

- Orion Energy Systems (OESX) +19.35%

- Calithera Biosciences (CALA) +7.61%

- Simulations Plus (SLP) +1.22%

- Relmada Therapeutics (OTC:RLMD) +3.01%

- SeaChange International (SEAC) +4.06%

- Agile Therapeutics (AGRX) +1.99%

- EDAP TMS (EDAP) +1.75%

- K12 Inc. (LRN) +4.54%

- Translate Bio (TBIO) +5.46%

- Huami Corporation (HMI) +0.51%

- GSX Techedu (GSX)

- Luminex Corp. (LMNX)

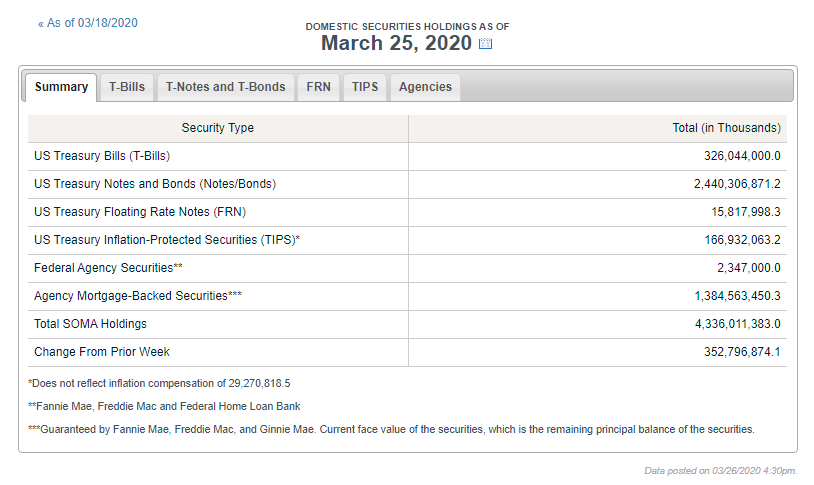

In addition to record stimulus around $4.2 trillion now pledged from central banks, we can now confirm more record Fed easing for Week 13 over $352.8 billion. This brings the total easing to $771.1 billion in liquidity just the past 22 weeks. This has also pushed the Federal Reserve’s balance sheet to the highest level ever over $5.5 trillion and unleashed 2.9% of US GDP in one week.

Fed Balance Sheet Hits $5.5 Trillion As Discount Window Usage Soars

System Open Market Account Holdings – FEDERAL RESERVE BANK of NEW YORK

The Weekly Momentum Gauge chart below shows the Fed’s easing activity in dark blue with the largest move this week since the QE 2 program in 2009. The huge Fed intervention this week dwarfs the record $111.8 billion plotted last week on the chart. The Weekly Momentum Gauge chart turned to a negative signal back in Week 9 with confirmation shown as the red line crosses above the green line on the chart.

(Value & Momentum Breakouts)

The more detailed Daily Momentum Gauge chart below is reserved for members and reflects the last 6 months. The Momentum Gauges closed Friday after hours at Negative 224 and Positive 16.

The MDA momentum gauges have correctly called every major market direction change since they began. These movements and signals were updated in more detail through the Daily Update articles this past week:

- V&M Breakout Morning Update – Mar. 27: Fed Eases Record $352.8 Billion And $2T Rescue Bill Goes To House Vote Today. Markets Lower With S&P 500 Near 2550 And Oil Below $23/Bbl.

- V&M Breakout Morning Update – Mar. 26: Largest $2T Rescue Package Passes Senate, Heads To House Vote FRI. Market Lower Ahead Of Jobless Claims.

- V&M Breakout Morning Update – Mar. 25: Congress Approves $2T Largest Rescue Package Ever While Stocks And Oil Head Lower.

- V&M Breakout Morning Update – Mar. 24: Tuesday Rally Premarket, S&P 500 Back Up To 2018 Lows At 2,330, Gold And Oil Rebounding.

- V&M Breakout Morning Update – Mar. 23: Stocks Pare Losses After -5% Limit Down Premarket, Crude Oil WTI Near $22/Bbl, GDP Q2 Forecasts To -20%+

Two conditional signals that are very important to watch:

- Avoid/Minimize trading when the Negative score is higher than the Positive momentum score.

- Avoid/Minimize trading when the Negative score is above 70 on the gauge.

The Week 14 – 2020 Breakout Stocks for next week are:

The Week 14 stocks consist of two Technology, one Financial and one Basic Material sector stock. These stocks are always released in advance to members early Friday and were hit hard with strong negative momentum conditions on Friday. Continue to use caution with the current negative Momentum Gauge conditions to see if an opportunity for entry emerges later in the week.

- GrowGeneration (OTC:GRWG) – Basic Materials / Agricultural Chemicals

- Zoom Video Communications (ZM) – Technology / Application Software

Zoom is a prior pick from the Week 12 MDA breakout portfolio with an entry point back at $112.16/share in this very highly demanded video-conferencing company.

GrowGeneration – Basic Materials / Agricultural Chemicals

(Source: FinViz)

GrowGeneration Corp., through its subsidiaries, owns and operates retail hydroponic and organic gardening stores in the United States. It offers horticultural, organics, and lighting and hydroponics products, including lighting fixtures, nutrients, seeds and growing media, systems, trays, fans, filters, humidifiers and dehumidifiers, timers, instruments, water pumps, irrigation supplies, and hand tools. The company also operates an online superstore, HeavyGardens.com for cultivators. The company serves commercial and urban cultivators growing specialty crops, including organics, greens, and plant-based medicines.

Zoom Video Communications – Technology / Application Software

(Source: FinViz)

Zoom Video Communications, Inc. provides a video-first communications platform that delivers changes how people interact primarily in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. It connects people through frictionless video, voice, chat, and content sharing. The company’s cloud-native platform enables face-to-face video experiences and connects users across various devices and locations in a single meeting. It serves education, entertainment/media, enterprise infrastructure, finance, healthcare, manufacturing, non-profit/not for profit and social impact, retail/consumer products, and software/Internet industries, as well as individuals.

Top 2 Dow 30 Stocks to Watch for Week 14

Applying the same breakout model parameters without regard to market cap or the below-average volatility of mega-cap stocks may produce strong breakout results relative to other Dow 30 stocks.

While I don’t expect Dow stocks to outperform typical breakout stocks over the measured five-day breakout period, it may provide some strong additional basis for investors to judge future momentum performance for mega-cap stocks in the short to medium term. Conditions remain highly negative and additional caution is highly recommended until we see more positive reversals in the signals.

In the prior week, Dow picks of UnitedHealth Group Inc. (UNH) gained +17.36% and Walmart Inc. (WMT) lost -3.85% as many oversold firms recovered through a week of record high federal stimulus actions. These Dow stocks have held up much better than the small cap sector with less solvency risks than may be present in the small cap sectors in the coming days.

The Dow pick for next week is:

The Procter & Gamble Company (PG)

Procter & Gamble continues in a strong rebound this week with early signals across the indicators of a potential breakout to the top of the negative channel around $122/share. Continue to monitor into next week to see if DJIA stocks are worth picking up as the Momentum Gauges remain near the highest negative values.

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

The point to be made is that the Momentum Breakout model was designed to increase the frequency, i.e. the rate over time, for selecting stocks that make greater than 10% moves. I know that when using the arbitrary period of 1 week (4 or 5 trading days) this model is consistently outperforming the market at more than 4 times the expected market frequency. So what if I take a look at longer momentum survivors? Can we see decay in performance among the top stock selections? ~ Value & Momentum Breakouts 2017

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

(Value & Momentum Breakouts)

These percentages reflect the results from 208 MDA breakout selections through 2019 across 52 weeks with 4 stocks selected each week. MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. An additional Stock Market column was added to compare similar groups that exclude high volatility penny-stocks below $2/share.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that include one-year buy/hold value stocks.

My recent thoughts on the Coronavirus impact can be found among the contributions to the SA Roundtable series:

The latest MDA breakout Growth & Dividend stocks for March were released at the start of the month and are still led by gains in Kroger (KR) +3.55%, Clorox Company (CLX) +8.64%, and Gilead Sciences (GILD) +5.03%. New selections will be released to members at the start of April.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts

Disclosure: I am/we are long FAZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment