We Are

The SPDR S&P Global Dividend ETF (NYSEARCA:WDIV) hits a lot of the right sectoral notes and contains lots of exposures that are going to be solid in spite of the various macroeconomic risk factors that the prudent investor would be concerning themselves with. While typically strong, the only potentially weak area is real estate due to the Hong Kong exposures, a very expensive real estate market that is seeing some unwinding. With income that could even grow with quite high a probability, the earnings yield and dividend yields provided, the ETF seems both a solid short-term and medium-term solution for achieving growth.

WDIV Breakdown

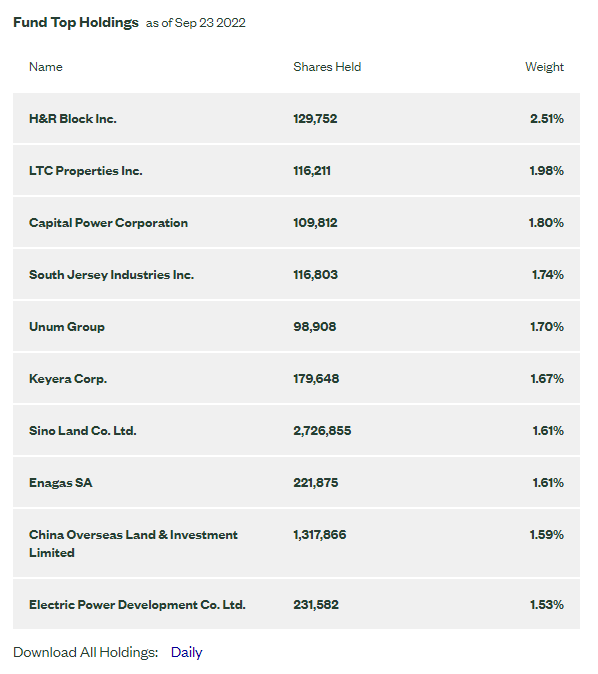

Let’s have a look at some of the key holdings.

Top Holdings (SSGA.com)

The fund is fairly diversified, but the top holdings do command some weight and lend themselves to recurring economics that will continue to support dividends. H&R Block (HRB) is the first, and as a tax help business, they offer the recurring revenues coming from annual tax seasons. They have been resilient to digital tax filing tools like those provided by Intuit (INTU). LTC Properties (LTC) focuses on senior living, which is a market that is supported by very strong demographics in the US, and real estate economics that support dividends through the recurring revenue coming from leases, often with rent-hike clauses built in. Capital Power (OTCPK:CPWPF) is a power generation play, which is getting into WDIV’s utility exposures. The only downside is that some of its capacity is gas-fired, but at least in terms of volumes of electricity demanded, we can expect resilience.

These top several holdings are a pretty good picture of how the sectoral exposures are distributed.

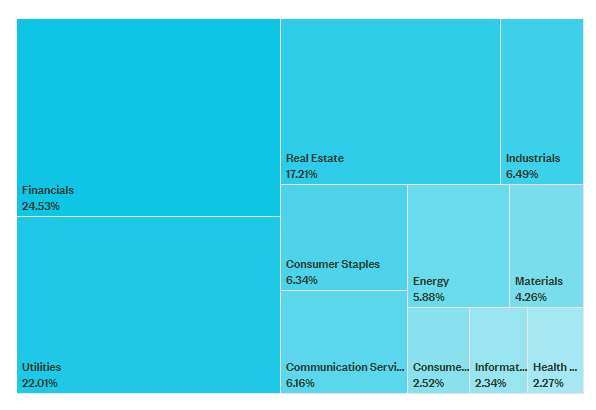

Sectors (SSGA.com)

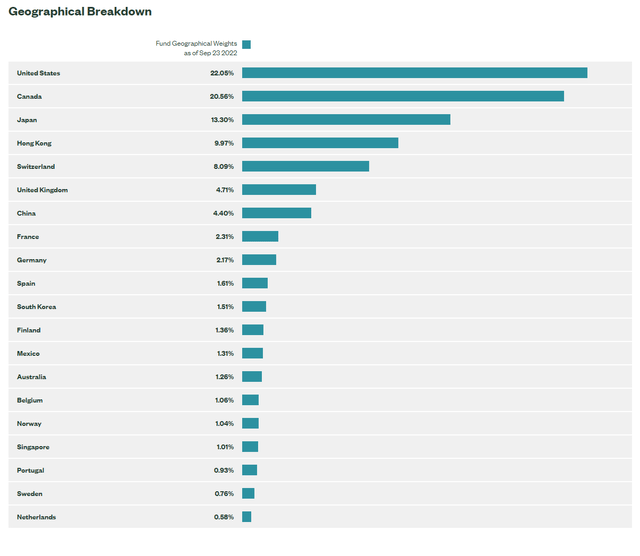

The big ones are financials, utilities and real estate, which together and in quite similar quantum account for more than 60% of the allocations. Then after that are consumer staples and telcos. Financials are well positioned with the rate hike environment, both on the insurance and banking side. Savings rates continue to lag lending rates in banking, and short-term fixed income is rolling over favorably in the higher rate environment thanks to their necessarily low duration portfolios. The only downside is that some of the Japanese allocations are financials, and they are outliers in their dovish CB policy.

Utilities are a little more mixed because power feedstocks are seeing inflation. CCGT power, for example, or gas-fired power, is not ideal. Hydro has also had its issues in the previous months in Europe on account of drought. But solar and wind are doing well, and utilities includes regulated utilities like Enagas (OTCPK:ENGGY) which gets remunerated on a fixed-income government basis for operating gas transmission. Government remuneration schemes are inflation and interest rate linked, so that income will keep up, and a lot of these exposures have high yields and low PEs and have scope to grow assets as the EU pushes the renewable energy transition. In other words, the utilities exposure provides high yields and often commodity agnosticism, and on balance should be a growing category despite some challenges in specific power generation modalities.

Real estate includes senior living in LTC as the top exposure. However, the rest of the exposures are a little more shaky because this is where a lot of the ETF’s China exposures come in. Sino Land (OTCPK:SNLAY) is almost fully levered to property sales in Hong Kong. Home prices are falling in one of the world’s least affordable cities. China Overseas Land (OTCPK:CAOVY) also is levered to home prices in HK with its property development businesses. Some exposures are directly exposed to the collapsing Chinese property market, even on the development and construction side, so not good at all. While not completely offsetting (allocations are about 40% of the China-HK ones), the Japanese RE exposures are likely to mitigate some of the KH property market risks, and HK-China risks in general, thanks to the dovish policy there supporting RE asset values and the stock prices of RE development and rental exposures there. On balance, RE is weaker than the average RE exposure that you’d get in a straight REIT ETF or a developed market property ETF. Nonetheless, its declines on average should be limited. But the RE exposure ends up being a weakness.

Consumer staples and telco exposures are solid in this ETF.

Takeaways

Overall, about 60% of this ETF is rock-solid and likely to even see growth. The rest are either commodity exposed, or in the RE allocation, about half is negatively exposed by being long the Chinese and HK property markets. China is an obvious disaster as financing and demand seem to collapse. This was perhaps a long time coming as Jim Chanos has been talking about the Ghost Palaces for almost half a decade now. Obviously, he was right eventually. On the Hong Kong side, the concerns include the fundamental one which is that the markets are very expensive there, and then the additional concern around how attractive the HK market is likely to be in the long-term as direct Chinese influence grows.

The overall PE of the portfolio is 10%, and the dividend yield over 5%. Most of the exposures support this yield, and can even help grow it thanks to macro-agnostic markets and exposures. WDIV ends up looking solid despite the weaker RE portfolio than what would be possible in a US REIT ETF thanks to return head-starts with the dividend, and a margin of safety in the multiple.

Be the first to comment