turk_stock_photographer

Plenty of dividend stocks are trading at valuations previously thought impossible, and Walgreens (NASDAQ:WBA) is one of them. Since the start of the year, its stock has fallen by 42%, pushing its dividend yield well above the 6% mark. While no investment can be thought of as being completely safe, I believe negative sentiment around this stock as being blown out of proportion. This article highlights why now is a great time for value investors to add this dividend aristocrat.

Why WBA?

Walgreens Boots Alliance is a global leader in retail pharmacy with over a century’s experience in the space. It brands itself as “America’s Drugstore” and has around 13,000 locations in all 50 states and Europe and Latin America. In addition, Walgreens has a material equity stake in the drug distribution giant, AmerisourceBergen (ABC).

Notably, WBA was already inexpensive earlier this year, and the general market negativity has made it even cheaper. The stock now trades well below its 200 and 50 day moving averages of $42 and $36 respectively, and as seen below, now has an RSI score of 30, indicating that the stock is now in oversold territory.

WBA Stock Technicals (StockCharts)

Longtime investors and followers of Walgreens know that the company hasn’t been without its challenges. While Walgreens has traditionally enjoyed competitive advantages and stronger margins compared to smaller players, it’s come under pressure in recent years in correlation with the growth in negotiating leverage of pharmacy benefit managers.

However, I believe investors are overlooking the positives around the company. As its core business remains relatively stable. This is reflected by U.S. retail sales growing by 1.4% YoY (2.4% excluding tobacco) during its fiscal third quarter, with positive comparable store transactions. Moreover, WBA’s Boots UK comparable sales grew at a more impressive 24%, with market share gains across all major categories.

Also encouraging, WBA has proven adept at navigating the ever-changing consumer and healthcare landscape with digital products. This is supported by myWalgreens members growth to over 99 million as of the end of fiscal Q3, up a robust 14 million from fiscal Q4 2021.

Furthermore, management is making good progress in addressing margin pressures by recently opening a fourth automated micro-fulfillment center, supporting around 1,100 stores with more locations being added as these facilities become fully operational. It’s also addressing shrinkage in its stores with partnership with ALTO US, by rolling out tech-enabled security services across more than 2,200 stores. These factors contributed to management recently upping its targeted annual savings to $3.5 billion by fiscal 2024, up from $3.3 billion previously.

Looking to the medium term, I believe WBA’s inroads towards integrated healthcare is a plus as the company continues to evolve. This is reflected by comments by the CEO around progress in VillageMD, as noted during the recent conference call:

We’re making important strides in building our next growth engine, Walgreens Health. VillageMD and Shields continue to realize tremendous top line growth, and we’ve added a third strategic partner for our Walgreens Health organic venture, bringing the number of lives covered above the 2022 year-end target of 2 million. Additionally, we launched our clinical trials business to improve access and diversity. We are moving quickly to implement our vision of consumer-centric, tech-enabled health care solutions that improve outcomes and lower costs for patients, providers and payers.

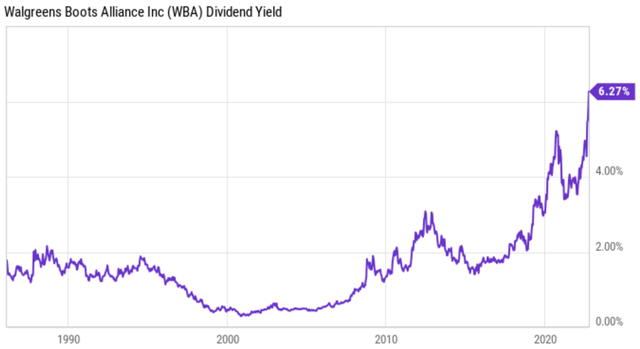

Meanwhile, WBA carries a strong BBB rated balance sheet, and has plenty of flexibility. This is supported by its stake in AmerisourceBergen, of which it sold 6 million shares worth $900 million in the recent reported quarter, thereby giving WBA an alternate funding source for its growth initiatives. Plus, the recent share price downturn has boosted WBA’s dividend yield to 6.3%. The dividend is well-protected by a 35% payout ratio and comes with a 5-year CAGR of 5%. As shown below, WBA is now yielding the highest in over 30 years.

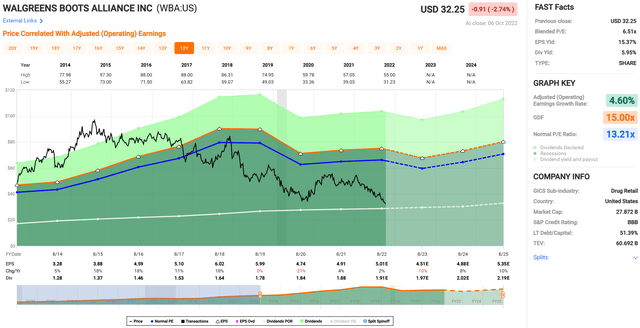

Lastly, I view the stock as being materially undervalued at the current price of $30.52 with a forward P/E of just 6.1, sitting at less than half of its normal P/E of 13.2 over the past decade. This translates to potential very strong double-digit annual returns should WBA simply revert to its mean valuation. In addition, sell-side analysts have an average price target of $40 and Morningstar has a $48 fair value estimate.

Investor Takeaway

In summary, WBA stock has gotten enticingly cheap and sports a historically high dividend yield that’s well protected by earnings. I believe the market is overly rotated on short-term headwinds while ignoring the ongoing transformation of the enterprise. As such, the current stock price presents a strong buying opportunity on this dividend aristocrat.

Be the first to comment