Erikona/iStock Unreleased via Getty Images

$85.4 billion, that’s how much AT&T (T) paid for Time Warner in 2016. $35 billion is how much Discovery was worth around its top last year. $12.4 billion was the size of Discovery’s market cap around the time of the recent merger, and the combined company Warner Bros. Discovery (NASDAQ:WBD) is trading at around $36 billion now. Wow, did you get all that? If we subtract Discovery’s market cap around the merger, Time Warner’s business is only worth around $23-24 billion. This valuation represents approximately a 72% drop from when Time Warner got bought out.

So, is Warner Bros. Discovery destined to fail? Why is this stock’s valuation so depressed right now? Could now be the time to step up and own this stock? Warner Bros. Discovery has around 100 million subscribers and offers some of the best online streaming services like HBO Max and Discovery+. Despite substantial growth prospects, WBD trades at only around ten times next year’s consensus EPS estimates. Furthermore, WBD has significant profitability potential, and the company should increase earnings substantially as we advance. As Warner Bros. Discovery continues to expand and grow EPS, its stock price should go significantly higher in the coming years.

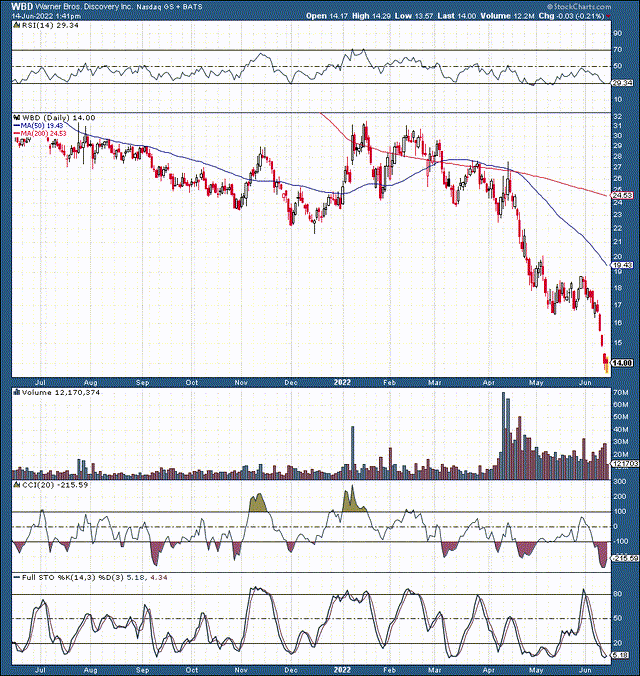

I’ve Seen Some Bad Charts, But Look At WBD

There is nothing pretty about this chart. It was a rocky ride for Discovery’s stock before the merger, and we’ve seen a sharp drop after the WarnerMedia deal. Warner Bros. Discovery’s stock began trading around $24, then advanced to around $27, but it’s been downhill ever since. We saw the stock price dip below $14 recently, representing about a 50% decline from the stock’s post spinoff high.

Yes, the chart looks terrible, but with the RSI below 30, we’re getting into deeply oversold territory now. Moreover, the CCI dipped below negative 300 in the recent decline, and the full stochastic is around five. So, several technical indicators illustrate that the stock is highly oversold now, and we could see a shift towards a more positive momentum soon. From a technical standpoint, we could be nearing a bottom. Therefore, as sentiment improves, the stock should stabilize and head substantially higher in the coming years.

Warner Bros. Discovery Vs. The Competition

Warner Bros. Discovery’s media library and assets are vast. Netflix (NFLX) and Disney (DIS) are the only comparable competitors to Warner Bros. Discovery. However, whereas Netflix is worth around $80 billion and Disney $180 billion, Warner Bros. Discovery is valued at only about $36 billion. Also, with Warner Bros. Discovery, you get news, CNN, and its streaming service CNN+, which may give the company an edge over its competition.

The vast Warner Bros. library consists of more than 114,000 hours of programming, including 10,000 feature films and 2,400 television programs (more than 120,000 individual episodes). Warner Bros. Discovery programming includes TNT, TBS, Food Network, Investigation Discovery, TLC, Discovery, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, New Line Cinema, Cartoon Network, Adult Swim, HGTV and HBO, and others.

HBO Max had about 77 million global subscribers at the end of March 2022. The subscriber count grew by roughly 20% from year-end 2020. In comparison, Disney Plus had around 130 million subscribers, and Netflix had about 222 million by a recent count. However, whereas Netflix’s growth has been stagnant recently, Warner Bros. Discovery likely has considerable growth left.

Also, while HBO Max is the company’s leading streaming network, Discovery+ had 24 million subscribers by the end of March when the deal got done. This number represented an addition of about 2 million subscribers from the start of the year and roughly 4 million from last September’s subscriber count. Therefore, HBO Max and Discovery+ are growing substantially and now have more than 100 million subscribers combined.

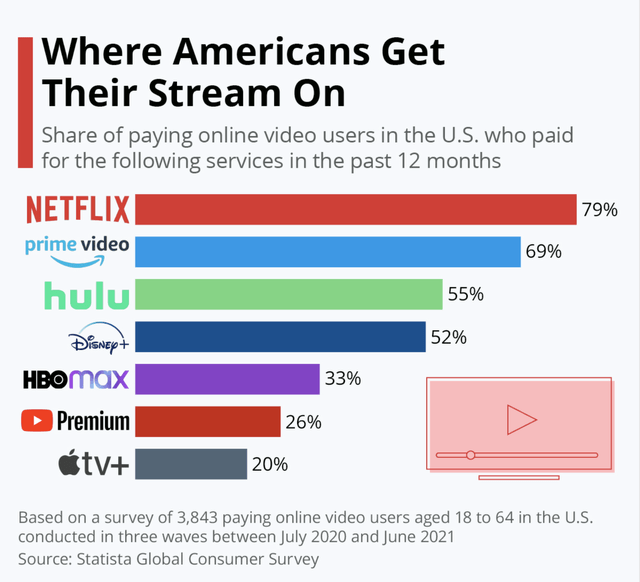

Streaming U.S. (Statista.com )

While only about 33% of Americans subscribe to HBO Max, that number is likely to grow, propelling the service into one of the leading streaming content providers in the world. Furthermore, with only about 25 million subscribers outside the U.S., HBO’s international exposure is relatively limited. However, that is likely about to change. The company’s streaming service is available in 61 countries and territories now, but it plans to provide its streaming service in 190 countries and territories by 2026. Therefore, we’re seeing a rebirth of Warner Bros. Discovery here. The company likely has a great deal of growth ahead, and where there is growth, profitability follows.

Warner Bros. Discovery’s Valuation is Ridiculous

Warner Bros. Discovery’s valuation is officially absurd now. The company should report about $1.32 in EPS next year (consensus estimates). Provided that the company’s stock is down to about $14, its valuation is only about ten times forward EPS estimates. If we look at sales, the company’s revenues should come in at about $52 billion next year, implying that the stock is trading around a rock bottom of 0.69 times forward sales. In comparison, Disney is trading at about 17 times forward EPS estimates and roughly two times forward sales estimates. Netflix trades at around 14 times forward EPS estimates and approximately 2.3 times forward sales estimates.

Warner Bros. Discovery is trading at substantially lower multiples than its direct competitors. Moreover, we see an increasing disconnect from the price to sales side. This dynamic implies that Warner Bros. Discovery is yet to unlock its profitability potential. The company has a good deal of revenue, 63% more than Netflix (forward), but its market cap is about 55% less. Therefore, we should see Warner Bros. Discovery’s profitability increase in the coming years, leading to multiple expansion and a much higher stock price.

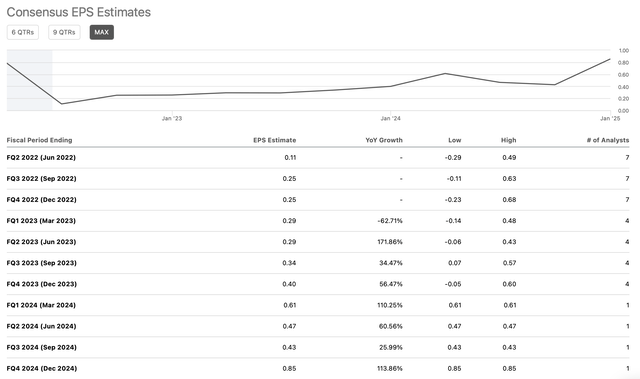

EPS Estimates

EPS estimates (SeekingAlpha.com)

2024 EPS estimates are for $2.36, implying that the stock is trading around six times 2024 earnings expectations. This valuation is remarkably cheap and will not likely remain here for long. Therefore, we should see Warner Bros. Discovery’s stock trade much higher in the coming years.

What Warner Bros. Discovery financials could look like as we advance:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $52 | $56.4 | $59 | $64 | $69 | $75 |

| Revenue growth | 8.5% | 9% | 8.5% | 8% | 8% | 7.5% |

| EPS | $1.35 | $2.36 | $2.80 | $3.30 | $4 | $4.50 |

| Forward P/E ratio | 12 | 14 | 15 | 16 | 15 | 15 |

| Price | $28 | $39 | $50 | $64 | $68 | $75 |

Source: The Author

I am not using overly bullish estimates here. Instead, I am generally utilizing consensus estimates. Furthermore, I am not applying an abnormally high growth rate here, and the multiple expansion seems in line with other comparable companies. My calculations are relatively modest, but given Warner Bros. Discovery’s dynamics, we see that the stock should appreciate considerably in the coming years. We may see a 260% appreciation through 2025 and 435% through 2028, making Warner Bros. Discovery a top stock to own right now.

Risks to Warner Bros. Discovery

Naturally, there are risks associated with this investment. Competition is fierce in the streaming business, and there is a chance that Warner Bros. Discovery won’t perform as well as some of its more established competitors. There is also the risk that the company will not grow as fast or will not become as profitable as expected. Additionally, there is a continuous risk of the recession, during which we could see stock prices fall in most companies, not just Warner Bros. Discovery. There is also the risk that the company will not execute as well as envisioned, leading to less optimal performance. Therefore, one should consider these and other risks carefully before investing in Warner Bros. Discovery.

Be the first to comment