André Muller/iStock Editorial via Getty Images

Introduction

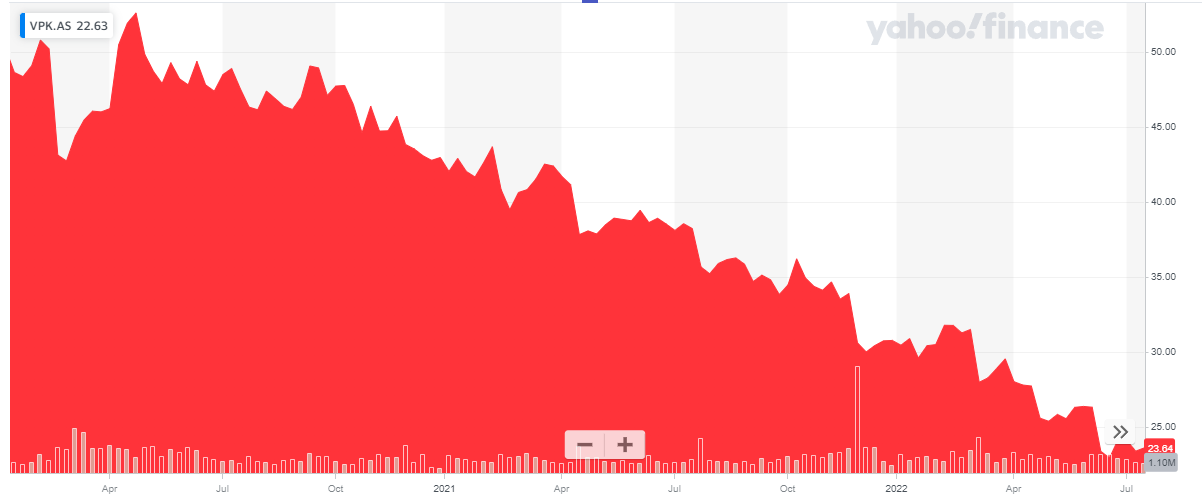

Back in April I turned positive on Vopak (OTCPK:VOPKF) as the company was trading at multi-year lows. Apparently that wasn’t low enough for Mr. Market as the share price has fallen an additional 20% since. I have been writing put options and after rolling some of them to later expiry dates, I am now considering to take delivery of the shares at the next few expiry dates. The current share price of 22-23 EUR appears to be very appealing for what essentially is an infrastructure company.

Yahoo Finance

As mentioned in my previous article, Vopak is a Dutch company and its listing on Euronext Amsterdam is a better option than its OTC listing. The ticker symbol in Amsterdam is VPK, and with an average daily volume of in excess of 330,000 shares, the Amsterdam listing clearly offers the most liquid listing and on top of that, there are options available. As Vopak trades and reports in EUR, I will use the Euro as base currency throughout this article.

For an overview of the company’s business model and assets, I’d strongly recommend you to read my previous article.

While the income statement looks bleak, the cash flows remain strong

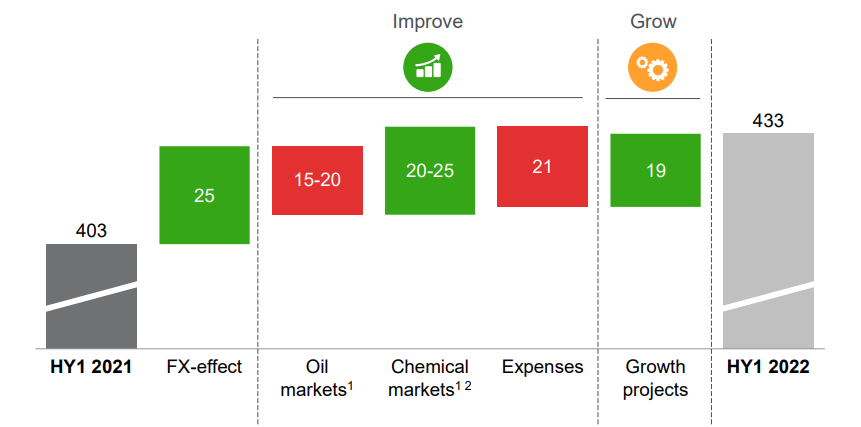

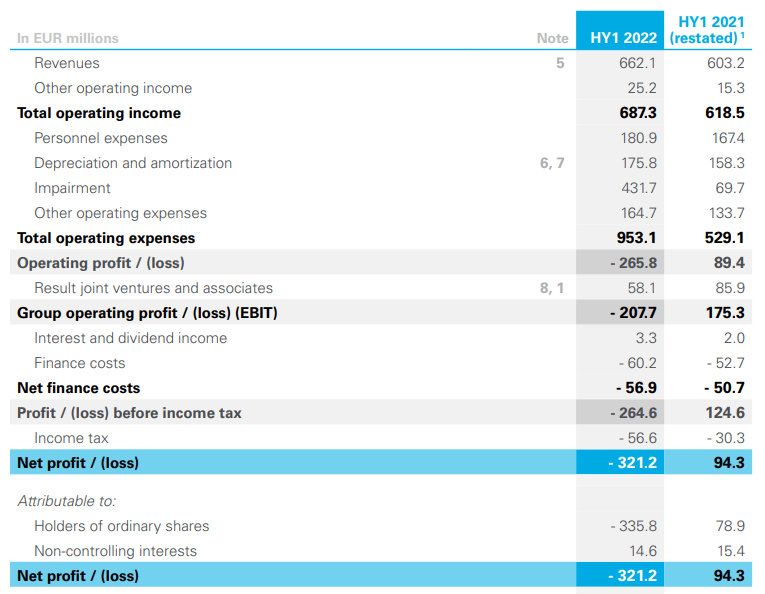

In the first half of the current financial year, Vopak’s revenue increased by approximately 10% while the other operating income increased as well, for a total revenue of 687.3M EUR. Whereas the company was able to report an operating profit of 89.4M EUR in H1 2021, it now had to record an operating loss of 265.8M EUR. The EBITDA came in at 433M EUR.

Vopak Investor Relations

Did the operating performance of the company take a turn for the worse? Not really. The company recorded a 432M EUR impairment expense (up from almost 70M EUR in H1 2021) and excluding these two impairment expenses, the adjusted operating income would have been approximately 160M EUR in H1 2021 and about 166M EUR in the first half of this year. I will discuss the impairment charges into more detail later in this article.

Vopak Investor Relations

These impairment charges obviously set the tone for the entire first semester performance as the EBIT was a negative 208M EUR and the net loss came in at 321M EUR. This includes the net income attributable to minority interests at some assets and the net loss attributable to the shareholders of Vopak was 336M EUR or 2.68 EUR per share.

Ouch. But keep in mind these impairment expenses are non-cash expenses. And on top of that, the total sustaining capex and lease payments tend to be lower than the depreciation and amortization expenses. That’s why we should always keep an eye on the cash flow statement as well.

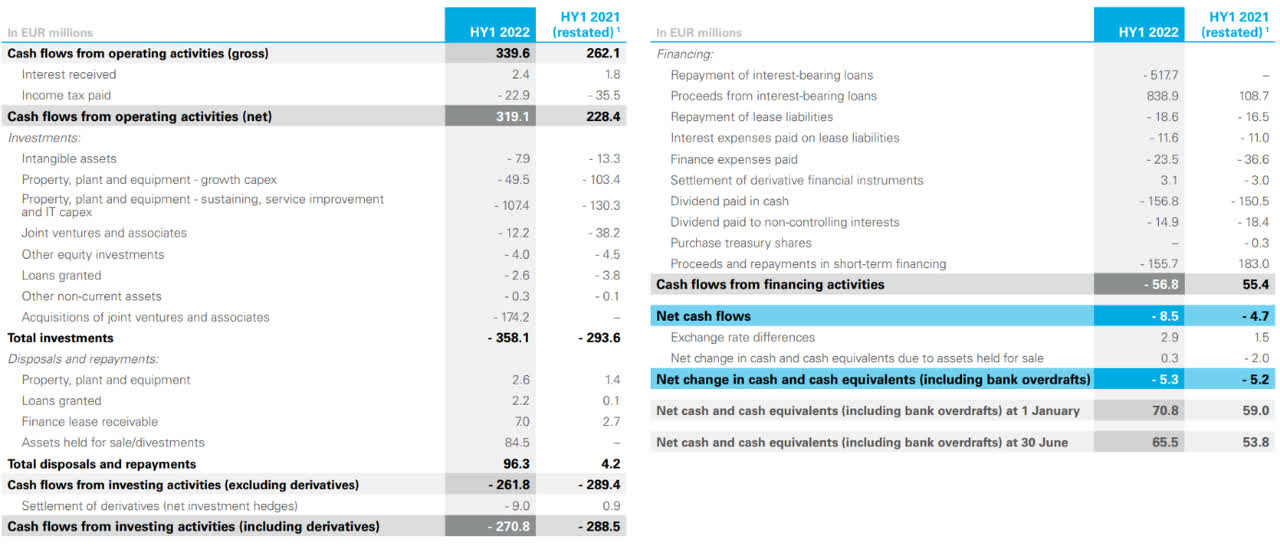

The reported operating cash flow was 319M EUR which includes a 23M EUR tax payment. Considering the pre-tax income turned negative I will not be using the official taxes of almost 57M EUR recorded in the first half of the year. Although some impairment charges may not have been (fully) deductible, I’m sticking with the company’s official version and will use the 319.1M EUR in operating cash flow as base scenario.

Vopak Investor Relations

We should however deduct the 30M EUR in lease expenses (leases + interest on leases) as well as the 40M EUR in other finance expenses and cash dividends paid to minority interests. This subsequently reduces the adjusted operating cash flow to approximately 250M EUR.

Vopak still splits up the sustaining capex and growth capex and the total sustaining capex was 115M EUR (I am including the capex related to intangible assets here, but I am excluding the 50M EUR in growth capex and additional investments in joint ventures and associates). This means the H1 sustaining free cash flow was 135M EUR or approximately 1.08 EUR per share. On an annualized basis, this means the full-year sustaining free cash flow will exceed 2 EUR per share which makes the current share price of just around 11 times the sustaining FCF quite attractive.

That would be too easy. Unfortunately we cannot just double the H1 free cash as Vopak’s second half of the year is traditionally more capex-intense. So we should definitely expect the sustaining free cash flow to decrease in the second half of the year, and that’s just normal.

Explaining the impairment charges, and why I’m not too worried about the earnings profile of the company

Before getting too excited, it’s never great to see an impairment charge to the tune of half a billion Euro so I wanted to dig a bit deeper into this to make sure this is a ‘realistic’ impairment. Just to give another example of a ‘strange’ impairment: one of Europe’s largest oil and gas groups recorded an impairment charge on the refinery division, which reported a record result in the second quarter. So I wanted to make sure I understood what the Vopak impairment charges were related to.

There were three important elements. The smallest was a 36M EUR impairment charge in Colombia where a Vopak associate operates an FSRU. Due to the increased availability of hydropower in the country and the increasing domestic gas production, the prospects for a floating regasification platform has decreased.

The two main impairment charges are related to the Europoort and Botlek assets. The company’s explanation was a bit superficial in its press release, half-year report and presentation, but the management did provide a bit more clarification on the issue on the conference call.

The assets were previously valued based on a 15 year useful life and discounted with an undisclosed discount rate. According to the company they didn’t want to be caught off-guard if the energy transition goes faster than anticipated and the term of the remaining useful life has been reduced. This means the anticipated returns have been reduced and that caused the impairment charge so it sounds like Vopak wanted to be ‘safe rather than sorry’ and is already reducing the carrying value of these assets. Hard to argue with that, but keep in mind these are non-cash expenses so it is basically a ‘sunk cost’ that is being written off.

Investment thesis

It’s difficult to make full-year projections now as the sustaining capex will accelerate in the second half of the year. But as the company has been guiding for a slightly higher EBITDA, that should be trickling down to the free cash flow result as well. Last year’s sustaining FCF was approximately 1.86 EUR per share for the year and I think the company can do slightly better this year and 1.92-1.96 EUR appears to be feasible based on the updated EBITDA guidance of 830-850M EUR.

At the current share price of 22.63 EUR, the stock is trading at a sustaining free cash flow yield of 8.6% which is relatively high for what essentially is an infrastructure company. The market seems to be uncertain about the oil exposure but keep in mind 75% of Vopak’s growth capex will go to other sectors with the industrial and gas divisions as main beneficiary.

I currently have no position in Vopak other than the put options which are now in the money. But as the stock is now trading at levels I never imagined, I will likely go long in the next few weeks.

Be the first to comment