Jacek_Sopotnicki/iStock Editorial via Getty Images

Overview

Yes, the collection of assets that include all of the Warner enterprises—the Warner Bros. film and television production studios and libraries, HBO, and the Discovery programming and streaming operations—are impressive. These ought to make Warner Bros. Discovery (NASDAQ:WBD) a potentially strong media competitor over the longer term.

The problems and issues are, however, concentrated over the near to medium term. Over the past five years and currently the old Time Warner entertainment assets have been subjected to three vastly different management protocols and strategic imperatives. As history in this sector has shown such excessive executive turmoil is especially toxic to creatively-driven businesses. In these, it’s always a question of Abbott & Costello’s classic “Who’s on First.”

Say you have a great project, idea, screenplay, etc. that you’ve been nurturing for years and your agent is ready to deal. Said agent is not apt to favor the studio with the most recent executive turmoil.

The management changes at WBD are just into the early weeks and it takes much longer than that for things to settle. So CEO David Zaslav can wine and dine all the Hollywood biggies, but project green lights are decided lower down in the organization. Meanwhile, passed over and uncertainly-perched previous decision-makers are probably still busy polishing resumes.

Challenges

A major headwind comes from having to compete with well-entrenched streaming competitors that include Netflix (NFLX) (~220 million subs), Disney (DIS) (~180 million), and a combination of Amazon (AMZN), Apple (AAPL), Paramount (PARA), and Peacock (CMCSA), which collectively add up to another 200 million subs. By comparison, the reconstituted WBD starts life with around 100 million subs. All of this collectively amounts to a worldwide industry total that gets close to a saturation point of around 600 to 700 million subs. (See The Problem With Streaming.)

Streaming competitors already altogether spend at least $35 billion a year in producing and marketing the new content that’s needed to attract, retain, and drive subscriber growth and attention—but probably not profits and profitability. None of these competitors are likely to readily cede market share to WBD, and this means that investors should not believe WBD management statements that they will be smart and relatively conservative in spending on streaming.

Another challenge will come from the $55 billion of debt that the company carries on its balance sheet. WBD’s ratio of debt to projected revenues—currently estimated to be at around 1.1 to 1—will initially be in a zone of financial stress. And under these circumstances rising interest rates will make future financing much more costly.

This would suggest that it makes sense to spin-off or sell the allegedly politically biased and prone-to-controversy CNN to a private equity firm. The no growth CNN might fetch $3 to $5 billion, but so far WBD has not indicated any intention to sell it.

Wall Street analysts will of course be obligated to issue earnings projections even though confidence in estimate precision would remain low until cost reductions and management strategies have been more finely sculpted. Optimists on WBD stock also like to point to the previous relatively high EPS and cash flow multiples accorded to the early streaming giants. But—given the current costly competitive, environment—those early high–multiple days will probably not return.

Finally, there’s the great hidden and unknown but substantial potential selling that might come from ATT shareholders, who after the deal’s closing now end up owning 71% of WBD shares.

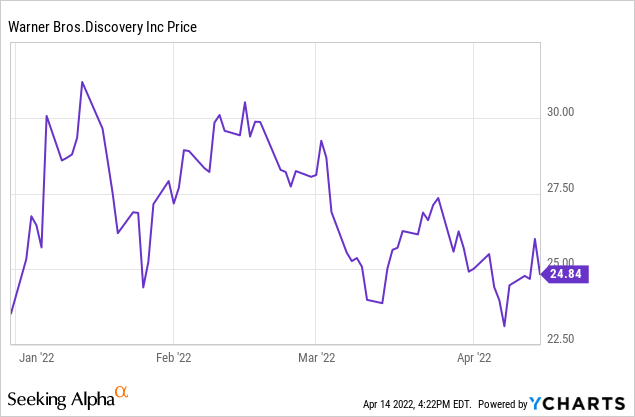

ATT’s huge base of yield-dependent shareholders has been walloped by the steep reduction in dividend payments from a yield of about 7% to 5.6% and such investors would accordingly be inclined to make up for this cut by selling their newly-acquired WBD shares. If so, WBD stock will be subjected to considerable and consistent selling pressure over the next year. Bear market conditions that include Fed tightening, would also weigh on WBD’s share price.

Conclusion

WBD might look good on the surface. But the company’s size and scope is now so large that it might turn out to be unwieldy and inefficient. And it might be several years until it all settles into a smoothly running operation.

High debt, rising interest rates, intense and costly competition in streaming services, and probable persistent selling by ATT shareholders make WBD a stock to watch but not yet ready to be owned.

A neutral rating that leans toward bearishness thus seems to be most appropriate.

Be the first to comment