AscentXmedia/E+ via Getty Images

Introduction

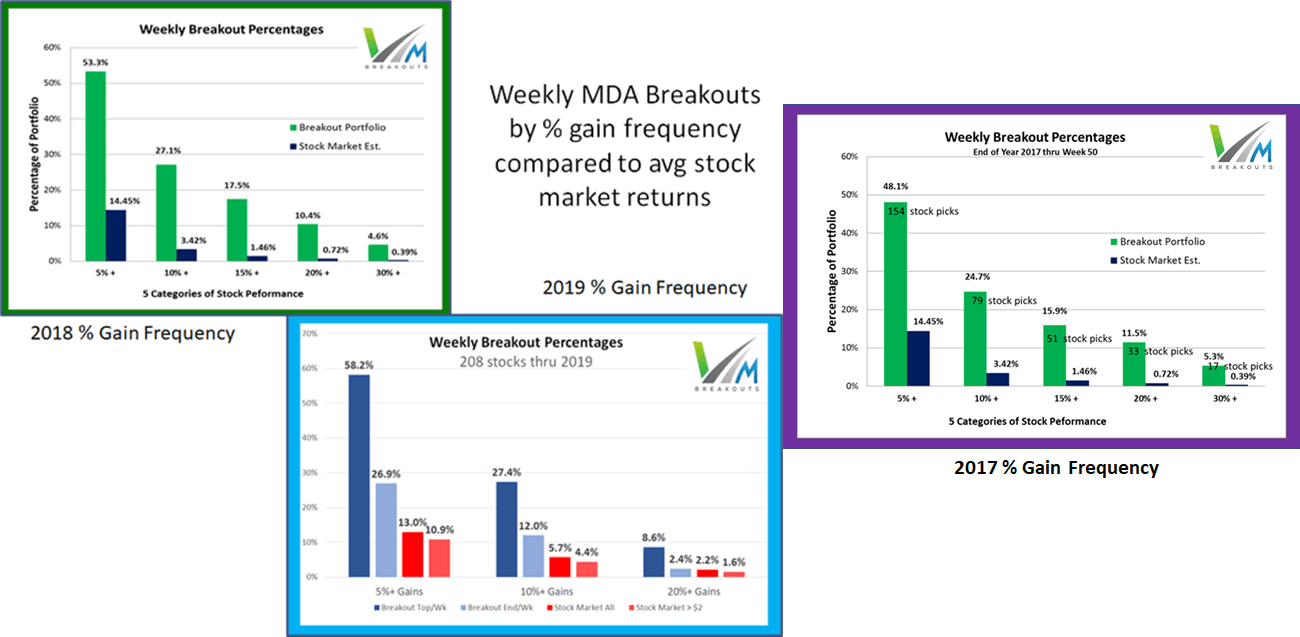

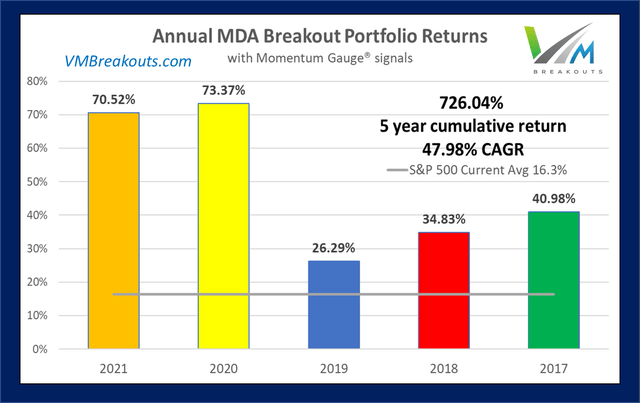

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now reached 250 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages over the past 5 years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate 4 selections each week. In addition 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading studies were made public:

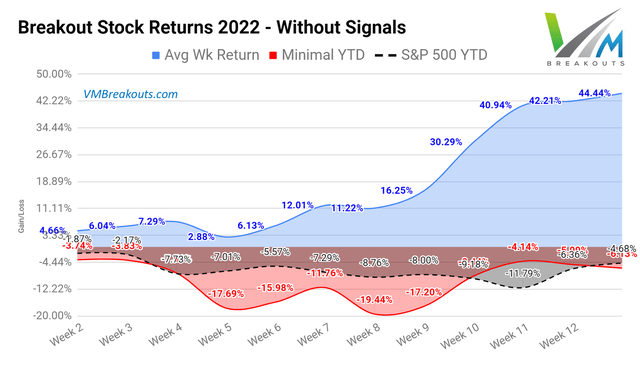

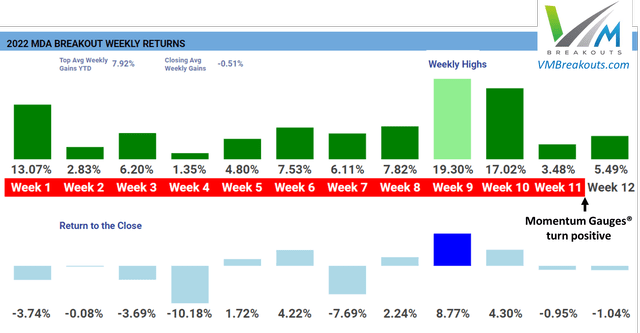

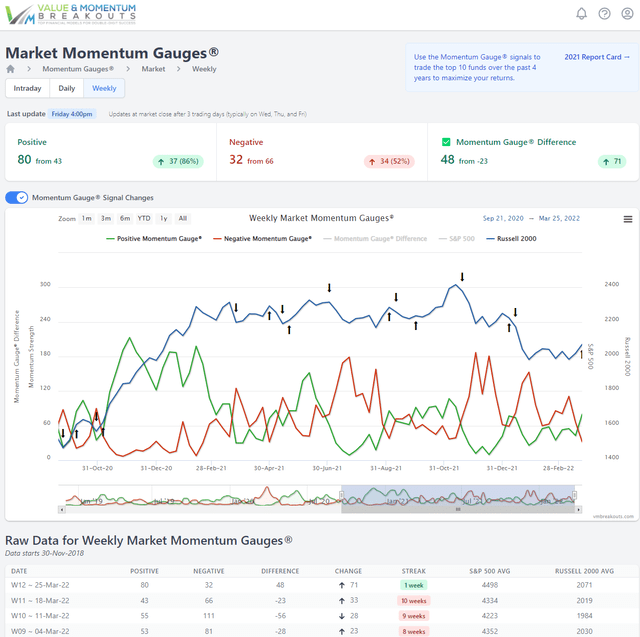

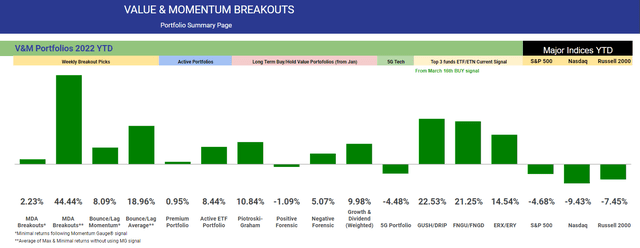

The cumulative breakout return average for 2022 is +44.44% not using the gauge signal. Officially, the MDA Breakout average returns are at +2.23% trading only on positive Momentum Gauge® signals and avoiding the major market declines YTD. Last week we received our first positive buy signal on the Momentum Gauges after 17 consecutive weeks of negative signals since November.

Additional background on the Weekly MDA Breakout model: Value And Momentum MDA Breakouts +70.5% In 52 Weeks: Final 2021 Year End Report Card

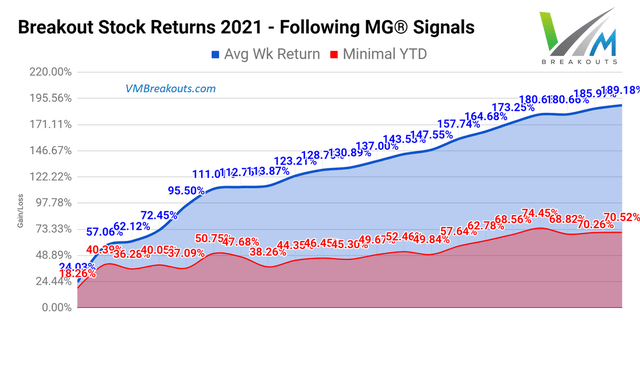

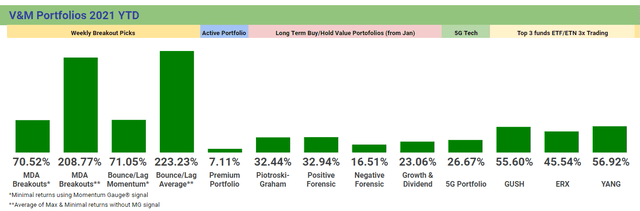

Returns from 21 Weeks of Positive Momentum Gauge signals in 2021

Last year there were only 21 positive trading weeks to achieve +70.5% returns and for 2022 we have only had one official positive weekly signal so far.

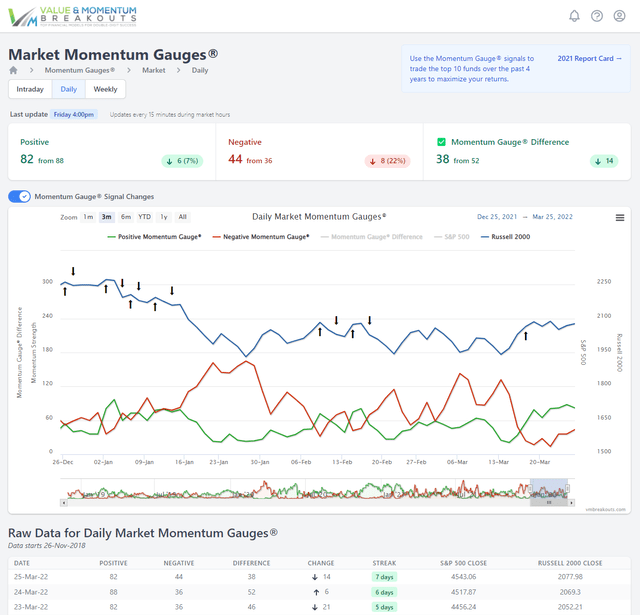

Momentum Gauge® trading signal: Positive conditions ahead of Week 13

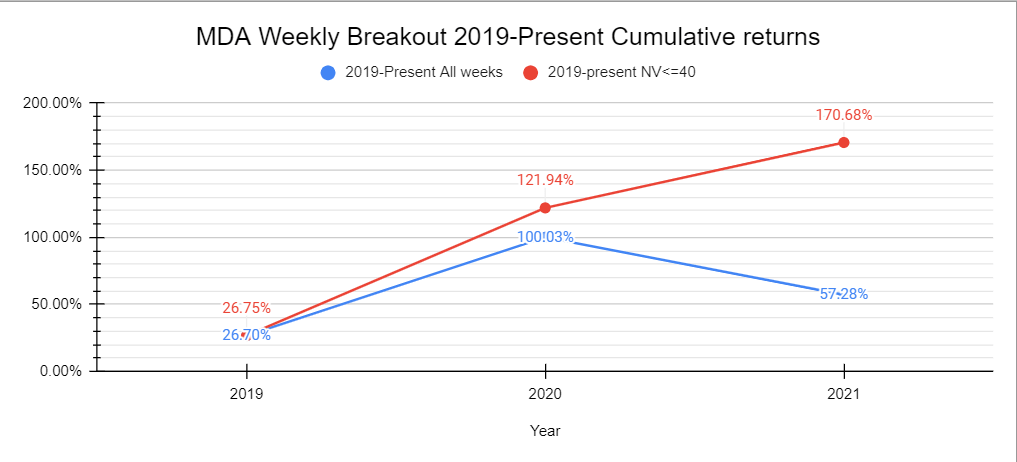

Red weekly color indicates negative Momentum Gauge signals over the last 11 weeks. MDA breakout selections tend to outperform when the signal is positive and negative values are below 40 level. This was an especially strong factor in 2021 showing cumulative returns below with and without the signal.

VMBreakouts.com

Historical Performance Measurements

The MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

Longer term many of these selections join the V&M Multibagger list now up to 137 weekly picks with over 100%+ gains, 59 picks over 200%+, 21 picks over 500%+ and 7 picks with over 1000%+ gains since January 2019 such as:

- Intrepid Potash (IPI) +2,517.9%

- Enphase Energy (ENPH) +1,301.4%

- Celsius Holdings (CELH) +1,083.6%

- Trillium Therapeutics (TRIL) +1008.7%

More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation

2022 Breakout Portfolio Returns

The Momentum Gauge® conditions turned positive last week for the first time in 2022 with official avg cumulative returns of +2.23% strictly following the signals and avoiding the worst start to the year since 2009.

The Breakout Picks are high volatility selections for short-term gains, but with no selections below $2/share, under 100k average daily volume, or less than $100 million market cap. Prior returns are documented here:

2022 marks the worst start to the stock market since 2009 and the Momentum Gauge® MDA buy signals have turned positive into a second week after 17 consecutive weeks since Week 46 of last year. It is best to follow the signals and avoid momentum stocks until conditions turn positive.

The Market Momentum Gauges® based on 7,500+ stocks continue positive this week closing at Negative 44 and Positive 82.

The Weekly Momentum Gauges® have turned positive for the first time in 10 weeks and for only the second time in 18 weeks since last November.

Two conditional signals that are very important to watch:

- Avoid/Minimize trading when the Negative score is higher than the Positive momentum score.

- Avoid/Minimize trading when the Negative score is above 40 on the gauge.

The Week 13 – 2022 Breakout Stocks for next week are:

The picks consist of 2 Technology, 1 Communication Services, and 1 Basic Material sector stock. These stocks are released to members in advance every Friday morning near the open. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals — but readers are cautioned to follow the Momentum Gauges® for the best results.

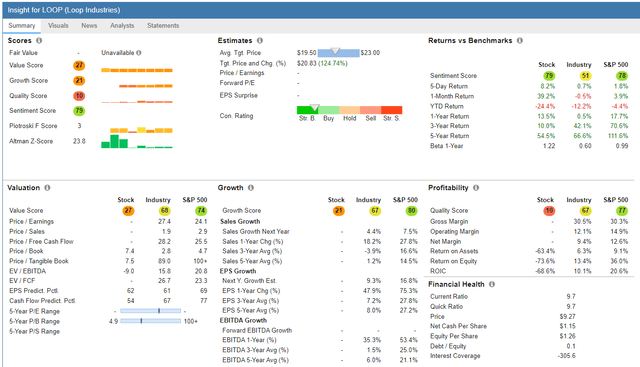

- Loop Industries (LOOP) – Basic Materials / Specialty Chemicals

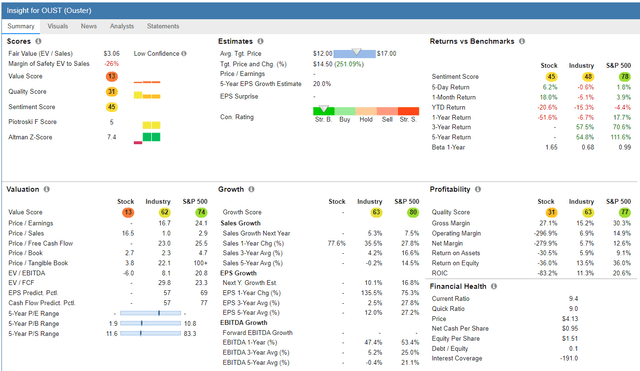

- Ouster Inc. (OUST) – Technology / Semiconductors

Loop Industries – Basic Materials / Specialty Chemicals

FinViz.com

Price Target: $18.00/share (See my FAQ #20 on price targets)

(Source: FinViz)

Loop Industries, Inc., a technology company, focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into base building blocks. It polymerized monomers into virgin-quality PET plastic for use in food-grade plastic packaging, such as plastic bottles for water and carbonated soft drinks, and containers for food and other consumer products; and polyester fibers, including carpets, clothing, and other polyester textiles.

Source: Company resources

Ouster Inc. – Technology / Semiconductors

FinViz.com

Price Target: $7.00/share (See my FAQ #20 on price targets)

(Source: FinViz)

Ouster, Inc. designs and manufactures high-resolution digital lidar sensors and enabling software that offers 3D vision to machinery, vehicles, robots, and fixed infrastructure assets. Its product portfolio includes OS, a scanning sensor and DF, a true solid-state flash sensor.

Source: Company resources

Top Dow 30 Stocks to Watch for Week 13

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks.

While I don’t expect Dow stocks to outperform typical breakout stocks over the measured five-day breakout period, it may provide some strong additional basis for investors to judge future momentum performance for mega-cap stocks in the short- to medium-term. The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (HD) | Home Depot | -6.94% |

| (CVX) | Chevron Corporation | +5.14% |

| (TRV) | The Travelers Companies | +8.07% |

| (CAT) | Caterpillar | +3.97% |

| CVX | Chevron Corporation | +7.48% |

| (WMT) | Walmart Inc. | +3.51% |

| (AMGN) | Amgen, Inc. | +7.01% |

| (MRK) | Merck & Co., Inc. | +8.64% |

| (PG) | The Procter & Gamble Company | -4.42% |

| (KO) | The Coca-Cola Company | -1.61% |

If you are looking for a much broader selection of mega-cap breakout stocks beyond just 30 Dow stocks with more detailed analysis and strong returns, I would recommend the Growth & Dividend MDA Breakout picks.

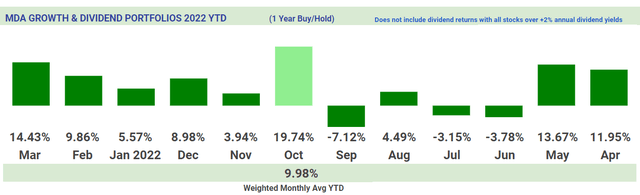

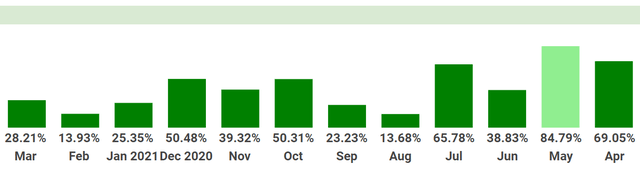

These picks are released monthly for long term total return with strong returns that are leading the S&P 500 by +14.66% through 2022. The latest March selections are already up +14.4% while all the major indices remain negative YTD. The 2-year returns of monthly portfolios are shown below:

VMBreakouts.com VMBreakouts.com

The Dow pick for next week is:

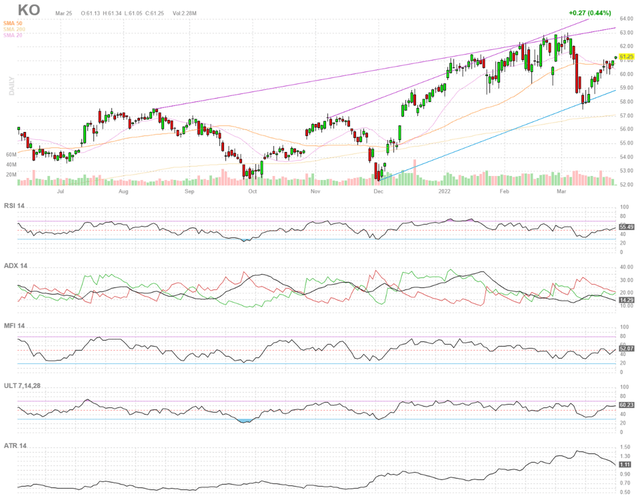

The Coca-Cola Company

Coca-Cola continues in breakout condition toward a retest of prior March highs ahead of earnings April 25th. Institutions are net buyers in the current quarter and consensus analyst price target is $67.4/share with net MFI inflows turning positive for the first time in March.

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

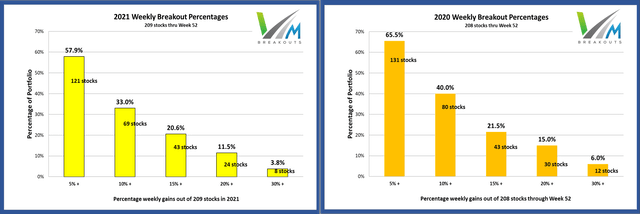

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio types are again beating the S&P 500 for 2022 that is down -4.68%. The new active ETF portfolio is up +8.44% YTD and value portfolios of Piotroski-Graham and Growth & Dividend picks are up 10% to start the year.

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment