marchmeena29/iStock via Getty Images

Beyond any doubt, one of the most iconic brands in the world is WD-40, which is produced by WD-40 Company (NASDAQ:WDFC). This product, which serves as a lubricant, rust preventative, penetrant, and moisture displacer, is practically ubiquitous across homes, garages, and businesses nationwide. The firm also has a growing presence overseas. In recent months, due to underperformance on its bottom line, combined with the fact that shares were already trading at lofty levels, shares of the business have suffered to some degree. There’s no denying that this is painful for investors today. And the fact of the matter is that, even after factoring in a likely recovery for the enterprise, shares do look rather lofty. But for how high quality the enterprise is, the company doesn’t look to be a particularly bad prospect, nor does it appear to offer significant upside. At the end of the day, it probably is just a ‘hold’ opportunity for long-term investors.

WD-40’s recent performance is mixed

The last time I wrote about WD-40 Company was in an article published in December of 2021. At that time, I called the company an excellent firm for long-term investors. Having said that, I acknowledged that shares were incredibly pricey and there was a substantial risk of underperformance relative to the market for an extended period of time because of the multiples shares are trading at. I tend to place a high value on quality companies with significant brand appeal and that have demonstrated strong performance over an extended period of time. This led me to rate the company a ‘hold’ at that time. Unfortunately, since then, shares of the business have not performed particularly well. Even as the S&P 500 has generated a loss of 1%, shares of WD-40 Company have resulted in a decline of 24.5%.

The problem here stems from the fact that pricey companies can drop in price even if fundamental performance is acceptable. In some ways, performance for WD-40 Company since publication of that article has been quite positive, while other performance has been disappointing. On the positive side, for instance, we need only look at revenue. For the first quarter of the company’s 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the firm, the business generated revenue of $134.75 million. That represents an increase of 8.2% over the $124.56 million generated one year earlier.

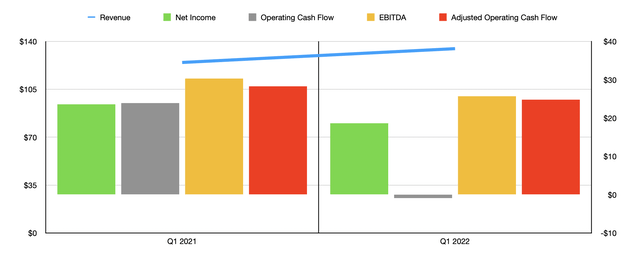

Author – SEC EDGAR Data

During this period, the company saw particularly attractive growth in the Asia-Pacific region. Sales there surged by 33.8%, taking the company’s exposure to the region up from 12% a year earlier to 15% now. By comparison, more established markets like the Americas and the EMEA (Europe, Middle East, and Africa), reported smaller increases of just 3.9% and 5.1%, respectively. It’s also worth noting that for the entire 2022 fiscal year, management does have high expectations for the company. They currently anticipate revenue of between $522 million and $547 million. At the midpoint, this implies a year-over-year growth rate of 9.5%.

Although revenue growth for the company remains robust, the same cannot be said of profitability. Net income in the first quarter of the year came in at $18.56 million. That’s down from the $23.62 million the company generated in the first quarter of its 2021 fiscal year. This was not the only profitability metric that suffered. Operating cash flow dropped from $23.92 million to negative $0.95 million, while this figure, if we exclude changes in working capital, would have declined from $28.35 million to $24.75 million. And finally, EBITDA for the business dropped from $30.27 million to $25.72 million. These declines for the company do not look good when you consider that profits increased for four of the past five years, while cash flows and EBITDA followed suit.

According to management, the company has experienced pain associated with supply chain issues and inflation. So even though sales are rising, the firm is experiencing margin contraction. The good news is that management expects this to be extremely temporary. Currently, the forecast for net income is for it to come in at between $71.7 million and $73.6 million, with a midpoint of $72.65 million. That would imply a year-over-year growth rate of just 3.4%, but at least it would be positive.

Keep an eye out on WD-40’s Q2 earnings

Heading into the company’s earnings release, which is supposed to take place on April 7th after the market closes, investors would be wise to keep an eye out on a couple of things. Most important, given the disparity between the company’s bottom line during the first quarter of this year and where management expects profits to go for the year as a whole, would be earnings. At present, analysts anticipate earnings per share of $1.02. That would imply net profits of $13.97 million. To put that in perspective, it would represent a decline of 18.7% compared to the $17.19 million the company generated the same time one year earlier. Seeing the company outperform on this front could help to push shares up and would allow investors to recognize that management might very well be right for the year. But failing to deliver at least what analysts expect could push shares down further.

When it comes to revenue, the expectation from analysts is for a reading of $126.80 million. This follows the trend the company reported in the first quarter of the year in the respect that it would be higher than what the company reported last year. Overall growth would be 13.3% over the $111.91 million the company achieved last year. Once again, the Asia-Pacific region will probably be a key driver of growth. But beyond that, we can’t really guess as to what might transpire on this front. As for other metrics for the company such as cash flow and EBITDA, there has been no guidance provided by analysts. But generally speaking, these should follow the trajectory of earnings.

WDFC stock is still pricey

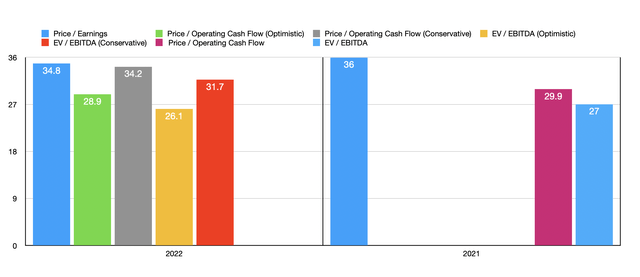

when it comes to valuing the company, I have decided to look at the company through the lens of both its 2021 year results and what the company might generate during the 2022 fiscal year. Using the firm’s 2021 results, we find that shares would be trading at a price to earnings multiple of 36. This drops to 34.8 if we assume that management is accurate in their forecasts. When it comes to other profitability metrics, it’s difficult to know what the future holds. If we assume that operating cash flow and EBITDA will increase at the same rate that earnings will, then the price to operating cash flow multiple should be 28.9, while the EV to EBITDA multiple should be 26.1. This compares to the 29.9 and 27, respectively, that the company is trading at if we rely on the 2021 results. If, however, we assume that the first quarter of the year is more indicative of what performance will ultimately be for these metrics, then the price 2 adjusted operating cash flow multiple would be 34.2, while the EV to EBITDA multiple would be 31.7.

Author – SEC EDGAR Data

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 16.1 to a high of 30.8. In this case, our prospect was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the range was from 12.8 to 30.3. And using the EV to EBITDA approach, the range was from 10.2 to 95.9. In both of these cases, four of the five companies were more expensive than WD-40 Company.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| WD-40 Company | 36.0 | 29.9 | 27.0 |

| Central Garden & Pet Company (CENT) | 16.1 | 12.8 | 10.2 |

| The Procter & Gamble Company (PG) | 27.5 | 22.2 | 18.8 |

| Church & Dwight (CHD) | 30.5 | 25.3 | 20.5 |

| Spectrum Brands Holdings (SPB) | 30.8 | 30.3 | 95.9 |

| Colgate-Palmolive Company (CL) | 30.3 | 19.8 | 18.6 |

Takeaway

Based on the data provided, it seems to me as though shares of WD-40 Company are still pricey. Having said that, investors would be unwise to underestimate a high-quality company with such significant brand value. To this day, I still view these factors as more or less balancing one another out. Of course, it was difficult to know that the company would underperform on its bottom line like it has. And part of the decline is likely a justifiable response to the drop in profits and cash flows. If management can come out and show signs of improvement, particularly on the bottom line, then investors will likely reward the company accordingly. But failure to do so could lead to more short-term pain.

Be the first to comment