Vera Shestak/iStock via Getty Images

Introduction

Despite suspending their special dividends, the steel-focused coal company, Warrior Met Coal (NYSE:HCC) still saw prospects for their massive special dividends to come back in the future, as my previous article discussed. Since more than half a year has subsequently elapsed, this article provides a refreshed analysis that reviews their updated outlook, which sees investors effectively able to buy now and receive a 10% to 20%+ refund within the next thirteen months despite their very low dividend yield of only 0.63% months, as their special dividends finally return once again.

Executive Summary & Ratings

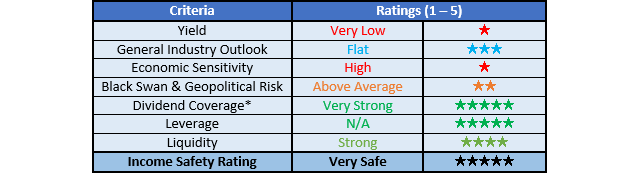

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

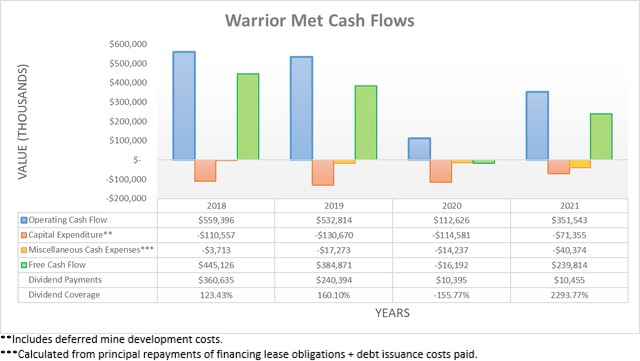

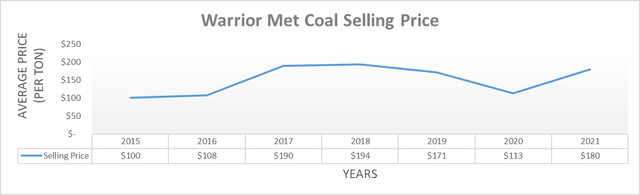

After seeing their cash flow performance demolished during 2020 by the now infamous Covid-19 pandemic and its resulting severe downturn, thankfully, their operating cash flow started recovering during 2021. This saw the year finish with a result of $351.5m, which was more than three times their previous result of $112.6m during 2020 and beginning to push back towards their pre-Covid-19 results of circa $550m during 2018-2019. It also marks an improvement versus their earlier result of $45.2m seen during the first quarter of 2021 when conducting the previous analysis, as their full-year results equate to a circa $90m per quarter run rate and thus essentially twice the rate as where it started the year. Their improvements during 2021 were driven by higher metallurgical coal prices more than offsetting their 15% year-on-year sales volume decrease versus 2020 that resulted due to strikes, as per slide four of their fourth quarter of 2021 results presentation and the graph included below.

It can be seen that their selling price during 2021 was $180 per ton, thereby broadly equally their results during 2018-2019 and thus helping offset their lower sales volumes. Since their production decreased almost twice as much during 2021 at 29%, it indicates that their future sales volumes could suffer more considerably during 2022 if this strike remains unresolved, as they boosted their sales volumes during 2021 by running down their inventory. Unfortunately, there appears to be little news of this strike ending with the one-year anniversary passing recently, which further compounds the normal uncertainties inherent with notoriously volatile commodity prices and contributes significantly to their special dividends remaining postponed despite otherwise increasing their fixed dividends by 20%, as per the commentary from management included below.

“It’s a possibility, we named a few factors that we want to get a little more clarity on, such as what we think the market will look like for the rest of the year. As we said, look, with the Chinese coming back after the new year in Olympics, want to see exactly what kind of policies and impact on the markets they may have. The strike as well and taking an over look at developing Blue Creek, that data is about two years old on Blue Creek and we want to pull together a refresh on the total cost of that project and the metrics and everything and see if that still makes sense. And so once we get a little clarity on those things, I think we will — we may have a change or an update on our capital allocation policy. We did up — or increase the quarterly dividend 20%, which was a small change, but still very good for us.”

-Warrior Met Coal Q4 2021 Conference Call.

They traditionally declare their special dividends during the last week of April, which is merely weeks away as of the time of writing, and given the recent language from management, it seems unlikely that 2022 will see any special dividends. Whilst I nor anyone can accurately predict when this strike will be resolved, thankfully, it remains possible to estimate their capacity to fund special dividends once they resume, which appear alike to a coiled spring after years suspended.

Due to the very strong operating conditions within commodity markets, especially steel where their metallurgical coal is utilized, it seems safe to assume that their operating cash flow for 2022 roughly matches their results from 2021, thereby providing a conservative outlook with a margin of safety given their ongoing strike. Since their operating cash flow was $351.5m during 2021, it would leave circa $250m after funding their capital expenditure guidance for 2022 of $100m at the midpoint, as per their fourth quarter of 2021 results announcement. This would leave their estimated free cash flow at circa $210m once subtracting their miscellaneous cash expenses, which were $40.4m during 2021 and mostly relate to their finance lease obligations, as listed beneath the first graph included above. Despite boosting their fixed dividends by 20%, these remain relatively immaterial at only circa $12m per annum, thereby leaving at least circa $200m of excess free cash flow after dividend payments for 2022, which could easily grow higher if their strike is resolved and production increases.

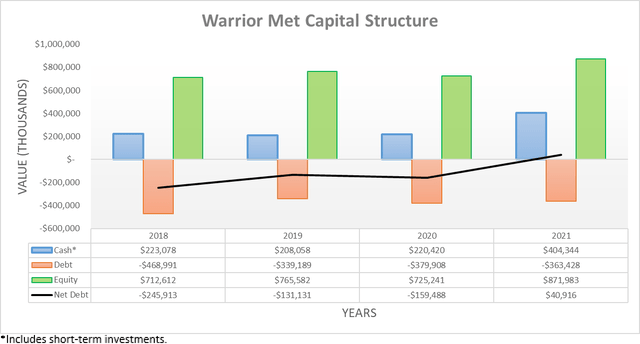

Following their lack of special dividends since conducting the previous analysis, their net debt has now been completely eliminated with 2021 ending with a net cash position of $40.9m as their cash balance swells to $404.3m and thus essentially double their usual circa $200m balance during 2018-2020. This means that assessing their leverage in detail would be pointless, and when looking ahead, they have no handbrakes placed upon their ability to return cash to their shareholders when management feels more confident.

Whilst it remains to be seen exactly how much capital management directs towards their special dividends once they finally resume in the future, in my view, it seems reasonable to expect their cash balance will be returned to its historical average of circa $200m that management traditionally held across the years. If resumed at the end of this month, this would see circa $200m returned, which on their current market capitalization of approximately $1.96b would see a very high dividend yield slightly above 10%. On the other hand, if they wait another year until April 2023, their cash balance should increase at least another $200m, if not even more, given their previously discussed cash flow outlook, thereby seeing their capacity for special dividends swelling to $400m and thus providing a massive 20%+ yield on current cost within as little as thirteen months from now.

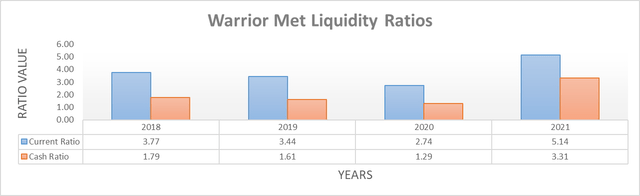

Quite unsurprisingly, their cash build sees their liquidity further improve with their current and cash ratios now sitting at 5.14 and 3.31 respectively, thereby easily warranting a strong rating. Until such time as they return their latent excess cash via special dividends, their resulting net cash position means that there are zero concerns over their future debt maturities or ability to access capital from credit facilities.

Conclusion

Whilst not ideal for shareholders to be left without special dividends for the past two years, thankfully, they have built up the capacity to fund massive payments with their cash balance doubling from its usual level. Regardless of whether this comes through one payment soon during 2022 and another during 2023 or one massive payment during 2023, investors can effectively buy now and expect to receive a 10% to 20% refund within the next thirteen months. Since this sees their shareholder returns alike to a coiled spring, I believe that upgrading to a buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Warrior Met Coal’s SEC filings, all calculated figures were performed by the author.

Be the first to comment