The dip we began last week has turned into an up-and-down trend, a very volatile sort of dance which seems to correspond somewhat to the ongoing trends of what the Coronavirus, COVID-19, is doing across the world.

From what we’ve seen, the federal stimulus has woefully failed to at least at this time address the “problem” (if one wants to see it as such), and the ups and downs seem to continue as investors take larger supply chain disruptions into account. Days of yearly record gains are subsequently followed by days of extreme drops, which are seeing certain sectors hurting badly.

Many readers have contacted me over the past few days with the question – just how am I preparing for a long-term sort of bear market/negative trend, which we may be going into?

I thought it could be a good idea to update the article from last week with some more thoughts on the matter.

What are we buying and for how long?

When entering any sort of negative market trend, the companies which the market views as “risky” or especially “exposed” to what’s causing the trend are usually the ones thrown out with the bathwater. It’s the same thing we’re seeing now.

One of the more common questions that I receive is do I keep buying the same companies ad infinitum as we go down.

To this, the answer is – yeah, and more.

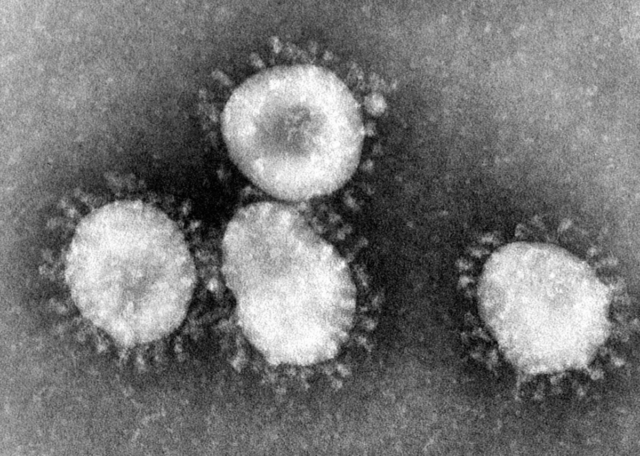

Much like a virus, the current market sentiment can be said to have two strains. The fear/surrender of local spread/community spread and millions/billions of people contracting COVID-19, which they fear would deeply affect the economy, growth and supply chains. The second strain is driven by the hope of stimulus from central banks across the world – and when these meet, we get the sort of volatile, Jojo-like market action we’ve been seeing.

Once this sort of market downturn hits, I already have a capital allocation plan. This was lined out in this article which I published recently. However, one thing to remember once the market starts pulling back more seriously is that while we initially see companies the market considers “risky” in the context dropping, after some time you start seeing other companies hit undervalued levels.

Let me give you some examples.

Since we hit this correction, a number of stocks on my watchlist have been suffering. Here, we find companies such as:

These are just a few examples; there are more. Travel stocks like Carnival (CCL) are also suffering. The point here is these companies more often than not share qualities. Many of them in this case are financial stocks. They’re cyclicals or companies recently out of a troubled time. They are, as a whole, more volatile than certain other stocks, and they’ve dropped a lot harder.

For the past two weeks, I’ve been adding to my position in these stocks as they’ve dropped. One possibility could have been that we might have seen a reversal at this time. Even though we did not, these are still excellent companies at an excellent price. Each of these companies, I want to own for a period of no less than 30-50 years.

This on the other hand is only the first step of what I view as proper capital allocation.

Quality is becoming cheaper

Outside of these initial stocks, we’re now seeing quality stocks come down as well, and this could just be the beginning. That’s why my strategy of keeping cash in different “buckets”, which are set depending on how big of a pullback we’re getting, combined with a set limit for each position, is what I consider to be an excellent idea for me.

But, first things first. Just what do I mean by “quality”?

I mean mostly A-rated, time-tested dividend growth stocks with perhaps lower yield, but also lower payout ratios, higher dividend safety and just overall less risk. They’re also stocks that are rarely cheap.

Here are the ones I’ve bought lately.

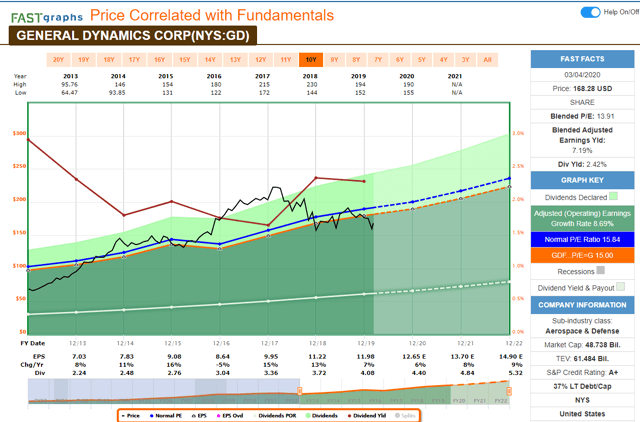

General Dynamics (NYSE:GD)

(Source: F.A.S.T. Graphs)

A buying opportunity of this kind for GD hasn’t been around for some time. A quality company like this for below 14 times earnings is an amazing deal. I wrote more about this specific opportunity in this article.

Thus far, 3 buy “levels” have triggered, so I’ve added around $1,900 worth of GD to my portfolio.

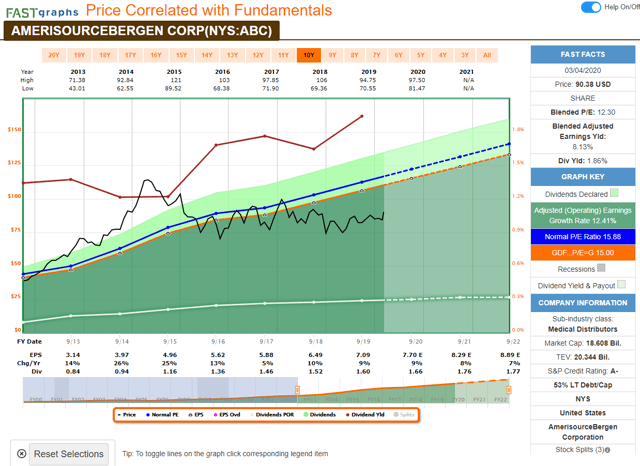

AmerisourceBergen (NYSE:ABC)

Apart from my stake in Cardinal Health (CAH), AmerisourceBergen is a company I’ve always been looking at, and I unfortunately missed some of the cheapness back one year ago.

(Source: F.A.S.T. Graphs)

So when market action hit ABC, I was quick to pump some of this company as well. Only one position triggered so far, but I’m hoping for more drops to add more of this company.

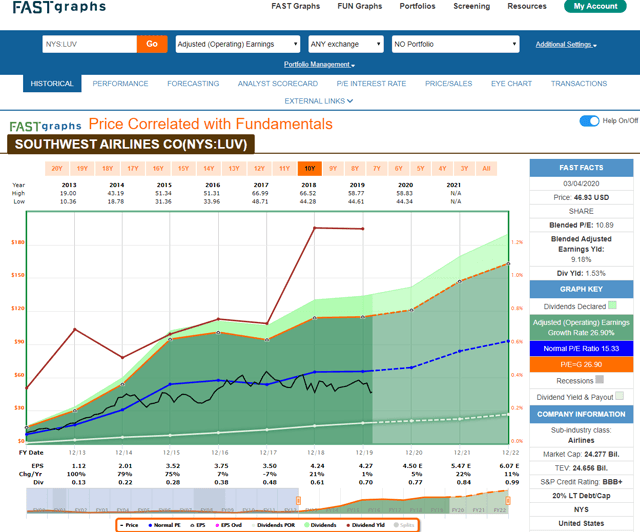

Southwest Airlines (NYSE:LUV)

Very few airlines have the history of Southwest Airlines in terms of growth.

(Source: F.A.S.T. Graphs)

While I don’t expect the history of a 27% CAGR in EPS to repeat itself going forward, the company’s growth prospects once Corona dies down is still above 12% per year going forward, with a fairly high analyst accuracy. Qualitative airlines are rare, but this is my pick of the bunch.

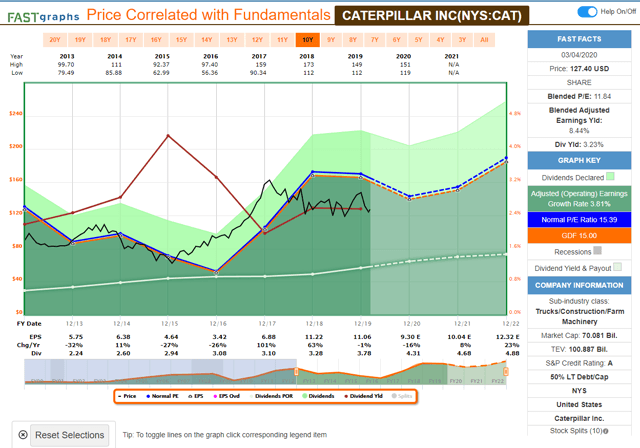

Caterpillar (NYSE:CAT)

Oh, it’s cyclical alright. There’s no denying that Caterpillar is a very cyclical company. However, there’s a method to the madness, and those with a sufficiently long investment horizon and patience can make some excellent dividends as well as capital appreciation investing here.

(Source: F.A.S.T. Graphs)

I’ve made no secret of my stance that investing in CAT should be done at a cheaper price than most consider fair. Anything above $125/share currently is what I consider to be too expensive here. However, now we’re starting to see some interesting price action for this company, and that’s why I bought when the company briefly dipped under $120/share.

These are the four examples of extremely qualitative companies which have been amongst the first in my watchlist to become undervalued. They are by no means the only ones nor perhaps the most suitable for you.

My point is, however, that a market crash shouldn’t change your investment logic nor cause you to panic. As we began this pullback, I came out of the gates offensively, purchasing stakes left and right in qualitative companies as they dropped.

Now that things seem to be continuing at least for the time being, and more qualitative companies are beginning to creep down to very interesting prices, let me show you what I’m doing in response.

The small price adjustments

As with much else, I keep track of my watchlist using Google sheets. Each company is tiered to a “buying” level which I consider fair and which I’ve calculated based off fair value/fundamentals.

It looks something like this.

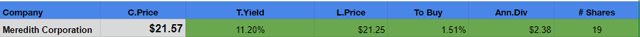

(Source: Google Sheets, Author’s Calculations)

The list tracks about 30 companies in real time, and when a price target is hit, a box to the right turns green – and I buy a position. I don’t use limit buy orders, as I do like to follow daily market action, especially during chaotic days. If I see things crashing harder, I may hold off and edit my target. As you can see for MDP, that target is 11.20% now. This is following a fairly long buying spree in the company and a current YoC of over 8.2%.

The finished order then goes into a different sheet where I keep track of executions. Now, as things creep farther down and more and more quality companies become available at excellent prices, I do two things.

- The spread between yield targets in lower-quality companies/stakes already approaching a maximum allocation becomes larger. Instead of a buy being at 11.20% (from 11% previous), I might demand 11.4% for the next buy.

- I start introducing more and more quality companies to the watchlist which I have on a larger list of desired companies. General Dynamics and Southwest Airlines were the first of these.

I also constantly keep a check on the amount of buying power I have and the amount of buying power coming in. As things get cheaper, I don’t simply buy more of the same.

I do buy more of the companies that I have, but I also add higher-quality names to that list and I do adjustments in relation to my overall portfolio exposure to already-bought companies.

That way, the further the market drops, the higher-quality names (in the eyes of the market) I’m buying and the “safer”, at least in theory, my portfolio becomes. Even though I consider Ocean Yield a qualitative company with excellent safeties, most people would agree that the market views Disney (DIS) as safer and far less volatile.

My desired goal is that by the time my buying power is spent – in about 123 buys, including my bear market bucket (but not including incoming dividends + income for the coming three months) – I go out of a potential bear market, when it ends, owning a whole host of not only businesses viewed as volatile but businesses viewed as extremely qualitative as well. An appealing diversity of excellent companies, as it were.

What is there to fear?

As an investor, my worry for the Coronavirus is quite literally zero in the long term. I see what is happening as a mixture of stock and market action coupled with the overblown short-term fears to company EPS/earnings, coupled with media-induced hysteria about a virus that to over 80% of current patients has turned out to be “mild” similar to a case of the flu.

The media is blowing things up with speculative numbers of deaths in the millions and inevitable full-blown market crashes. The second, I hope, actually occurs – though time will tell what happens.

What seems certain at this point is that Corona and the associated effects, including a 50 bps rate cut, are going to influence company earnings in 2020. That is, after all, part of why finance stocks are dropping hard at this time. However, what will the long-term effects be?

Me, I took the opportunity to load up and put almost $30k of capital to work in a very short time, with another $50-80k available for deployment as things drop further. Thus far, what I’ve seen in terms of deals and effects on my annual dividends is very promising.

The fact is Corona thus far is really nothing when put into the bigger context. When one of the last pandemics actually hit us and did damage the human population with infections and death, it infected close to a fifth of the entire global population – Sweden was amongst the areas affected. I’m talking about Swine Flu which had hundreds of thousands of people dying in the disease. Corona isn’t there and perhaps it won’t be – at this time, we simply don’t know.

Even if it was, however, why would it change the investment approach of anyone with a long-term perspective?

The results of a market drop on my portfolio are very simple and straightforward:

- Higher YoCs for my positions of qualitative, appealing companies.

- Additions of qualitative, appealing companies at historically appealing price points and yields.

- Higher overall dividends on both a monthly basis and an annual basis going forward.

Why wouldn’t you as an investor with a very long-term view want for the market to behave exactly as it is? It’s in these market climates where future wealth is minted, when investments in undervalued, quality companies are done which following a resurgence enjoy multiple expansion.

Quite literally the only fear that I see as relevant is the following: Is the epidemic/potential pandemic likely to influence any company’s fundamental investment thesis?

I’m sure there are companies out there where this could be argued to be true. However, I don’t own any of them. Even my travel/cruise companies will in the long term be fine even if FY19 earnings take a hit and possibly be forced to temporarily cut the dividend.

So, the question again – what is there to fear?

In market activities such as this, I believe we need to fear ourselves and our instincts the most. Remember, we humans have a natural tendency to do as others do, or social proof. It’s our nature, and outside of the stock market, it’s where safety is found.

However, in the stock market, if you listen to the crowd and do so at the wrong time, you will always lose in the long run. You need to conduct yourself according to an investment strategy that will pull you through thick and thin, and not change it in times of market hysteria, but only change if/when the fundamentals of a certain company change.

Wrapping up

We’ve moved from a pullback into a correction, and judging by market action and volatility, it seems we may be going into a bear market before the end of next week if things continue to swing as violently as they are.

This shouldn’t scare long-term investors, but it should make you double-check your war chest and your capital deployment plan for when certain things occur. Given that I’ve reached my investment goals already, I’m fine with being parts in cash (usually above-8-10%) outside of the worst market crashes. Once these crashes come, however, I want to deploy most of that capital into quality stocks.

Over the last two weeks, this is what I’ve done, increasing my annual dividends sharply to where they now approach a 150% average expense coverage.

What becomes interesting is that the more time goes on, the more quality businesses are coming down to fair value or undervaluation. To continue to make prudent investment decisions, my reaction to this is to increase the yield spread between buying points, as well as introducing the quality companies which become undervalued.

So my message in this piece is two-fold:

First, act contrary to human nature and stick to your investment strategy. Do not let fear rule your investment decisions or allow your long-term goals to become influenced by short-term hysteria. This is the way of the market.

Second, consider – aside from buying undervalued quality companies with high yield – starting to include more conservative, quality businesses to increase potential portfolio diversification and long-term returns. While these may look unappealing in terms of yield at first glance, they usually turn out to be some of the best, long-term investments ever made.

And with that, I’m hoping I’ve clarified how I go forward into this, the second and potential third week of this market hysteria. I didn’t really expect I’d genuinely enjoy this stock market chaos as much as I am (not the human/virus portion, that’s horrible – but the price action) in the face of my portfolio being down double digits, but I see this as a testament to my overall, long-term investment thesis.

I hope this finds you in a similar state of mind.

Disclosure: I am/we are long ABC, CAH, CAT, CCL, EQNR, LUV, MDP, OYIEF, OZK, RDS.B, TD, UNM, VIAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.

Be the first to comment