niphon

Investment Thesis

Favorable industry dynamics including the new SEER2 regulation and the Inflation Reduction Act, are expected to benefit the Heating, Ventilation, Air conditioning, and refrigeration (HVAC/R) distribution industry. While SEER2 should benefit the HVAC/R industry with higher ASP leading to higher revenue and profits, the Inflation Reduction Act should increase demand for higher efficiency products that qualify for the rebate and tax credits. Being the industry leader in the HVAC/R distribution industry, Watsco, Inc. (NYSE:WSO) is poised to benefit from these tailwinds. Additionally, the company’s technology investment is expected to help in customer acquisition and retention, resulting in higher market share. Watsco is currently trading below its 5-year average forward P/E. Watsco’s reasonable valuation and good growth prospects make it a buy.

Favorable Industry Tailwinds

Watsco reported $2.04 billion in revenue for Q3 2022, up 14% year over year. Sales of HVAC equipment (which make up 69% of total sales) increased by 13%, while sales of other HVAC products (27% of total sales) and commercial refrigeration products (4% of total sales) increased by 15% and 18%, respectively.

The third-quarter sales reflect normalized residential HVAC equipment volume and higher price realization with increased adoption of higher efficiency products. Sales of higher-efficiency products increased 26% Y/Y compared to an overall growth of 14% in the quarter. Notably, the company was able to post good last quarter results despite Hurricane Ian impacting sales in Florida, the largest market for Watsco.

Looking forward, under the SEER2 framework, the federal government is mandating the use of HVAC systems that adhere to an enhanced minimum efficiency level in terms of power consumption. In addition to raising the minimum efficiency, the new regulation, set to be effective in 2023, will increase the average selling price of entry-level systems. Moreover, another such regulation for refrigerants would come into effect in 2025. Historically these regulations increased the cost of service and repair of phased-out systems, which encouraged the consumer to replace them with new ones. The new regulations are expected to raise the average selling price by almost 10-15% in the next few quarters and around half of the company’s outdoor equipment sales are expected to benefit from this mandatory regulatory requirement.

Additionally, demand for higher efficiency products such as variable-speed HVAC systems and heat pumps is expected to rise with the Inflation Reduction Act of 2022. The federal law will provide tax credits for homeowners who install qualifying HVAC equipment and tax deduction for owners of commercial buildings that are upgraded to achieve defined energy savings. Moreover, this act would also fund state-administered consumer rebate programs worth $4.3 billion.

So, Watsco is expected to benefit from favorable regulatory actions and the progression of the industry toward higher efficiency products resulting in higher average selling prices for the company, and this should act as a meaningful tailwind for the company’s revenue in the coming years. In addition, the company also is a secular market share gain story in the fragmented HVAC/R distribution industry which should support revenue growth.

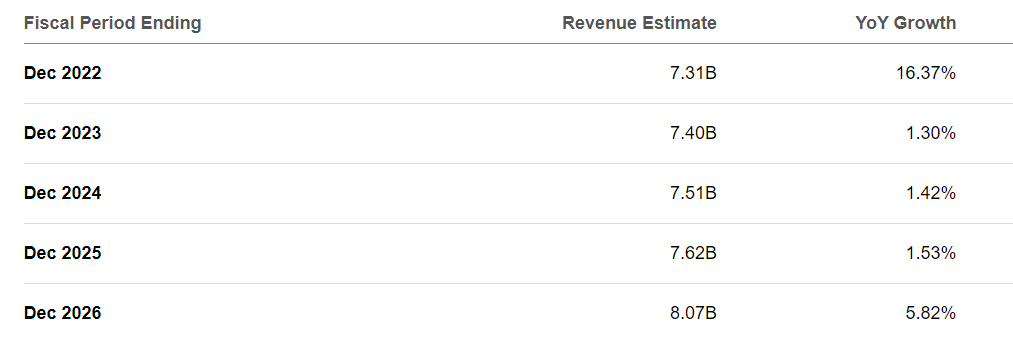

If we look at the current sell-side consensus estimates, they are building in a modest low single-digit growth for the next few years.

Watsco Consensus Revenue Estimates (Seeking Alpha)

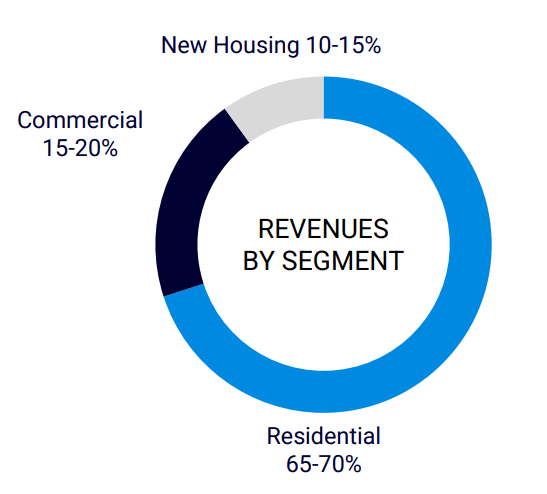

Their main concern appears to be the macroeconomic slowdown and rising interest rates which are impacting new home sales. However, new home sales are just 10% to 15% of the company’s total sales. Residential repair and remodel accounts for ~65% to 70% of the total sales while the remaining 15% to 20% comes from the commercial sector.

Watsco Revenue by End market (Investor Presentation)

Residential repair and remodeling demand is much less cyclical and one has little choice but to repair their HVAC system if there is any fault. Also, on the commercial side, with the economy reopening and people going out, I am optimistic about the demand outlook.

Given the SEER 2 mandates and associated pricing benefits, I believe the company can post much higher revenue growth (likely in the mid to high single digits) in FY2023 as against the low single digit which the sell-side is modeling.

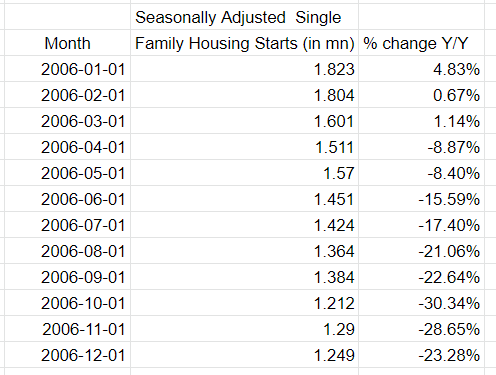

I believe the current situation can be compared to 2006 when the previous SEER regulations were implemented. At that time housing market also started correcting and the correction became much steeper as the year progressed.

Single Family Housing Starts in 2006 (Census.gov, GS Analytics Research)

However, benefits from SEER mandate more than offset the new housing slowdown and the company reported strong sales and same-store sales in each quarter. In 2006, same-store sales was 14% in Q1, 15% in Q2, 5% in Q3, and 6% in Q4.

Margin Outlook

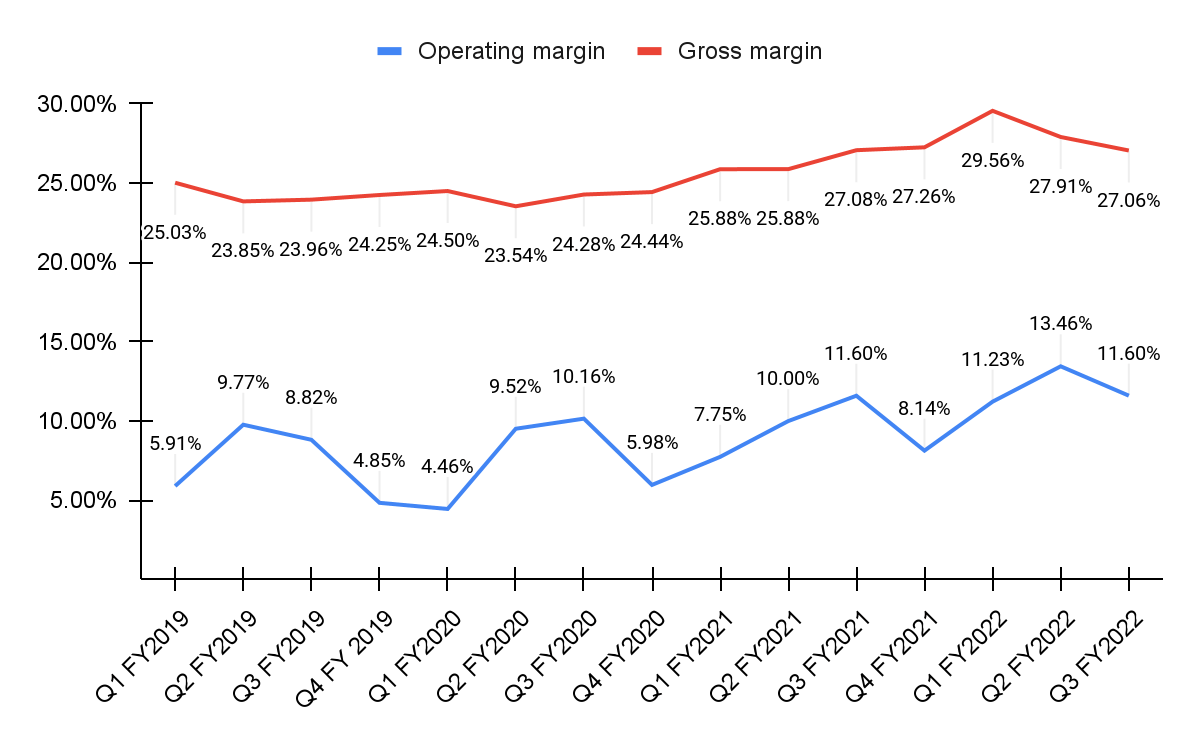

During the third quarter of 2022, the company realized lower rebates and discounts on purchases which put downward pressure on its gross margin. Additionally, freight and transportation costs were up from the year-ago quarter due to the lesser availability of goods which resulted in more inter-store shipping of goods from the stores which have the particular good to the store which needs it. Both lower rebates and higher transportation costs resulted in flat gross margins at 27.1%, even though the selling margin [ defined as (selling price – purchase price of products) divided by selling price] rose 80 basis points (bps) year over year. SG&A, as a percentage of revenue, remained flat Y/Y reflecting higher investment in human resources and increased technology spending to increase market share. Meanwhile, supply chain disruption and inflationary pressures resulted in higher variable operating expenses and temporary labor and other costs. Flat gross margin and SG&A as a % of revenue led to a flat operating profit margin of 11.6% in the quarter.

Watsco Gross and Operating margin (Company Data, GS Analytics Research)

Looking forward, transportation cost is expected to normalize with easing supply chain issues and better availability of goods. This should help gross margins. Management’s long-term gross margin target is above 27% which, in my opinion, the company should be easily able to maintain. Further, SG&A, as a percentage of revenue, should decrease with higher sales leverage due to a rise in revenue. This should help the operating margin. If we look at the current consensus estimates, they are expecting a gross margin of 26.7% in FY23. I believe they are too conservative. I don’t see a reason why gross margins should sequentially worsen from Q3 2022 levels when there is a tailwind from lower freight costs and easing supply chain constraints. So, I believe there is a good chance that the company’s reported margins may positively surprise the street next year.

Technology Investments Aiding Market Share Growth

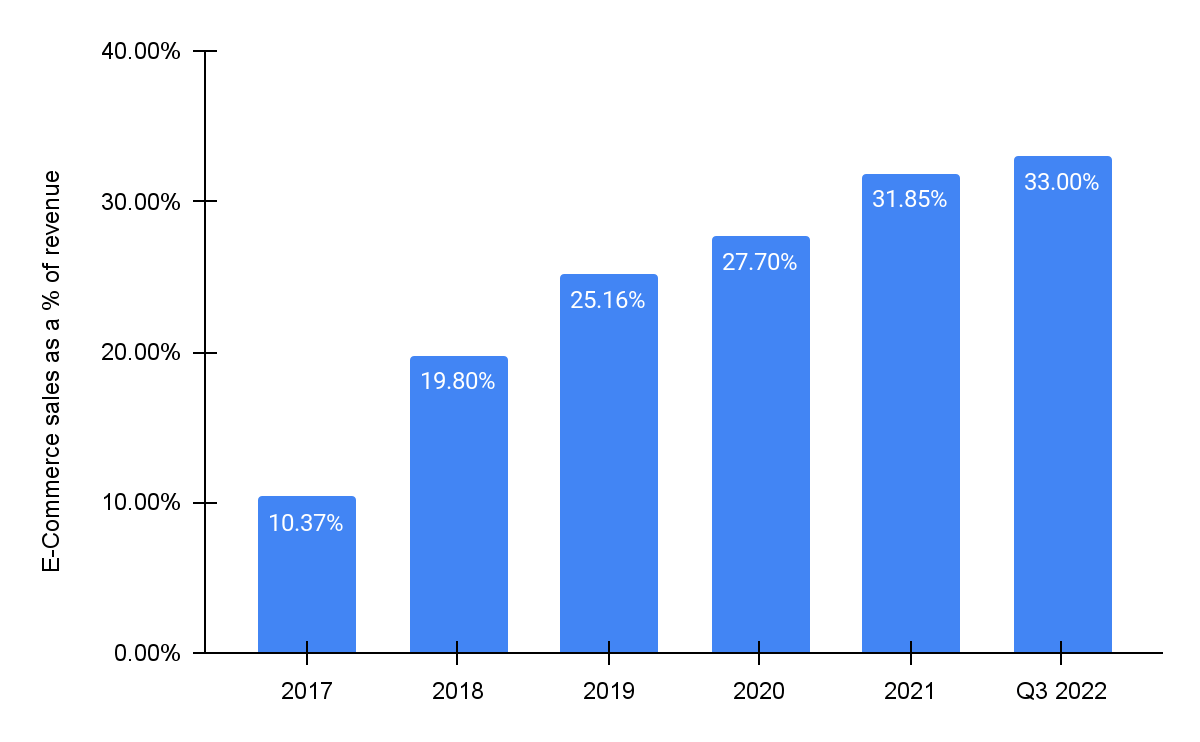

Watsco recorded $2.3 billion in e-commerce sales in the past 12 months. Notably, E-commerce sales expanded 22% so far in 2022, outpacing the organic sales growth rate of 17%. E-commerce sales now account for 33% of total sales inclusive of revenue from acquisitions.

Watsco’s e-commerce sales as a % of total revenue (Company Data, GS Analytics Research)

The company’s digital sales platform OnCall Air increased penetration among HVAC/R contractors as more customers engage digitally. During the third quarter of 2022, contractors gave 66,000 quotes via OnCall Air which grew 39% over last year. This generated a gross merchandise value of $269 million. Additionally, Watsco’s contractor-assist mobile application, which provides critical information to contractors to improve their speed and profitability, grew its user community by 21% year to date to 45,000 users.

Looking forward, Watsco’s technology investment should assist in acquiring new customers and retaining current customers, facilitating market share growth.

Valuation

The stock is currently trading at a P/E 18.80x 2022 consensus EPS estimate of $14.04 and 19.81x 2023 consensus EPS estimate of $13.32, which is at a significant discount to its five-year average forward P/E of 26.72. Watsco’s attractive valuation and positive industry dynamics make it a good buy at current levels. Further, I believe the sell-side estimates are too conservative and should see a significant upward revision as 2023 progresses. This should also help in the upward re-rating of the P/E multiple and act as a catalyst for the stock’s outperformance.

Risks

Watsco sources ~63% of its products from Carrier Global (CARR) and ~83% of its products from the top ten suppliers. So, how these suppliers handle and execute SEER2 transition may also impact Watsco’s results. So far things seem to be transitioning nicely and CARR’s management also talked about a 10% to 15% increase in pricing for the next-generation products but if there are any issues at the supplier end it might impact Watsco’s results as well. Watsco also faces a lot of competition and if a player with much higher resources like Amazon (AMZN) enters the industry, it may pose some risks. There may also be a risk to my gross margin expectations if supply chain conditions start worsening again. Further, if my assumptions ended up being too optimistic and the SEER2 regulations ended up providing less lift up to the sales or the housing slowdown resulted in more than anticipated headwinds, the stock may end up underperforming.

Conclusion

Watsco is set to benefit from the implementation of SEER2 regulations next year. If we look at the current sell-side estimates, they are building in low single-digit growth for the next year and they seem to be worrying about a housing slowdown. However, I believe the regulatory tailwinds will help the company more than offset the housing slowdown akin to what happened in 2006. Also, the company’s gross margin might sequentially improve if the supply chain constraints continue easing and sell-side estimates on margins appear conservative as well. Given these potential catalysts and lower than historical valuations, I believe Watsco’s stock might outperform in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment