Alberto E. Rodriguez/Getty Images Entertainment

Perhaps no entertainment company in the world is more iconic than The Walt Disney Company (NYSE:DIS). This behemoth, with its hands in everything from streaming, to theatrical releases, to theme parks, to toys, to sports, and so much more, is a global player that has created tremendous value for its investors in its lifetime. Unfortunately, some times are more difficult than others. And while the company has done remarkably well when it comes to streaming in recent years, both its theatrical releases and its theme parks have suffered because of the COVID-19 pandemic. The most recent data, however, is supportive of the idea that the worst for the company from a theatrical perspective has passed it. What we see today is a full-fledged recovery in the theater in what will ultimately mean significant additional revenue for the company moving forward. And with shares of the company trading 50.1% lower than their 52-week high mark, and only slightly off of their 52-week low mark, the upside potential for investors moving forward could be meaningful.

Walt Disney’s encouraging results at the box office

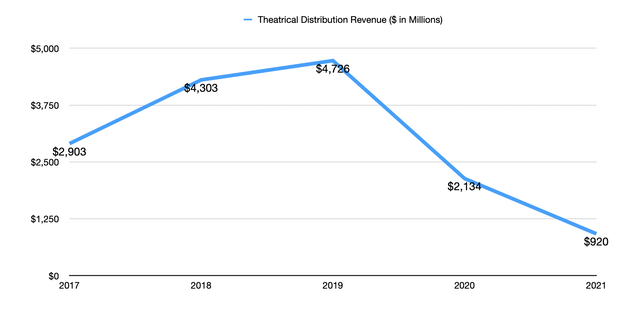

While the vast majority of the economy was negatively impacted by the COVID-19 pandemic, few, if any, industries were hit as hard as the theater business. Social distancing led to the temporary closure of most theaters across the planet, and for good reason. After all, sitting in a densely populated room with poor air circulation it’s not exactly a great way to avoid a highly contagious illness. While the theater operators were slammed the hardest during this time, the Hollywood studios were also negatively impacted. What shows aired ultimately performed poorly, while many other shows were delayed or were released through alternate channels. To illustrate what I mean, we need only look at a company like The Walt Disney Company. After seeing theatrical distribution revenue rise from $2.90 billion in 2017 to $4.73 billion in 2019, it plummeted to $2.13 billion in 2020 before declining further to just $920 million during the company’s 2021 fiscal year.

Author – SEC EDGAR Data

Although standalone studios would have been impacted the most, it’s important to acknowledge that the pain experienced by The Walt Disney Company was definitely material. After all, while the company does have other sources of revenue, many of which are not related to its content library, the films and television shows are the lifeblood that helped to fuel consumer enthusiasm for toys, video games, and especially its theme parks. Without this spring of renewal, these other revenue streams would eventually suffer and die off.

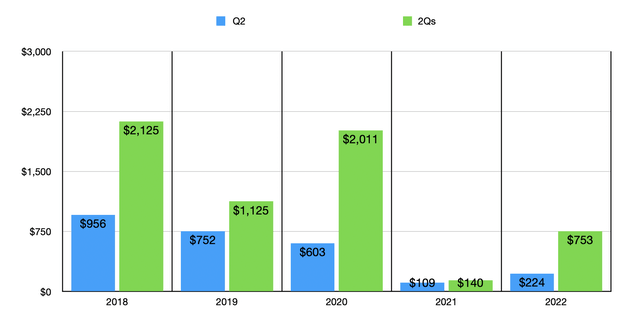

Author – SEC EDGAR Data

The good news for the businesses that it did start to see some improvement in the early parts of the current fiscal year. This can be seen by looking at theatrical revenue both in the latest quarter and for the first half of the year as a whole. In the latest quarter, for instance, theatrical distribution revenue totaled $224 million. That’s over double the $109 million reported just one year earlier. For the full first half of the year, revenue of $753 million dwarfed the $140 million reported for the first half of 2021. Admittedly, these numbers are still significantly removed from what the company generated in prior years. For instance, in the second quarter of 2018, revenue came in at $956 million. And for the first half of the year, it was $2.13 billion.

Author – SEC EDGAR Data

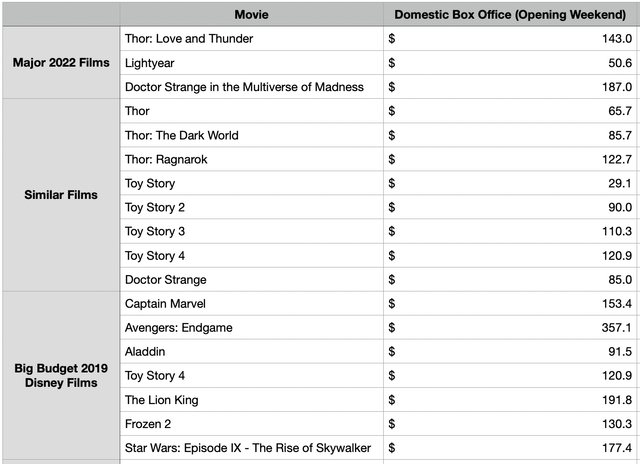

(in USD millions)

What data we have now does suggest, however, that the company is in the process of making a full recovery from a theatrical distribution perspective. This past weekend, the company celebrated the release of the latest installment in the Thor franchise, Thor: Love and Thunder. Domestic revenue for the film totaled $143 million. Globally, that figure came out to $302 million. It’s helpful to put this into perspective. For the first Thor film, the opening weekend totaled $65.7 million in the domestic market. For the second film, Thor: The Dark World, the box office was $85.7 million. And for the third film, Thor: Ragnarok, the domestic market totaled $122.7 million. By all accounts, Thor: Love and Thunder, looks set to be a fantastically profitable film for the company. But it’s not the only film that’s doing great this year. The second installment in the Doctor Strange franchise, Doctor Strange in the Multiverse of Madness, which was released on May 6th of this year, had an opening weekend debut of $187 million. That covers the domestic market only. Globally, its opening weekend was $265 million. To put this in perspective, the domestic release for the first Doctor Strange installment was just $85 million.

Of course, not every film that The Walt Disney Company released has been a winner this year. Lightyear, which was slated to have significant potential, ended up generating just $50.6 million in the domestic box office and $85.6 million globally. By comparison, Toy Story 4, which had the highest opening weekend of any within that franchise, had a box office release in the domestic market of $120.9 million. Though some may chalk this up to controversies regarding the company and that particular film, a more likely explanation is that spinoff films can be hit or miss. For instance, Solo: A Star Wars Story, generated just $65 million during its first weekend out in the domestic market.

The-numbers

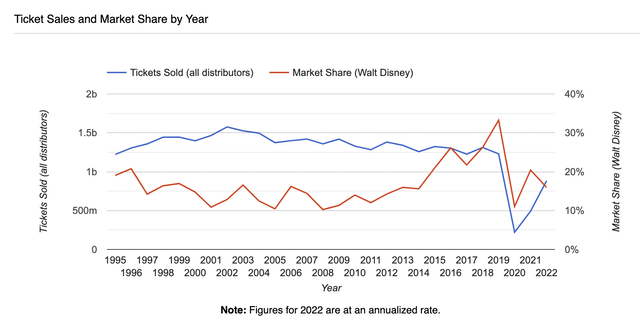

No doubt, both Thor: Love and Thunder and Doctor Strange in the Multiverse of Madness, are evidence of a significant resurgence in box office fortunes for The Walt Disney Company. Compared to major releases during the 2019 year, it’s worth noting that only four films outperformed the former from a domestic box office release for the weekend, while for the latter that number was two. As the image above illustrates, there is still some weakness in ticket sales for The Walt Disney Company films for the current fiscal year compared to the pre-pandemic era. But that may have more to do with the fact that the number of releases in theaters this year is still down 30% compared to what it was in 2019. This is largely due to the decision of studios to slow their investment in recent years because of uncertainty regarding a return to normalcy. some may argue that another contributor to the slow recovery in the space may be the rise of streaming services like Disney+ and the decision of some companies to release their films on those platforms. However, that seems unlikely. After all, Doctor Strange in the Multiverse of Madness was released on May 6th of this year while its release on Disney+ was June 22nd. And for the latest Thor film, the release date was July 8th, while the date for its debut on Disney+ is currently August 22nd.

If this trend of continued strength at the box office remains, the end result for investors could be quite positive. After all, the entertainment conglomerate is already posting strong results for its 2022 fiscal year. Revenue in the first half of the year is up 28.9% year over year, having risen from $31.86 billion last year to $41.07 billion this year. Net income has shot up 71.5%, rising from $918 million to $1.57 billion. Operating cash flow is up a more modest 6%, having risen from $1.47 billion to $1.56 billion. But if we adjust for changes in working capital, it would have risen from $1.84 billion to $4.67 billion. That’s a year-over-year improvement of 153.7%.

Takeaway

Based on the data provided, it looks to me as though The Walt Disney Company is performing exceptionally well right now. Yes, there are still some signs of weakness. But that picture is largely improving. Add on to this other strong parts of the company, such as their streaming platforms, and the picture is looking quite bright. This adds to my already extensive list of reasons why The Walt Disney Company makes for a ‘strong buy’ at this time.

Be the first to comment