JHVEPhoto

(This article was in the newsletter on September 9, 2022.)

Warner Bros. Discovery, Inc. (NASDAQ:NASDAQ:WBD) management just gave a presentation at a “roadshow.” These presentations are designed to clarify exactly how execution of the management strategy will occur. It is particularly important to have a vehicle to add certainty to market expectations at a time when impairments appear to be leading to market uncertainty about the original merger assumptions.

This particular presentation probably could not have come at a more opportune time. It very much helped to delineate what management can control and what is beyond the control of management. One of the things that always surprises the market is how good management finds ways to meet goals in spite of preconceived hurdles that prevent such an occurrence.

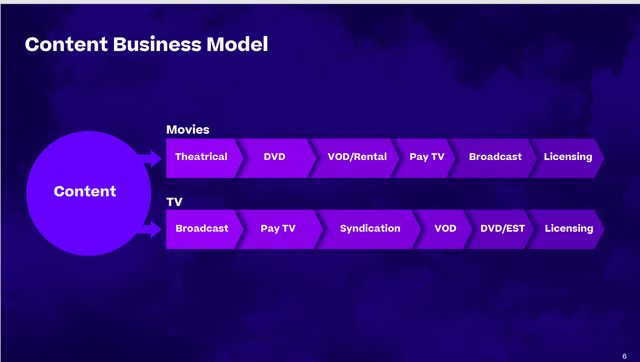

Delivery Diversification

This management believes that streaming should not be the main delivery tool for the future. This actually is kind of similar to the thinking that online purchases added yet another channel to sell to customers but did not completely replace traditional ways to sell to customers. To this day, I personally believe that will remain the case for a very long time to come. Some of us enjoy the shopping experience yet we order online as well.

Warner Bros Delivery Strategy Sumarized (Warner Brothers Presentation September 2022.)

For me, the answer to all those that think streaming should be the only consideration is something like the above. There is absolutely no reason to throw away existing distribution channels. As Kathryn Rudie Harrigan describes in her book “Strategies For Declining Businesses,” there are several ways for that decline to occur. Probably the most lucrative of the possibilities is a slow and predictable decline rate that generates a cash flow that can be used profitably elsewhere. It generally costs a business nothing to remain in an existing sales channel to find out what the future holds.

I have seen too many businesses “dump” an existing line to head towards the preconceived future only to find out the future is very different. At least with the above strategy, management can still pivot as the future unfolds without eliminating cash flow opportunities that exist in the short and intermediate term. This strategy could well exist in a different form well into the future. Even if it does not, a lot of us like the theater experience from time to time just as we like to go shopping even though there may be an “at home” alternative.

Streaming

Probably the key attitude is a quote from the presentation: “But at the end of the day, what doesn’t get measured doesn’t get managed.” as stated by Gunnar Wiedenfels during that presentation. (As a side note, I come from an industry that does not measure because it probably does not know how to measure, which results in little to no change.)

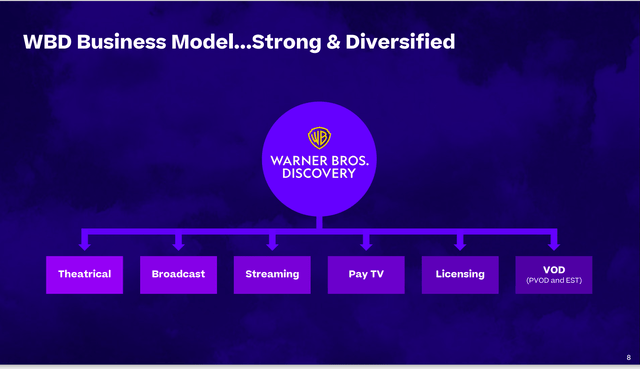

Warner Bros Discovery Corporate Structure (Warner Bros Discovery September 2022, Corporate Presentation)

This model not only reinforces the above ideas, but it also strongly implies some very strict cost controls on content that currently appear to be lacking with many competitors.

Management has a goal to reduce losses starting in the next fiscal year in the streaming segment. Whether or not they succeed will depend upon industry streaming conditions. But management can control the number of benefits from streaming that flow through to the other divisions. Such a “flow through” could more than offset the streaming losses to increase company profitability even though streaming loses money.

That also implies that the streaming profitability outlook for the industry could be worse before it gets better. The market has long felt that streaming was going to “print money.” Yet the initial management forecast really is a nice way of denying that vision for the time being. In fact, increasing competition is far more likely (and out of management’s control) in the short-term.

Adjusting The Vision Of The Market

“The other one is the streaming landscape that has changed quite significantly and we’re — I guess the company was set up on a track that was assuming very different assumptions for the evolution of that business, not only for WarnerMedia, but for the entire industry.”

Source: Presentation of Warner Bros Management At Conference.

One of the reasons for the structure and strategy shown before is that it provides a possible way to a profitable future in streaming as the other more generous market visions fade towards the reality of increasing competition.

Disney (DIS) has proven that established franchises provide a far greater chance of profitable success than is the case for movies in general. Prequels and other related movies (to those franchises) appear to be the future of movies with a few “chances” from time to time.

This is bad news for a company like Netflix (NFLX) that appears to be dedicated to a dependency of hits. Back in 2016, I wrote that one of the basic principles of the public offering of the company (the virtuous circle) apparently no longer held. That still appears to be the case.

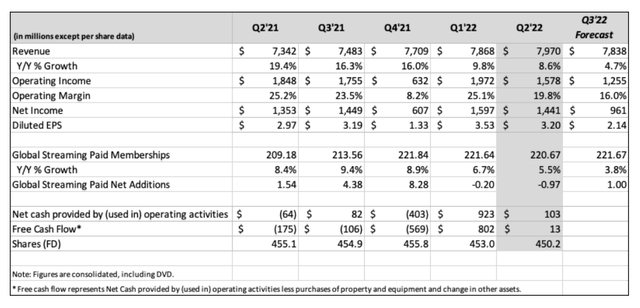

Netflix Summary Of Financial And Operational Results Second Quarter 2022 (Netflix Shareholders Letter Second Quarter 2022.)

The company only reported significant cash flow in one quarter of the five shown above. It appears that the only time the company generally generates any cash flow is when they are not making new content or acquiring new content. This situation is unlikely to improve given the quote above from Warner Bros Discovery management.

The big drop in the net cash provided by operating activities shown above likely confirms the statement made by Warner Bros Discovery management because this company represents a pure play on streaming.

Integrated companies like Warner Bros Discovery and Disney have other ways to make money off content, as shown in the corporate structure above. Clearly Netflix does not. Increasing competition does not speak well for future cash generation even if management guides to the contrary.

Investors need to remember that the cure for extremely good profits is extremely good profits. Basic economic theory holds that more companies will enter an area of outsized profitability until that profitability comes into line with other profit prospects. That should be the case here to the disadvantage of Netflix.

Further confirmation of this comes from the licensing by Amazon (AMZN) of the “Lord Of The Rings” rights. This is in addition to Amazon purchasing a studio. Amazon appears to likewise be taking the stand that streaming by itself may not be a profit center that justifies investment. Warner Bros Discovery, for their part, apparently thinks there are better profit opportunities for the amount of money received. Time will tell how this works out.

The Future

The strategies of companies like Disney, Warner Bros Discovery, and even Amazon appear to indicate that an independent streaming service like Netflix is less likely to succeed. If it does succeed at all, it will likely succeed as an online television channel. But then it would face additional competition from established entities (of which there are far too many to list). That makes Netflix much too overpriced for such a future. Other television outlets do not have a value anywhere near the valuation of Netflix.

On the other hand, the most likely integrated survivors are Disney, Warner Bros Discovery, and possibly Amazon. These companies have several ways to make money from content, of which streaming is one way.

Clearly, the landscape changes in streaming are out of the control of these companies. But companies like Warner Bros Discovery have a lot of flexibility through integration to deal with market changes. That enhances the long-term chances of success for shareholders. The intention of management to strictly measure (results) as the company evolves also implies very good cost controls that are likely to result in above average profitability. One cannot find profitable niches (or manage superior execution) without a lot of measurements.

Be the first to comment