Dimitrios Kambouris

Warner Bros. Discovery (NASDAQ:WBD) has become a significant player in the streaming business and it has drawn the interest of investors searching for undervalued companies with good long-term perspectives. Although the stock offers a high reward, the firm faces major threats that can cripple its operations. Warner Bros. Discovery offers engaging and highly valuable content through its various offerings. However, it operates in a highly competitive industry. Apart from that, debt weighs heavily on its financial health. Although the company’s debt usually constitutes an important part of an investment thesis, the subject is often swept under the rug by analysts. Optimistic projections seem to be enough to justify the debt position Warner Bros. is in.

Besides that, Warner Bros. Discovery is a merger – spin-off – turnaround story that makes things even more complex. And although the current price of the business may look compelling, it trades so low for a reason. An investment into the company may be a rocky ride for an extended period of time.

Pricing Power

Warner Bros. Discovery operates in the Movie and Entertainment industry which is both – dynamic and competitive. In such an environment, it’s crucial to have the ability to raise prices without losing customers – known as pricing power.

The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by a tenth of a cent, then you’ve got a terrible business. I’ve been in both, and I know the difference.

– Warren Buffett

And it may be true for Warner Bros. Discovery. The company’s CFO Jean-Briac Perrette touched on pricing during the Q3 earnings call.

Number one is, by 2023, HBO Max will not have raised price since its launch. So it will have been three years, since pricing has moved, which we think is an opportunity, particularly in this environment.

Although seen as an opportunity, it may be rather a sign of fear of losing customers to competitors. Especially in 2022, with inflation hitting new records, people cut expenses and what they cut on first is entertainment. An example of this trend was seen in the first half of the year when 600,000 people in the U.S. and Canada gave in on their subscriptions to Netflix (NFLX) once the company hiked its fees. And these were increases in the range of $1 – $2 a month per household.

Apart from its direct-to-consumer [DTC] division, Warner Bros. Discovery makes revenues from two other segments – Studios and Networks. Both have their own issues. Studio production and release of films haven’t recovered from the pandemic-related impact. Linear television on the other hand is on a decline, which coupled with a softening ad market, has led to fewer revenues and lost subscribers.

These aspects indicate that the economic characteristics of the movie and entertainment business are tough and indeed operating in this industry has always been very challenging. In the case of Warner Bros. Discovery, the pricing power, fierce competition, the change in consumer taste, and the dynamics of the industry it operates in are great unknowns weighing on the business model.

Debt

In order to finance the purchase of WarnerMedia, Discovery raised $30 billion in a debt offering prior to the merger. As a result, Warner Bros. Discovery owes currently $50.4 billion to its creditors.

If you don’t have leverage, you don’t get in trouble. That’s the only way a smart person can go broke, basically. And I’ve always said, ‘If you’re smart, you don’t need it; and if you’re dumb, you shouldn’t be using it.

– Warren Buffett

Although the quote refers to individuals it remains valid when it comes to enterprises. Having little to no leverage often keeps a company out of trouble. Yet, it’s frequent that a substantial debt burden is disregarded by the market observers and labeled as “manageable” or justified as “it’s the nature of the industry”. These statements are very dangerous and should be considered a warning sign for whoever assessing a potential investment.

What is concerning about the financial health of Warner Bros. Discovery is that the debt subject stands at the forefront of the company’s performance discussion. The firm even releases a separate document with listed obligations and their maturities on a quarterly basis. Warner Bros. Discovery assures its investors that despite the size of its debt, there is progress in terms of repayment. Indeed, the company managed to repay $6 billion since the closing of the merger, which is impressive. Yet, there is still $50.4 billion due. With free cash flow of -$192 million in Q3 FY2022 and cash and cash equivalents of $2.44 billion, it’s a high-risk bet on smooth sailing through the post-merger shake-up, looming recession, strengthening dollar, high inflation, rising interest rates, and business-specific issues.

Certain Coca-Cola bottlers became quite leveraged… They have a business that’s a steady solid business but it’s not one with abnormal profitability so it can take leverage in the sense that it won’t be subject to huge dips but it also it’s a business where it’s very tough to increase margins significantly. So, if most of the money goes to the debt service that is something that you have to take into account when you value the equity. It’s a fairly capital intensive business… It’s just the nature of the bottling business. It’s a reason why I like basically a syrup business better than the bottling business. It’s less capital intensive. I think that the bottling business is a perfectly decent business. It isn’t a wonderful business because it’s very competitive out there…

– Warren Buffett – Berkshire Hathaway Shareholder Meeting 2002.

It’s a great analogy to today’s streaming industry. Content creation is capital intensive and achieving profitability won’t come easy for Warner Bros. Discovery. Yet, the CFO – Gunnar Wiedenfels – projects the DTC segment to exceed 20% margin, as stated at the earnings call for the Q2 fiscal 2022 year.

We spoke – we reiterated earlier that we see 20% plus margin potential for the D2C business. We are assuming moderate price and ARPU increases as JB laid out.

Being in a capital-intensive business while carrying a substantial debt regardless of its maturity embodies a high risk. It doesn’t mean the management can’t work it out. However, this debt burden contradicts a sleep-well-at-night investment. It’ll be dragging the company and its potential down for some time into the future. Besides that, with a debt of this size, the company becomes vulnerable. In this business and in the complex post-merger-turnaround situation the firm finds itself in now, there are a few things that may go wrong. And when there are things that can go wrong, they probably will.

Financials

Warner Bros. Discovery with its franchises such as HBO has always stood for quality which already gives the company a great advantage over one of its fiercest competitors – Netflix – which was covered in more detail in the article Netflix: Does The Reward Outweigh The Risk?

In an already crowded market, consumers know these brands, and they trust them to deliver quality. The quality of our content engine speaks for itself as evidenced by the 193 Emmy nominations this year, more than any other media company…

– Jean-Briac Perrette – President & CEO of Discovery Streaming & International – Earnings call for the Q2 fiscal 2022 year

Unfortunately, unlike Netflix, Warner Bros. Discovery has shown declining revenues and deepening unprofitability quarter-over-quarter. The company focuses on EBITDA, which is a highly adjusted profit number that skews the perspective on actual earnings. It’s also a sophisticated term that covers a negative net income. What the company should present for more transparency when reporting its segment performance is operating income. It stands for profit after operating expenses like wages, depreciation, or amortization.

As we said last quarter, our focus is on delivering $1 billion of EBITDA in streaming by 2025. And we expect to make significant progress toward this goal next year.

– David Zaslav – CEO – Earnings call for the Q3 fiscal 2022 year

Walt Disney (DIS), unlike Warner Bros. Discovery, does declare operating income numbers from all its divisions. The company has just reported its fiscal 2023-year earnings and interestingly, three years since the launch of Disney+, the segment’s operating margin is negative and equals a staggering -20.5%. The company claims that expenses in DTC bottomed and numbers will be improving from now on.

Disney, similarly to Warner Bros. Discovery, has Linear Networks and Media and Entertainment Distribution which would correspond to Warner Bros. Discovery’s Studios. More importantly, it also owns Disney Parks with a 27.5% operating margin that can cover the losses from the DTC segment. But most of all, Disney has an incredible moat that can’t be replicated even by the strongest competitors in the industry.

A look at Warner Bros. Discovery’s financial health doesn’t boost optimism.

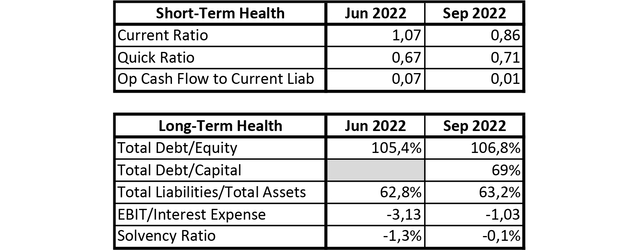

Warner Bros. Discovery Financial Health (Author: Based on Data from Seeking Alpha)

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Total Cash + Short-Term Investments + Total Receivables) / Current Liabilities

Both ratios should be preferably above 1.

- Operating Cash Flow / Current Liabilities

The operating cash flow ratio determines the number of times the current liabilities can be paid off with the use of net operating cash flow. It represents the company’s liquidity and its ability to pay off short-term financial obligations. Warner Bros. Discovery has an astoundingly low operating cash flow ratio of 0.01.

Capital-intensive industries tend to have a higher debt-to-equity ratio that can be greater than 100%, which is the case of Warner Bros. Discovery. For lenders and investors, a high ratio translates to an elevated risk.

- Total Debt / Capital = Total Debt / (Total Equity + Total Debt)

The ratio measures the financial leverage of a company and the lower it is the better. 58% as it is for Warner Bros. Discovery is far from a desirable range.

- Total Liabilities / Total Assets

The liabilities-to-assets ratio shows the proportion of the company’s credit financing to its assets. A lower ratio is considered better.

The lower the ratio, the more the business is burdened by debt service. A company’s interest coverage ratio is desired to be above 1.5. Warner Bros. Discovery has a negative ratio due to its unprofitability. Thus, its ability to meet interest expenses may be questionable.

- Solvency Ratio = (Net Income + Amortization + Depreciation) / Total Liabilities

The solvency ratio compares the company’s profit including amortization and depreciation to the firm’s total liabilities and determines the company’s ability to stay solvent. Preferably it should be higher than 20%. Since Warner Bros. Discovery doesn’t generate a positive operating profit, thus the ratio is below zero.

Besides Warner Bros. Discovery’s poor financial health, the company’s recently reported numbers don’t make investors enthusiastic.

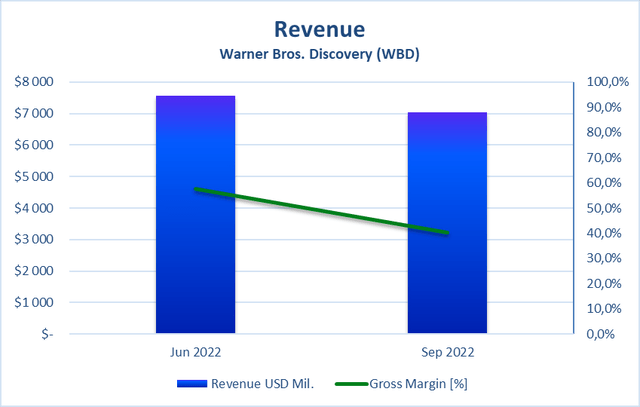

Warner Bros. Discovery Revenues (Author: Based on Data from Seeking Alpha)

Revenues declined 7% quarter-over-quarter and the gross margin slipped by 18 percentage points. The company justified it with difficult COVID comparisons, fewer theatrical releases, and macro conditions.

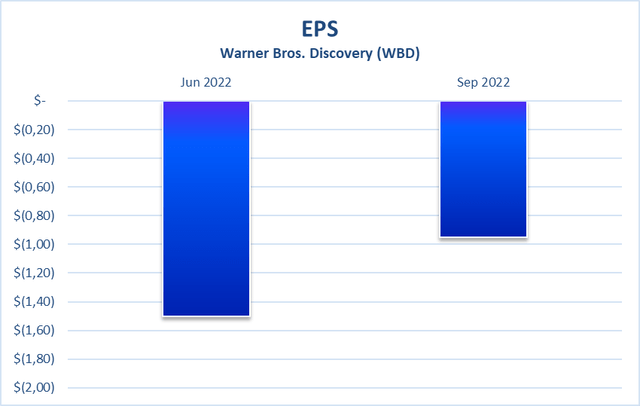

Warner Bros. Discovery EPS (Author: Based on Data from Seeking Alpha)

The company doesn’t generate profit and thus, its EPS remains negative.

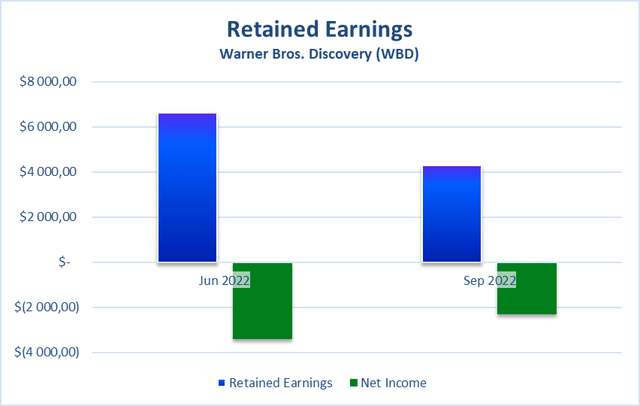

Warner Bros. Discovery Retained Earnings (Author: Based on Data from Seeking Alpha)

The net income that is earned every year is retained by the company. Due to the net losses generated by Warner Bros. Discovery, retained earnings declined.

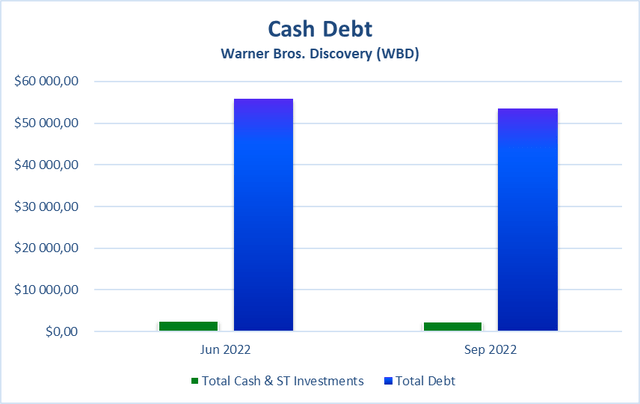

Warner Bros. Discovery Cash and Debt (Author: Based on Data from Seeking Alpha)

The scariest of all the graphs above is a comparison of the total cash and short-term investments to the company’s total debt.

Valuation

With two months left in the year, the company guides adjusted EBITDA for the fiscal 2022 year in the middle of the range of $9.0 – $9.5 billion. Besides that, for the fiscal 2024 year, the management sees EBITDA grow to $12 billion

Building off of this projected baseline and looking to 2023, we continue to target and our teams are working towards $12 billion in adjusted EBITDA, and in a more normal advertising environment, we believe that target should be achievable.

Warner Bros. Discovery reiterated its goal towards a 2.5 – 3.0 gross debt leverage ratio which is calculated by dividing the company’s total debt by its EBITDA. The projected range should be reached by the end of 2024 according to the management. For the current fiscal year, it’s expected to be around 4.8 which would correspond with $44.4 billion in total obligations.

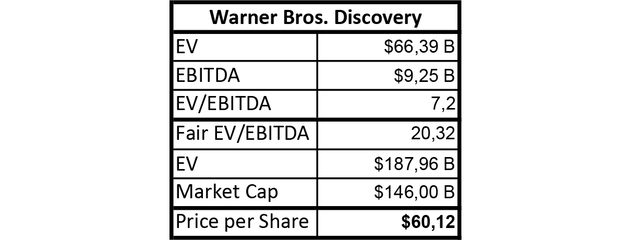

Based on this information given by the management, the company’s EV / EBITDA ratio should be approximately 7.2 for the fiscal 2022 year. For comparison, Disney’s and Netflix’s ratio amount currently 19.5 and 21.2, respectively.

By applying an EV / EBITDA of 20.3 which is a mean average of the competitors’ ratios, a price per share for Warner Bros. Discovery equals $60.12. Having adjusted it by using a conservative margin of safety of 25%, the fair share price comes down to $45.09. This corresponds with a ~4x potential return if invested in the company today.

EBITDA Valuation Model (Author: Based on Data From Seeking Alpha)

Due to the fact that the company doesn’t generate profit or a positive free cash flow, the valuation model utilizes EBITDA. It gives a sense of how much an investor should pay for a piece of the business. However, the value of a company should be measured by assessing the present value of all its future cash flows. Since it can’t be applied to Warner Bros. Discovery, the EBITDA valuation model serves as a rough estimation.

Conclusion

Warner Bros. Discovery is undoubtedly a company with a portfolio of high-quality brands. The firm has a decent diversification across its segments which mitigates some risks. The company reduces operating costs through synergies and puts a strong focus on its DTC segment. However, Warner Bros. Discovery operates in a tough, capital-intensive industry with fierce competition. What creates headwinds is the uncertain macro situation to which the media and entertainment business is particularly vulnerable. Yet, the company’s debt is a nail in the coffin. It ruins Warner Bros. Discovery’s financial health and constitutes a burden, especially in difficult economic times. The management has difficult tasks to make a successful turnaround, reach profitability, substantially reduce debt and keep adding subscribers by creating new content. This is an inconvenient position to be in.

I believe the stock may be undervalued and investing in the company today may result in ample returns. However, I consider the current investment risk too high no matter how low the price is.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

– Warren Buffett

Be the first to comment