DOERS/iStock via Getty Images

Since initiating bullish coverage on ClearSign (NASDAQ:CLIR) almost two years ago with a strong buy rating, CLIR stock could not break out of a perpetual downtrend. Shares traded at $4.00 in July 2021 and kept falling. Other than the occasional “rip,” rallies faded. Speculators bet that Chief Executive Officer Jim Deller would finally announce Exxon (XOM) validating its clean energy projects. Instead, the firm needed to recognize $712,000 in expenses for the Exxon project. It announced a common stock offering on May 26, 2022, further pressuring the stock to a low of $1.05 on June 16, 2022.

As its market capitalization shrinks to $42 million at the time of writing, what are ClearSign’s prospects from here?

Highlights from the First Quarter of 2022

Investors need to watch a company’s cash burn, cash balance, and negative earnings when they are in a pre-revenue phase. In the last quarter, ClearSign posted a 5-cent loss per share on a GAAP basis. It ended the quarter with $6,667,000 in cash and cash equivalents. The firm burned through approximately $1.5 million in the quarter. This is consistent with last year’s cash burn rate.

The company improved its net loss to $1.5 million, $500,000 better than last year. It cut staff costs and restructured its compensation plan for its Board of Directors. It also raised around $614,000 in the quarter by selling ~ 496,000 shares at an average price of $1.24 a share.

In its June 1 underwriting, ClearSign raised around $4.2 million by issuing 4.186 million shares. Importantly, the firm should have enough cash to operate until 2024.

Key Developments

In May 2022, the Department of Energy awarded ClearSign with a grant to develop a hydrogen-fueled ultra-low NOx process burner. The initial funding is worth $250,000. The project will last six months. It started at the end of June 2022. The project would enable the adoption of hydrogen fuel for industrial heating. Although carbon dioxide and nitrogen oxide decarbonization reduction is critical for clean energy solutions, the industry has other priorities.

The lack of investments in U.S. energy market infrastructure weakens the country. It increases its reliance on energy imports. Potential clients are deprioritizing clean energy initiatives. Fortunately, the Department of Energy’s involvement enables ClearSign to continue finding solutions to reduce CO2 and NOx emissions.

ClearSign is hopeful that its Core Process Burner technology will allow burners to burn fuels having up to 100% hydrogen while cutting NOx emissions. If successful, the Department of Energy will grant the company up to $1.6 million in the Phase 2 work. This phase of the project is for two years.

In January 2022, ClearSign launched and successfully demonstrated its California Boiler. A third-party source confirmed the burner’s performance that month. CLIR stock bottomed at the time and staged a rally to $1.80 in April.

Weak stock market conditions, led by the S&P 500, ended ClearSign’s rally. Small capitalization companies fared worse.

Exxon Updates Absent

On Sept. 3, 2021, ClearSign said it received a verbal notification from ExxonMobil which put on hold the testing of its ClearSign Core process burners. ExxonMobil reasoned that it did not have enough time to include the installation at its Baytown, Texas refinery in 2022.

Worryingly, the company did not post any discussion updates since last year’s announcement. After nearly a year, investors may speculate that ClearSign is due to issue a news release on any developments by September.

Delays in China

China locked down Shanghai for nearly two months. During the downtime, ClearSign continued project work activity. For example, it plans to certify the watertube boiler for the Beijing Heating Group.

Although it re-opened in June by loosening its Covid restrictions, the country is increasing lockdown efforts countrywide. Still, once Chinese government officials return to work, they will process visas for ClearSign’s personnel. As a result, the company will continue certification efforts for its 500-horsepower midrange fire tube boiler burner.

Other Risks

Markets are losing interest in ClearSign’s project results. Speculators may blame weak stock market conditions for the stock’s decline. However, the company had almost two years to obtain certification for its boiler burner. This would result in its first major supply deal. Without any revenue, shareholders are justifiably concerned that the company will run out of money.

ClearSign has enough cash until 2024. It may need to raise more cash to cover operations should it win a supply deal.

Stock Scores

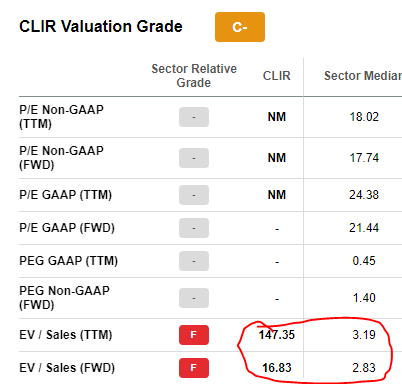

Seeking Alpha has limited data to formulate a stock score. Based on its EV/sales data, the stock’s valuation grade is a C- as shown below.

Seeking Alpha Premium

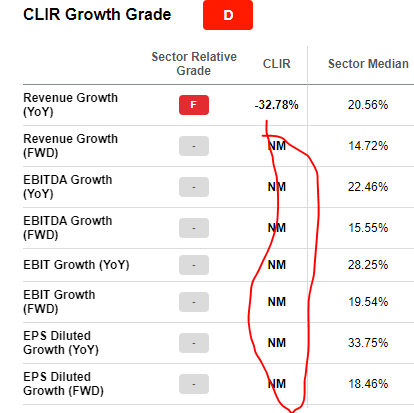

With no revenue, investors cannot estimate its future sales growth. Notice the missing data below in formulating its growth score.

Seeking Alpha Premium

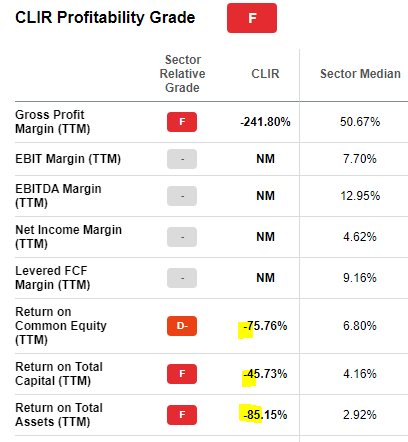

ClearSign is nowhere close to profitability. It scores an F:

Seeking Alpha Premium

The company’s future depends on customers wanting to use its products and incorporate them into their heaters. Still, CEO Jim Deller said “the review of their capital projects is still ongoing. And as I mentioned in the script, we have to be a little patient and wait for the outcome of that.”

The CEO is optimistic. He said the project testing went extremely well. For now, investors are willing to wait for the outcome of the project review. News that ClearSign may demonstrate the burners in the field would lift the stock.

ClearSign’s Chart

According to finviz, CLIR stock indicated a multiple bottom at current levels.

Blue line indicates ‘multiple bottom’ or a support price (finviz)

This suggests that buyers are buying shares from here. To rally from here, ClearSign needs a catalyst. Any major announcement with a customer would likely be enough to send the stock higher.

Be the first to comment