Jaskaran Kooner

It’s been about 3 months since I wrote my latest cautious note on Westinghouse Air Brake Technologies Corporation (NYSE:WAB), and in that time, the shares of Wabtec are up about 9% relative to a 5% gain for the S&P 500. The company has reported earnings since I last reviewed them, so I thought I’d take this opportunity to return to the business and ask whether or not it makes sense to finally pull the trigger and buy. I’ll review the financials, and will look at the stock as a thing distinct from the underlying business. I also feel very compelled to remind investors that in the domain of investing, everything is relative.

My writing isn’t for the faint of heart. I tend to brag often, I needlessly use words like “onomatopoeically”, and some of my American audience may be put off by the fact that I spell words like “labour” and “characterise” properly. If you were looking for a reason for the shape of my current social life, I think you just got three. Anyway, because I’m at least self-aware enough to know that my stuff can be “a bit much”, I offer up the gist of my thinking in a single paragraph that I like to call the “thesis statement paragraph.” I’m still avoiding this stock in spite of the fact that results were great relative to both 2021 and 2019. This is particularly significant because 2019 was a real “barn burner” of a year. The problem for me is the valuation. The shares simply remain very expensive, and, as a result, the dividend yield remains anemic.

I know I promised that my “thesis statement” would be contained within one paragraph. I’m sorry about leading you down the path on this, but I think we need to remember a very important lesson about investing in general. We’re limited by, among other things, the capital we have to invest. For my part, I’m always trying to find the best investment option relative to others. In my previous missive on this name, I determined that Wabtec was an inferior investment to the ten-year Treasury Note, because the latter spun off more cash, and came with much greater certainty. Check out my prior work for a more in-depth look at the relative merits, as I think the conclusions still hold water. Additionally, I’ve decided that Wabtec shares are a poor choice relative to where I want to spend much of my “investment in the rail ‘space‘ capital.”

In short, I think there is greater safety in 10-year Treasuries, and I think there is greater capital appreciation potential elsewhere. I think shares of Wabtec may very well continue to rise from here, and I think that’s largely beside the point. I don’t care about “returns.” I care about “risk-adjusted” returns, and on that measure, Wabtec doesn’t really cut it for me. Finally, you may think that part of the reason I mentioned my highly profitable investment in FreightCar America is a cheesy attempt to shoehorn in a brag. If I were standing in front of you, I’d say something like, “how dare you level that obviously true accusation at me!”

Financial Snapshot

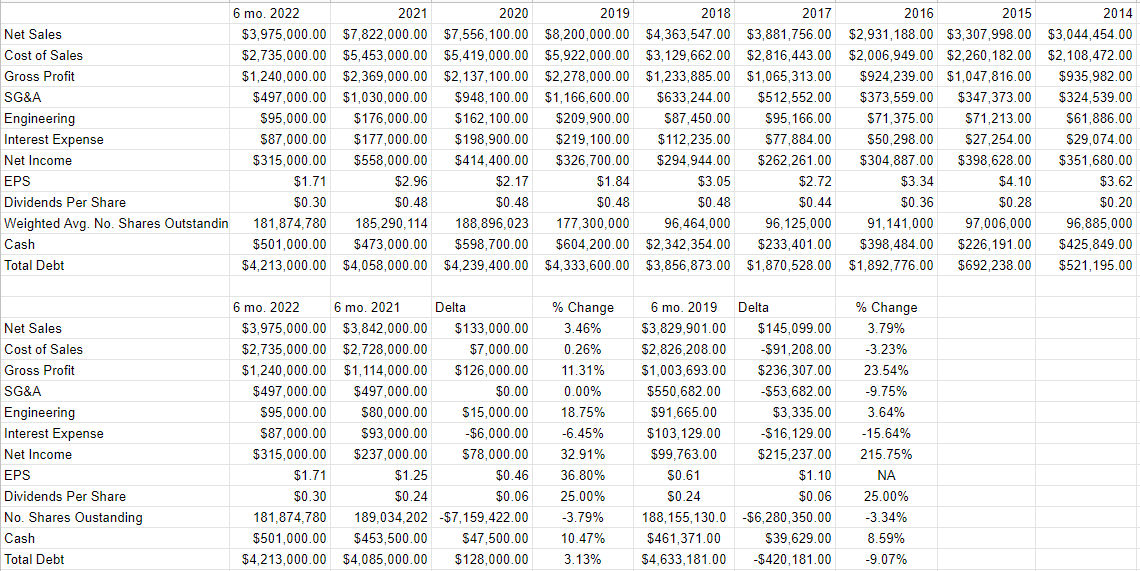

In my previous article on Wabtec, I characterised the financial performance as “spectacular”, and found nothing to complain about in the accounts. This was uncharacteristic of me, and, if I’m being honest, I found it frustrating, as “complaining about stuff” is a hobby that I’ve perfected over the years. In my view, the trend continues. The most recent financial results were spectacular relative to the same period in 2021. While revenue was up only about 3.5% in 2022, gross profit and net income were higher by about 11.3%, and 33% respectively. There are no one-time items or other extraordinary factors affecting the income this year. The company sold $133 million more during the first six months of this year, and $78 million more of those dollars found their way to the bottom line.

You may recall that the world was struck by a global pandemic that may have impacted results for the year 2021, and so you could be forgiven for suspecting that this is an unfair comparison because 2021 may have been relatively “soft.” If that is indeed your worry, you can stop clutching your pearls because the most recent results are good when compared to 2019 also. The top and bottom lines in 2022 were higher by 4% and 215% (!) when compared to 2019. This is in spite of a much higher amortization expense in 2022 relative to 2019. We should also remember that 2019 itself was a banner year for the firm. So, if it’s doing better now than it did in 2019, that’s saying something.

Finally, the company’s backlog increased by ~$2.3 billion from last year and now sits at around $23 billion, so I think it’s reasonable to expect strong financial performance to continue.

Wabtec Financials (Wabtec investor relations)

The Stock

If you are one of my regular readers, you’ll not be surprised to be reminded that I consider the “business” and the “stock” to be quite different things. If you’re not one of my regulars, I’m going to explain my view here. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. There are obviously many factors that affect the crowd’s view. For instance, if some influential analyst decides that “future growth catalysts” are weaker than once thought, the stock may fall in sympathy. If that analyst gets a call from a teammate at his firm, describing the potential for investment banking business, suddenly the “future growth catalysts” are quite appealing, and the stock rises in sympathy to that view. Additionally, the stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the business chugs along, while the stock price is impacted by factors that have little, if anything, to do with the company.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly over time when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

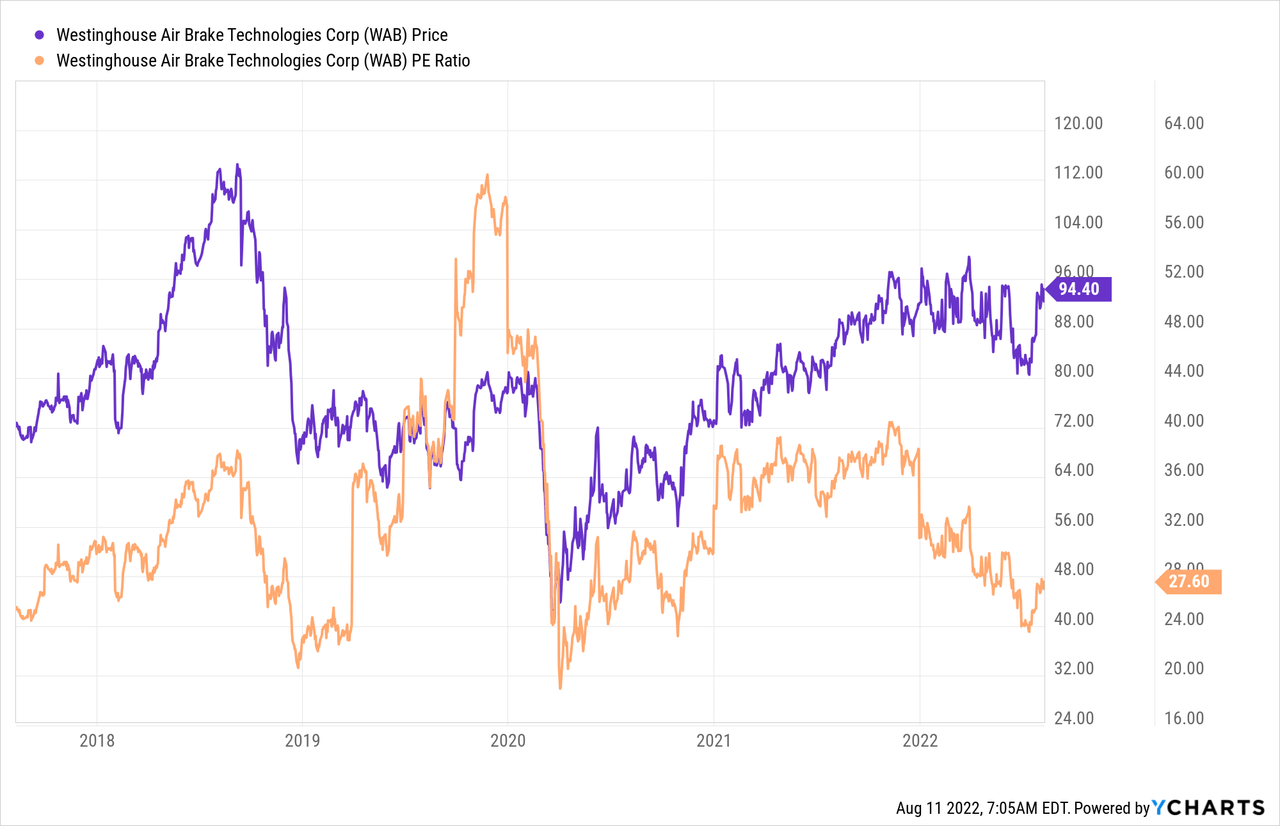

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, the shares were trading at a PE of about 27.4, which was cheaper than it was when I reviewed the stock prior to that. The stock hasn’t really budged from that valuation, per the following:

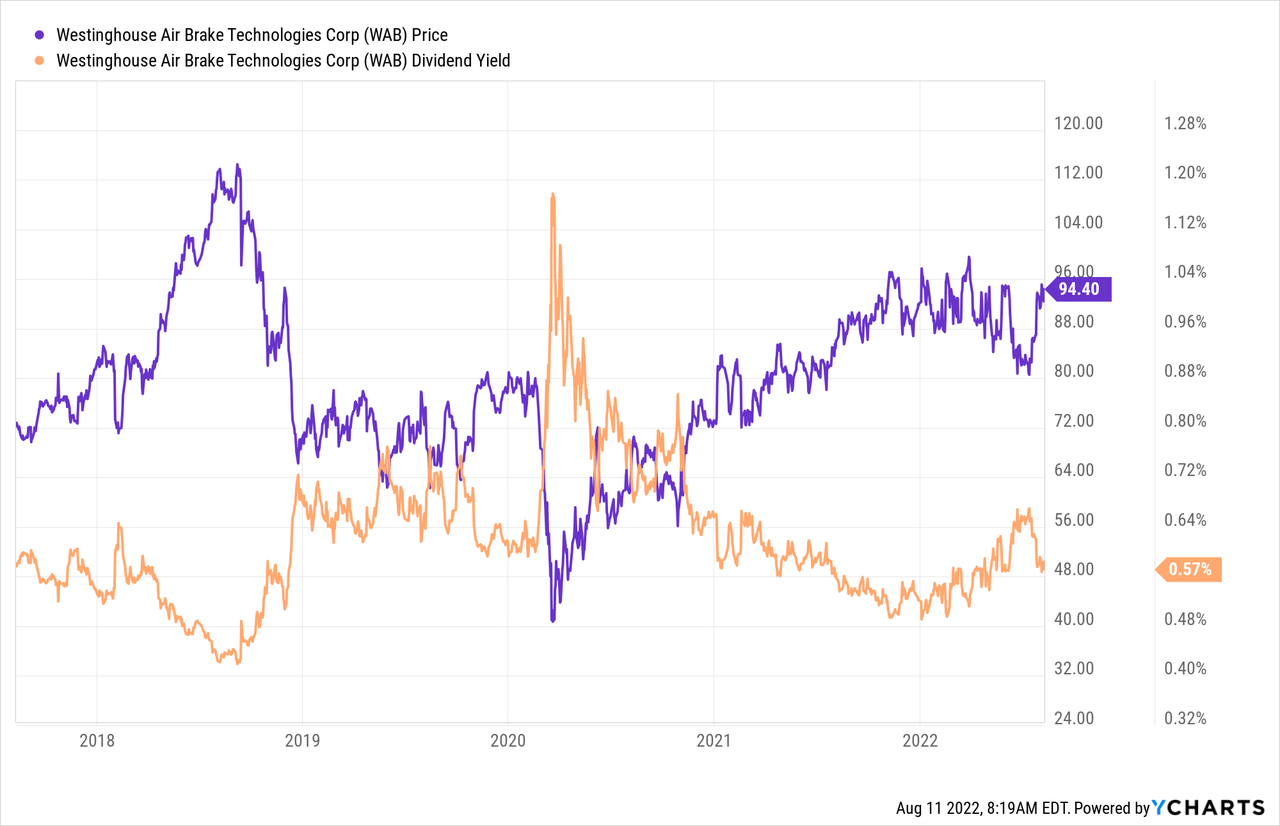

While the shares remain expensive relative to the overall market, investors are receiving a relatively anemic yield per the following:

Everything’s Relative

I think some of my readers sometimes misunderstand my perspective when I eschew the shares of a particular company. They assume that I’m avoiding shares because I think there’s something wrong with the business. While that’s often the case, I’m quite comfortable passing on the shares of perfectly good businesses. I avoid the shares of certain companies because everything’s relative.

In my previous missive on this name, I came to the view that an investment in Wabtec stock would be inferior to an investment in a 10-year Treasury Note, as the latter was yielding a shade under 3%. I remain of that view. Although the stock investor may enjoy some price-driven gains, what the market giveth, the market can very much taketh awayeth, very, very quickly. Given that we’re looking for “risk-adjusted returns”, rather than simply “returns”, I am still of the view that there are safer, superior places to be than Wabtec.

To add to this idea, when it comes to “capital to be deployed in the ‘rail space'”, I happen to think other investments are relatively more compelling than Wabtec. This doesn’t mean that I think Wabtec is “bad”, or that I think the shares will fall in price from here. They may very well go on to perform reasonably well. On a risk-adjusted basis, though, I don’t like the name. In my view, these shares don’t offer the certainty of an IOU from Uncle Sam. At the same time, they don’t offer the high growth potential of a rail turnaround. This is why I remain lukewarm on this stock. That written, I’ll certainly change my tune if the shares drop nicely in price.

Be the first to comment