BCFC/iStock Editorial via Getty Images

Walgreens (WBA) reported a solid quarter on January 6, 2022, with the fiscal Q1 ’22 results showing a very nice EPs and revenue beat of 26% and 4% respectively.

The stock sold off the day the retail giant reported earnings, but has since found its footing again and closed Friday, January 14, 2022, just a few bucks shy of its 2021 high around $57 per share.

While turning bearish on the stock with the lack of foot traffic during the delta variant, the strong front-end revenue driven by omicron and the seeming growing need for what looks like a an annual Covid-19 shot (much like the annual flu shot), I’m more neutral now, particularly with the seeming solid reception by private equity of the sale of Walgreen’s Boots stores in the UK.

While Stefano Pessina will have “bought high and sold low” at least according to some numbers I’ve seen (and these are not from investment bankers), Stefano paid 15 – 16 billion pounds for the British drug store chain, and some preliminary estimates are for 8 billion offered.

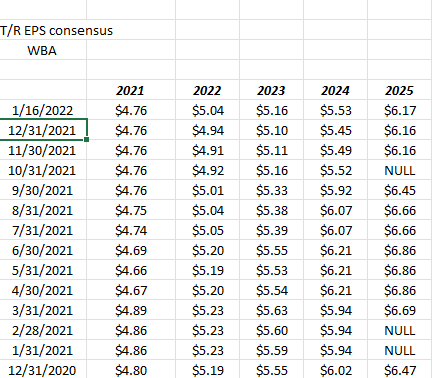

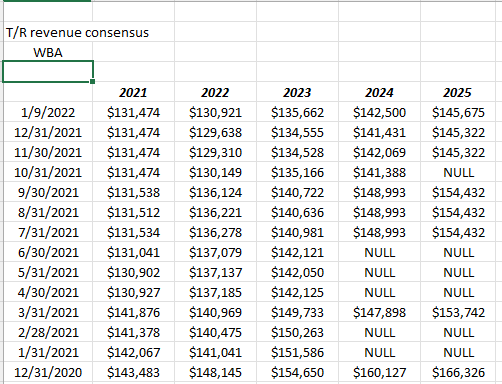

Here’s a quick look at Walgreens EPS and revenue revisions following fiscal Q1 ’22:

WBA EPS estimates with revisions IBES data by Refinitiv Walgreens revenue revisions IBES Data by Refinitiv

Readers can see my primary concern over the stock, and it’s prospects, although the positive trend in EPS is very good to see, the continued downward slide in forward revenue revisions is worrisome, particularly for a retail giant that already sports a 0.33 trailing-twelve-month price-to-sales ratio.

What worries me about this price-to-sales it’s reach levels that are K-Mart and Sears like price-to-revenue metrics, but I don’t believe Walgreens is nearly that dire.

It’s nice to see fiscal 2022 revenue estimates giving the appearance of stabilizing (look at the last 4 months) so if that continues, fiscal 2023 might also begin to stabilize.

Valuation update

Trading at $54 per share, WBA is trading at 11x fiscal ’22 and ’23 EPS for expected EPS growth this year of -3% and +2% next year. With corporate in the throes of a re-org ($1 billion invested in Village MD, potentially shedding of Boots, and focusing on improving the core front-end business while Covid traffic represents a temporary advantage, the 3.5% current dividend yield, the 6% free-cash-flow yield and the 9x price-to-cash-flow valuation aren’t that expensive.

Front-end foot traffic has always been the key to “historical WBA” since foot traffic drives convenience buying and the front-end convenience part of the store is the higher-margin part of the core business. All the retail metrics – both scrips and front-end revenue – beat expectations in fiscal q1 ’22.

Even with the strong beat for the quarter, US sales revenue is expected to decline 6% in fiscal ’22 (versus the previous expectation of -8%), which should still give investors pause.

The longer-term question is can Roz Brewer and the Board transform the company on the fly and continue to execute in the core business.

Summary / Conclusion

As a loyal Walgreens customer, and someone who has modeled the stock and updated quarterly earnings reports and cash-flow data since 1995, I like to keep an eye on the drugstore retail giant.

The ladies in the Oak Brook Illinois store take good care of me, as I had Covid but still took both vax’s and opted for the booster as soon I was eligible having had cancer twice 10 years ago. While I consider myself very healthy and exercise vigorously, I’d still rather have more protection than less.

From a sentimental perspective, my father was a Chicago attorney and had a small insurance practice from the early 1950’s to the mid-1980’s in down-town Chicago. Walgreens ( I think) was the first stock my father ever bought since one of the guys who worked for him realized litigation probably wasn’t for him in the late 1960’s, and went to work for Walgreens as a corporate lawyer and crossed paths one day with my father in court, and told him, “this is a really good company, you should look at owning the stock” and I believe part of mine and my younger brother’s undergraduate educations were eventually paid by Walgreens appreciation, not to mention my father’s own retirement.

Walgreens was a fabulous performing stock in the 1980’s and 1990’s being an under-the-radar growth stock, which peaked in 2000, and then CVS took over the performance mantle and outperformed (then WAG, now WBA), for the decade from 2000 to 2009, and since it’s been back and forth for the two retail giants.

I do think Roz Brewer and the current Board are trying to find a viable business model going forward that plays off the retail strength and the core prescription business, but to be blunt and fair about it, this has been the case since walk-in-clinics in the stores started appearing in the decade of the 2000’s. I’m sure there is some greater strategic competitive advantage to Village MD than the walk-in-clinics of 20 – 20 years ago, I just haven’t studied it yet.

WBA’s valuation is attractive here in a market over the next year which will likely return to more “value” than growth investing and could put a premium on value stocks over growth stocks.

The more Covid-19 becomes a permanent part of American lives, whether that’s an annual vax or occasional boosters, the better for Walgreens.

What I’ll be looking for or watching with the next few earnings reports is – as omicron fades and as the Covid-19 hysteria fades – what happens to foot traffic and how are the metrics from VillageMD developing.

Be the first to comment