Marko Geber

W. P. Carey (NYSE:WPC) is a popular net lease REIT due to its long history of growing dividends. The stock has outperformed some peers as of late, perhaps due to hopes that its financials will prove more inflation-resistant. I discuss why those hopes may be misplaced, as the stock suddenly looks relatively expensive as compared to faster-growing peers. While WPC is not necessarily expensive at a 5.1% yield, dividend investors may find it worthwhile to look elsewhere in the net lease sector for better valuations.

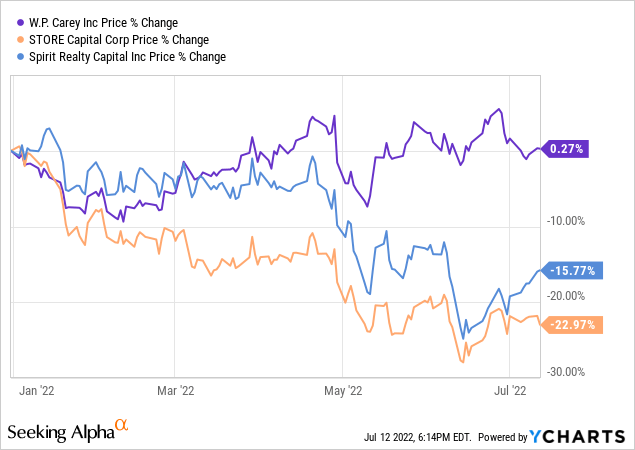

WPC Stock Price

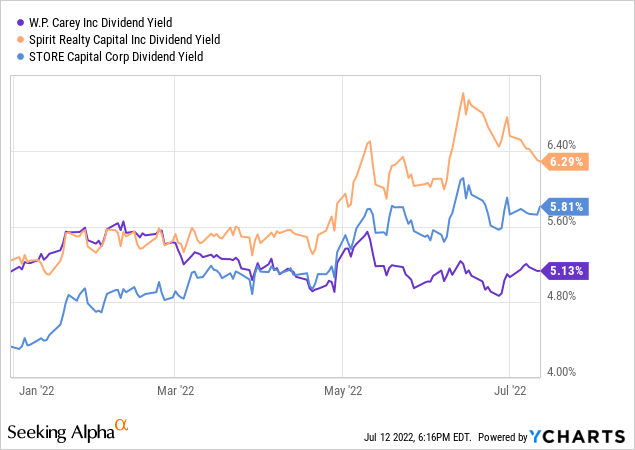

Since the start of the year, WPC has maintained a stable stock price while peers like STORE Capital (STOR) and Spirit Realty (SRC) are down a sizable amount.

I last covered WPC in January where I discussed the reasons why I was not buying the stock. The relative outperformance since then has only strengthened my view that WPC is far from being the most compelling name in the net lease sector.

WPC Stock Key Metrics

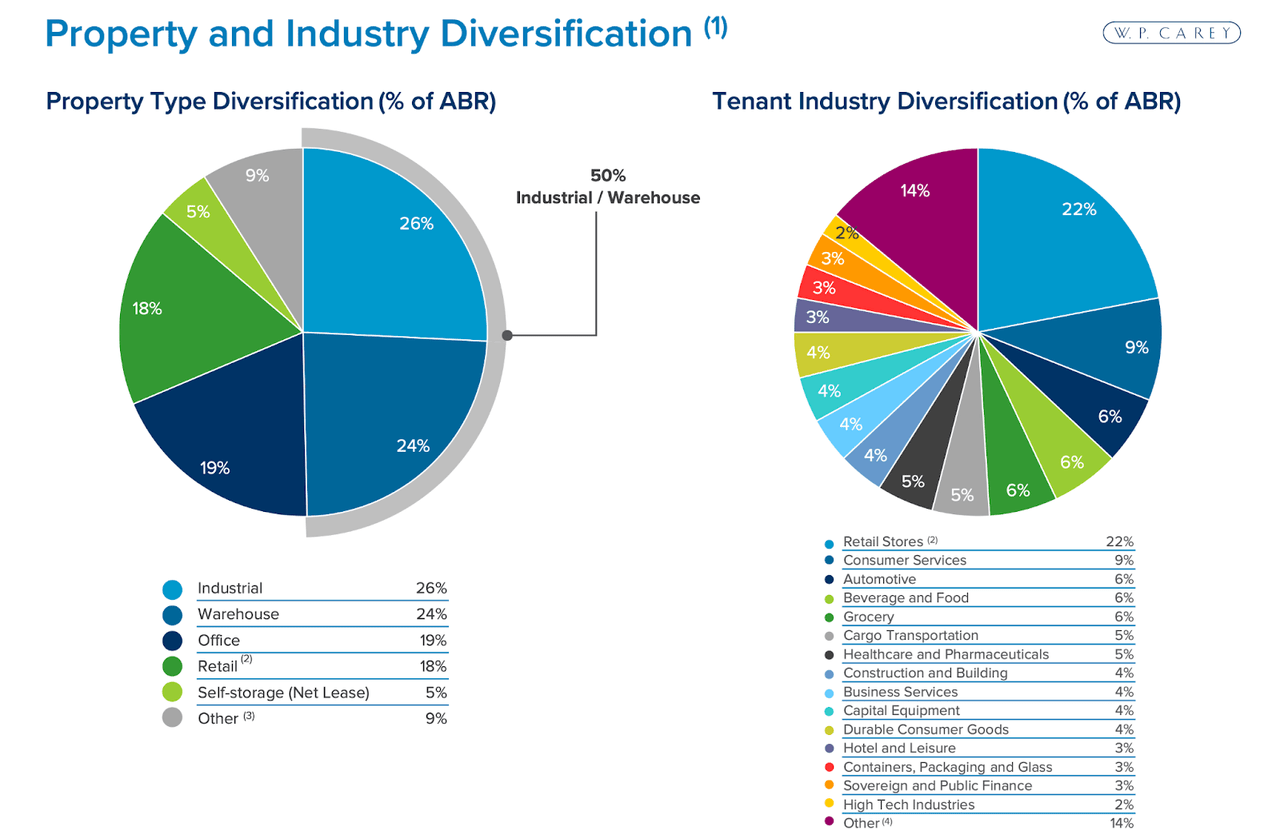

Unlike many net lease peers, WPC owns a sizable exposure to industrial and warehouse assets.

2022 Q1 Presentation

That diversified exposure though might be offset by its exposure to office real estate – the stocks of publicly traded office REITs have been strongly pressured in recent months.

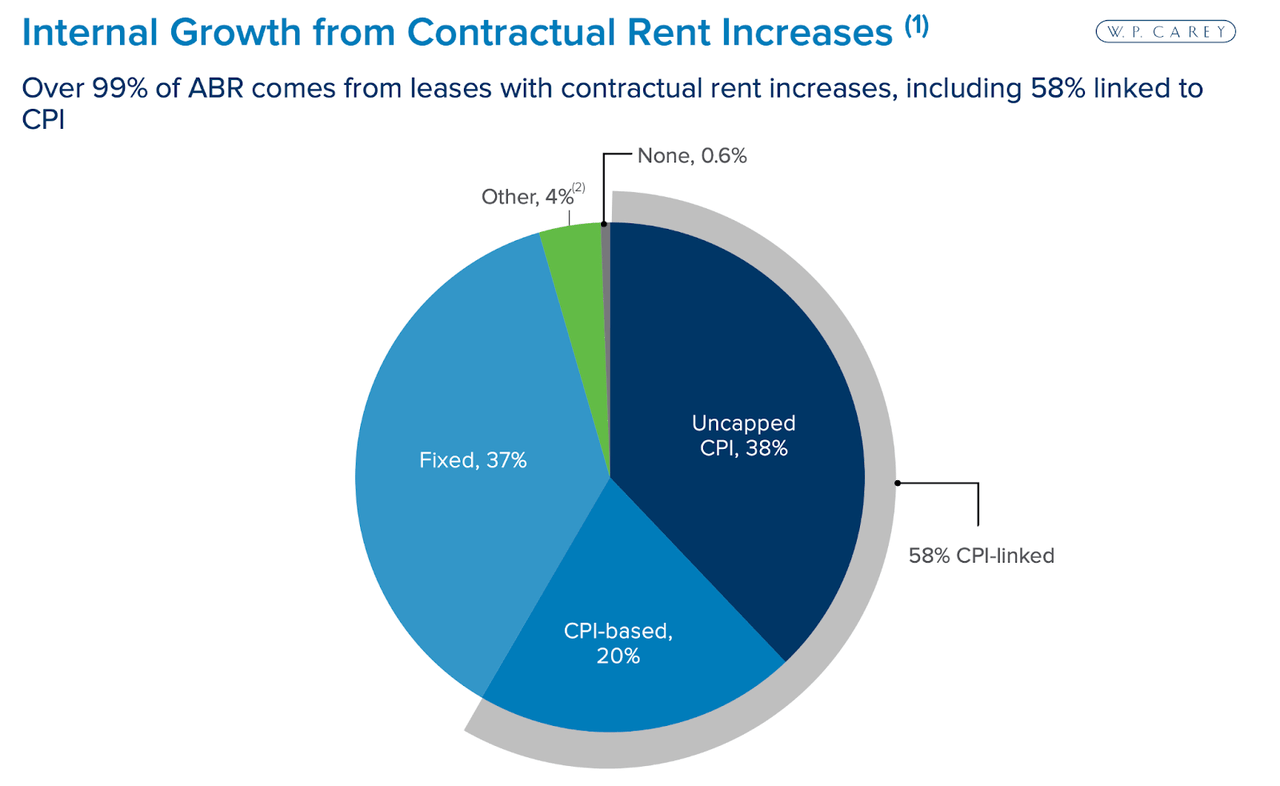

I suspect that WPC’s outperformance is largely due to wide investor awareness regarding its annual lease escalators. 99% of the company’s leases include contractual rent increases, with 58% of them linked to inflation.

2022 Q1 Presentation

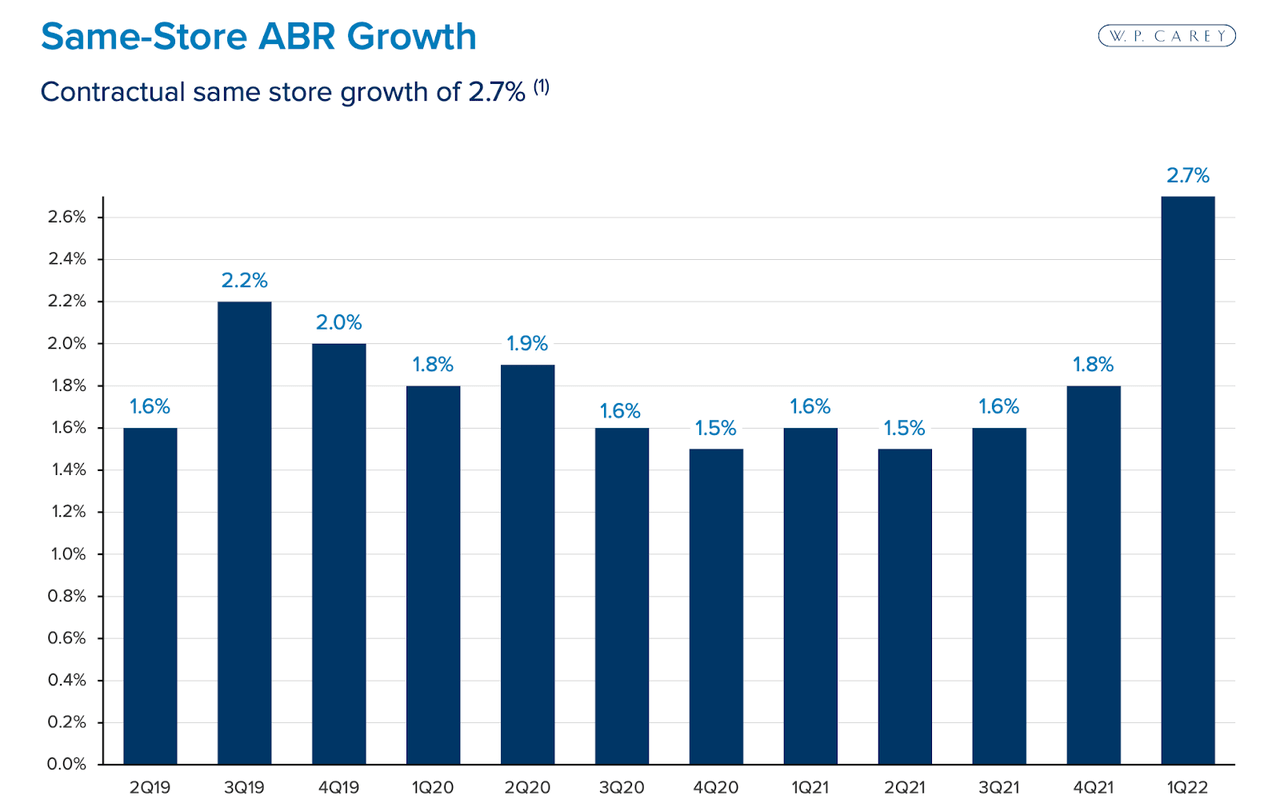

Couple that with the strong 2.7% same store rent growth in the latest quarter and it is not surprising to see why WPC has been cheered as an inflation-resistant stock.

2022 Q1 Presentation

But in actuality, such reasoning is flawed, as STOR and SRC also include annual lease escalators in the 1.6% range themselves. Sure, WPC might show faster same-store growth in the near term, but this might not be enough to compensate for what has historically been a slow-growth company.

In the latest quarter, AFFO stood at $1.35 per share – barely higher than the $1.31 per share posted in the first quarter of 2016. In comparison, STOR has grown AFFO per share by 39% since 2017. I have written over the years that WPC suffers from a large amount of disposition activity relative to investment activity. The net lease business model is quite simple to understand – these companies are extending capital to its tenants in exchange for ownership of properties and long-dated leases. These companies perform strongest when there is minimal capital recycling, because net acquisition activity would be more accretive. While it is possible for these companies to realize strong returns here and there on dispositions, that is far from the norm.

In 2021, WPC invested $1.72 billion in new assets but disposed of $170.7 million of existing assets. That 10% ratio is higher than the mid-single-digit ratio seen at Realty Income (O), and is a low mark for the company. For 2022, WPC has guided for up to $2 billion in acquisitions and $350 million of dispositions. In 2020, WPC invested $825.9 million versus $381.2 million of dispositions. In 2019, WPC invested $868.1 million versus $383.9 million of dispositions.

With WPC, the investment thesis (at least in my view) has long been based on figuring out when the company will be able to reduce its disposition activity and allow its acquisition pipeline to fully benefit the financials. While disposition activity as a percentage of acquisition activity has declined in recent years, it still remains higher than the top tier names in the sector.

Is WPC Stock A Buy, Sell, or Hold?

With the above thesis in mind, it becomes easier to understand why I view the stock as being unattractive today. WPC has often traded at a higher dividend yield than peers due to its slower growth. That tradeoff helped make the stock more investible. But WPC has suddenly seen its yield compress relative to STOR and SRC.

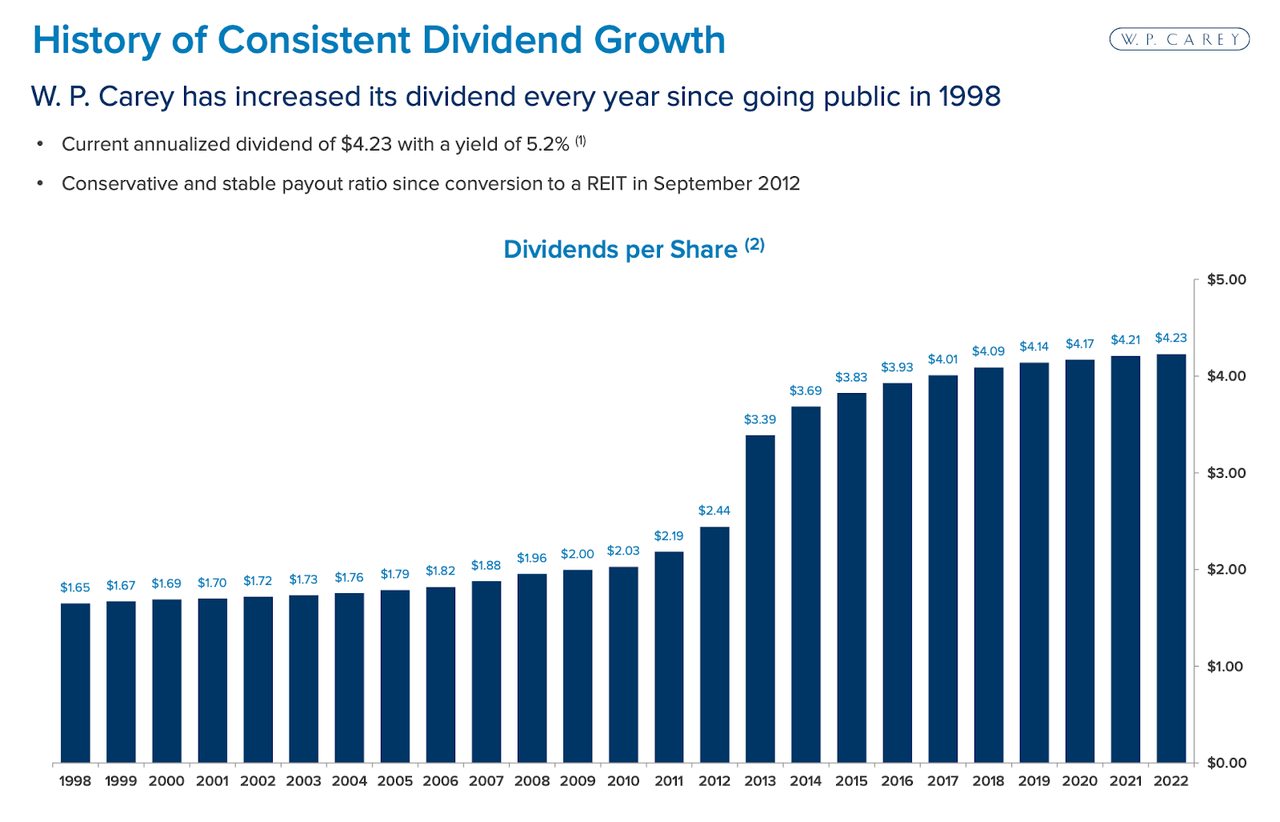

Sure, WPC has a longer history of growing its dividend, as it has increased its dividend over the past 22 years.

2022 Q1 Presentation

But investors today are paying for future results, not past results. There is little indication to suggest that WPC will suddenly begin to grow faster than peers. Perhaps its inflation-linked escalators may help offset its overall slower growth, but I still expect the name to grow slower than peers over the long term. There is some argument that WPC should not trade at a 5.1% dividend yield – perhaps a 4.2% yield is more appropriate. The stock has 18% capital appreciation upside to that target. But I expect STOR and SRC to return to trading at relatively premium valuations due to their faster growth, suggesting that those names have notably more upside at current prices. Absent multiple expansion, WPC is priced for around 6% total returns, which may not be enough to outperform the broader market especially during a period of rising interest rates. I am careful to not label WPC a “short” because the stock may still deliver positive returns, albeit lower than the returns of the broader market. I rate the stock a hold due to both the low projected upside in its own right as well as the more compelling opportunities within the net lease sector.

Be the first to comment