da-kuk

Over the past six weeks, we have seen international stocks significantly outperform their U.S. counterparts and I believe this is the start of a long-term trend. The dollar looks to have posted a major high and remains overvalued relative to most international currencies. Meanwhile, international stocks are significantly cheaper than U.S. stocks despite a similar long-term growth outlook. The Vanguard Total International Stock ETF (NASDAQ:VXUS) should outperform the S&P 500 by a wide margin over the coming years and charges a minimal expense ratio.

The VXUS ETF

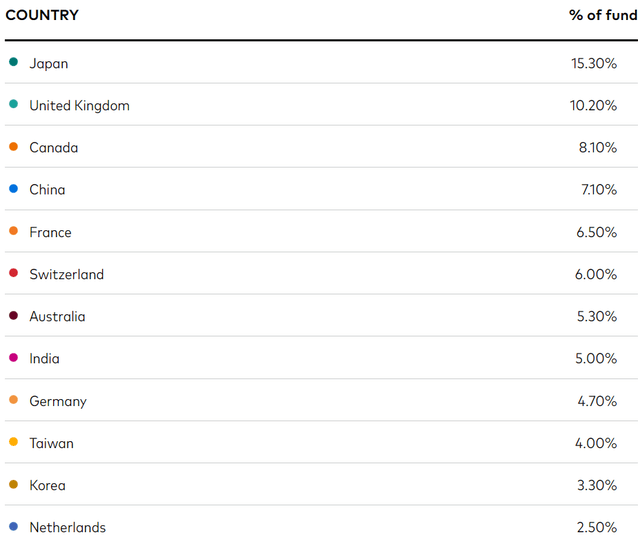

The VXUS seeks to track the performance of the FTSE Global All Cap ex U.S. Index, which measures the investment return of stocks issued by companies located outside the United States. The ETF has a good mix of developed and developing market exposure, with EM stocks making up 25% of the fund, led by China (7%), India (5%), Taiwan (4%), and Korea (3%). The developed market component is dominated by Japan and the U.K., which have a 15% and 10% weighting respectively, followed by Canada (8%) and France (7%).

VXUS Holdings By Country (Vanguard)

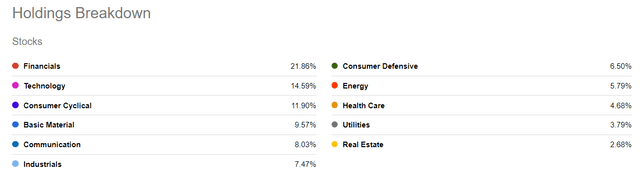

Sector exposure is also well diversified. Financials make up the largest weighting at 19%, followed by Industrials (13%) and Technology (11%). for comparison, these figures for the S&P 500 are 14%, 9%, and 24% respectively. In terms of individual companies, Nestle is the single largest stock, with a weighting of just 1.3% in the index, and the top 10 stocks make up just 9% of the index. The VXUS also has a minimal expense ratio of just 0.07%, despite holding almost 8000 stocks.

VXUS Holdings By Sector (Seeking Alpha)

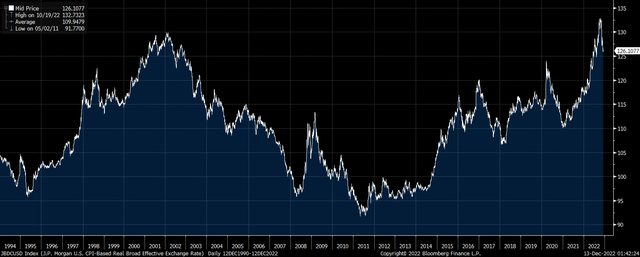

The Dollar Has Peaked

The strength in the dollar over the past 18 months has been a key driver of the underperformance of international equity markets such as the VXUS, but there are signs that the huge dollar bull market is now over. Even after the declines seen in the dollar over the past two months, its real effective exchange rate remains extremely elevated from a long-term perspective. The REER remains within its top 5 percentile over the past 30 years, and 15% above its long-term average. While in part this overvaluation reflects the U.S.’s higher real interest rates, I expect these to decline over the coming months as economic weakness forces the Fed to adopt a more dovish stance in line with most of the rest of the developed world.

U.S. Real Effective Exchange Rate (JPMorgan)

International Valuations Are Far Below The U.S.

Trends in the dollar are likely to be the main driver of the relative performance of the VXUS relative to the S&P 500 in the near term, but over the longer term the significantly lower valuation should provide steady outperformance for international stocks. Depending on the valuation metric in question, the VXUS is trading between 65% and 37% cheaper than the S&P 500, as shown in the table below. Taking an average of the main valuation metrics, the VXUS is around 50% cheaper than the S&P 500, which is significantly below the long-term average.

| Price/Earnings | EV/EBITDA | Price/Book Value | Price/Sales | Average | |

| VXUS | 11.3 | 8.2 | 1.4 | 1.0 | |

| S&P 500 | 19.1 | 13.1 | 4.0 | 2.3 | |

| VXUS % Discount | 41% | 37% | 65% | 56% | 50% |

Source: Bloomberg

The VXUS also has a much higher dividend yield, which is more than double that of the S&P 500, at 3.6% versus 1.7%. In order for this higher yield to be justified, investors must be anticipating almost 2 percentage points stronger growth in U.S. dividends relative to the rest of the world, indefinitely, which seems far too ambitious given the growth headwinds faced by the U.S. economy. Even a slight narrowing of the valuation gap between U.S. and international stocks could see the latter significantly outperform. For instance, should the dividend yield gap fall to just 1pp from the current 2pp, this would equate to almost 30% upside for the VXUS relative to the S&P 500.

Summary

The VXUS is well placed to deliver positive real returns over the long term. It is very well diversified in terms of geography, sector, and individual company exposure, and provides an opportunity for U.S.-based investors to hedge against dollar weakness. The deep valuation discount relative to U.S. stocks should provide a significant tailwind to the VXUS’ relative outperformance.

Be the first to comment