Maximusnd

We are now watching the Federal Reserve to see whether or not it sticks to its “tightening” policy.

The Fed has started.

As I wrote last week in my weekly Federal Reserve Watch post

“So far, what the Fed is doing is consistent with what they have been saying.”

The big issue: will they stick to it?

Many investors in the stock market do not believe that the Fed will “stick to it.”

That is why the stock market has been so volatile this year.

Investors just don’t believe the Fed will keep up its “tightening” effort over an extended period of time.

But, this is seemingly the way the Federal Reserve conducts policy these days.

It All Started With Bernanke

To explain this behavior, however, it is necessary to go back to the beginning… that is, the beginning of this new policy approach.

Ben Bernanke, when he was the Chair of the Board of Governors of the Federal Reserve System, introduced a “new way” of conducting monetary policy.

Previously, the Fed had primarily changed its policy rate of interest to either loosen up or, tighten up its monetary policy stance.

But Bernanke changed all that.

Mr. Bernanke believed that the best way to conduct monetary policy was by creating “a wealth effect.”

And, to create this wealth effect he focused upon the stock market.

Mr. Bernanke’s idea, back during the Great Recession, was to use monetary policy to generate rising stock prices. These rising stock prices would create a wealth effect that, over time, would result in people spending more money, and this spending would generate and sustain an economic recovery.

This is exactly what Mr. Bernanke did, and it is this monetary policy that generated the foundation for the longest period of economic expansion since the Second World War.

But, stock prices are volatile. Investors respond to the slightest bit of information and can rise or fall if, for any reason, they believe that they need to alter their position.

Therefore, to follow this kind of policy, the Federal Reserve needed to announce its policy of buying (or selling) securities from its portfolio so as to stabilize expectations about what they were doing.

Expectations needed to be stabilized so that investors would continue to stay in the market if the Fed was trying to follow an easy monetary policy.

And, this is exactly what Mr. Bernanke did. Mr. Bernanke’s efforts were captured in the phrase “quantitative easing.” Mr. Bernanke conducted three rounds of quantitative easing during his tenure as the Fed chair.

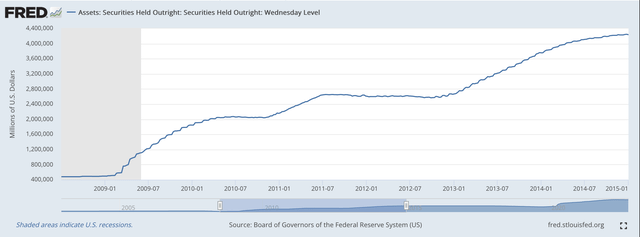

These three rounds can be easily decerned in the following chart showing the Fed’s securities portfolio.

Securities Held Outright (Federal Reserve)

The S&P 500 Stock Index followed right along.

S&P 500 Stock Index (Federal Reserve)

The Federal Reserve, under the leadership of Chairman Jerome Powell also did a similar thing.

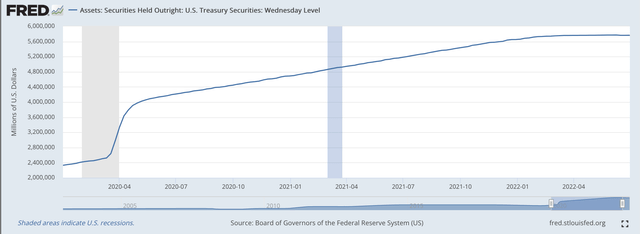

In early 2020, Mr. Powell committed the Federal Reserve to purchase $120.0 billion of securities every month to protect the United States’ financial and economic system from catapulting into a national disaster.

Mr. Powell succeeded in preventing such a disaster. The regular monthly purchases continued from March 2020 to the end of December 2021.

Here is the chart.

Securities Held Outright (Federal Reserve)

The S&P 500 Stock Index followed right along hitting one new historical high after another up to January 3, 2022, its last historical high.

S&P 500 Stock Index (Federal Reserve)

Investors “followed the Fed.”

And, Now

The Federal Reserve is now trying to move in the other direction.

Its posted goal: to reduce the size of its securities portfolio by $95.0 billion per month.

But, the Fed has only started.

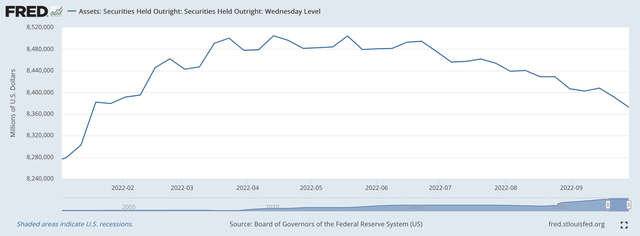

Here is the picture.

Securities Held Outright (Federal Reserve)

The peak amount of securities held by the Fed occurred on April 13, 2022, at $8,504.6 billion.

On September 28, the securities portfolio amounted to $8,372.4 billion.

The Fed’s securities portfolio had been reduced by $132.2 billion.

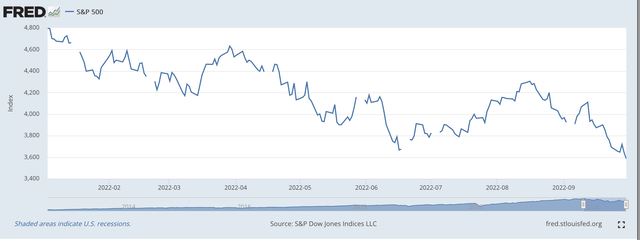

And, the S&P 500 Stock Index?

S&P 500 Stock Index (Federal Reserve)

Since hitting its historical high on January 3, 2022, the S&P 500 has trended downwards.

But, as can be seen from the chart, the downward move has not been very steady. There has been a lot of volatility in the market over this period of time.

The conclusion: investors are not fully with the Fed at this particular point in time.

That is why the Fed must “stay the course” on its announced buying schedule.

This is how monetary policy is conducted these days.

The Fed is trying to create “a wealth effect,” this time in a downward direction.

To do so, it must keep stock prices declining for a substantial period of time.

In our previous two examples, the Fed had to maintain its quantitative easing for at least a couple of years.

The Fed had to get the market “following the Fed.”

Right now, that is not happening.

So, to achieve any kind of credibility, the Fed must stick to its plan to reduce the size of its securities portfolio.

My guess is that trying to reduce the size of the Fed’s securities portfolio will not be as easy as trying to increase the size of the Fed’s securities portfolio.

But, to create the appropriate “wealth effect” it is going to have to sustain reducing the portfolio for quite some time.

This is what investors must observe.

The Third Time Around

So, this is the third time around for the Fed to focus on creating a wealth effect to produce a successful monetary policy.

The Fed has all sorts of issues to face in reducing the securities portfolio, issues that it did not have to face in the same way when it was increasing the size of its securities portfolio.

This is not going to be an easy job, and lots of things could happen between now and the end of the program.

The one real danger is that it is easier to create a program of quantitative easing when protecting against an unexpected downward shock to the markets.

Stripping the financial system of reserves as the Fed tightens policy can only leave the effort exposed to further downward shocks.

In other words, it is easier for the central bank to err on the side of monetary ease when pumping liquidity into the system. If you are erring on the side of monetary ease when you are trying to reduce the liquidity in the banking system…you are not really doing your job.

But, this is the “new” way the Federal Reserve is conducting its monetary policy. It creates wealth effects.

Be the first to comment