sefa ozel

A Quick Take On Vroom

Vroom (NASDAQ:VRM) went public in June 2020, raising $468 million in gross proceeds from the sale of its stock in an IPO priced at $22.00 per share.

The firm operates a website and service enabling consumers and dealers to buy used cars online in the U.S.

Given all the challenges the company faces, from needing to optimize many aspects of its operations to facing a macroeconomic slowdown ahead, I’m on Hold for VRM in the near term.

Vroom Overview

New York, NY-based Vroom was founded to source high-demand used automobiles in the U.S. and sell them to buyers via its e-commerce website.

Management is headed by CEO Thomas Shortt, who has been with the firm since May 2022 and was previously a Senior Vice President at Walmart and an SVP at The Home Depot.

The company’s primary offerings include:

-

Automobile sales

-

Vehicle reconditioning services

-

Third-party and captive financing

-

Other value added products and services

The firm acquires customers through a mix of online marketing and its Sell Us Your Car centers.

VRM sources high-demand used cars through dealerships, wholesalers, and consumers.

Vroom’s Market And Competition

According to a market research report by McKinsey & Company, the market for used car sales is significantly larger than that for new cars.

The U.S. used car market also has been more resilient to external economic shocks.

Additionally, used vehicles are becoming ‘younger’ in age due to greater ‘off-lease supply and newer certified pre-owned vehicle’ inventories.

The report estimates ‘that the number of used vehicles three years old or less will increase from 51 percent of the total in 2017 to about 60 percent in 2022’.

Major competitive or industry vendors include:

Management says its system offers a wide range of integrated services that buyers and sellers want and that other services do not provide the complete capabilities it can offer.

VRM’s Recent Financial Performance

-

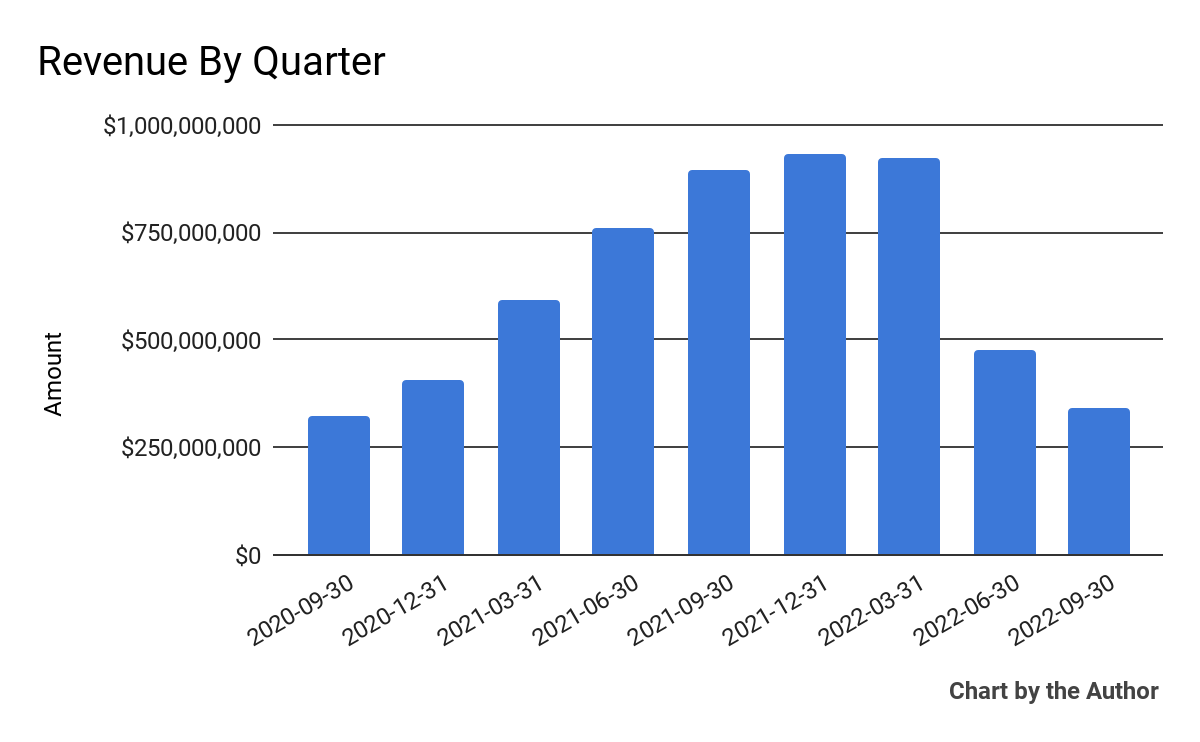

Total revenue by quarter rose sharply in 2021 and has since fallen sharply in 2022:

9 Quarter Total Revenue (Financial Modeling Prep)

-

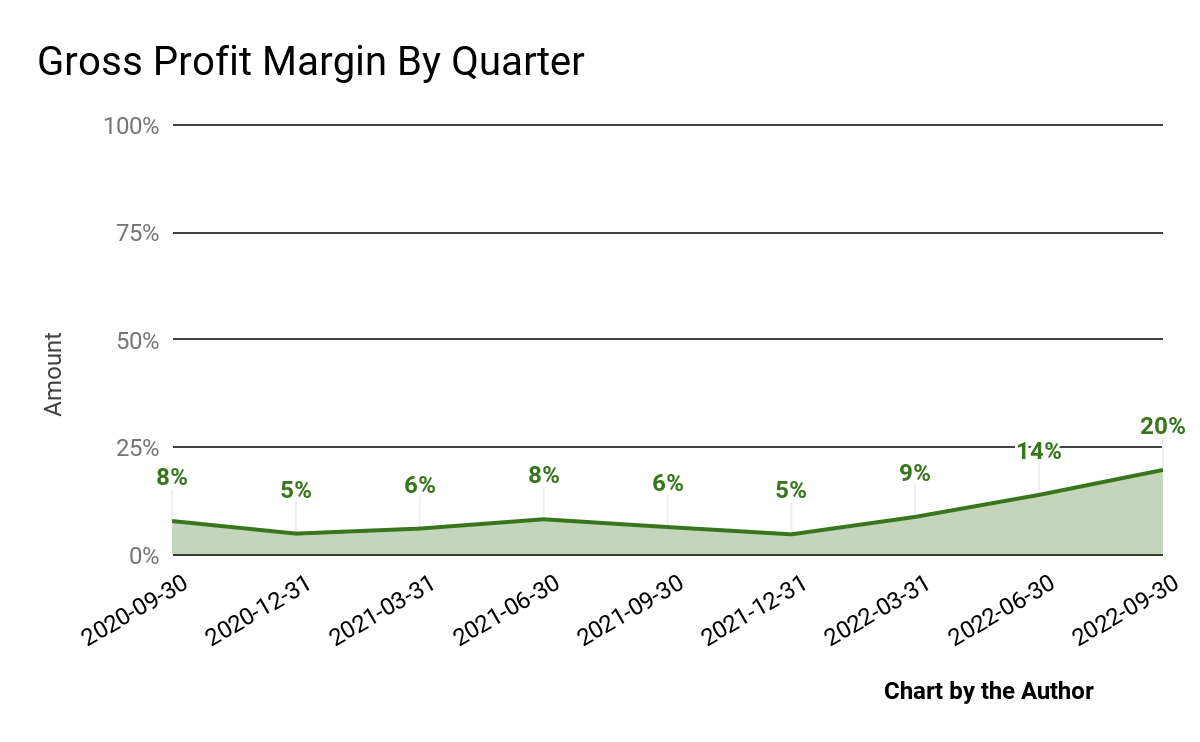

Gross profit margin by quarter has risen materially in recent quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

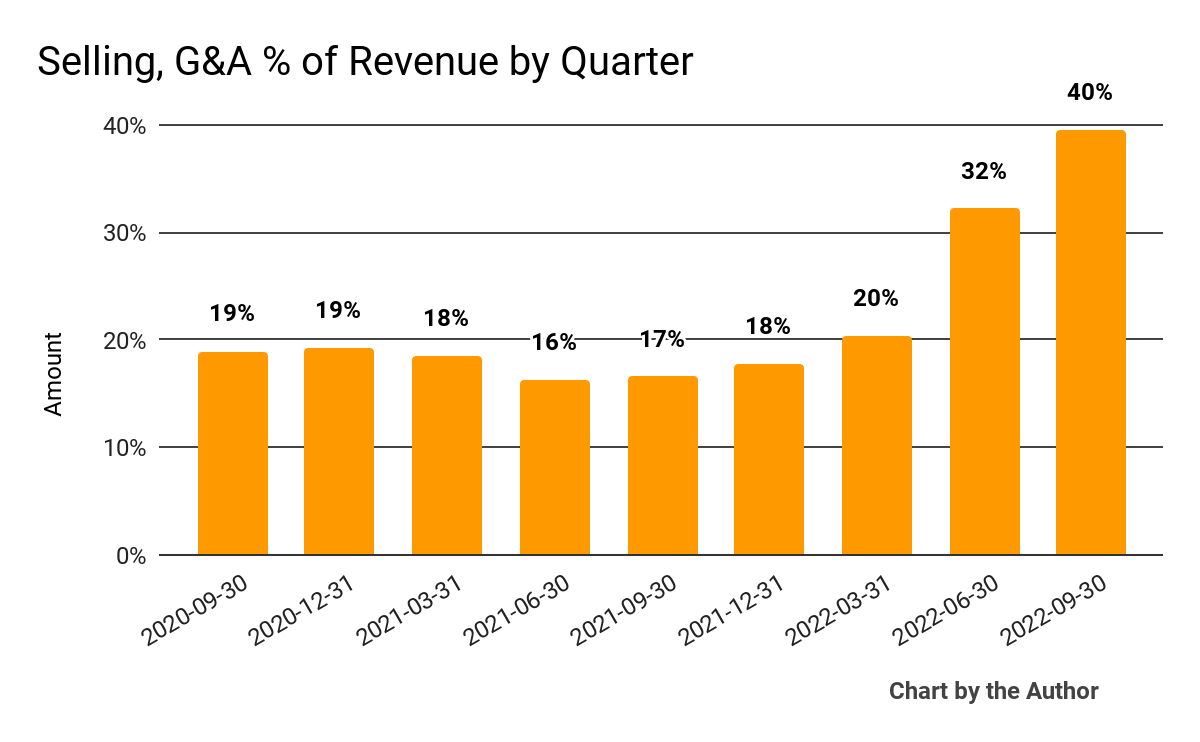

Selling, G&A expenses as a percentage of total revenue by quarter have also grown sharply in recent quarters, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

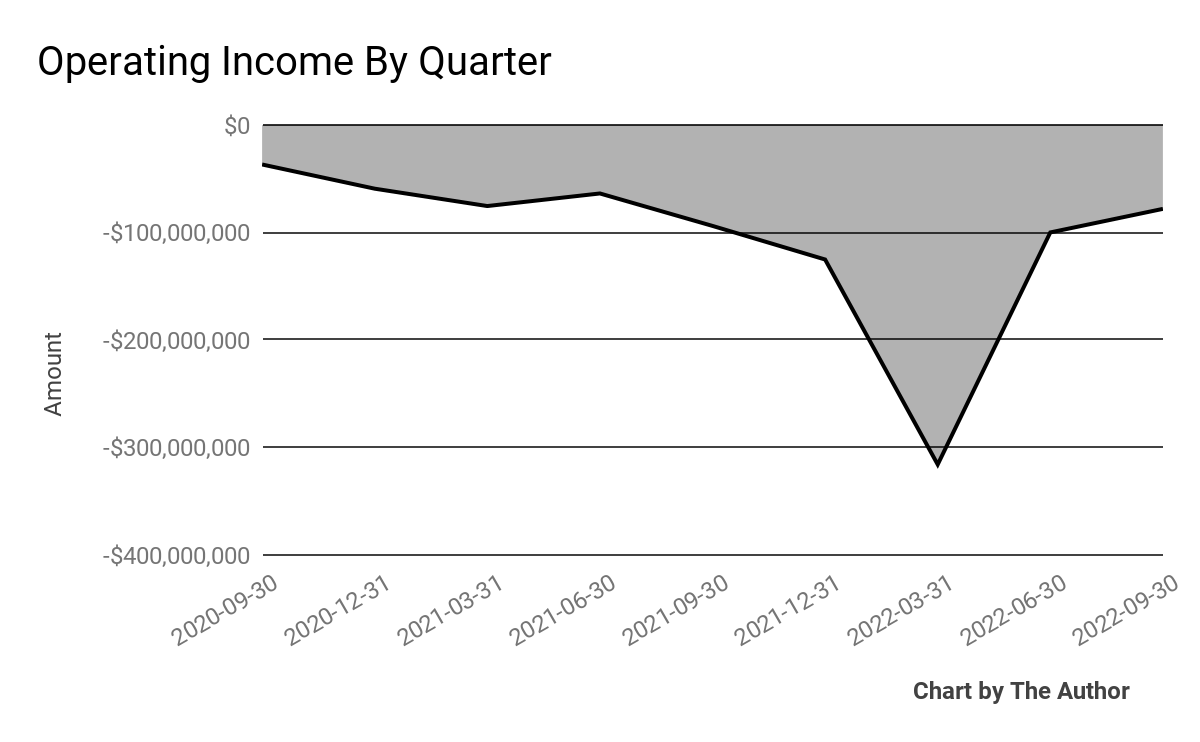

Operating income by quarter has varied greatly recently:

9 Quarter Operating Income (Financial Modeling Prep)

-

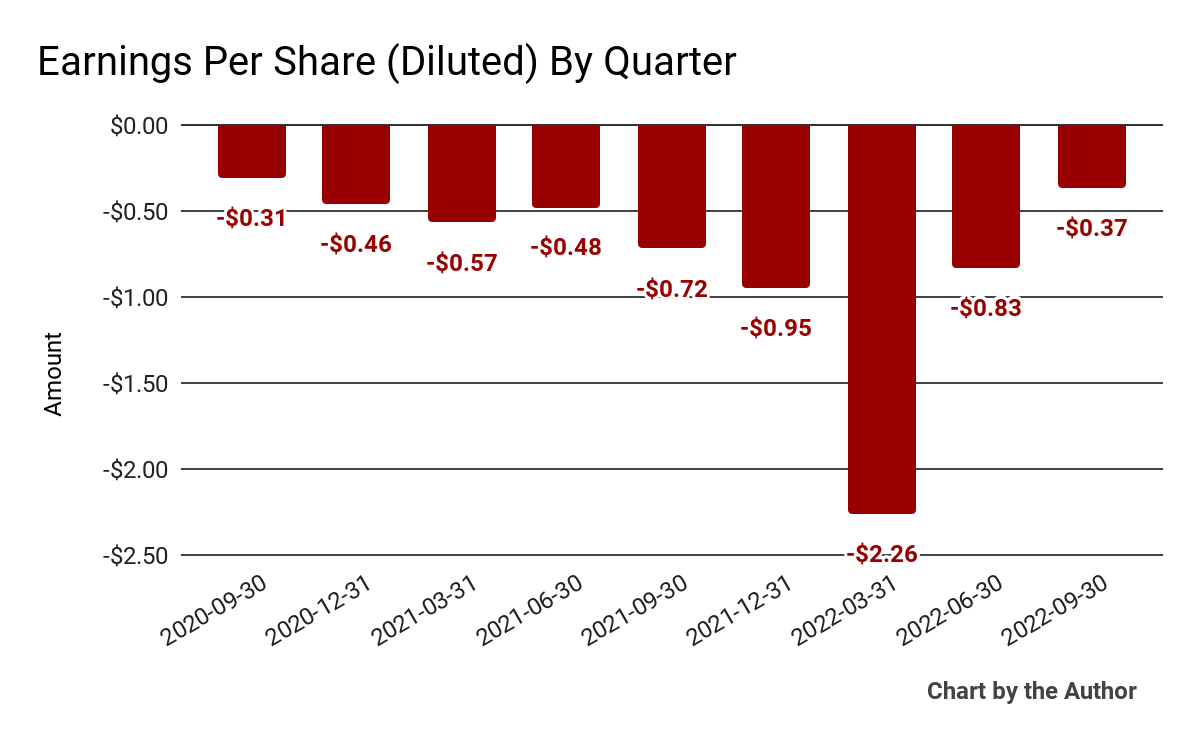

Earnings per share (Diluted) have remained heavily negative, as shown below:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

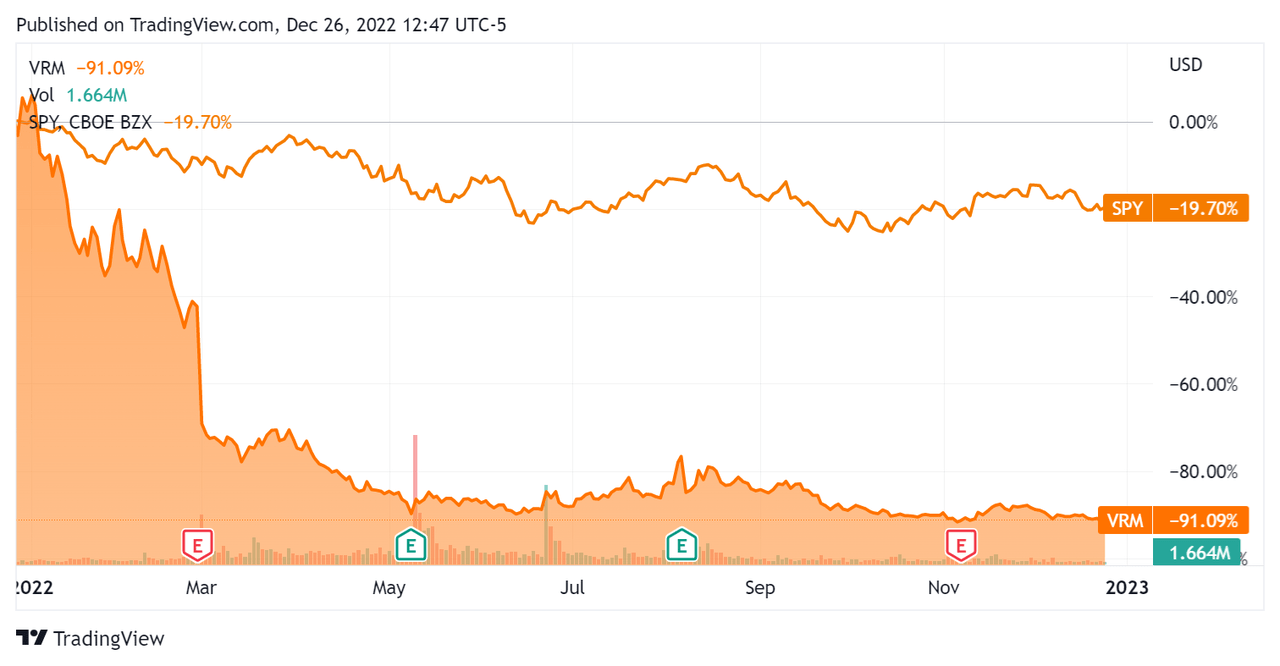

In the past 12 months, VRM’s stock price has fallen 91% vs. the U.S. S&P 500 index’s drop of around 19.7%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Vroom

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.3 |

|

Enterprise Value / EBITDA |

-1.4 |

|

Revenue Growth Rate |

0.7% |

|

Net Income Margin |

-22.7% |

|

GAAP EBITDA % |

-21.0% |

|

Market Capitalization |

$129,813,526 |

|

Enterprise Value |

$792,157,499 |

|

Operating Cash Flow |

-$266,331,000 |

|

Earnings Per Share (Fully Diluted) |

-$4.41 |

(Source – Financial Modeling Prep)

As a reference, a relevant partial public comparable would be Carvana (CVNA); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Carvana |

Vroom, Inc. |

Variance |

|

Enterprise Value / Sales |

0.6 |

0.3 |

-46.1% |

|

Revenue Growth Rate |

33.4% |

0.7% |

-97.9% |

|

Net Income Margin |

-6.0% |

-22.7% |

-278.6% |

|

Operating Cash Flow |

-$1,760,000,000 |

-$266,331,000 |

-84.9% |

(Source – Seeking Alpha and Financial Modeling Prep)

Commentary On Vroom

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its goals of being a ‘breakeven business and our long-term goal of a 5% to 10% adjusted EBITDA margin business.’

To achieve this, the firm has to further optimize its various operations as it seeks to create a regional operating model to reduce the ‘number of miles of vehicle travel and reduce inbound and outbound transportation costs.’

Also, management wants to expand its ‘captive finance offering for Vroom customers which we believe will improve conversion rates and improve unit economics…’

As to its financial results, revenue decreased 28% year-over-year while the firm reduced fixed and variable operating costs.

Gross profit margin improved substantially, but SG&A costs as a percentage of rose also rose markedly, a negative trend.

As a result, GAAP operating losses remained high and earnings per share remained heavily negative.

For the balance sheet, the firm finished the quarter with cash, equivalents and short-term investments of $533.6 million and approximately $1.1 billion in short-term borrowings and long-term debt.

Over the trailing twelve months, free cash used was $295.9 million, of which capital expenditures accounted for $29.6 million of cash used.

Looking ahead, management said it is going to be more ‘focused on unit economics over growth.’

So, management is still in the process of optimizing GPPU while being careful about how much volume it is driving through the system.

However, by being selective on volume, the company will need to continue to lower its SG&A structure to get to operating breakeven.

Within SG&A, it will need to sharply improve its marketing cost per unit.

Regarding valuation, the market is valuing VRM at half the EV/Revenue multiple of Carvana.

The used car industry is facing the twin effects of the end of a short-term supply bottleneck which led to a pricing mini-bubble and the start of what appears to be a recession in the U.S.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic downturn keeping volumes more elevated than a full-blown recession.

However, given all the challenges the company faces, from needing to optimize many aspects of its operations to facing a macroeconomic slowdown ahead, I’m on Hold for VRM in the near term.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment