Mike Coppola

(Note: This article appeared in the newsletter on August 14, 2022.)

Warner Bros. Discovery (NASDAQ:WBD) is a stock that just got punished for following through with the first quarter guidance. Investors should have realized that terms like “noisy” and “no free cash flow” that were mentioned in the first quarter conference call implied a thorough housecleaning once management actually got control of the acquisition and did a thorough review of operations. As an investor, anyone with experience should have focused on this part of the management discussion rather than:

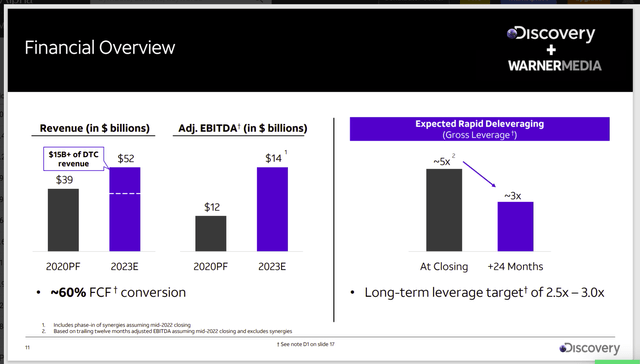

Warner Bros. Presentation Of Post-Acquisition Finances (Warner Bros. Discovery Of Acquisition From AT&T)

David Dreman, in his book “Contrarian Investment Strategies: The Psychological Edge“, has noted (as have several other authors I follow) a tendency of investors to over-rely upon numbers to the point of total thinking process elimination. The numbers given so over-dominate Wall Street thinking to the point that they are used well past the point they were intended.

The numbers above were given by a management that saw financials without really being able to review the business as they could once, they gained control of the acquisition. It was a best estimate of the business that an “educated” outsider could give. Given some of the other management descriptions at the time, an upward adjustment to those estimates would have been unusual to say the least.

Surely one would have expected a much better estimate to be given once management thoroughly reviewed the operations. The key warning was the zero free cash flow, and that zero free cash flow (which was an addition to the new entity) should have been compared to what the previous entity was reporting before the combined acquisition.

Everyone should have expected the bloodbath that became the second quarter report because no free cash flow in this industry is an unacceptable state of operations. Instead of applauding management for taking steps to “right the ship”, the market punished management.

Comparison To Netflix

This points to management needing to manage market expectations with numbers. Netflix (NFLX) management in contrast managed to beat expectations of a horrible second quarter with less horrible results that managed to result in a stock price rally.

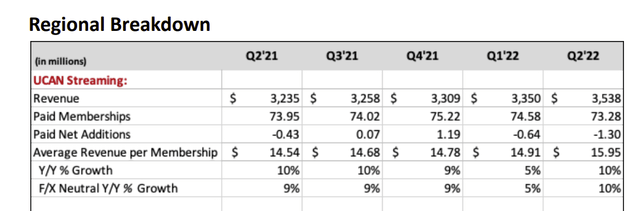

Netflix Report Of Second Quarter 2022, Paid Membership Trend (Netflix Second Quarter 2022, Earnings Press Release)

The first line of the earnings press release has the key words “better than expected”. That was what was needed for a stock price rally. The fact that the later third quarter guidance switched from a subscriber decline to a very inadequate growth was again seen as a positive. Management gets full credit for having the market focused on a positive direction even if the solution appears to not come close to supporting the current market valuation.

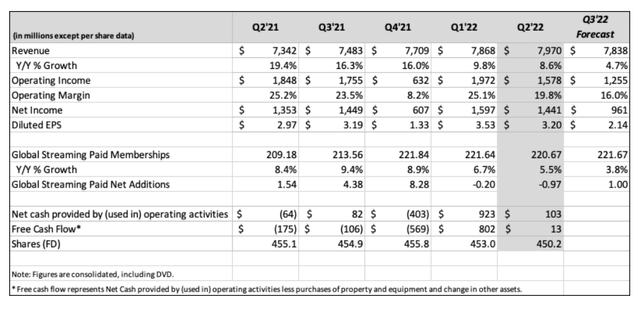

Netflix Second Quarter 2022, Operations Summary (Netflix Second Quarter 2022, Earnings Press Release)

What the market was clearly not focused upon was the lack of second quarter cash provided by operating activities as shown above. This company has failed time and again to consistently provide sufficient cash flow to really justify any stock price. The only time there was significant cash flow and free cash flow was in fiscal year 2020 when the company had to shut down operations.

The goal this fiscal year appears to be about $1 billion of cash flow (or maybe even free cash flow depending upon the source). But that was basically achieved in the first quarter. Lost upon the market is the lack of generation of cash flow despite the relative paucity of growth. Fast growing companies often have negative free cash flow because working capital grows with the company (as do fixed assets and sometimes intangibles). When there is little to no growth as there is now, then those companies should be expected by the market to generate a lot of cash. Clearly this company is exempt from that expectation because the market still expects “a pot of gold at the end of the rainbow”. I used to think hope was not an investment strategy. With this company I definitely have a lot of investors disagreeing with me.

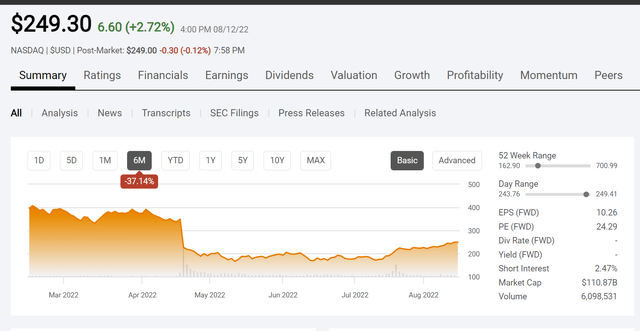

Netflix Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 14, 2022.)

As one can see from the chart, the stock price has been inching upward despite the market cap of $111 billion. Clearly investors are somehow expecting a miracle cash flow improvement to justify such a valuation. Even though that cash flow improvement has not come in the decades since the company went public, it becomes clear from the chart above that “hope springs eternal”.

It also points to the importance of management managing market expectations with conservative numbers. When the guidance first appeared that the company would lose subscribers in the second quarter, the stock price reaction was obvious. Yet often times, “the first loss is the best loss”. Hence it appears that management prevented a further stock price decline by managing things the way they did.

Warner Bros. Discovery Second Quarter

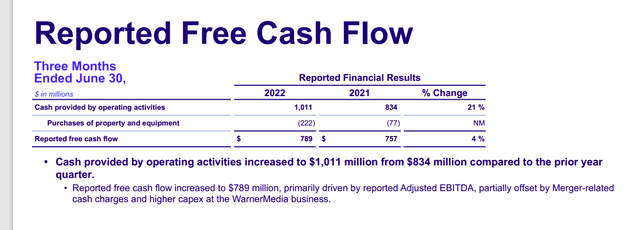

This company, in contrast, reported increasing free cash flow:

Warner Bros. Discovery Second Quarter 2022, Free Cash Flow Comparison (Warner Bros. Discovery Second Quarter 2022, Earnings Press Release.)

Despite the fact that the market cap is roughly one-third of the market cap of Netflix, the market reacted negatively because free cash flow was not the focus.

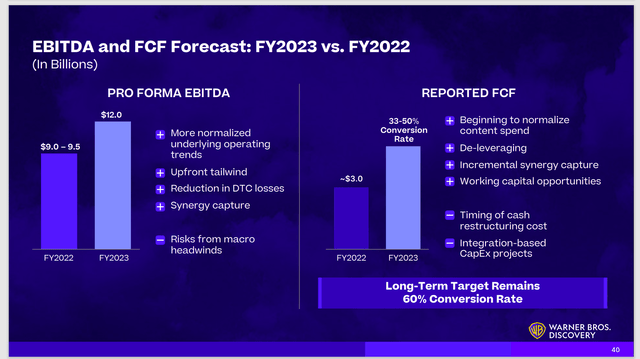

Instead, the market focused on a reduction in EBITDA guidance:

Warner Bros. Discovery EBITDA Guidance Post Merger (Warner Bros. Discovery Second Quarter 2022, Earnings Conference Call Slides)

Notice that the market was focused upon the downward revision of numbers despite the fact that the latest numbers are far more likely to withstand any more acquisition surprises that tend to come with large acquisitions. The first “best guess” that was shown above was exactly that, an educated guess. This latest guidance has far more solid grounding in that management is now actually managing the operations. All Mr. Market cares about though is that the numbers went down.

Of course, there is a risk of further losses and write-offs. But those are still likely to be non-cash charges of previously spent sunk costs. They represent a refocus of the statements upon what is likely to make money in the future.

The last thing that should not have shocked the market was the write-offs:

“Net loss available to Warner Bros. Discovery, Inc. was $(3,418) million, and includes $2,004 million of amortization of intangibles, $1,033 million of restructuring and other charges, and $983 million of transaction and integration expenses. “

Source: Warner Bros. Discovery Second Quarter 2022, Earnings Press Release

Much of what was written off is known in accounting as a sunk cost. That means that the money was spent while AT&T owned the company, but the current owner determined those “book costs” were not justified. Of that horrible sounding loss, over $3 billion of that loss does not involve a single current dollar spent. The remaining $983 million of transaction costs are highly unlikely to recur. But that means this whole loss is in the past and does not reflect anything about the future. Probably this loss was already figured into the purchase price.

None of this implies a downward revision of the earnings potential of the acquired assets. Instead, as noted before, it implies the remaining book value will generate that income.

No one should have expected an automatic improvement into a fantastic future. Yet the stock price reaction indicates otherwise.

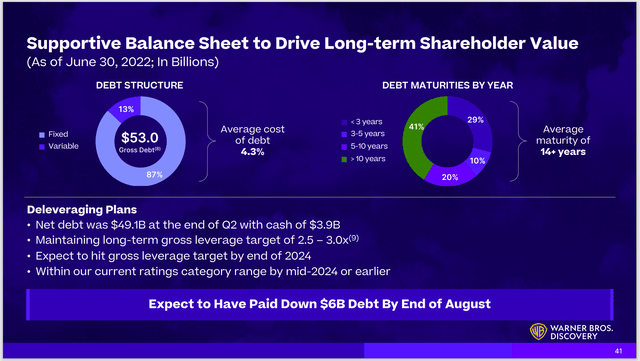

Warner Bros. Discovery Balance Sheet Guidance And Debt Payoff Guidance (Warner Bros. Discovery Second Quarter 2022, Earnings Conference Call Slides)

Clearly what management did was “take out the garbage” to unleash the potential free cash flow of the acquisition. Management still demonstrates that they have faith in the debt repayment. Mr. Market is concerned that the debt repayments are coming from the cash balance as opposed to that supposedly important free cash flow. More importantly, the free cash flow of the predecessor company (before the acquisition) will not carry the debt load in the eyes of the market and possibly the debt market.

But as the write-offs show, this management is quickly going to turn the acquisition into a free cash flow generating machine even if streaming is going to lose money. There are a lot of assets here that can generate earnings and cash flow to more than offset the streaming loss. The key was to not spend that cash flow upon low return projects (as was evidently the prior case).

The Future

This company generated free cash flow before the acquisition from AT&T. It managed to generate more free cash flow in a quarter with a lot of “noise”.

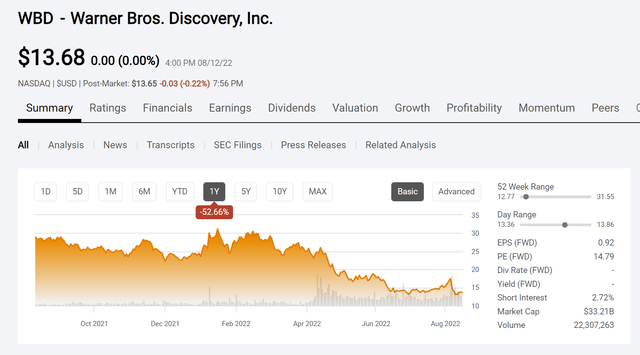

Warner Bros. Discovery Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 14, 2022.)

The market value of the stock combined with the long-term debt means that the enterprise value of the company is north of $80 billion. The annualized cash flow of the second quarter is at the rate of $3 billion. Like Netflix, that figure needs to increase to justify the current enterprise value. Unlike Netflix, this management is carving a pathway to get there. That is shown by the guidance to repay debt to a leverage level that was shown in a previous slide within two years.

The interesting thing to me is that the focus on the market of all the negative things and the downward revision of EBITDA also means to Mr. Market that the cash flow goal will not be met.

On the other hand, the very deft management of market expectations by Netflix implies that the market believes that cash flow starting at a much lower level will eventually support an even greater enterprise value than is the case for Warner Bros. Discovery. Another reason for this is that the Netflix management has long painted a cash rich future driven by ever more subscribers that will throw cash at the company’s great programming.

This, as David Dreman reports in his book, is a common assumption by the market that the good times will last forever. The same thinking process expects that there is more bad news to come from Warner Bros. Discovery for the foreseeable future. The stock is clearly priced that way too.

But Warner Bros. Discovery has a cash flow head start and far more profitable businesses to rely upon. Not spending that cash upon unfocused expenditures is an easy fix because the underlying cash generation will show within months (not years). Management noted a whole lot of “new initiatives” that cost cash flow but had no revenue that got canceled. That alone should set the stage for a material financial improvement within the next six months.

Netflix has nowhere to go for improvement except streaming. Nothing else the company does is anything close to as material to results as the programming for that streaming business.

As is usually the case, the company where expectations are low is likely to outperform (even if one bought near the higher stock price when the merger completed). That does not mean an investor should load up on any one company like this one. It does mean that a well-chosen basket of companies with low expectations like Warner Bros. Discovery is likely to outperform a favored stock like Netflix (or a basket of Netflix type stocks) over the next five years.

Be the first to comment